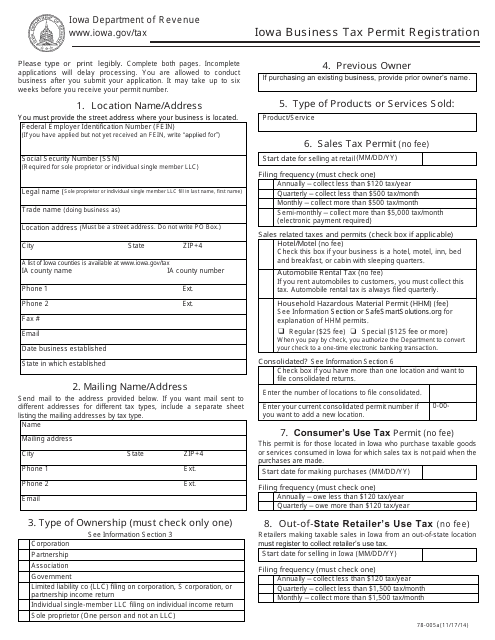

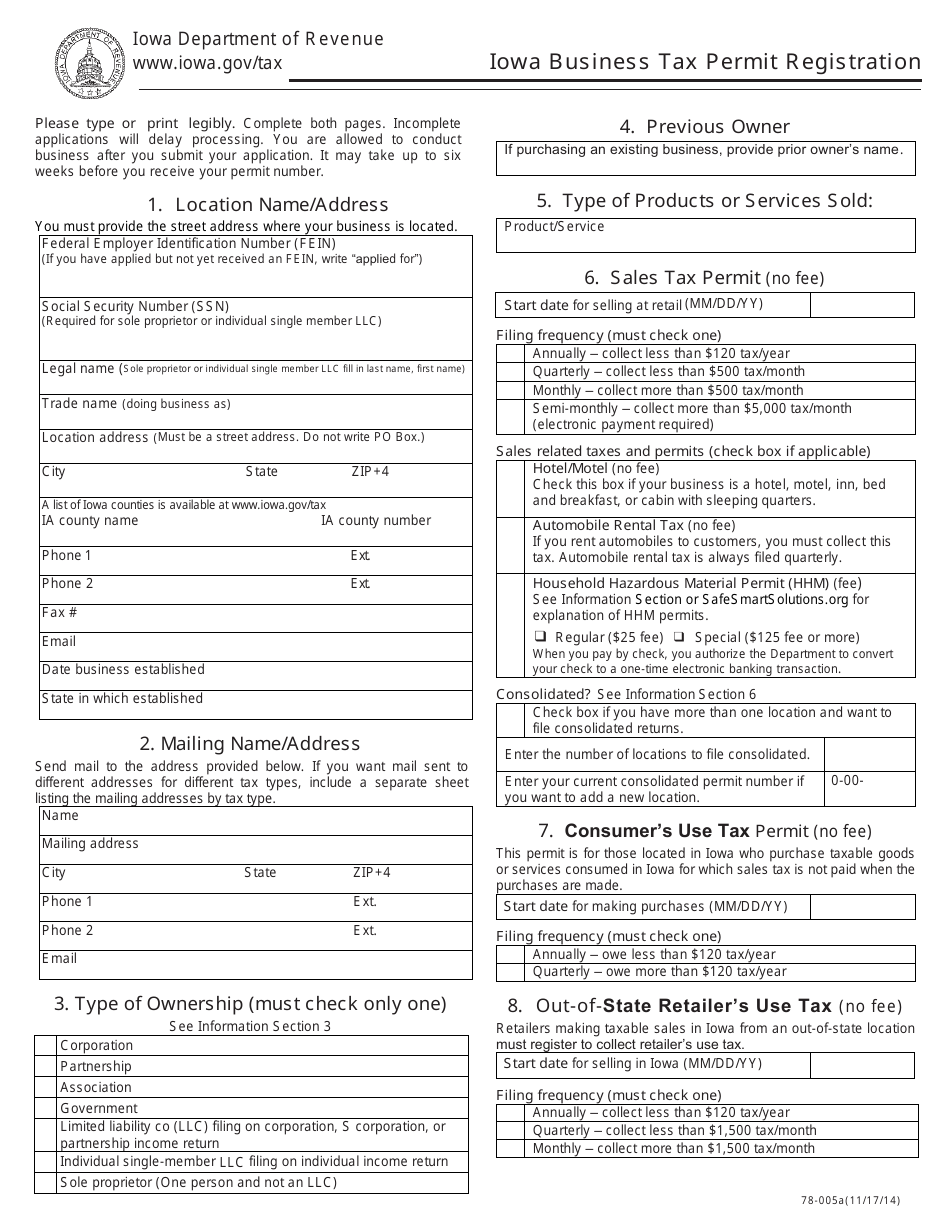

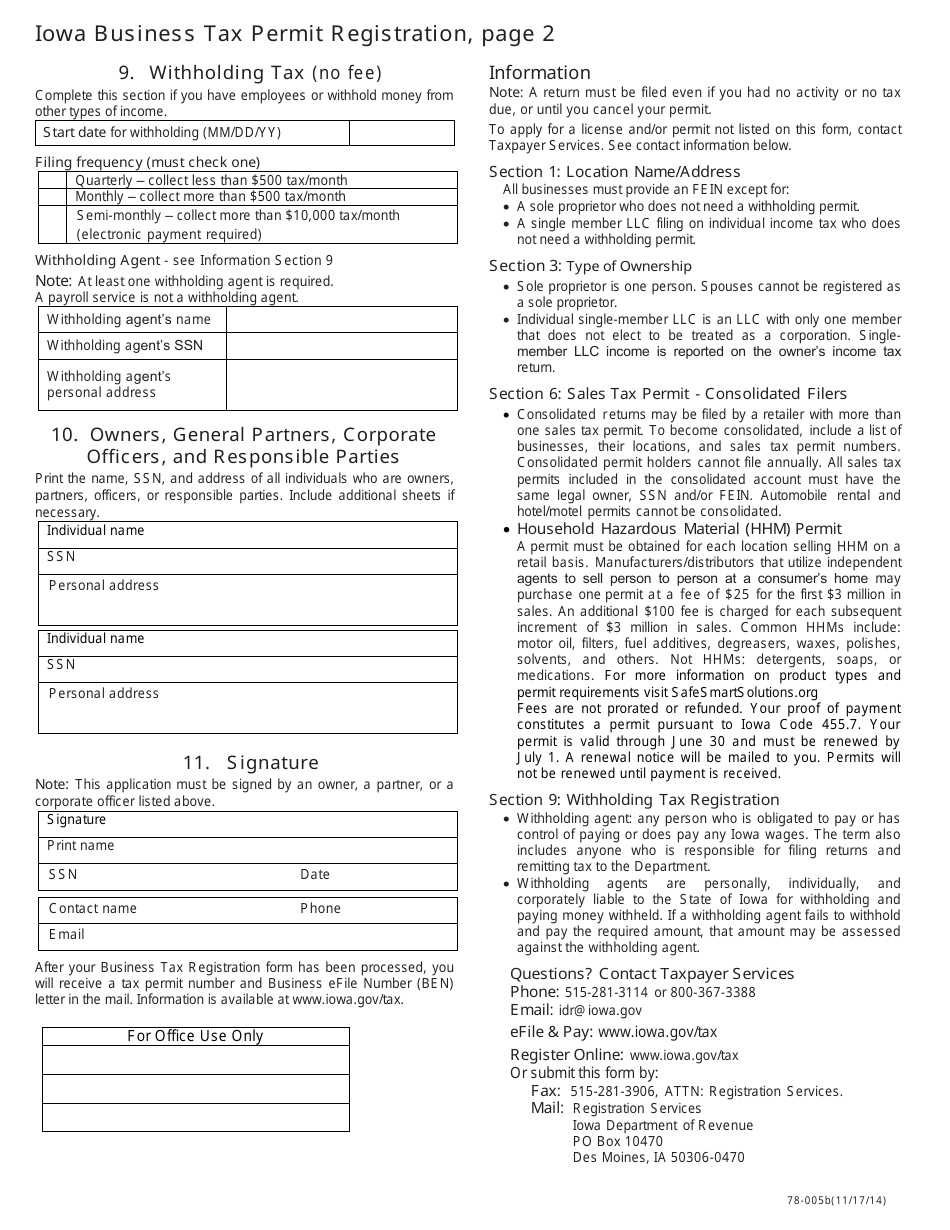

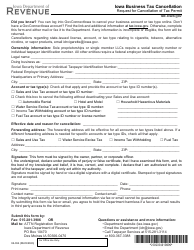

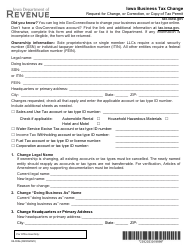

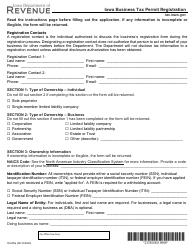

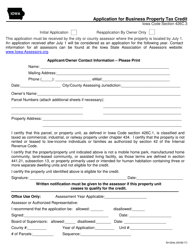

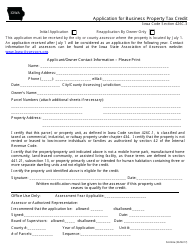

Form 78-005a Business Tax Permit Registration - Iowa

What Is Form 78-005a?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 78-005a?

A: Form 78-005a is the Business Tax Permit Registration form for the state of Iowa.

Q: Who needs to file Form 78-005a?

A: Any business operating in Iowa that is required to collect sales tax or withhold income tax must file Form 78-005a.

Q: What information is required on Form 78-005a?

A: Form 78-005a requires information such as business name, address, contact information, and tax account information.

Q: Is there a fee for filing Form 78-005a?

A: No, there is no fee for filing Form 78-005a. It is simply a registration form.

Q: When is Form 78-005a due?

A: Form 78-005a should be filed before you start doing business in Iowa.

Q: Do I need to renew my Business Tax Permit?

A: Yes, the Business Tax Permit should be renewed annually by filing a new Form 78-005a.

Q: What happens if I don't file Form 78-005a?

A: Failure to file Form 78-005a may result in penalties or fines imposed by the Iowa Department of Revenue.

Q: Can I obtain a copy of my filed Form 78-005a?

A: Yes, you can request a copy of your filed Form 78-005a from the Iowa Department of Revenue.

Form Details:

- Released on November 17, 2014;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 78-005a by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.