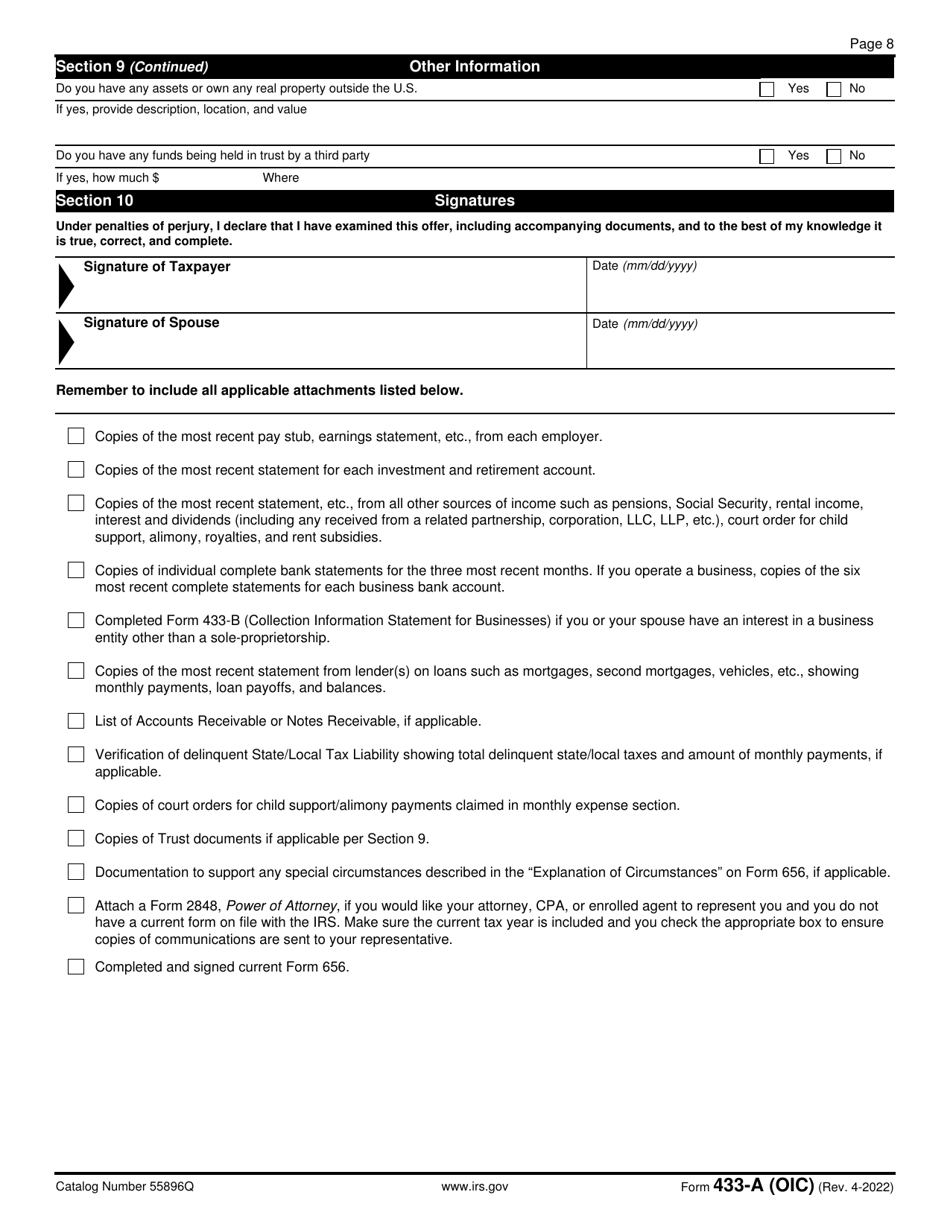

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 433-A (OIC)

for the current year.

