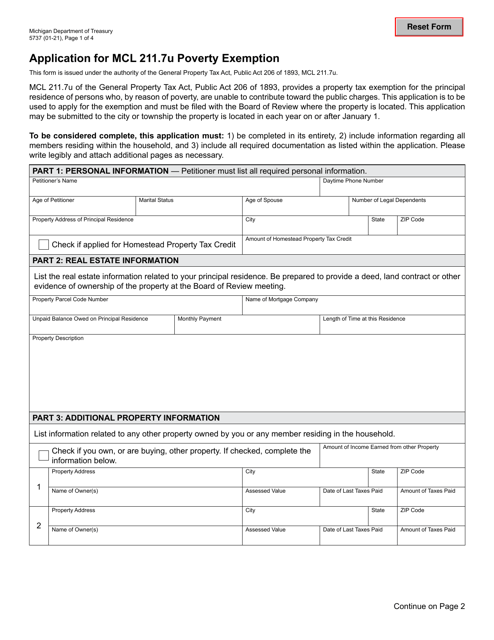

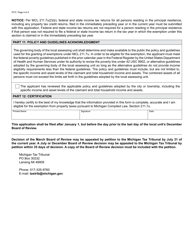

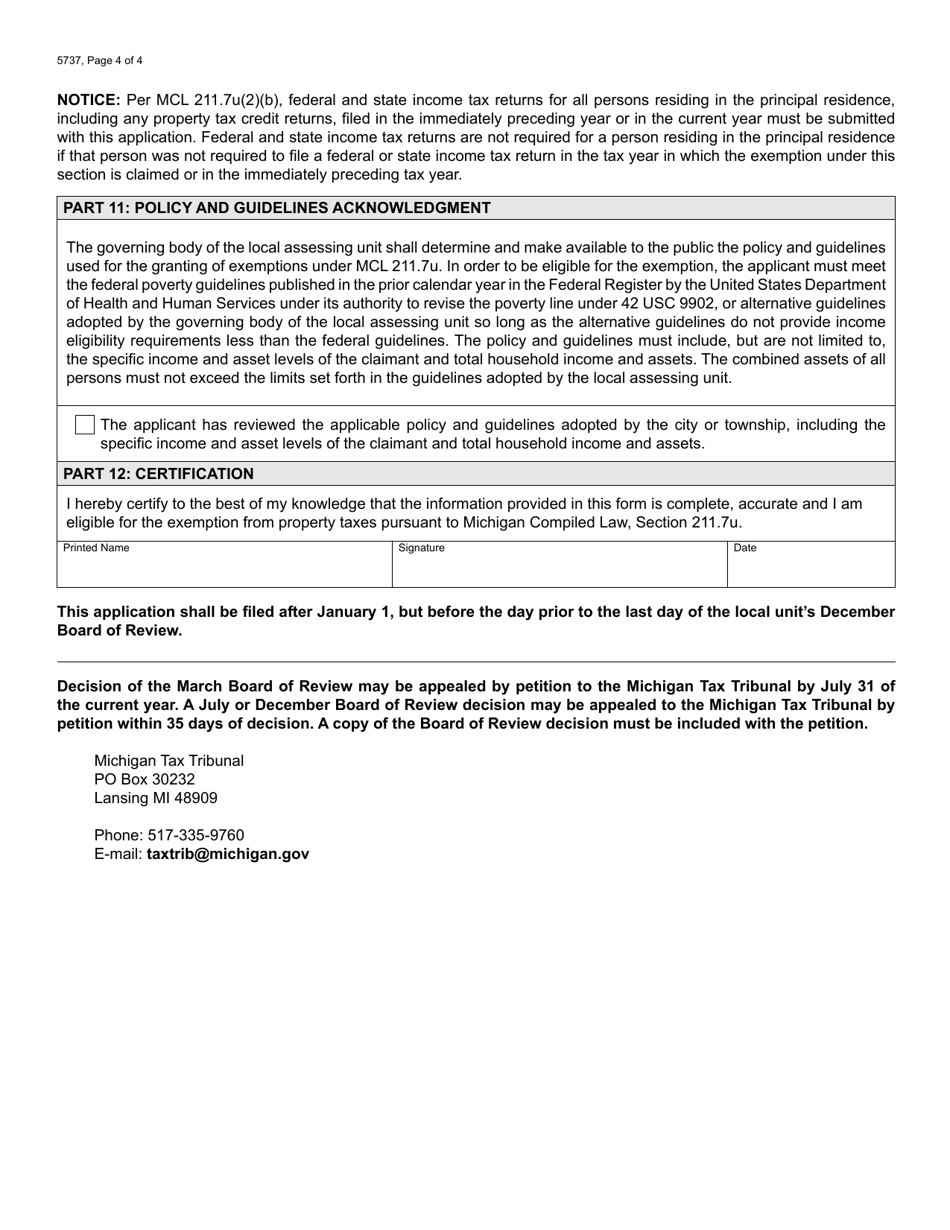

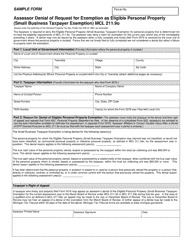

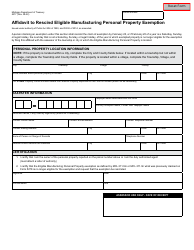

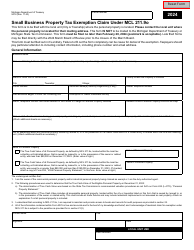

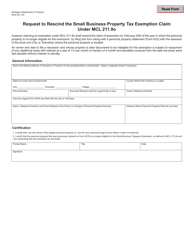

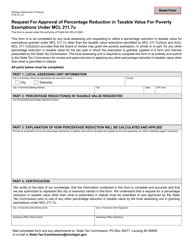

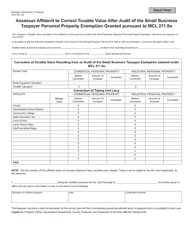

Form 5737 Application for Mcl 211.7u Poverty Exemption - Michigan

What Is Form 5737?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5737?

A: Form 5737 is the Application for MCL 211.7u Poverty Exemption in Michigan.

Q: What is MCL 211.7u?

A: MCL 211.7u is a state law in Michigan that allows for a poverty exemption from property taxes.

Q: Who is eligible for the MCL 211.7u poverty exemption?

A: Individuals or families in Michigan who meet certain income and asset criteria may be eligible for the poverty exemption.

Q: What is the purpose of the MCL 211.7u poverty exemption?

A: The purpose of the MCL 211.7u poverty exemption is to provide property tax relief for individuals or families who are experiencing financial hardship.

