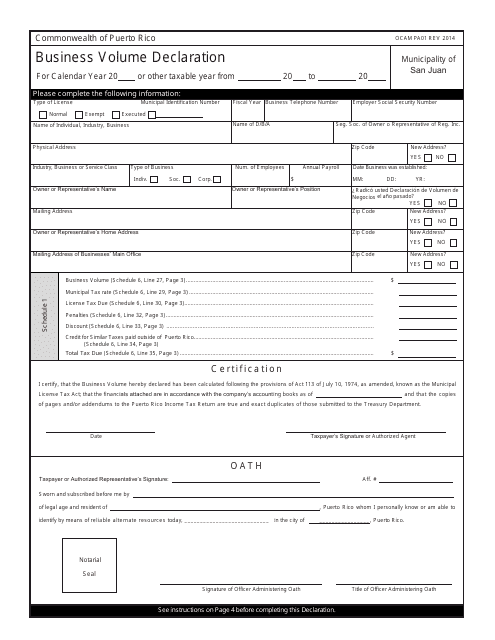

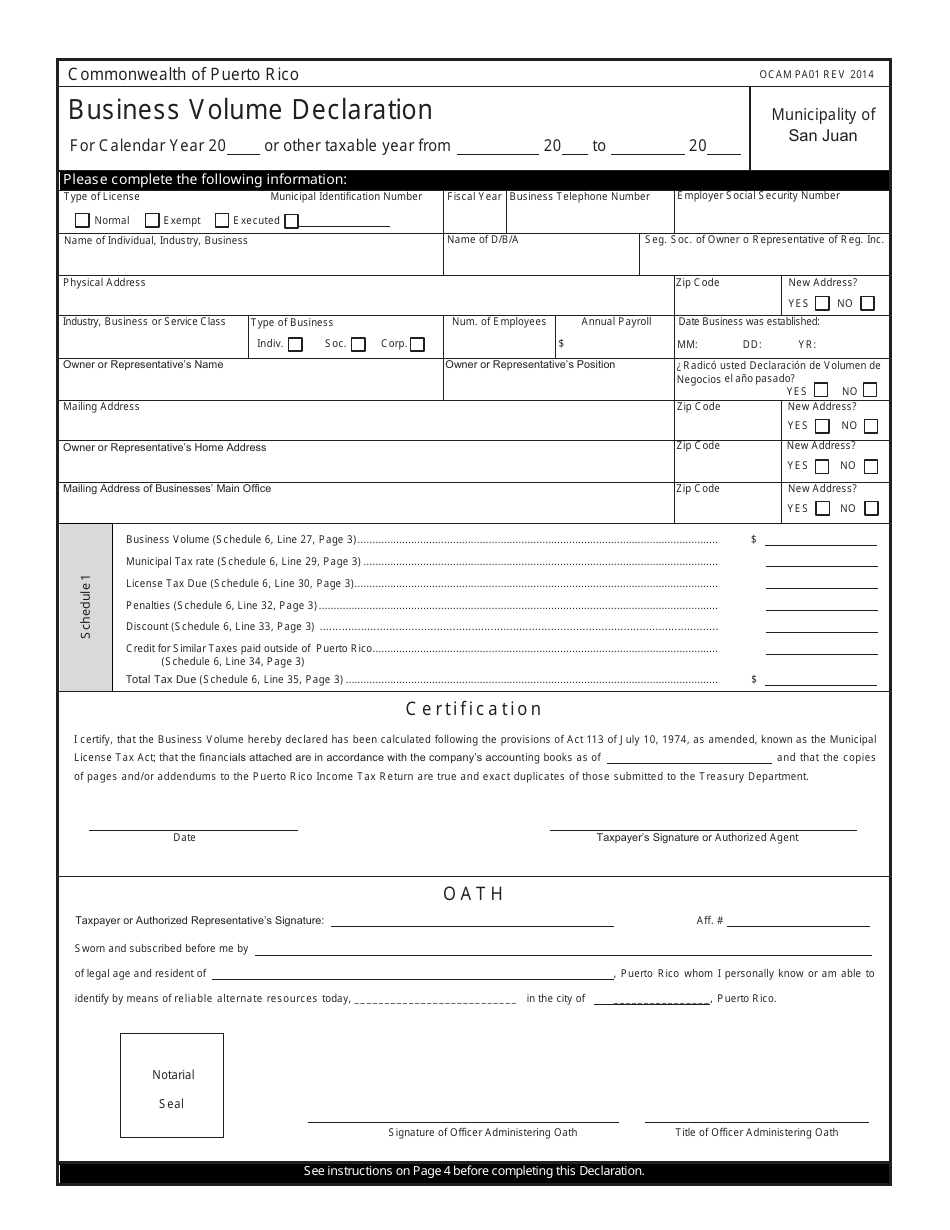

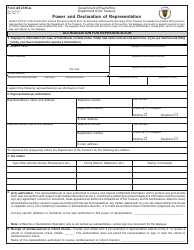

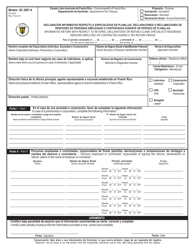

Form OCAM PA01 Business Volume Declaration - Puerto Rico

What Is Form OCAM PA01?