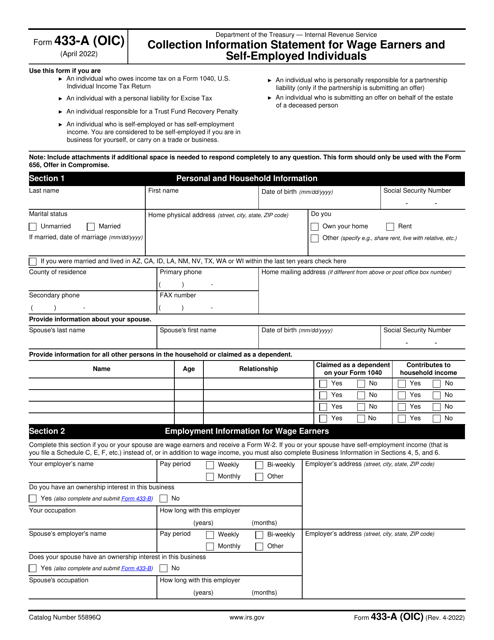

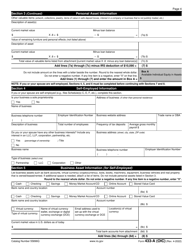

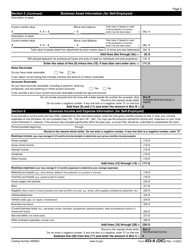

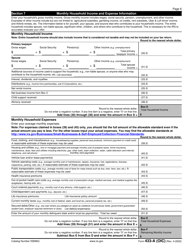

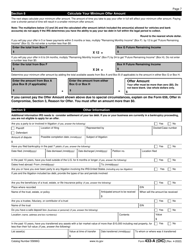

