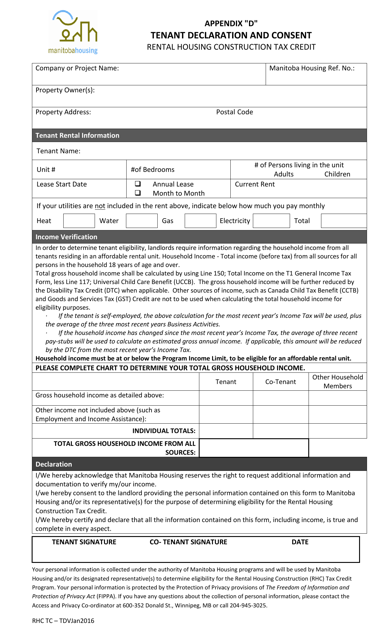

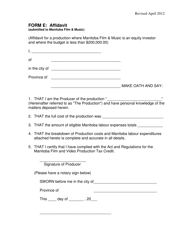

Appendix D Tenant Declaration and Consent - Rental Housing Construction Tax Credit - Manitoba, Canada

The Appendix D Tenant Declaration and Consent - Rental Housing Construction Tax Credit is a form used in Manitoba, Canada for tenants to declare their consent and eligibility to receive tax credits on rental housing construction.

The tenant is responsible for filing the Appendix D Tenant Declaration and Consent form for the Rental Housing Construction Tax Credit in Manitoba, Canada.

FAQ

Q: What is Appendix D?

A: Appendix D is a Tenant Declaration and Consent form.

Q: What is the purpose of the Tenant Declaration and Consent form?

A: The form is used for the Rental Housing Construction Tax Credit in Manitoba, Canada.

Q: Who needs to fill out Appendix D?

A: Tenants of a rental housing unit in Manitoba need to fill out the form.

Q: What is the Rental Housing Construction Tax Credit?

A: The Rental Housing Construction Tax Credit is a tax incentive program for landlords in Manitoba.

Q: Why is the Tenant Declaration and Consent form required?

A: It is required to verify the eligibility criteria for the tax credit.

Q: Is Appendix D confidential?

A: Yes, the information provided in Appendix D is confidential and protected by privacy laws.

Q: What information is required on the Tenant Declaration and Consent form?

A: The form requires information such as tenant name, address, and consent to disclose rental information.

Q: When should the Tenant Declaration and Consent form be submitted?

A: The form should be submitted to the landlord or property manager as soon as possible.

Q: Can a tenant refuse to fill out Appendix D?

A: Yes, a tenant has the right to refuse to fill out the form, but it may affect the landlord's eligibility for the tax credit.