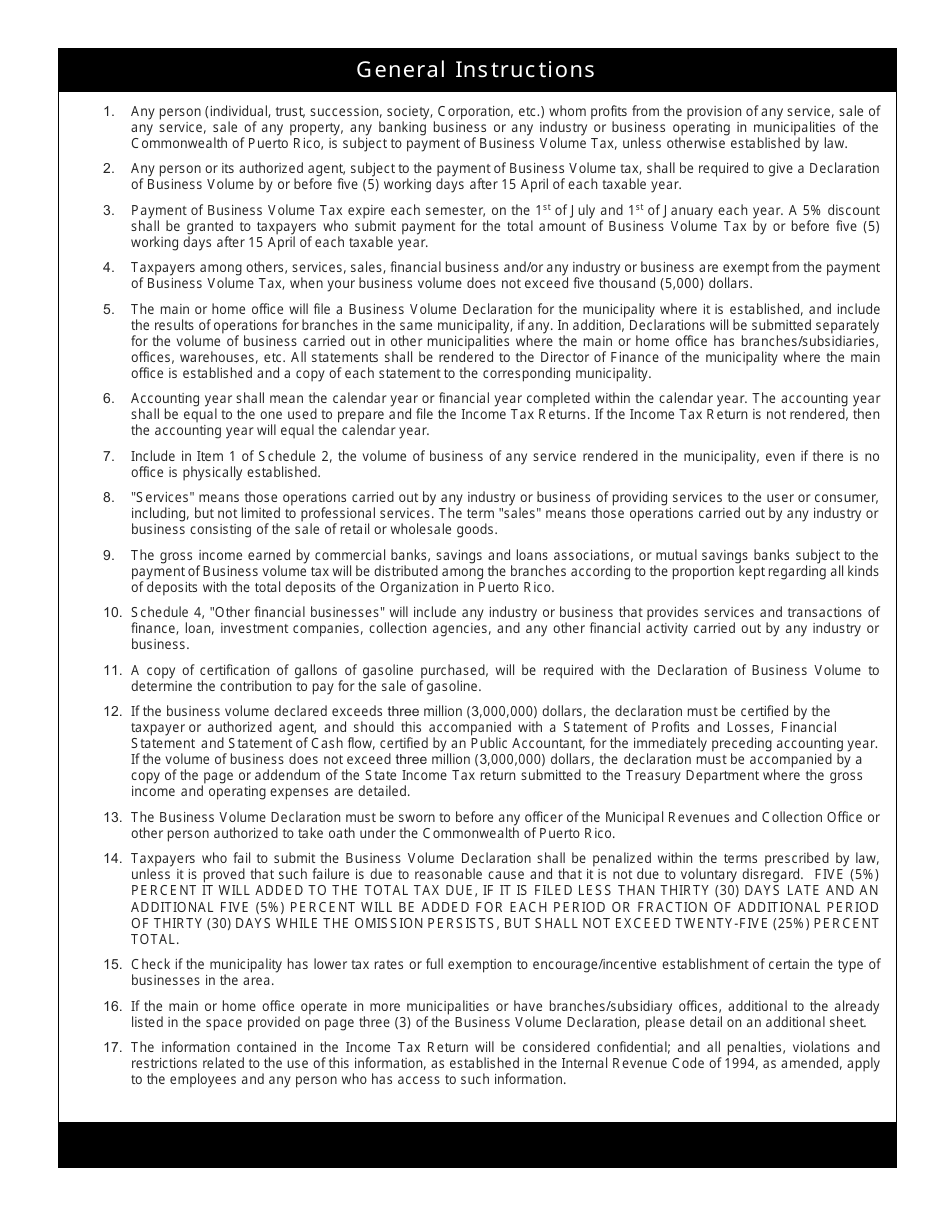

This is a legal form that was released by the Puerto Rico Department of Treasury - a government authority operating within Puerto Rico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an OCAM PA01 Business Volume Declaration?