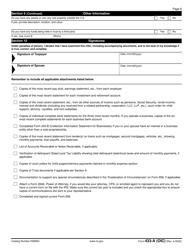

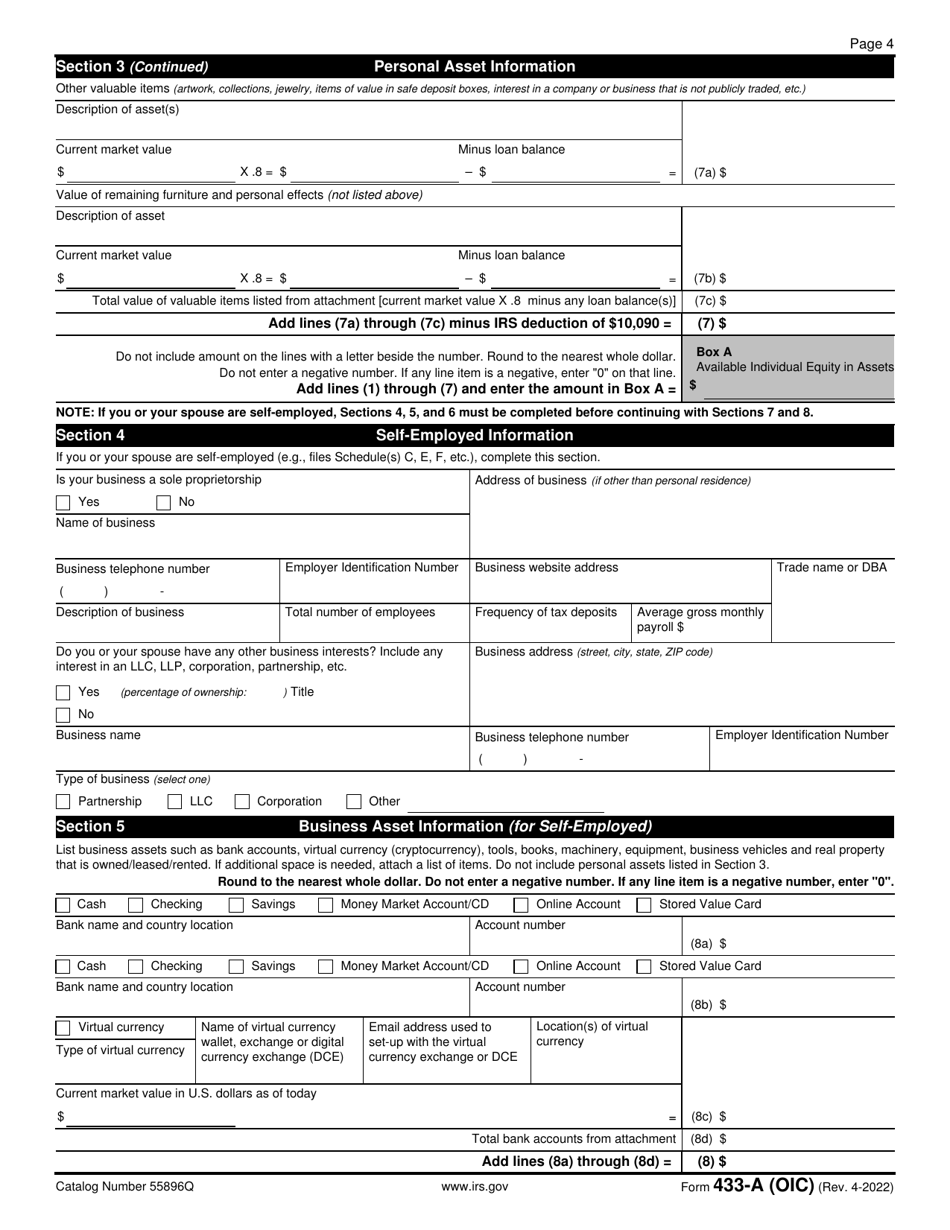

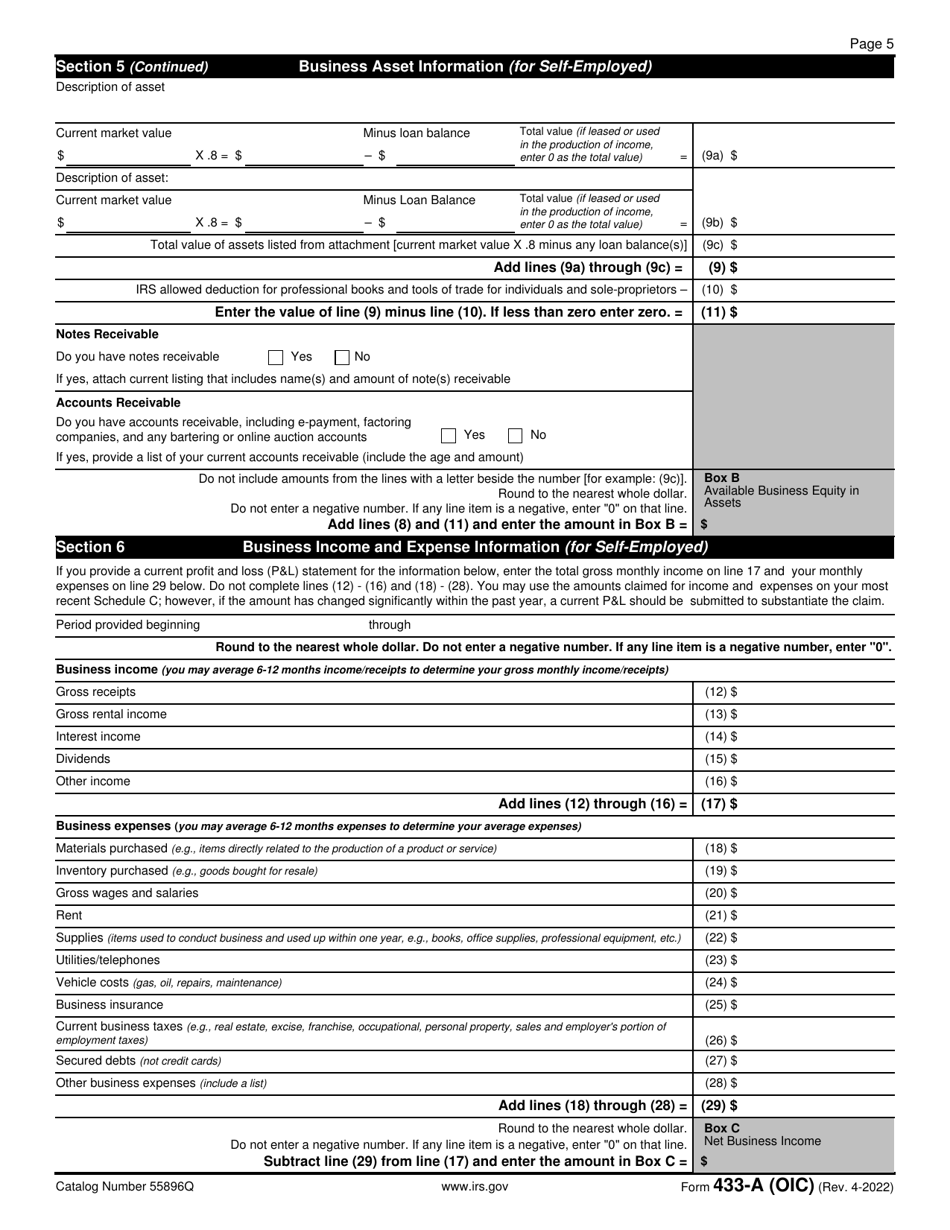

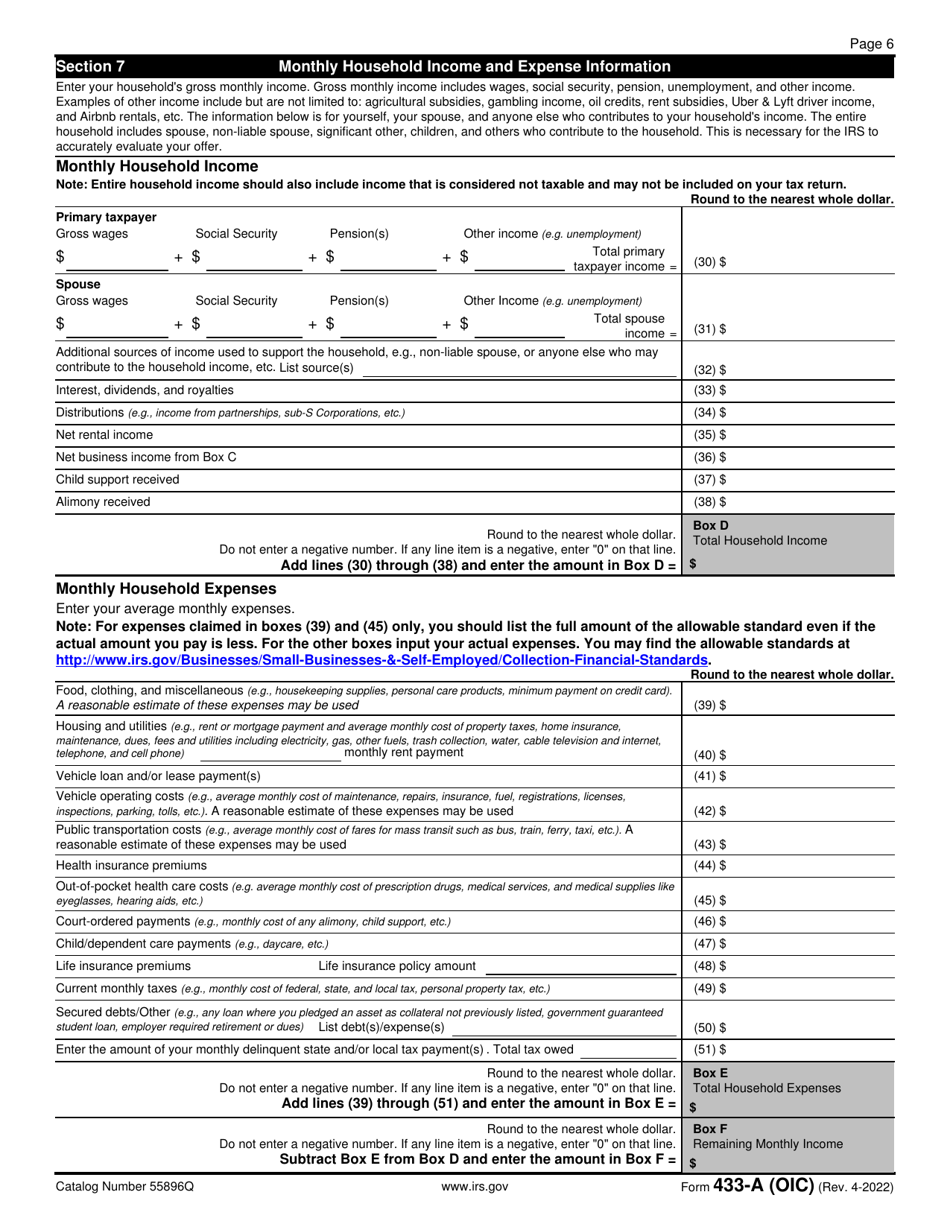

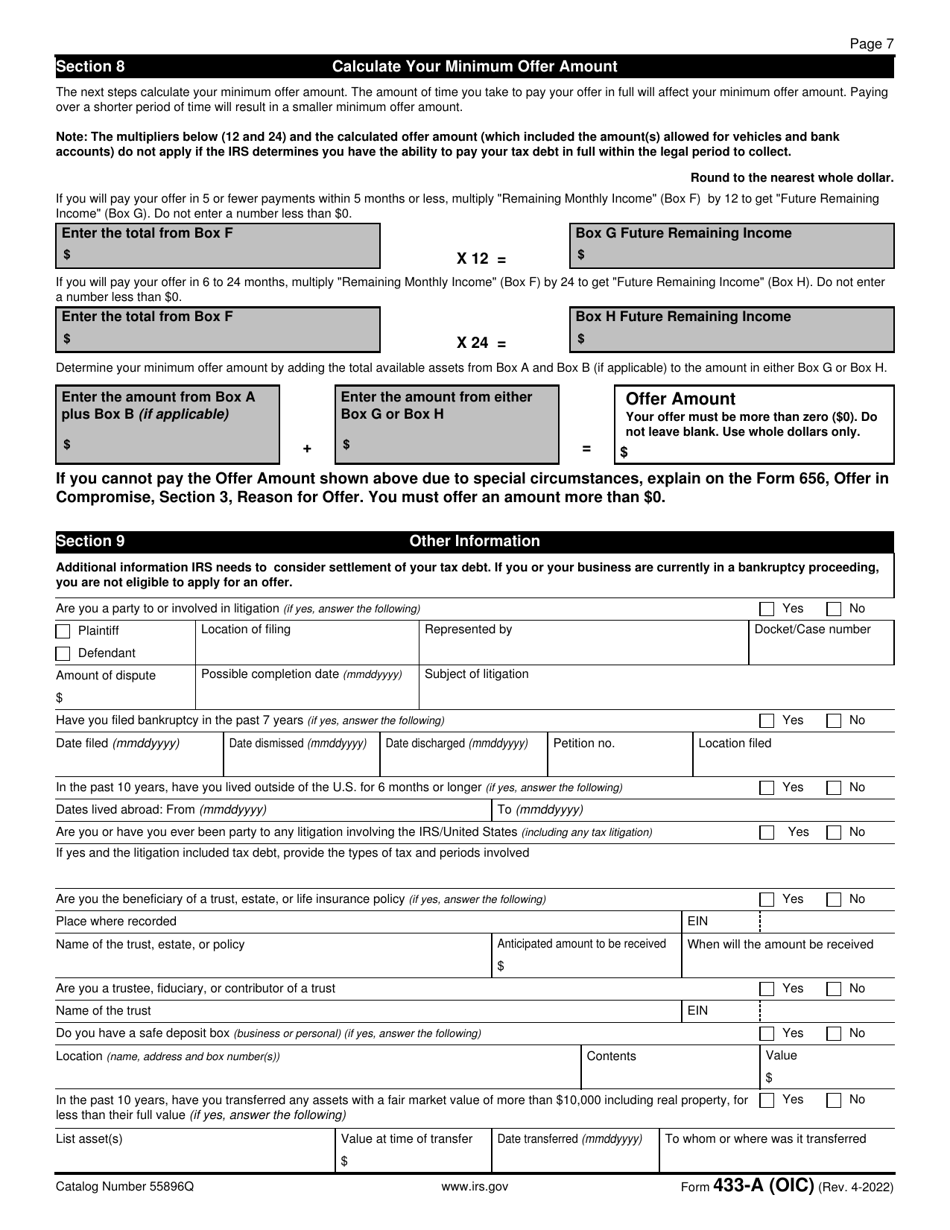

IRS Form 433-A (OIC) Collection Information Statement for Wage Earners and Self-employed Individuals

What Is IRS Form 433-A (OIC)?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2022. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 433-A (OIC)?

A: IRS Form 433-A (OIC) is a collection information statement used by wage earners and self-employed individuals to provide financial information to the IRS.

