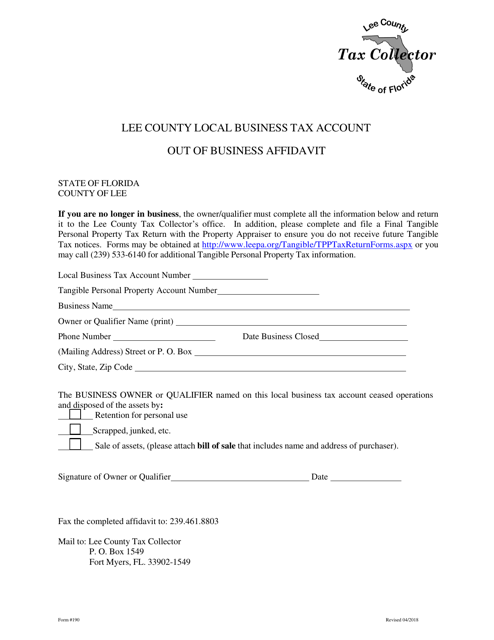

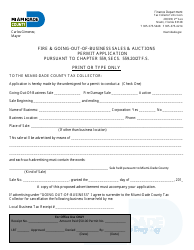

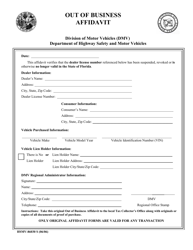

Form 90 Out of Business Affidavit - Lee County, Florida

What Is Form 90?

This is a legal form that was released by the Tax Collector's Office - Lee County, Florida - a government authority operating within Florida. The form may be used strictly within Lee County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 90 Out of Business Affidavit?

A: Form 90 Out of Business Affidavit is a legal document used in Lee County, Florida.

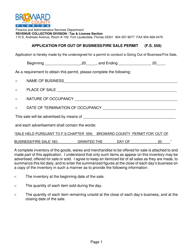

Q: What is the purpose of Form 90?

A: The purpose of Form 90 is to declare that a business is no longer in operation.

Q: Who needs to fill out Form 90?

A: Business owners in Lee County, Florida, who have ceased their operations need to fill out Form 90.

Q: Do I need to pay a fee to file Form 90?

A: There is no fee required to file Form 90.

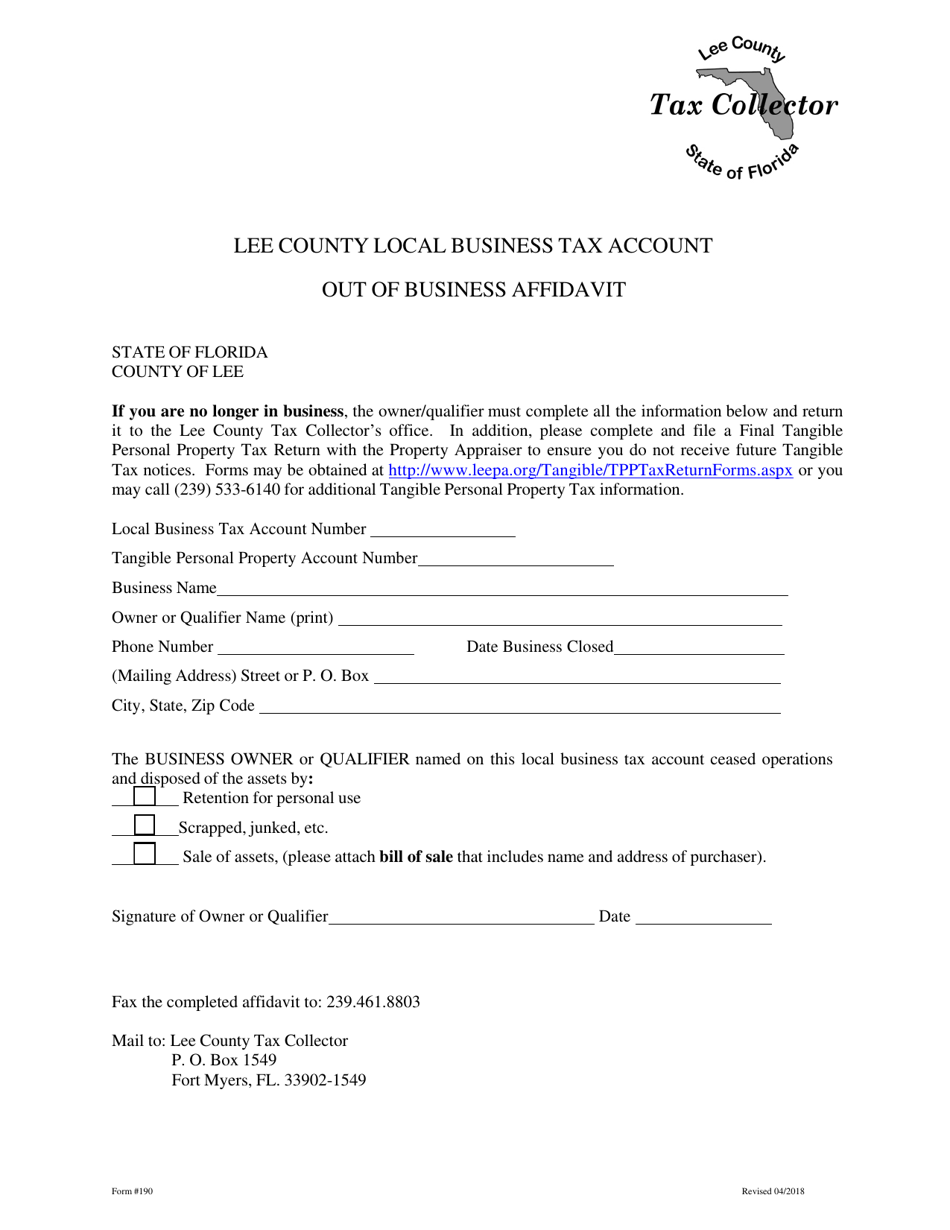

Q: What information is required on Form 90?

A: Form 90 requires information such as the business name, contact information, date of closure, and a statement affirming that all taxes have been paid.

Q: What should I do with Form 90 once it is filled out?

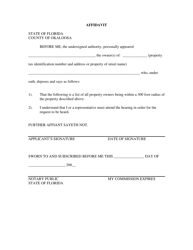

A: Once filled out, Form 90 should be notarized and submitted to the Lee County Clerk of Court's office.

Q: What happens after I submit Form 90?

A: After submitting Form 90, the business will be officially recognized as out of business by the county.

Q: Is Form 90 only for businesses in Lee County, Florida?

A: Yes, Form 90 is specific to businesses in Lee County, Florida, and may not be applicable in other counties or states.

Q: Are there any penalties for not filing Form 90?

A: While there are no specific penalties mentioned, it is advisable to file Form 90 to ensure legal compliance and avoid any future complications.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Tax Collector's Office - Lee County, Florida;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 90 by clicking the link below or browse more documents and templates provided by the Tax Collector's Office - Lee County, Florida.