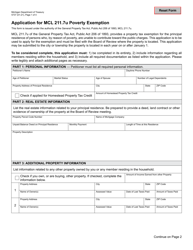

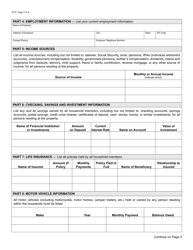

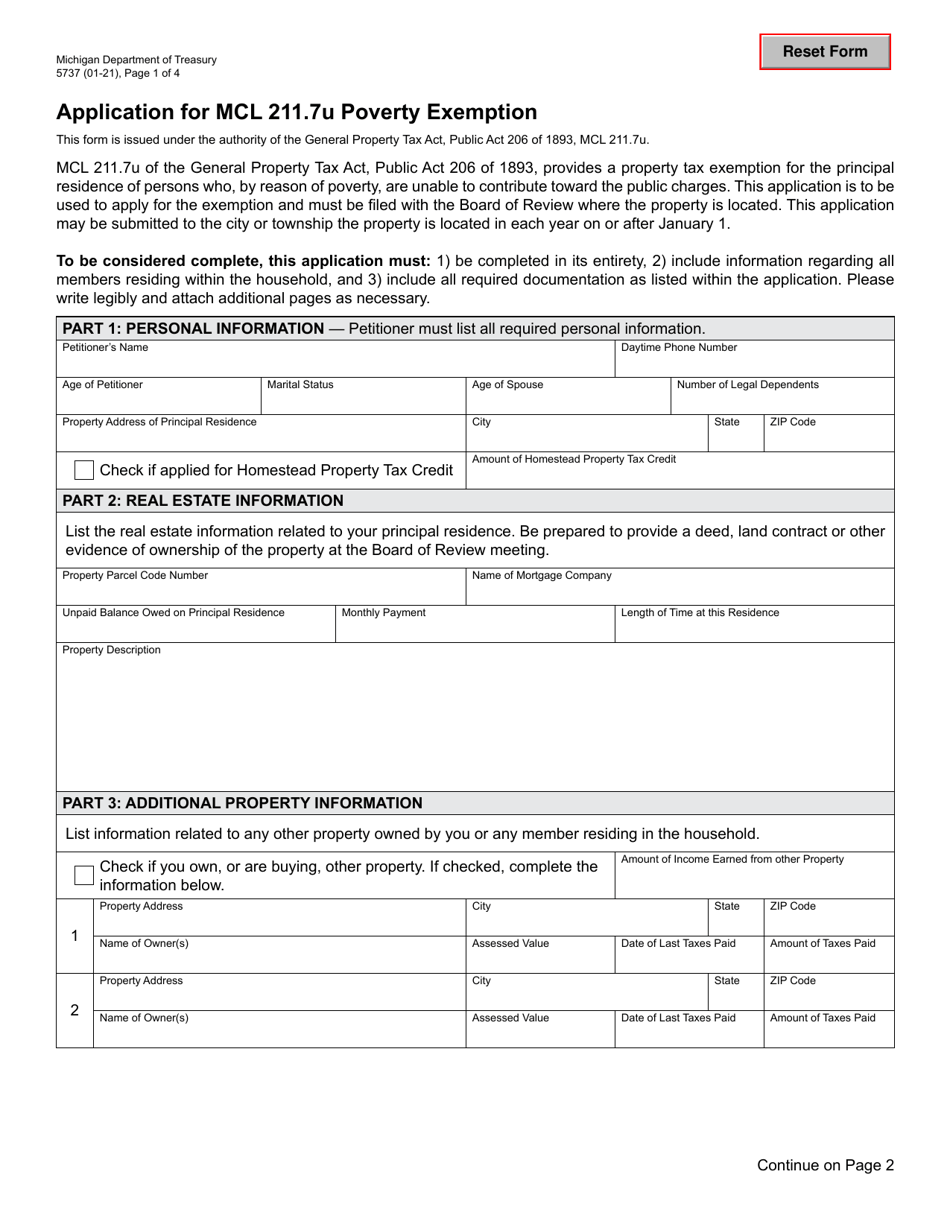