Q: Who needs to file IRS Form 433-A (OIC)?

A: Wage earners and self-employed individuals who are seeking to make an Offer in Compromise (OIC) to settle their tax debts with the IRS need to file Form 433-A (OIC).

Q: What is the purpose of IRS Form 433-A (OIC)?

A: The purpose of IRS Form 433-A (OIC) is to provide the IRS with detailed financial information to determine the taxpayer's ability to pay their tax debts.

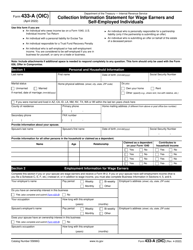

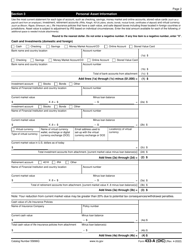

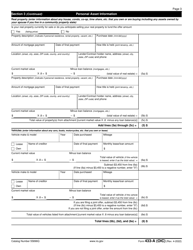

Q: What information is required on IRS Form 433-A (OIC)?

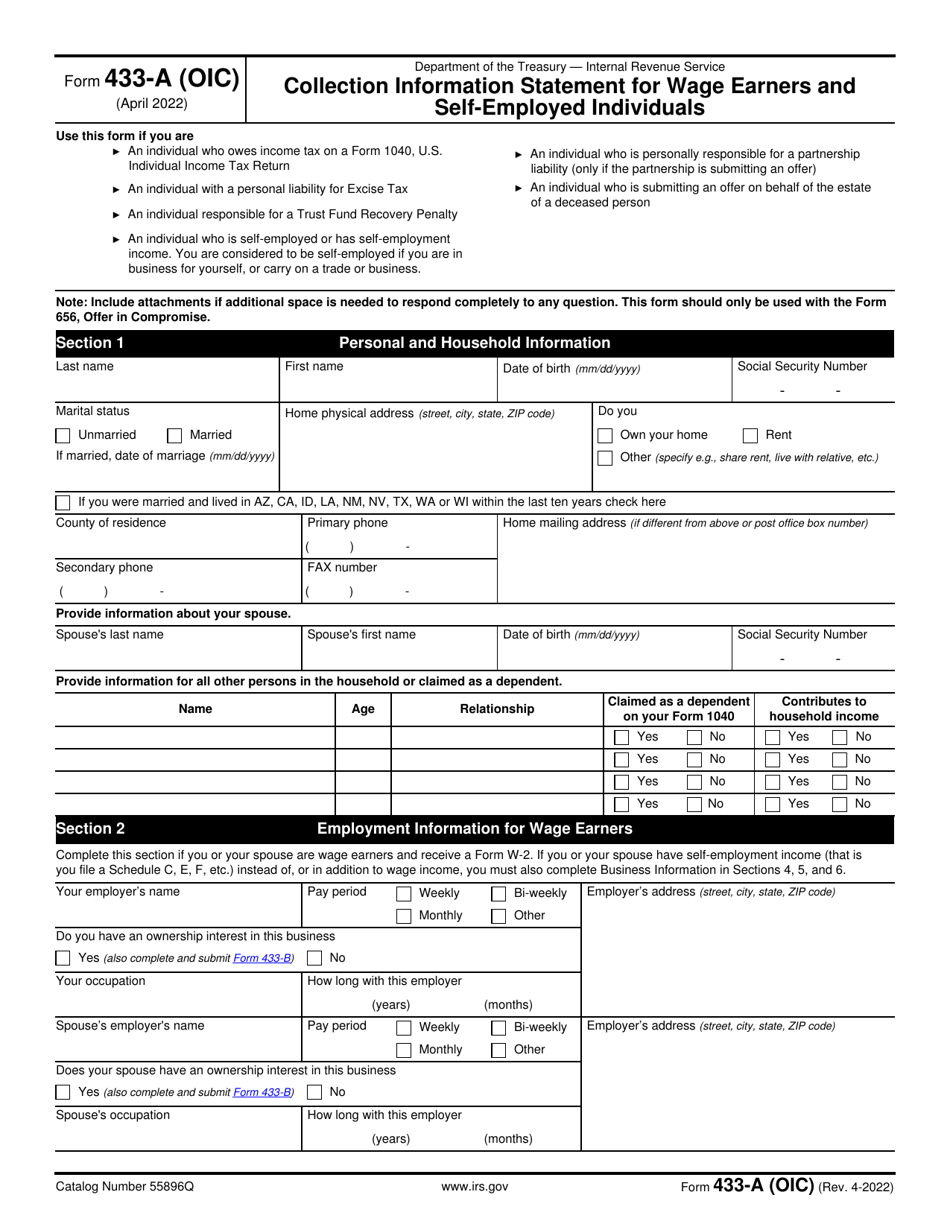

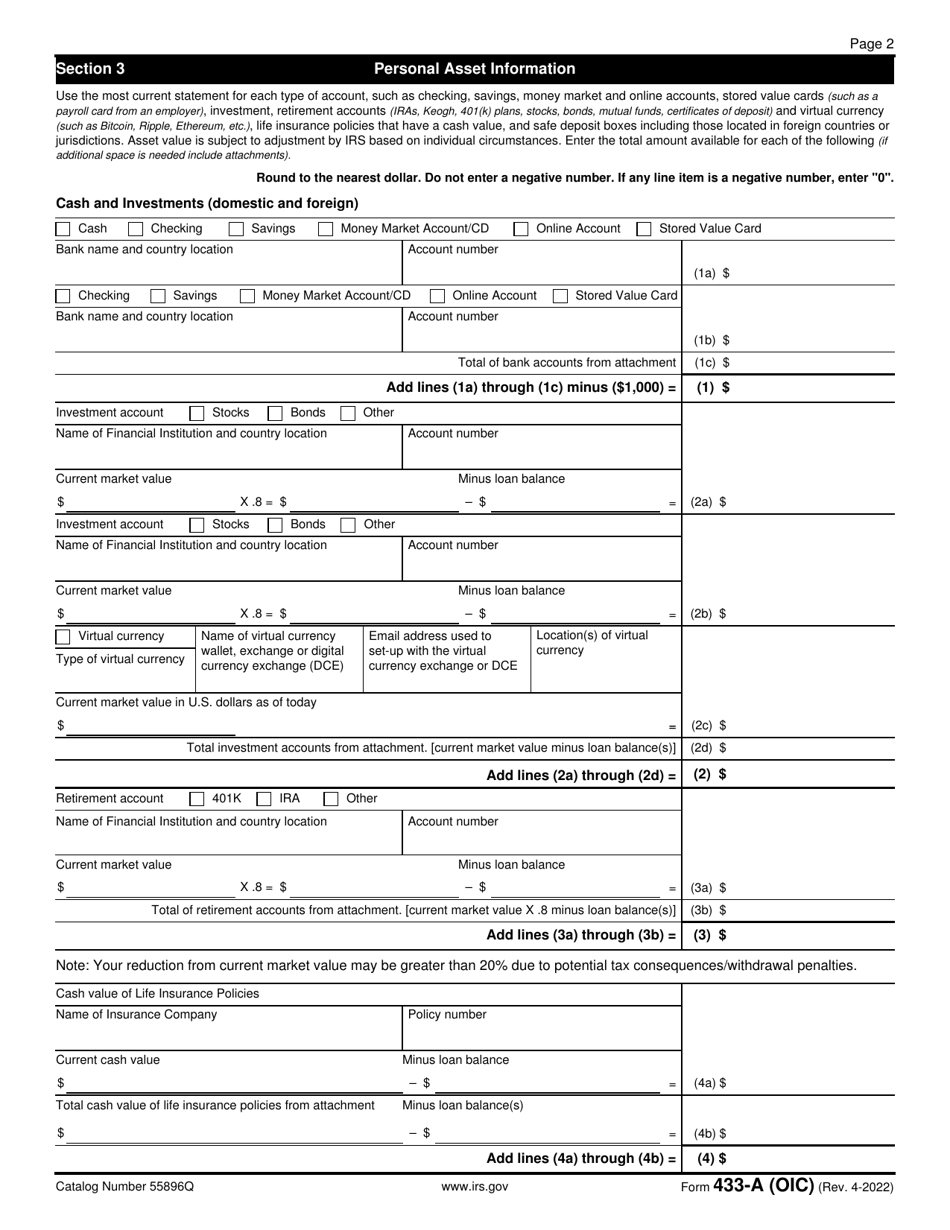

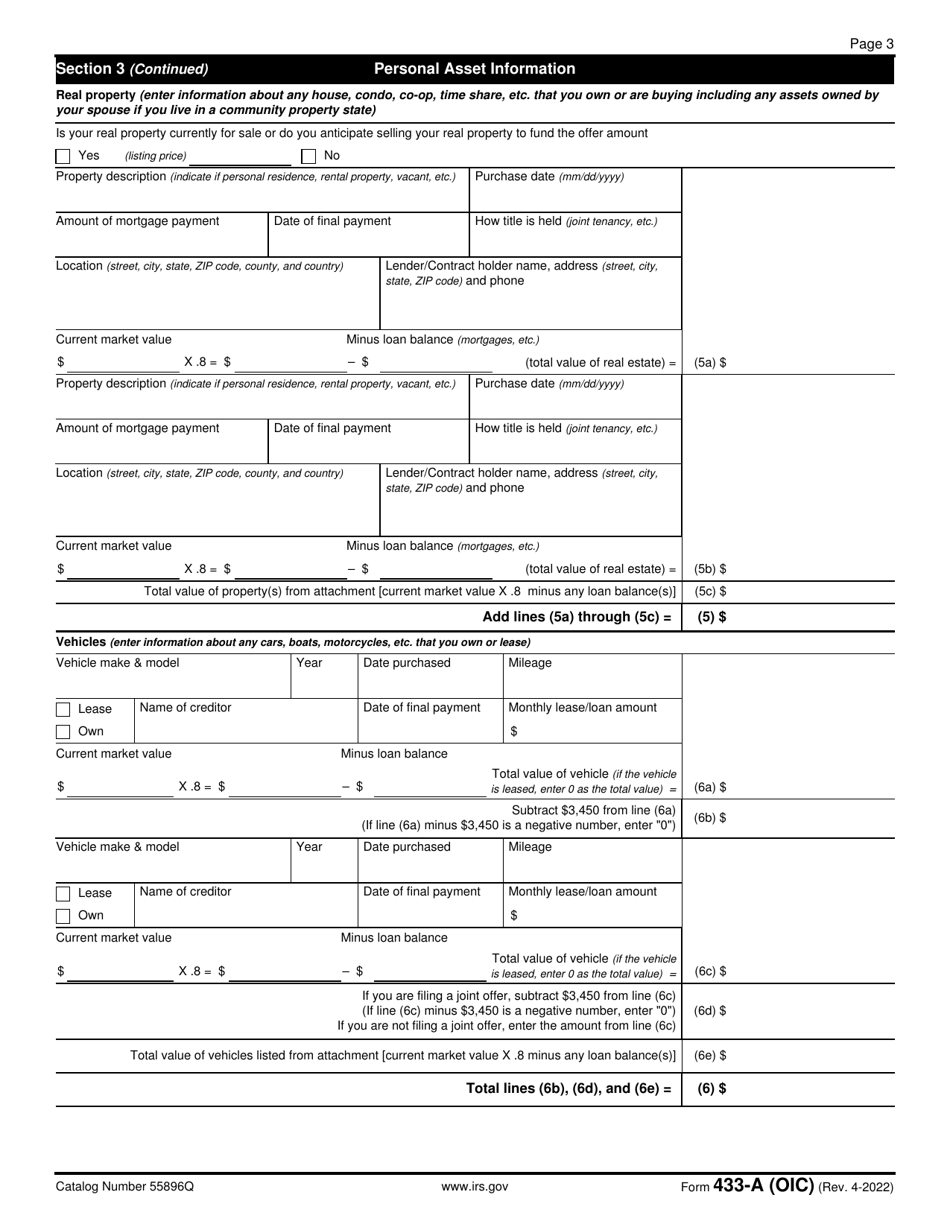

A: IRS Form 433-A (OIC) requires information about the taxpayer's income, expenses, assets, liabilities, and other financial details.

Form Details:

- A 8-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- A Spanish version of IRS Form 433-A (OIC) is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 433-A (OIC) through the link below or browse more documents in our library of IRS Forms.