Income-Driven Repayment Plans: Questions and Answers

Income-Driven Repayment Plans: Questions and Answers is a 26-page legal document that was released by the U.S. Department of Education on February 1, 2016 and used nation-wide.

FAQ

Q: What are income-driven repayment plans?

A: Income-driven repayment plans are federal student loan repayment options that base your monthly payment amount on your income and family size.

Q: How do income-driven repayment plans work?

A: Income-driven repayment plans calculate your monthly payment based on a percentage of your discretionary income. If your income is low, your monthly payment may be as low as $0.

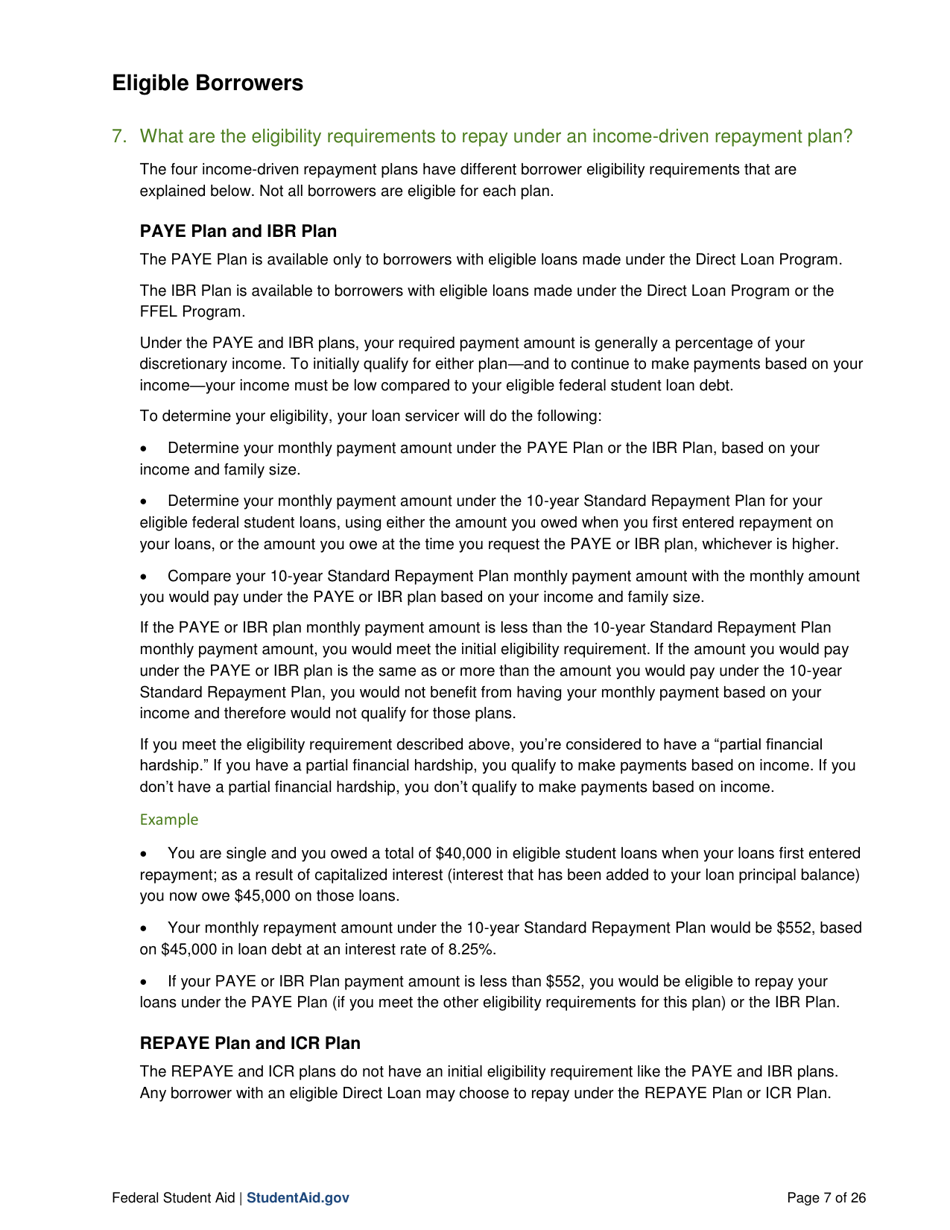

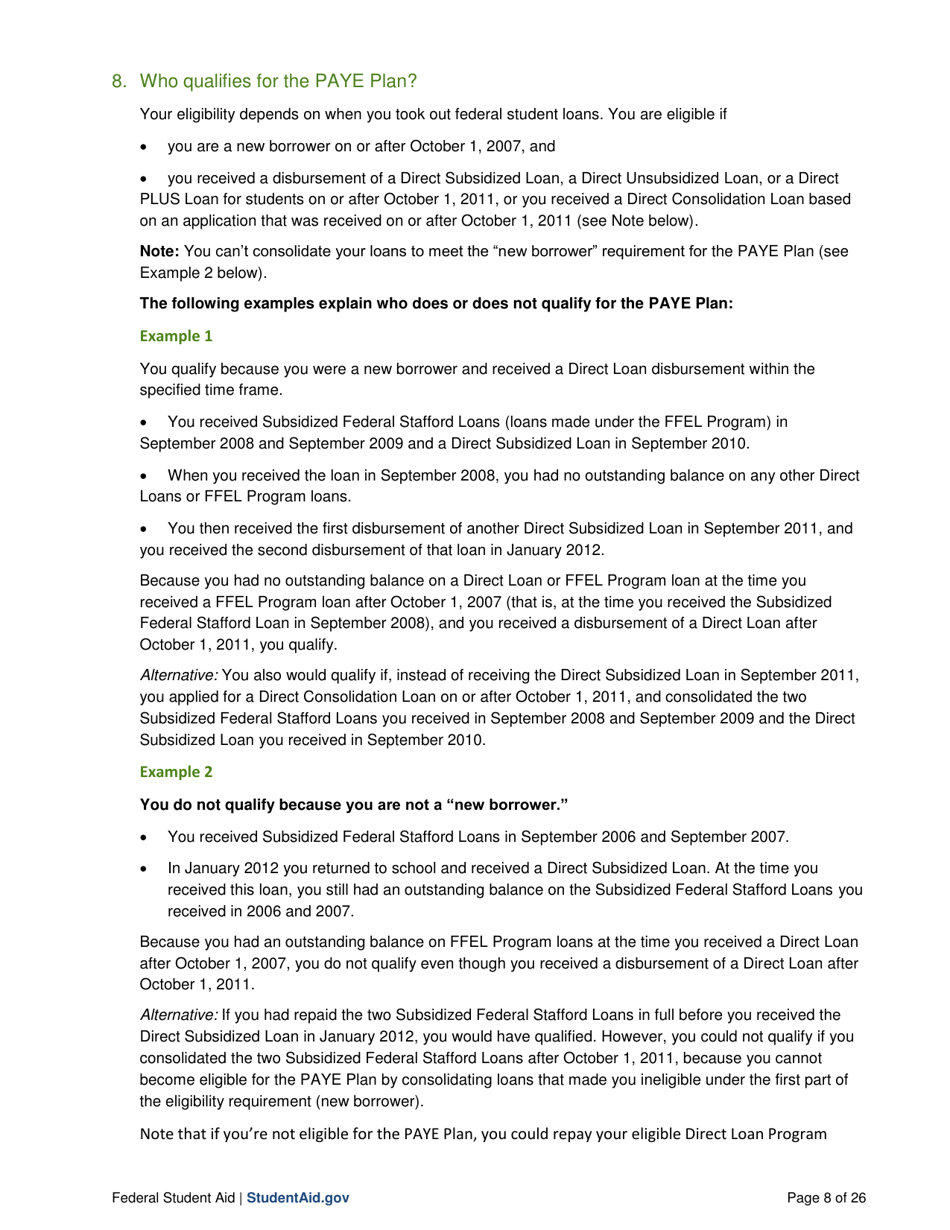

Q: Who is eligible for income-driven repayment plans?

A: Most federal student loan borrowers are eligible for income-driven repayment plans regardless of income or loan balance.

Q: Can I switch to an income-driven repayment plan if I'm already on a different repayment plan?

A: Yes, you can switch to an income-driven repayment plan at any time if you meet the eligibility criteria.

