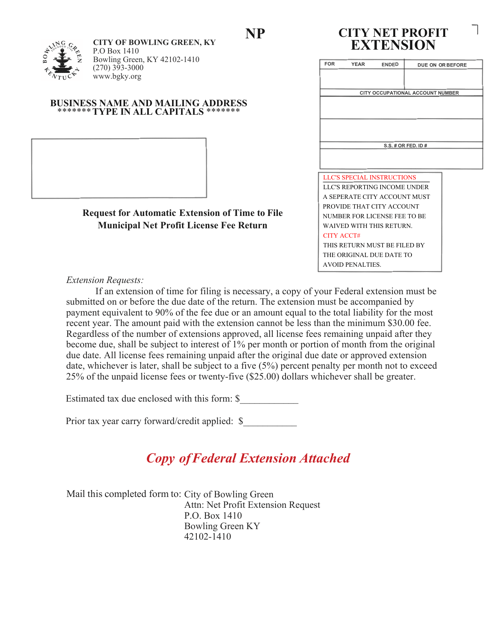

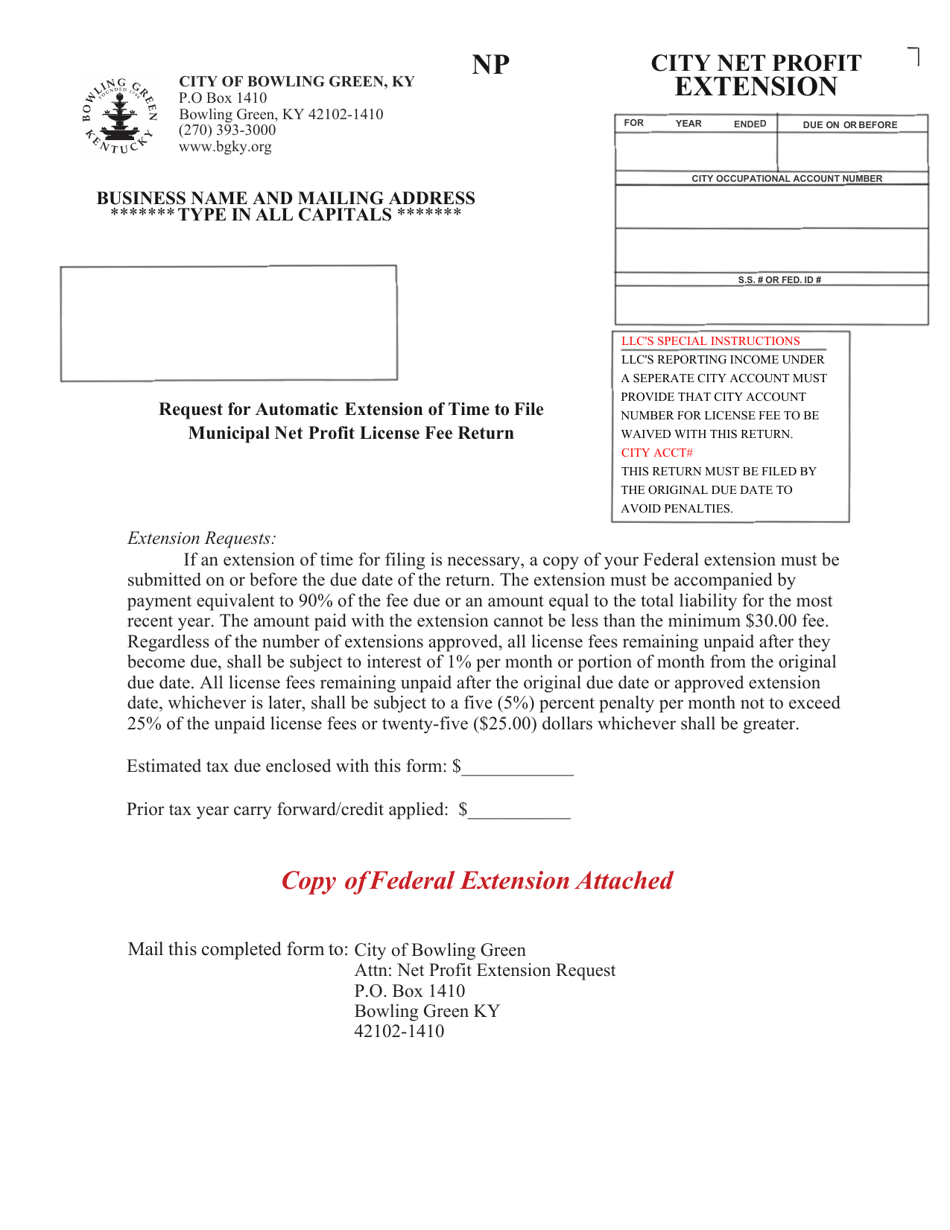

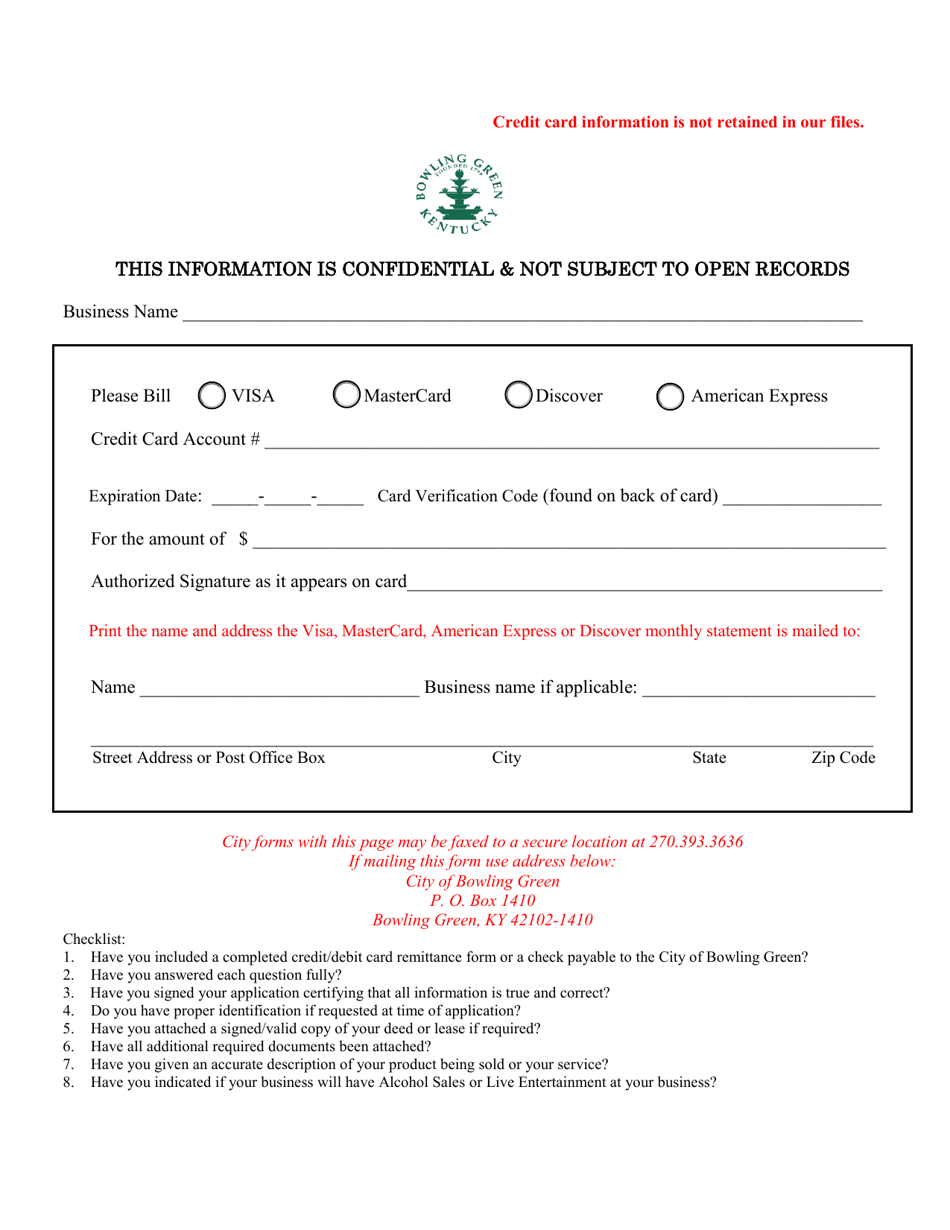

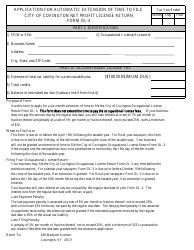

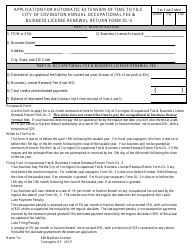

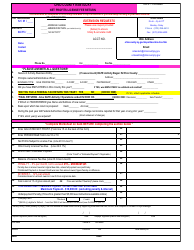

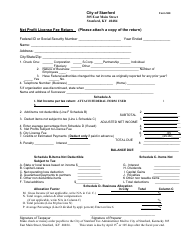

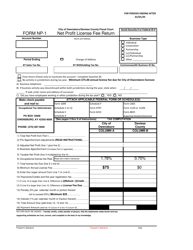

Request for Automatic Extension of Time to File Municipal Net Profit License Fee Return - City of Bowling Green, Kentucky

Request for Automatic Extension of Time to File Municipal Net Profit License Fee Return is a legal document that was released by the Finance Department - City of Bowling Green, Kentucky - a government authority operating within Kentucky. The form may be used strictly within City of Bowling Green.

FAQ

Q: What is an Automatic Extension of Time to File Municipal Net Profit License Fee Return?

A: An Automatic Extension of Time to File Municipal Net Profit License Fee Return is a request to extend the deadline for filing the return.

Q: Who issues the Automatic Extension of Time to File Municipal Net Profit License Fee Return for City of Bowling Green, Kentucky?

