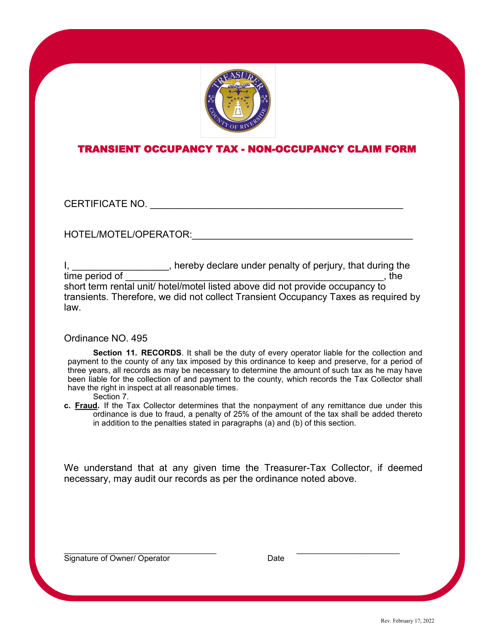

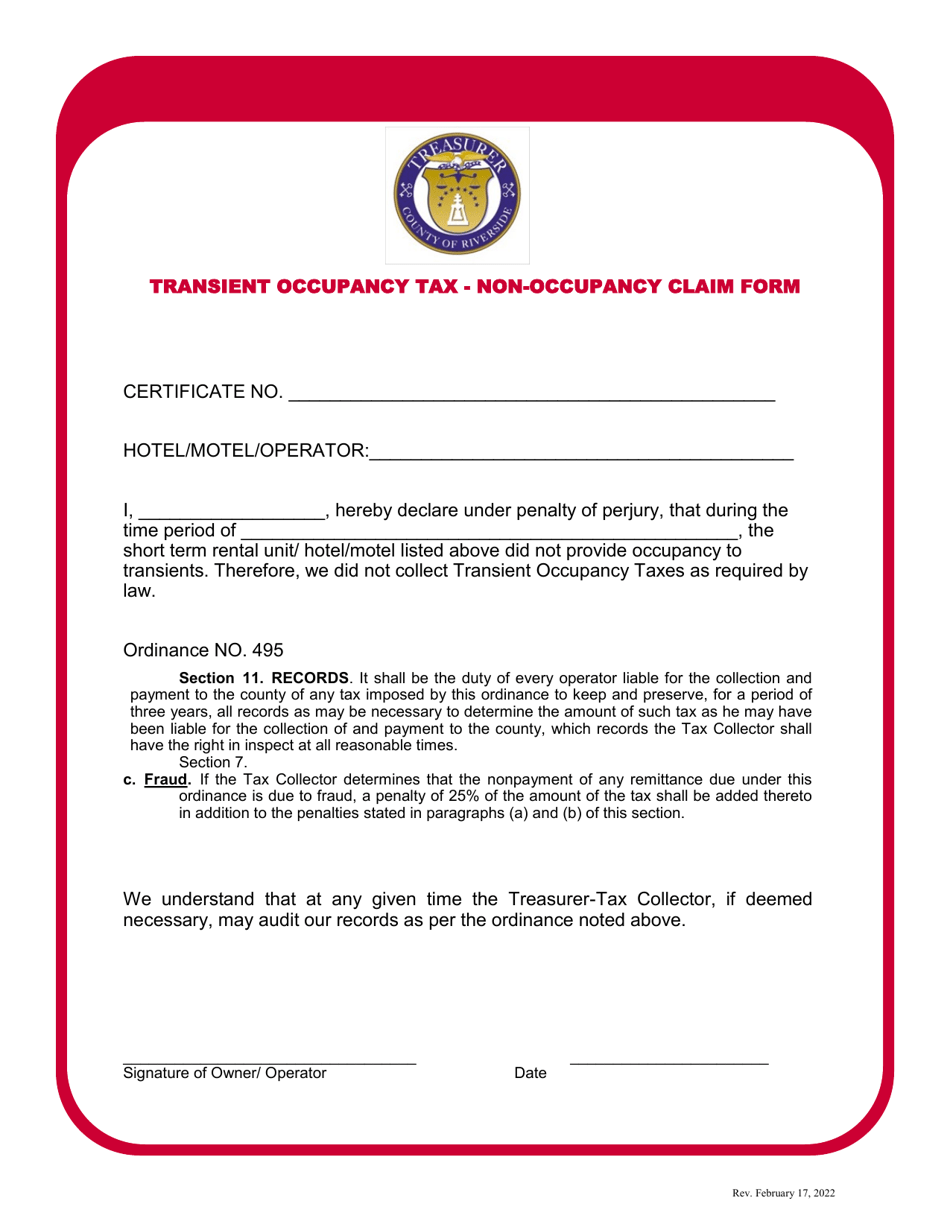

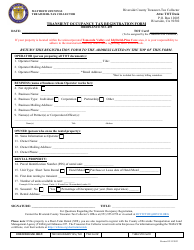

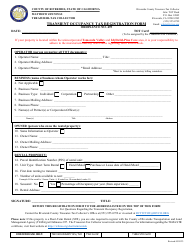

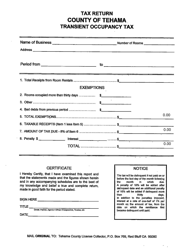

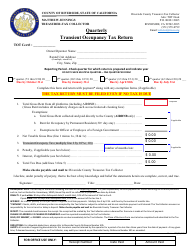

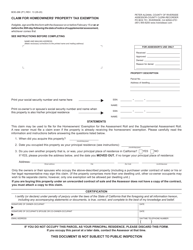

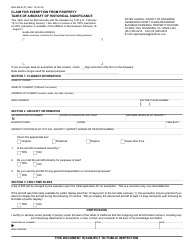

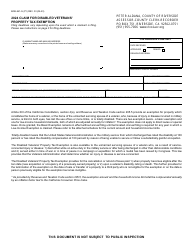

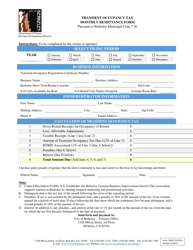

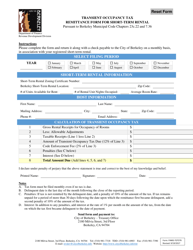

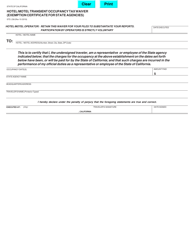

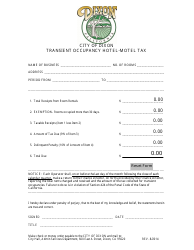

Non-occupancy Claim Form - Transient Occupancy Tax - Riverside County, California

Non-occupancy Claim Form - Transient Occupancy Tax is a legal document that was released by the Office of the Treasurer-Tax Collector - Riverside County, California - a government authority operating within California. The form may be used strictly within Riverside County.

FAQ

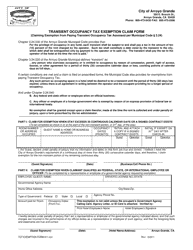

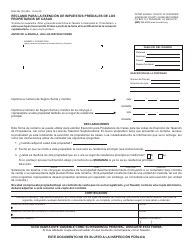

Q: What is a non-occupancy claim form?

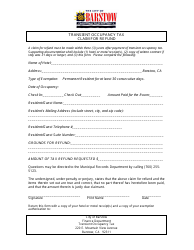

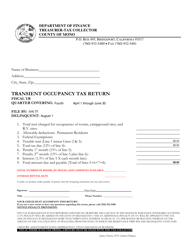

A: A non-occupancy claim form is a form used to claim exemption or refund from paying transient occupancy tax in Riverside County, California.

Q: Who needs to fill out a non-occupancy claim form?

A: Property owners or operators who believe they are exempt or eligible for a refund of transient occupancy tax in Riverside County, California.

