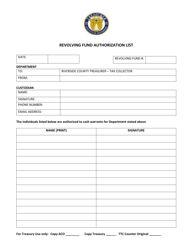

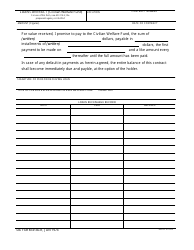

Revolving Loan Fund Applicable Laws - California

Revolving Loan Fund Applicable Laws is a legal document that was released by the California Department of Toxic Substances Control - a government authority operating within California.

FAQ

Q: What is a revolving loan fund?

A: A revolving loan fund is a pool of money that is continuously replenished as loans are repaid.

Q: How does a revolving loan fund work?

A: A revolving loan fund works by lending money to borrowers, who then repay the loan over time. The repaid funds are then used to make new loans to other borrowers.

Q: What laws govern revolving loan funds in California?

A: Revolving loan funds in California are governed by various laws, including the California Financial Code and other applicable state and federal laws.

Q: What is the purpose of a revolving loan fund?

A: The purpose of a revolving loan fund is to provide financial assistance to individuals and businesses in need, promoting economic development and growth.

Q: Who can apply for a loan from a revolving loan fund?

A: Anyone who meets the eligibility criteria set by the revolving loan fund can apply for a loan, typically including individuals, small businesses, and non-profit organizations.

Q: What can a loan from a revolving loan fund be used for?

A: Loans from a revolving loan fund can be used for various purposes, such as starting or expanding a business, purchasing equipment or inventory, or financing affordable housing projects.

Q: How can I find a revolving loan fund in California?

A: You can find revolving loan funds in California by contacting your local government agencies, economic development organizations, or small business development centers.

Q: Are there any fees or interest associated with loans from revolving loan funds?

A: Yes, loans from revolving loan funds may have fees and interest rates, which vary depending on the specific fund and loan terms.

Q: Are there any loan repayment assistance programs for revolving loan funds?

A: Some revolving loan funds may offer loan repayment assistance programs, which provide support to borrowers who face financial challenges in repaying their loans.

Q: Can I apply for multiple loans from a revolving loan fund?

A: It depends on the policies of the specific revolving loan fund, but in some cases, borrowers may be eligible to apply for multiple loans if they meet the criteria.

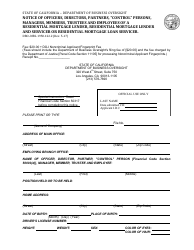

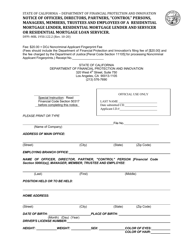

Form Details:

- The latest edition currently provided by the California Department of Toxic Substances Control;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Toxic Substances Control.