A: The City of Bowling Green, Kentucky issues the Automatic Extension of Time to File Municipal Net Profit License Fee Return.

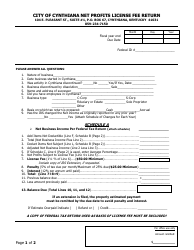

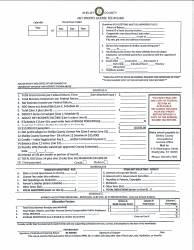

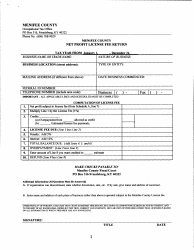

Q: What is the purpose of the Municipal Net Profit License Fee Return?

A: The Municipal Net Profit License Fee Return is used to report and pay the net profit license fee to the City of Bowling Green, Kentucky.

Q: How can I request an automatic extension of time to file the Municipal Net Profit License Fee Return?

A: You can request an automatic extension of time by filing the appropriate form with the City of Bowling Green, Kentucky.

Q: What is the deadline for filing the Municipal Net Profit License Fee Return?

A: The deadline for filing the Municipal Net Profit License Fee Return is typically April 15th, unless an extension has been granted.

Form Details:

- The latest edition currently provided by the Finance Department - City of Bowling Green, Kentucky;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of Bowling Green, Kentucky.