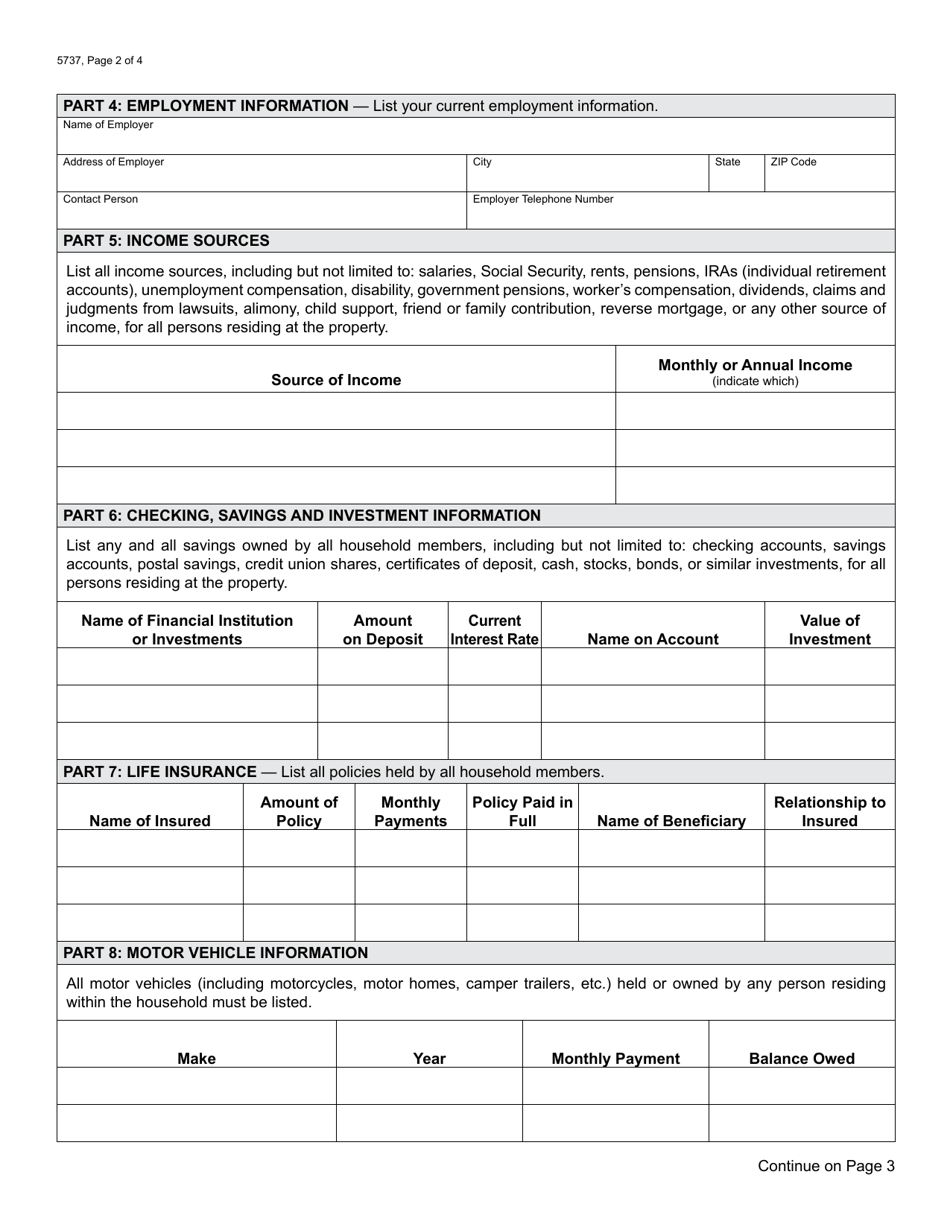

Q: What documents are required to accompany Form 5737?