A: The OCAM PA01 Business Volume Declaration is a form used in Puerto Rico to report the business volume of a company.

Q: Who needs to file an OCAM PA01 Business Volume Declaration?

A: All businesses in Puerto Rico are required to file an OCAM PA01 Business Volume Declaration.

Q: When is the deadline for filing an OCAM PA01 Business Volume Declaration?

A: The deadline for filing an OCAM PA01 Business Volume Declaration in Puerto Rico varies depending on the type of business, but it is typically due by the end of April.

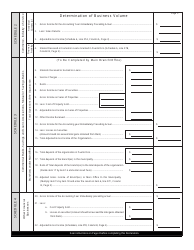

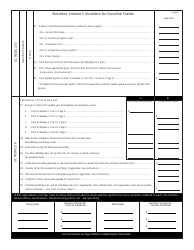

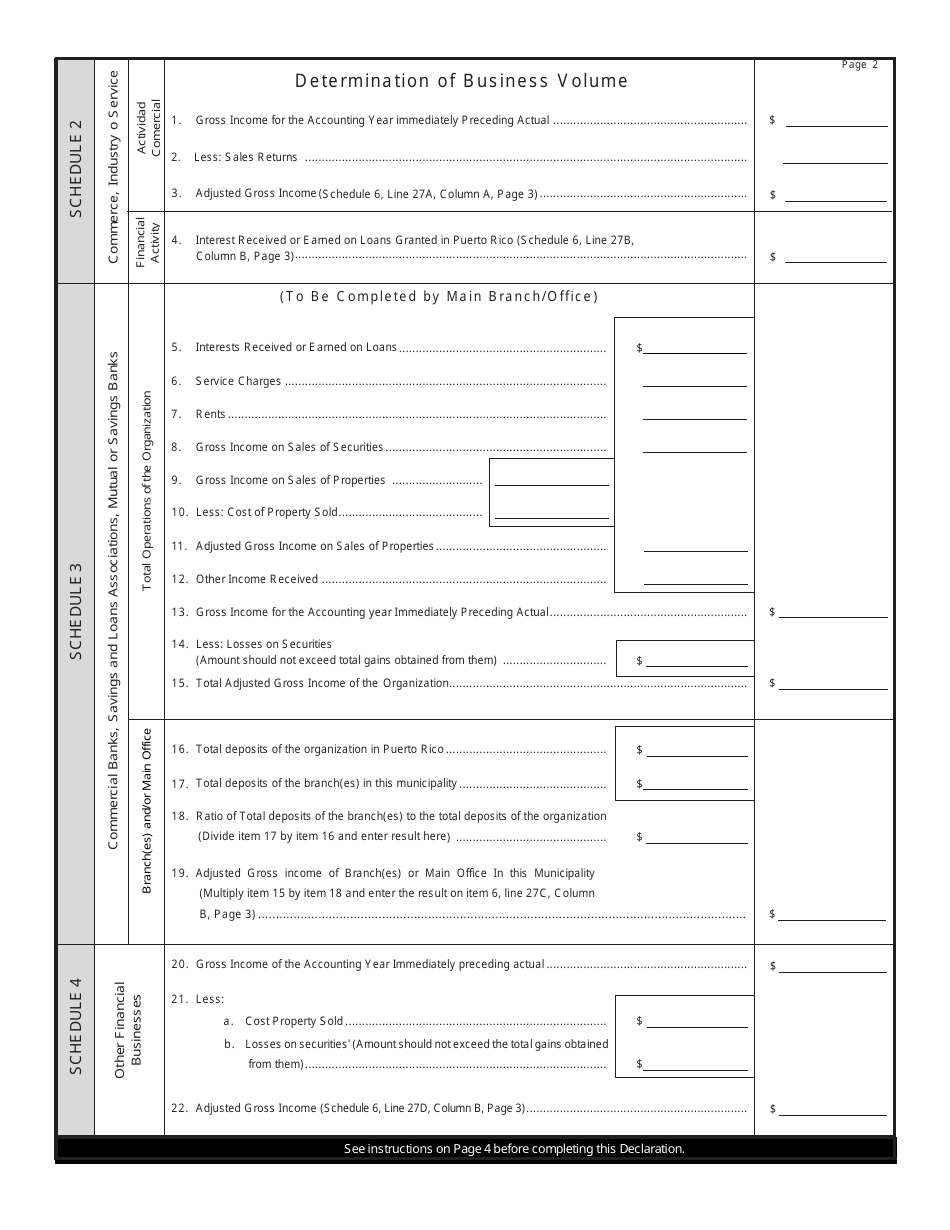

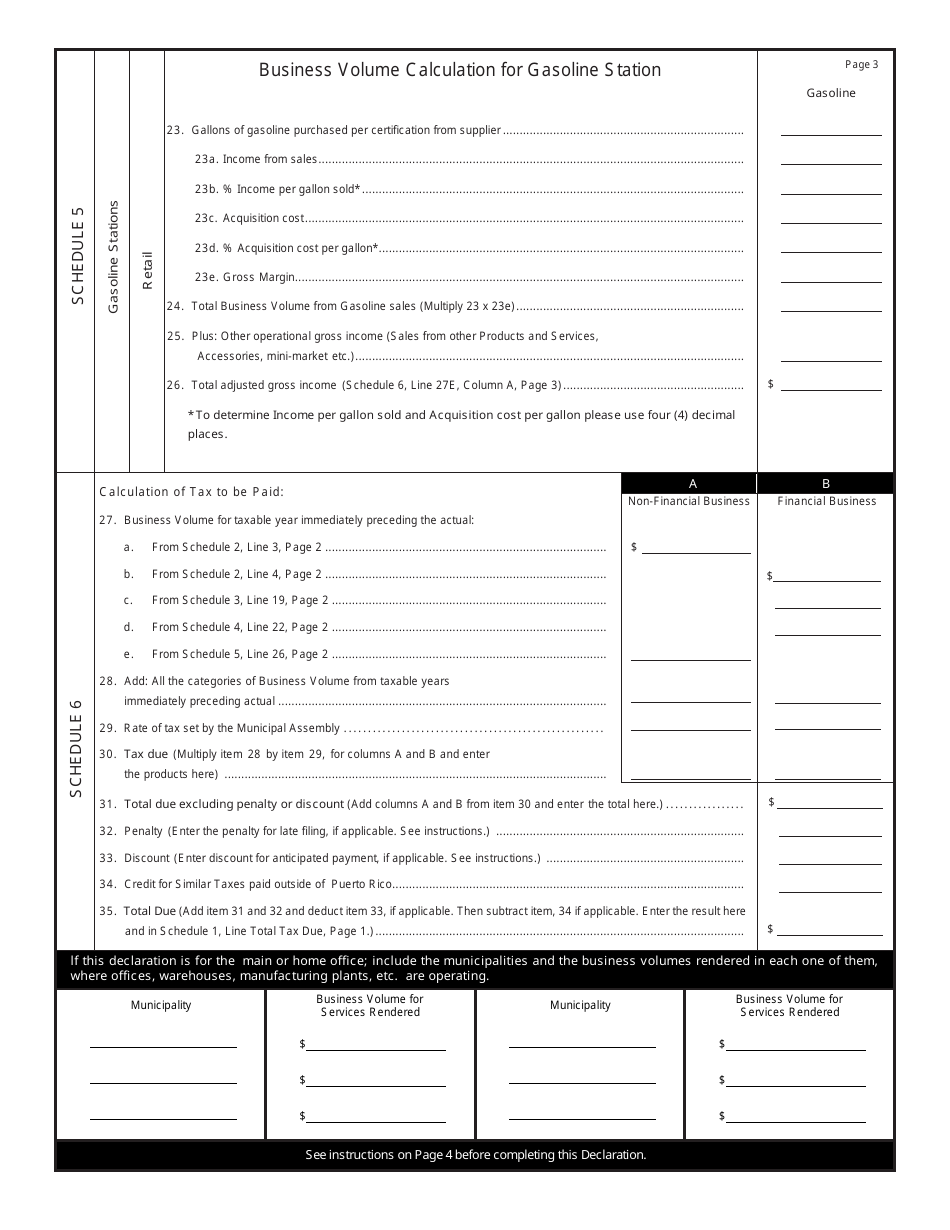

Q: What information is required on an OCAM PA01 Business Volume Declaration?

A: The OCAM PA01 Business Volume Declaration requires information on the business's sales, gross income, and expenses.

Q: Is there a fee for filing an OCAM PA01 Business Volume Declaration?

A: No, there is no fee for filing an OCAM PA01 Business Volume Declaration in Puerto Rico.

Q: What happens if I don't file an OCAM PA01 Business Volume Declaration?

A: Failure to file an OCAM PA01 Business Volume Declaration in Puerto Rico can result in penalties and fines for the business.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Puerto Rico Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OCAM PA01 by clicking the link below or browse more documents and templates provided by the Puerto Rico Department of Treasury.