This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

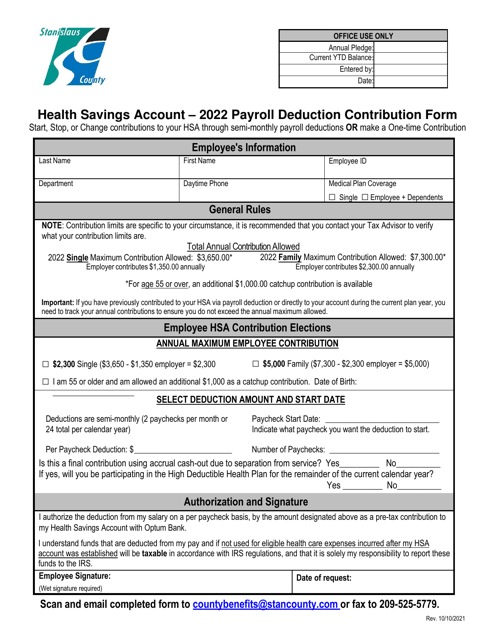

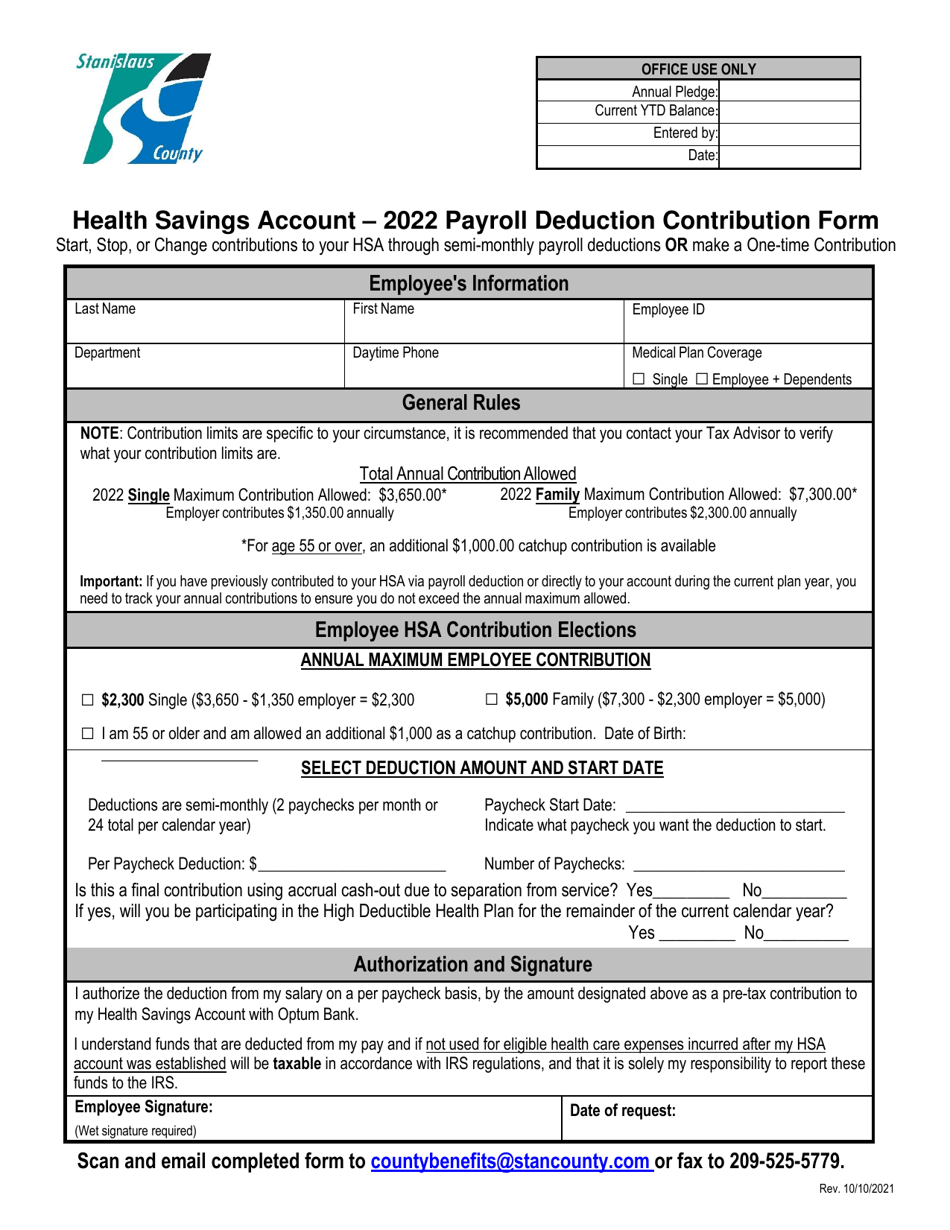

Health Savings Account Payroll Deduction Contribution Form - Stanislaus County, California

Health Savings Account Payroll Deduction Contribution Form is a legal document that was released by the Risk Management Service - Stanislaus County, California - a government authority operating within California. The form may be used strictly within Stanislaus County.

FAQ

Q: What is a Health Savings Account (HSA)?

A: A Health Savings Account (HSA) is a savings account that allows individuals to save money specifically for medical expenses.

Q: Who is eligible to contribute to a Health Savings Account (HSA)?

A: To be eligible to contribute to an HSA, you must have a high-deductible health plan (HDHP) and cannot be enrolled in Medicare or claimed as a dependent on someone else's tax return.

Q: What is the purpose of the Health Savings Account Payroll Deduction Contribution Form?

A: The purpose of this form is to authorize your employer to deduct a specific amount from your paycheck and contribute it directly to your HSA.

Q: Do I need to fill out this form if I don't have a Health Savings Account (HSA)?

A: No, if you do not have an HSA or do not want to contribute through your payroll, you do not need to fill out this form.

Q: What information do I need to provide on the form?

A: You will need to provide your personal information such as name, address, and Social Security number, as well as the amount you want to contribute and the frequency of the deductions.

Q: Can I change the contribution amount or frequency later?

A: Yes, you can change the contribution amount or frequency by filling out a new form and submitting it to your employer.

Q: Are there any limits on the amount I can contribute to my HSA?

A: Yes, there are annual contribution limits set by the IRS. For 2021, the limit is $3,600 for individuals and $7,200 for families.

Q: Are HSA contributions tax-deductible?

A: Yes, HSA contributions are tax-deductible, meaning you can deduct the contributions from your taxable income when filing your taxes.

Q: Can I use the funds in my HSA for non-medical expenses?

A: Yes, but if you use the funds for non-medical expenses, you may be subject to income tax and penalties.

Q: What happens to the money in my HSA if I change jobs?

A: The money in your HSA belongs to you and is portable, meaning you can take it with you when you change jobs or retire.

Form Details:

- Released on October 10, 2021;

- The latest edition currently provided by the Risk Management Service - Stanislaus County, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Risk Management Service - Stanislaus County, California.