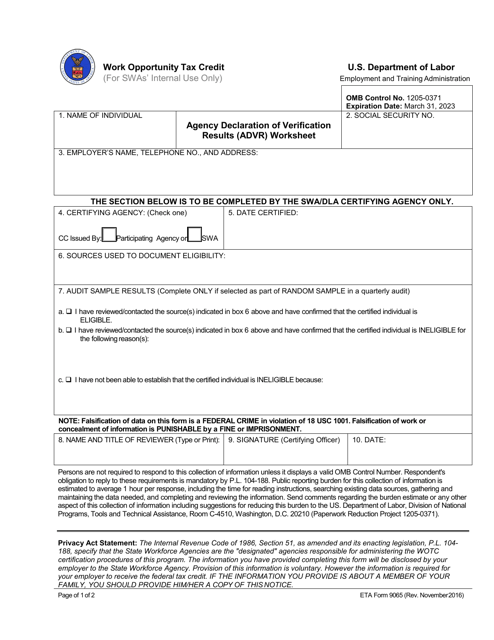

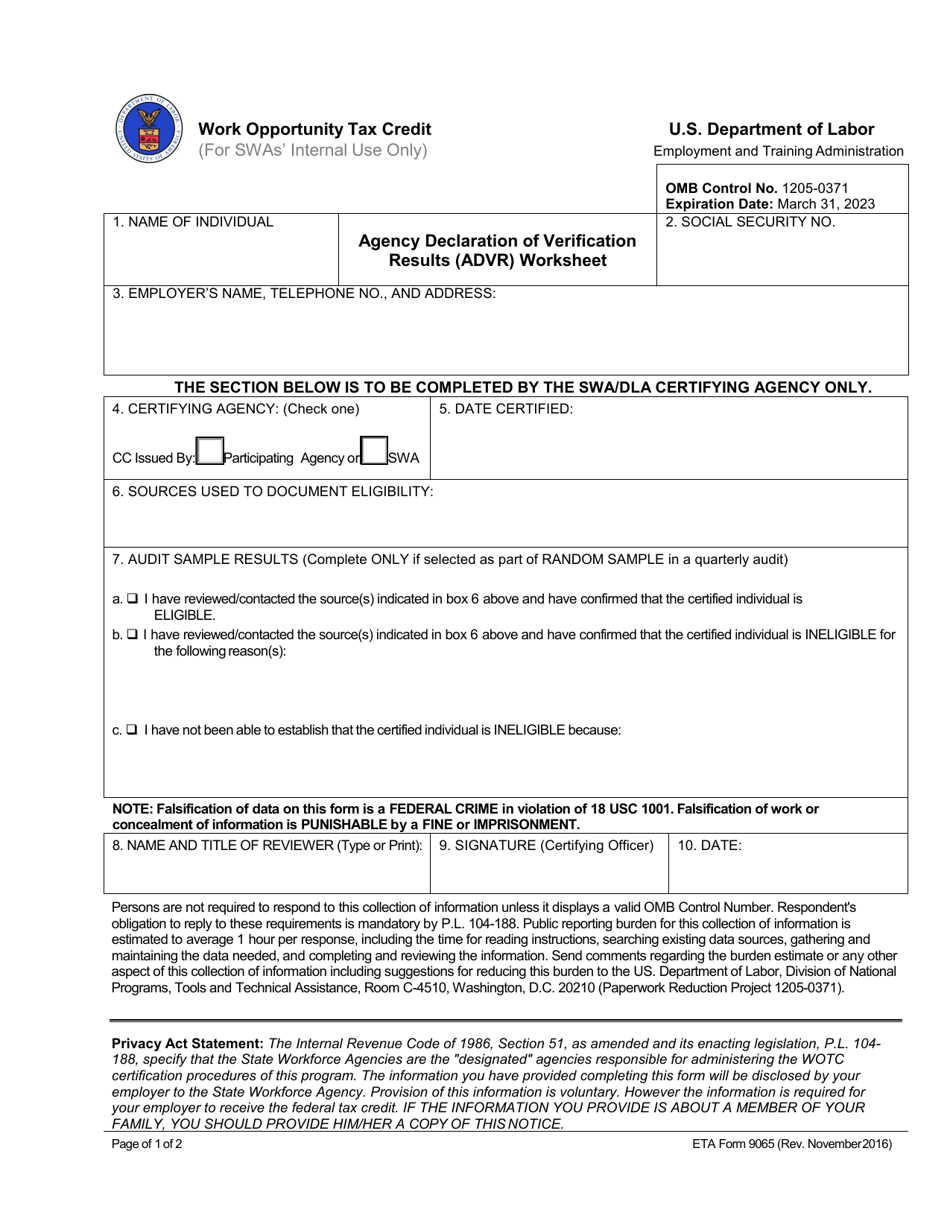

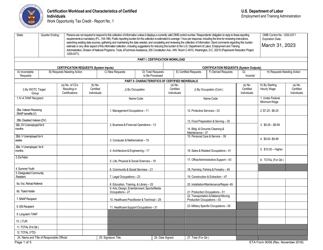

ETA Form 9065 Wotc Agency Declaration of Verification Results (Advr) Worksheet

What Is ETA Form 9065?

This is a legal form that was released by the U.S. Department of Labor - Employment & Training Administration on November 1, 2016 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ETA Form 9065?

A: ETA Form 9065 is the WOTC Agency Declaration of Verification Results (ADVR) Worksheet.

Q: What is the purpose of ETA Form 9065?

A: ETA Form 9065 is used to document the verification results of the Work Opportunity Tax Credit (WOTC) program.

Q: What is the WOTC program?

A: The Work Opportunity Tax Credit (WOTC) program is a federal tax credit program that provides incentives to employers who hire individuals from specific target groups.

Q: Who completes the ETA Form 9065?

A: The employer or employer representative completes the ETA Form 9065.

Q: Is ETA Form 9065 mandatory?

A: Yes, ETA Form 9065 is required for employers participating in the WOTC program.

Q: What information is required on ETA Form 9065?

A: ETA Form 9065 requires employer and employee information, as well as details about the employee's eligibility and employment status.

Q: How long should I keep ETA Form 9065?

A: Employers should retain ETA Form 9065 and any supporting documentation for a minimum of three years from the date of the employee's start date.

Form Details:

- Released on November 1, 2016;

- The latest available edition released by the U.S. Department of Labor - Employment & Training Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of ETA Form 9065 by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employment & Training Administration.