Q: What are the requirements for claiming non-occupancy in Riverside County, California?

A: The requirements for claiming non-occupancy vary, but generally include providing evidence such as lease agreements, proof of residency in another location, or other documentation.

Q: Can I claim a refund if I rented out my property for less than 30 days?

A: In Riverside County, California, you may be eligible for a refund of transient occupancy tax if your rental period was less than 30 consecutive days.

Q: Are there any penalties for falsely claiming non-occupancy in Riverside County?

A: Yes, falsely claiming non-occupancy or providing false information can result in penalties, fines, or legal consequences.

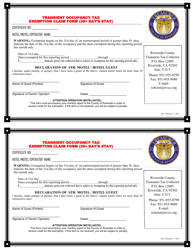

Q: How long does it take to process a non-occupancy claim form in Riverside County?

A: The processing time for a non-occupancy claim form in Riverside County, California can vary, but it typically takes several weeks to process and receive a response.

Q: Can I appeal the decision if my non-occupancy claim is denied?

A: Yes, if your non-occupancy claim is denied, you have the right to appeal the decision with the Riverside County Tax Collector's office.

Form Details:

- Released on February 17, 2022;

- The latest edition currently provided by the Office of the Treasurer-Tax Collector - Riverside County, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Office of the Treasurer-Tax Collector - Riverside County, California.