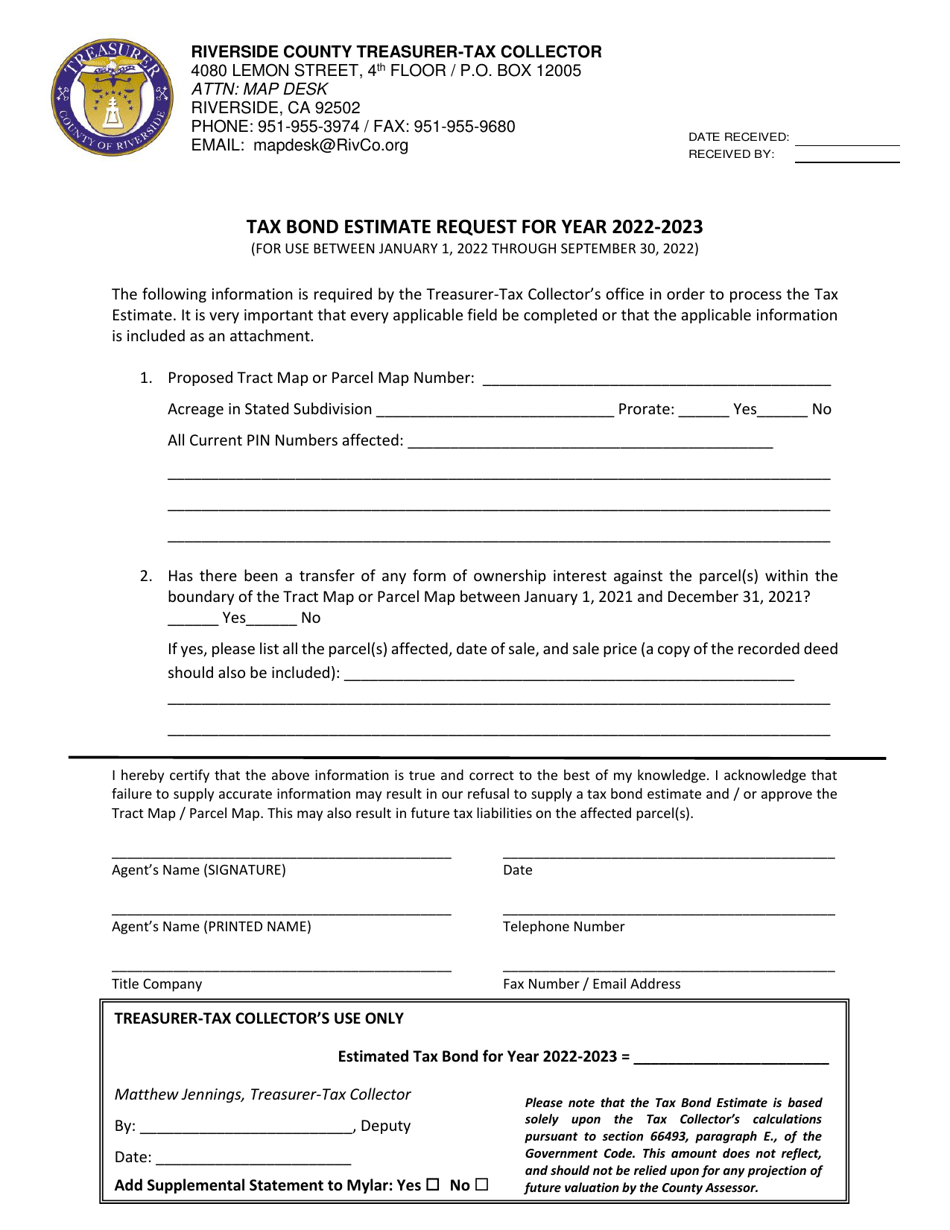

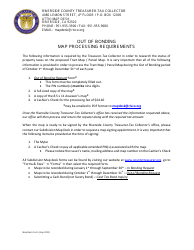

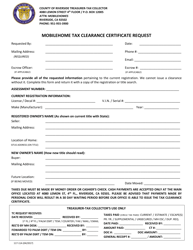

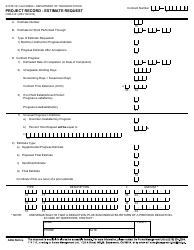

Tax Bond Estimate Request - Riverside County, California

Tax Bond Estimate Request is a legal document that was released by the Office of the Treasurer-Tax Collector - Riverside County, California - a government authority operating within California. The form may be used strictly within Riverside County.

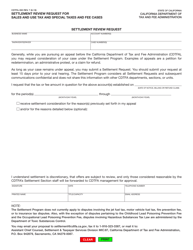

FAQ

Q: What is a tax bond?

A: A tax bond is a type of surety bond that guarantees payment of taxes by a business or individual to the government.

Q: Why would someone need a tax bond?

A: Someone may need a tax bond if they have taxes owed to the government and need to provide assurance that the taxes will be paid.

Q: How can I request a tax bond estimate in Riverside County, California?

A: To request a tax bond estimate in Riverside County, California, you can contact the county's tax collector office or a surety bond provider.

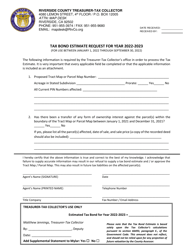

Q: What information is needed to request a tax bond estimate?

A: To request a tax bond estimate, you will typically need to provide information such as the amount of taxes owed, the type of taxes owed, and your financial information.

Q: How long does it take to get a tax bond estimate?

A: The time it takes to get a tax bond estimate can vary depending on the provider and the complexity of the request. It is best to contact the provider directly for an estimate of the timeframe.

Form Details:

- The latest edition currently provided by the Office of the Treasurer-Tax Collector - Riverside County, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Office of the Treasurer-Tax Collector - Riverside County, California.