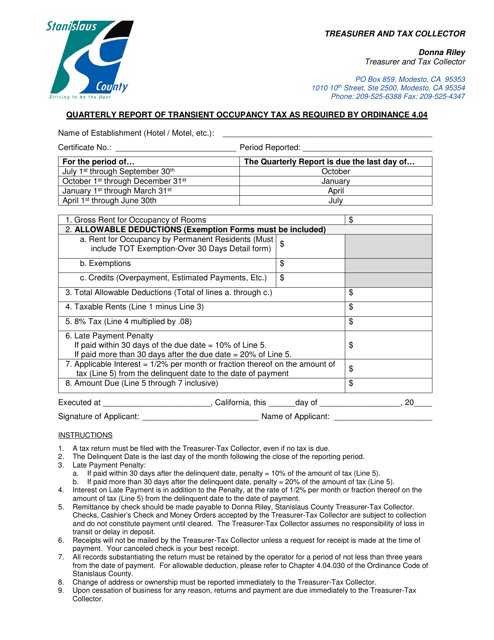

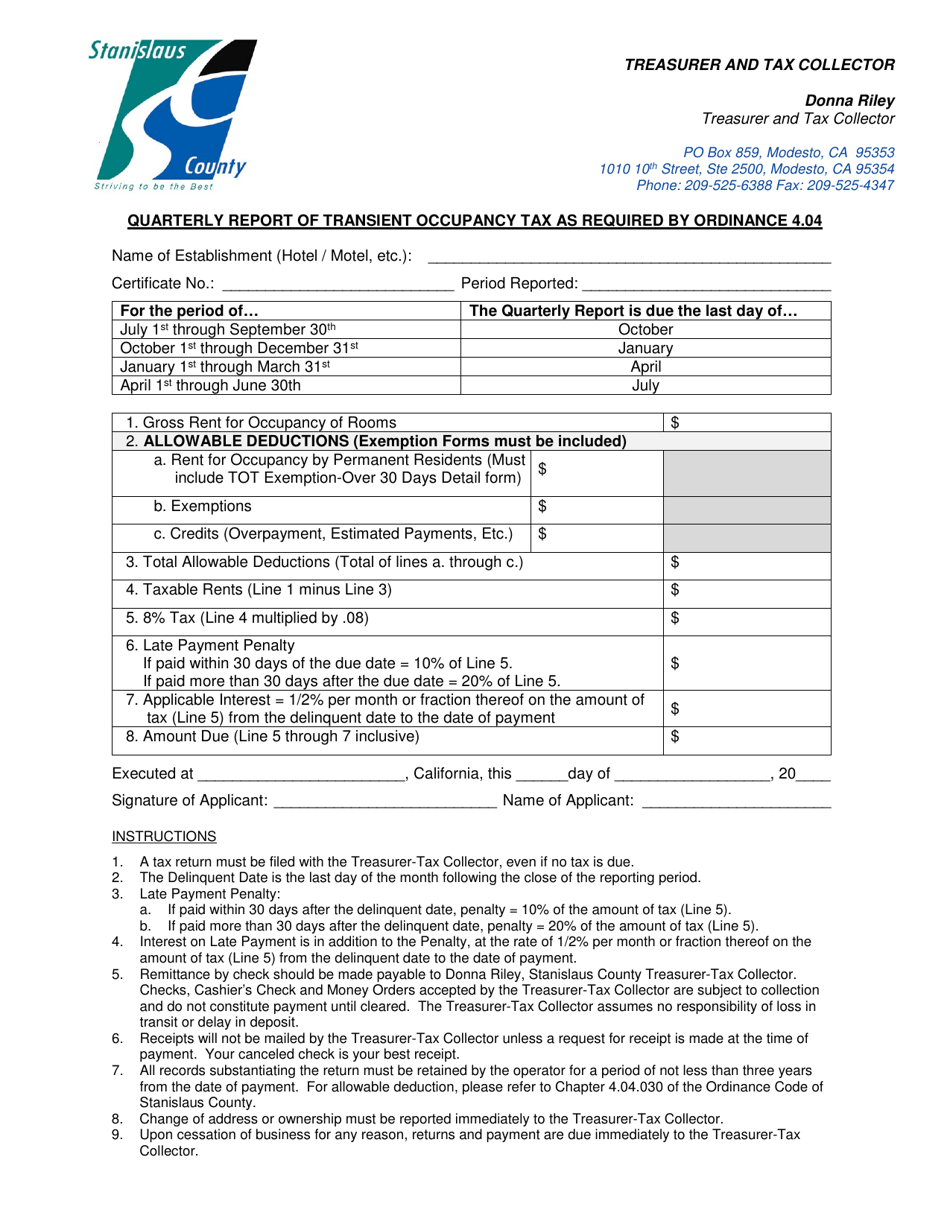

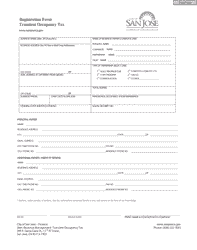

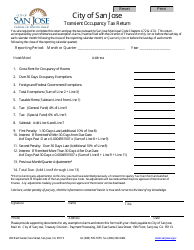

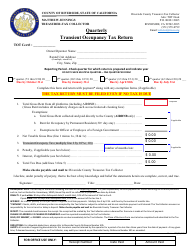

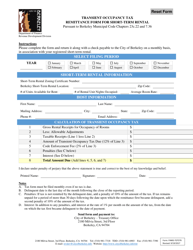

Quarterly Report of Transient Occupancy Tax as Required by Ordinance 4.04 - Stanislaus County, California