A: The specific documents required may vary, but typically you will need to provide proof of income, assets, and any other supporting documentation as requested.

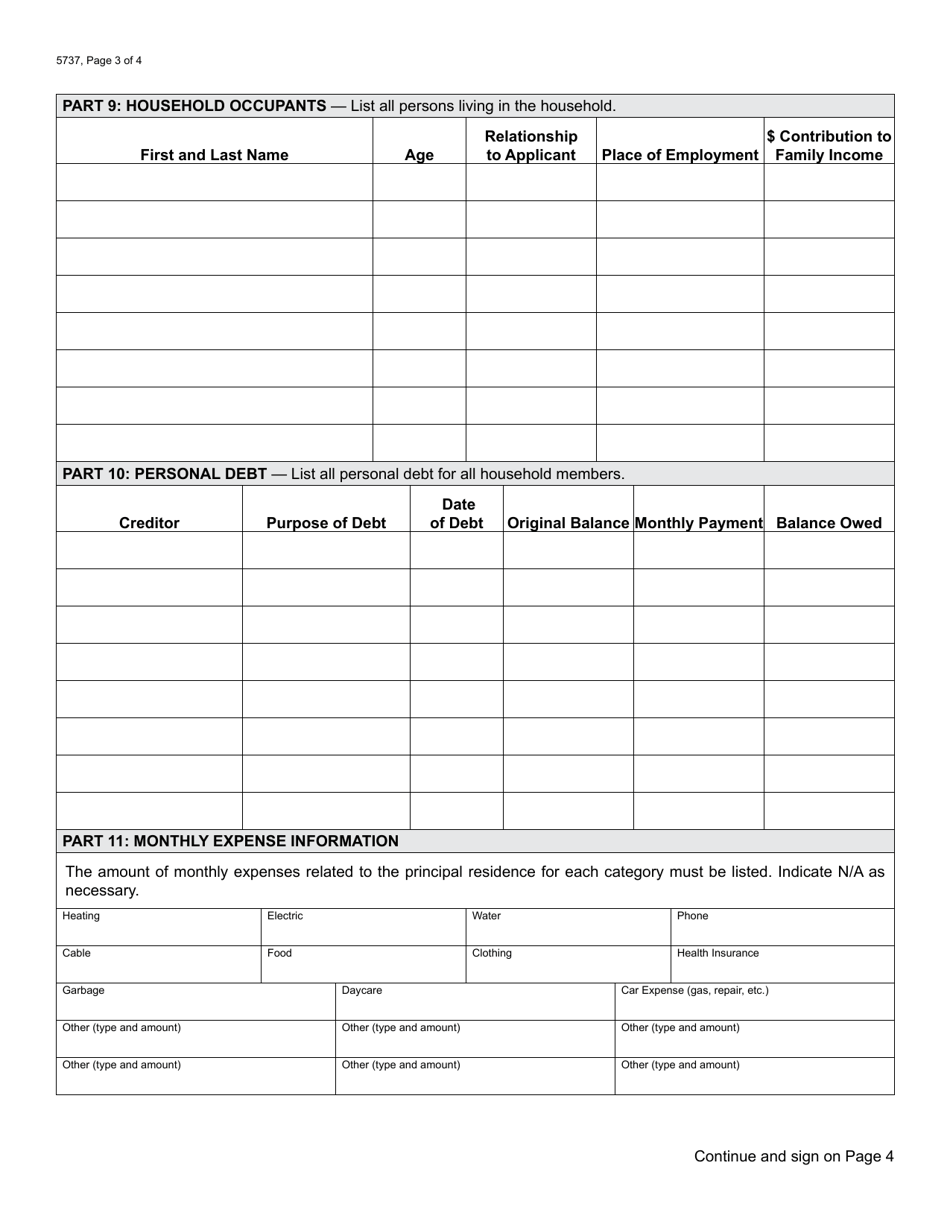

Q: When is the deadline to submit Form 5737?

A: The deadline to submit Form 5737 varies by jurisdiction, so it is important to check with your local assessor's office for the specific deadline.

Q: What happens after I submit Form 5737?

A: After you submit Form 5737, the local assessor's office will review your application and make a determination on your eligibility for the poverty exemption.

Q: What happens if I am approved for the poverty exemption?

A: If you are approved for the poverty exemption, you may be granted a reduction or exemption from property taxes for the specified time period.

Q: What happens if I am denied the poverty exemption?

A: If you are denied the poverty exemption, you may have the option to appeal the decision or explore other forms of property tax relief that may be available.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5737 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.