Q: What is the maximum repayment term for income-driven repayment plans?

A: The maximum repayment term for most income-driven repayment plans is 20 or 25 years, depending on the plan.

Q: Do income-driven repayment plans forgive the remaining balance after a certain period of time?

A: Yes, most income-driven repayment plans offer forgiveness of any remaining loan balance after a certain number of years of qualifying payments.

Q: Do income-driven repayment plans affect my credit score?

A: No, participating in an income-driven repayment plan does not directly impact your credit score.

Q: Can I still qualify for income-driven repayment plans if I am married?

A: Yes, your spouse's income will be considered if you choose to file taxes jointly, but you can still qualify for an income-driven repayment plan.

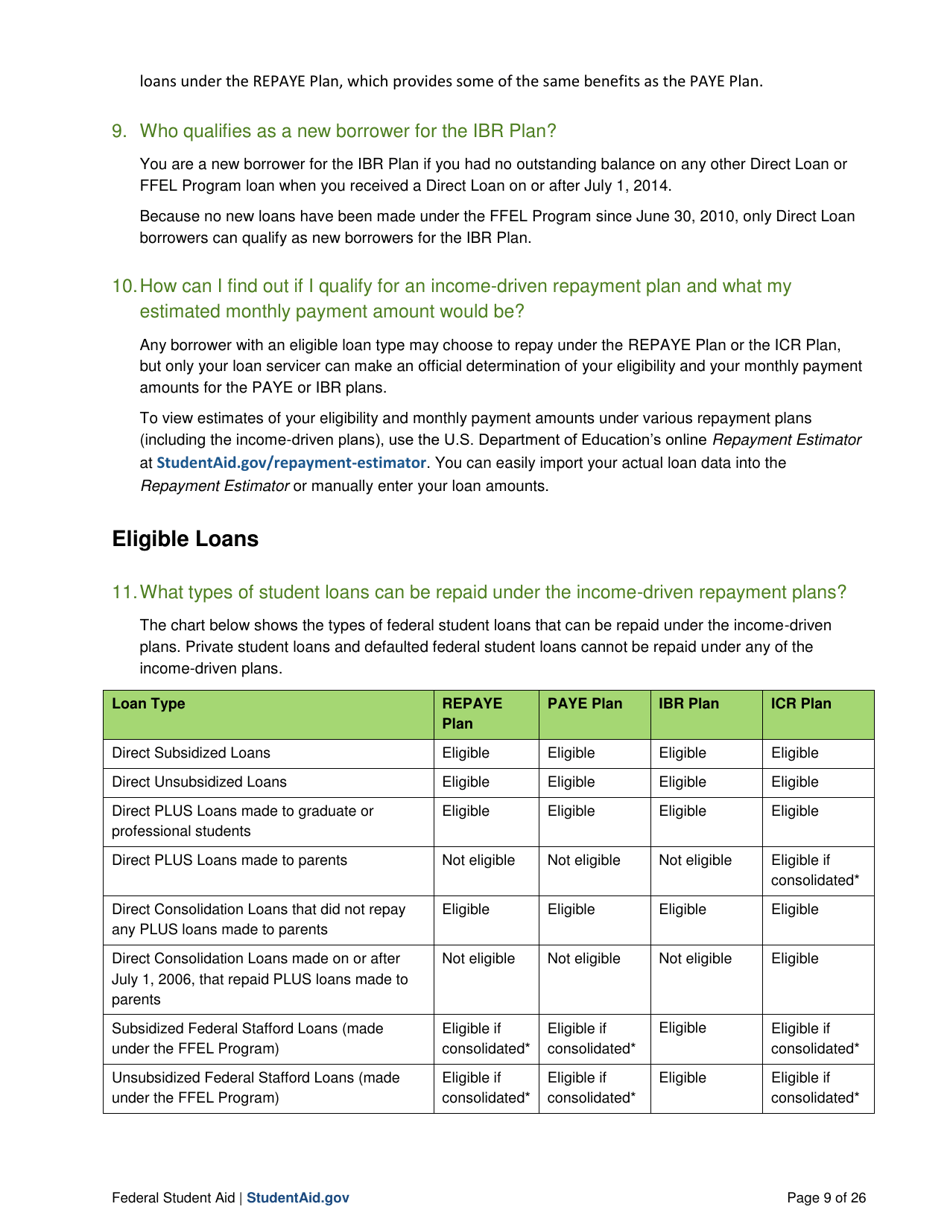

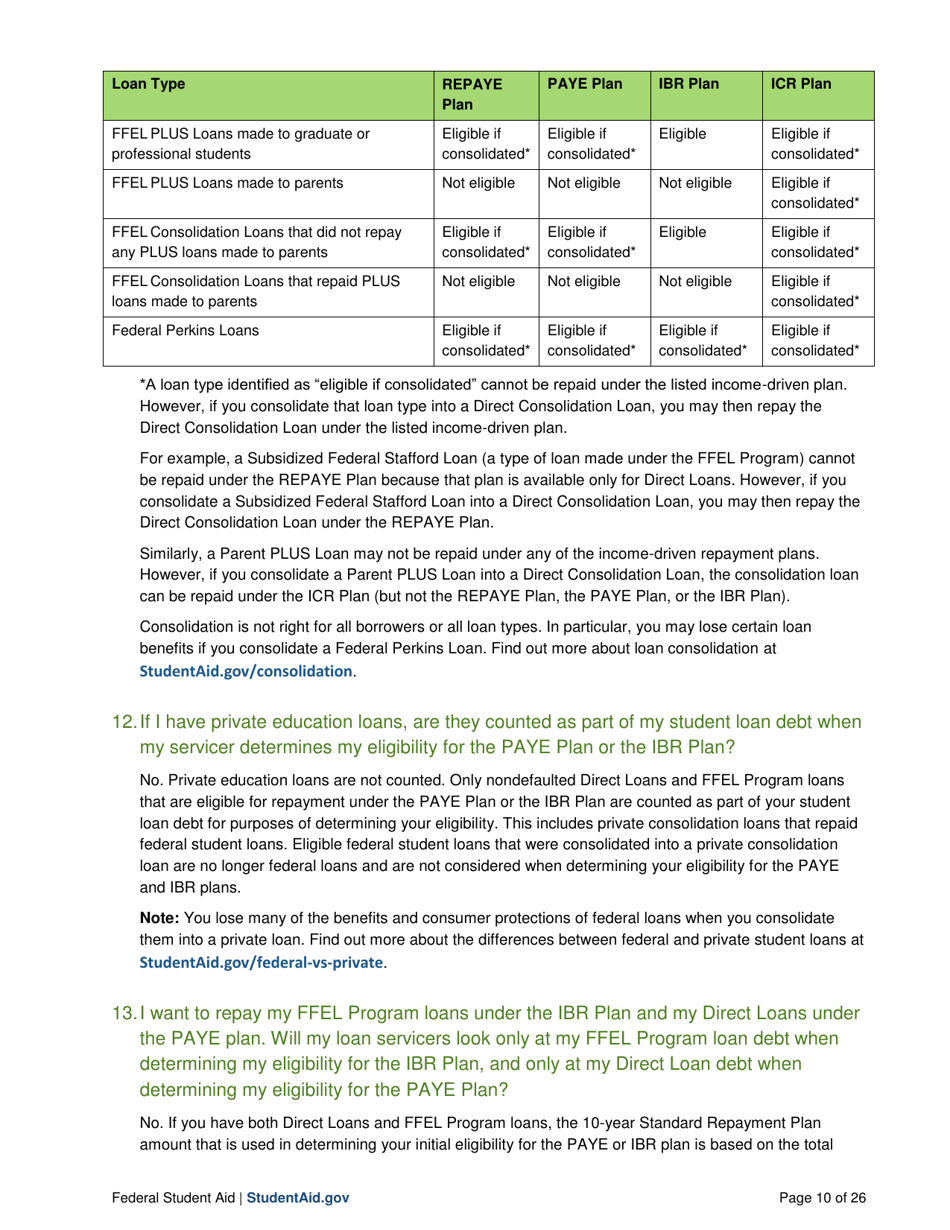

Q: Are income-driven repayment plans available for private student loans?

A: No, income-driven repayment plans are only available for federal student loans.

Form Details:

- The latest edition currently provided by the U.S. Department of Education;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.