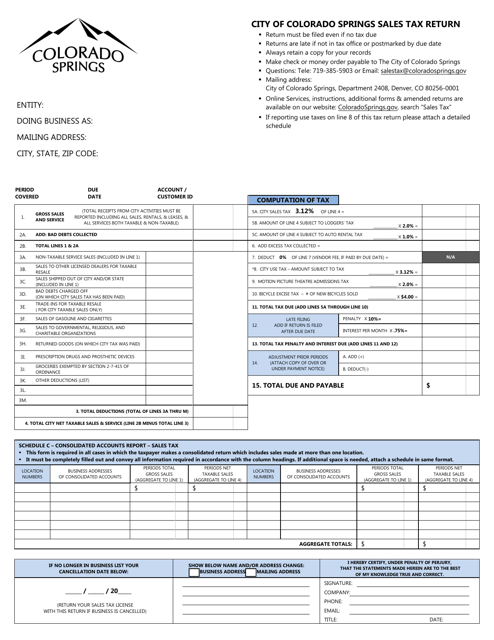

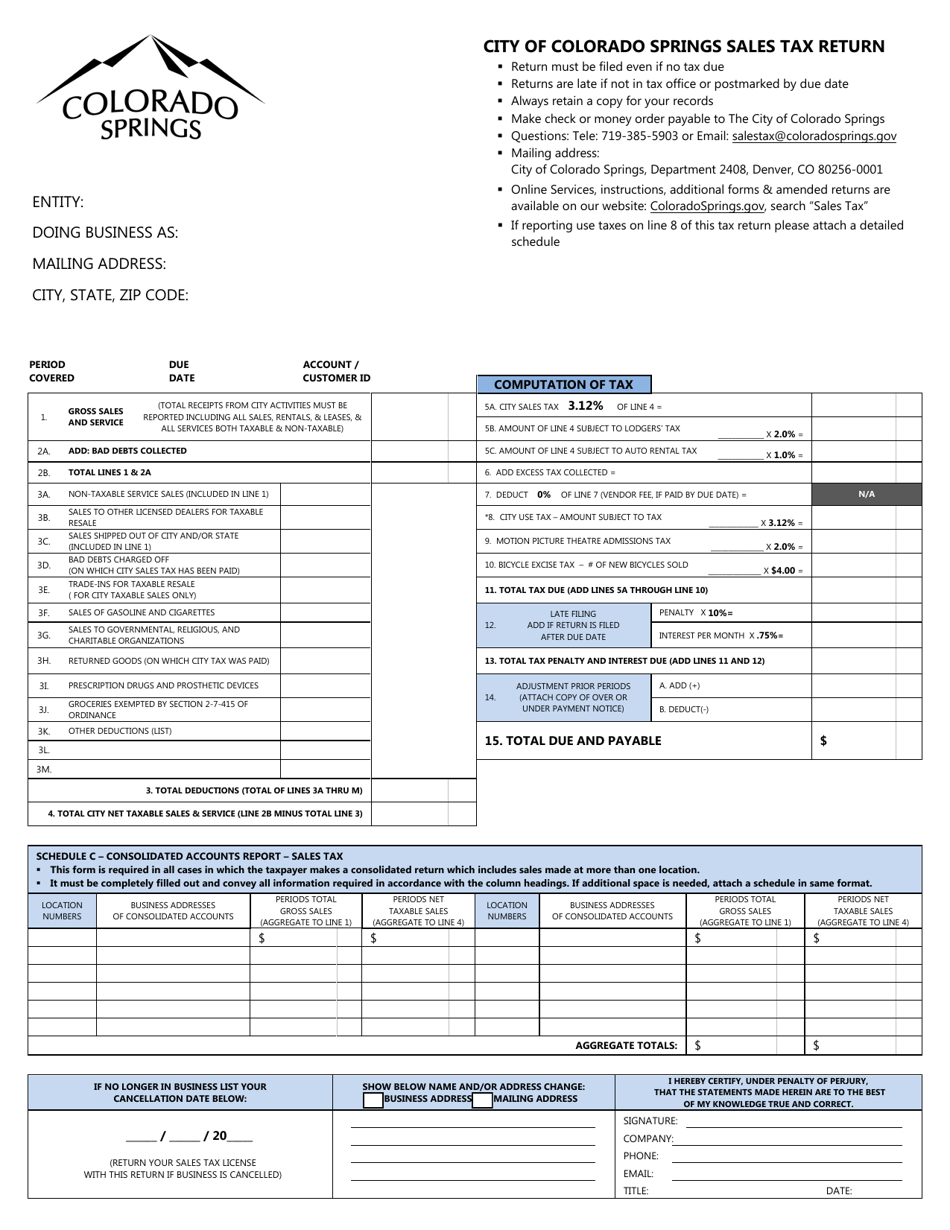

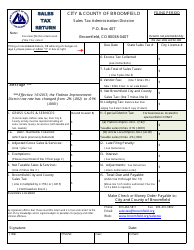

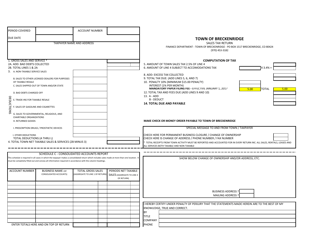

3.12% Sales and Use Tax Return - City of Colorado Springs, Colorado

3.12% Sales and Use Tax Return is a legal document that was released by the Finance Department - City of Colorado Springs, Colorado - a government authority operating within Colorado. The form may be used strictly within City of Colorado Springs.

FAQ

Q: What is the sales and use tax rate in Colorado Springs, Colorado?

A: The sales and use tax rate in Colorado Springs is 3.12%.

Q: What is a Sales and Use Tax Return?

A: A Sales and Use Tax Return is a form that businesses use to report and pay the sales and use taxes they have collected from their customers to the City of Colorado Springs.

Q: Who is required to file a Sales and Use Tax Return in Colorado Springs?

A: All businesses that sell taxable goods or services in Colorado Springs are required to file a Sales and Use Tax Return.

Q: How often do businesses need to file a Sales and Use Tax Return in Colorado Springs?

A: Sales and Use Tax Returns are generally filed on a monthly basis in Colorado Springs.

Q: What is the deadline for filing a Sales and Use Tax Return in Colorado Springs?

A: The deadline for filing a Sales and Use Tax Return in Colorado Springs is generally on or before the 20th day of the month following the reporting period.

Form Details:

- The latest edition currently provided by the Finance Department - City of Colorado Springs, Colorado;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of Colorado Springs, Colorado.