Quarterly Report of Transient Occupancy Tax as Required by Ordinance 4.04 is a legal document that was released by the Treasurer-Tax Collector's Office - Stanislaus County, California - a government authority operating within California. The form may be used strictly within Stanislaus County.

FAQ

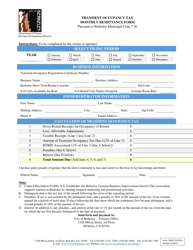

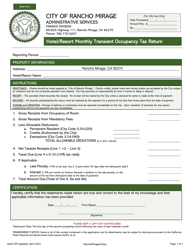

Q: What is the Transient Occupancy Tax?

A: The Transient Occupancy Tax is a tax imposed on guests who stay in hotels, motels, or other lodging establishments.

Q: What is Ordinance 4.04 in Stanislaus County, California?

A: Ordinance 4.04 is a local law that mandates the collection and reporting of the Transient Occupancy Tax.

Q: Who is responsible for paying the Transient Occupancy Tax?

A: The guests who stay in hotels, motels, or other lodging establishments are responsible for paying the Transient Occupancy Tax.

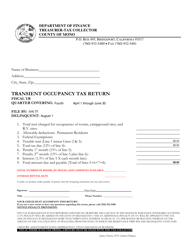

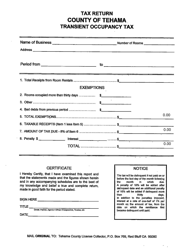

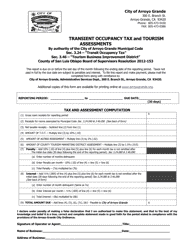

Q: How often is the Transient Occupancy Tax reported?

A: The Transient Occupancy Tax is reported quarterly, meaning it is due every three months.

Q: Why is the Transient Occupancy Tax collected?

A: The Transient Occupancy Tax is collected to generate revenue for the county and support local tourism and hospitality initiatives.

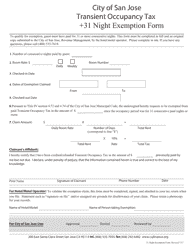

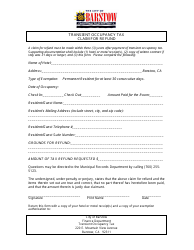

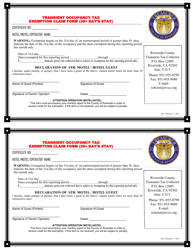

Q: What happens if the Transient Occupancy Tax is not paid?

A: If the Transient Occupancy Tax is not paid, penalties and fees may be imposed on the lodging establishment and the guests.

Q: What is the purpose of Ordinance 4.04?

A: The purpose of Ordinance 4.04 is to ensure the proper collection and reporting of the Transient Occupancy Tax in Stanislaus County, California.

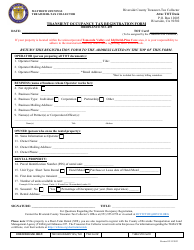

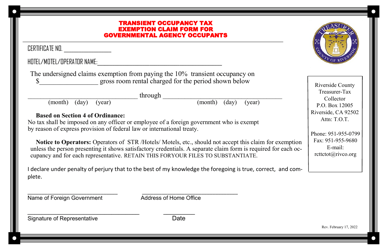

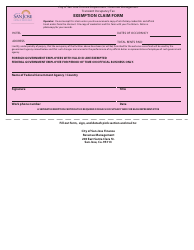

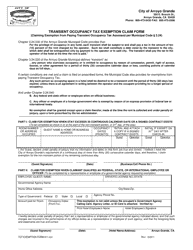

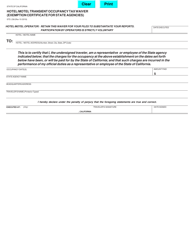

Q: Are there any exemptions to the Transient Occupancy Tax?

A: There may be exemptions to the Transient Occupancy Tax, such as for government employees or individuals staying for medical reasons. It is best to check with the local authorities for specific details.

Q: What is the current Transient Occupancy Tax rate in Stanislaus County, California?

A: The current Transient Occupancy Tax rate in Stanislaus County, California is X%. Please check with the local authorities for the most up-to-date information.

Form Details:

- The latest edition currently provided by the Treasurer-Tax Collector's Office - Stanislaus County, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Treasurer-Tax Collector's Office - Stanislaus County, California.