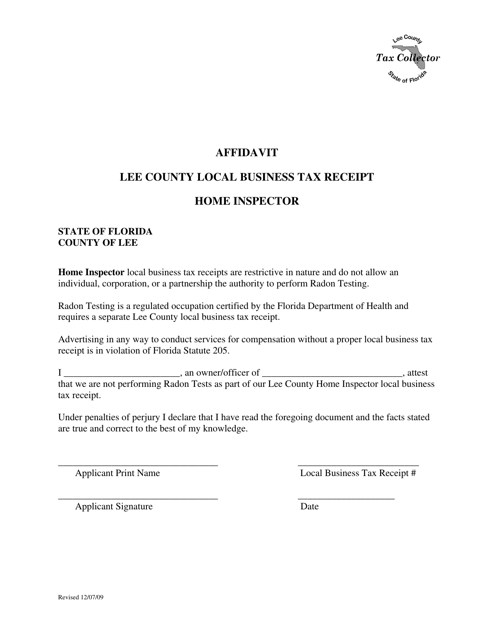

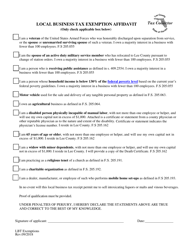

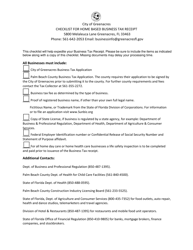

Home Inspector Local Business Tax Receipts Affidavit - Lee County, Florida

Home Inspector Tax Receipts Affidavit is a legal document that was released by the Tax Collector's Office - Lee County, Florida - a government authority operating within Florida. The form may be used strictly within Lee County.

FAQ

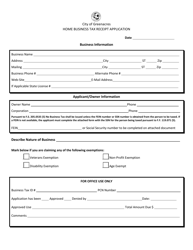

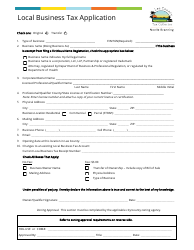

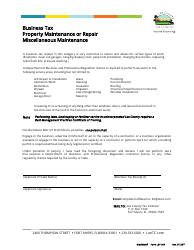

Q: What is a Home Inspector Local Business Tax Receipt?

A: A Home Inspector Local Business Tax Receipt is a document obtained by home inspectors in Lee County, Florida to legally operate their business.

Q: Why do home inspectors need a Local Business Tax Receipt?

A: Home inspectors need a Local Business Tax Receipt in order to comply with the local licensing and taxation requirements in Lee County, Florida.

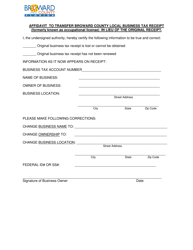

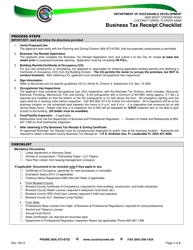

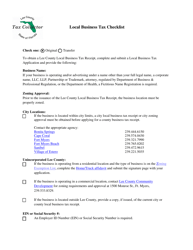

Q: How can home inspectors obtain a Local Business Tax Receipt?

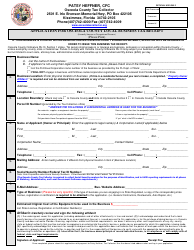

A: Home inspectors can obtain a Local Business Tax Receipt by submitting a completed affidavit and payment to the Lee County Tax Collector's Office.

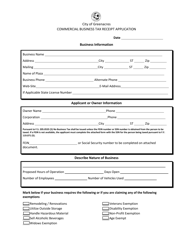

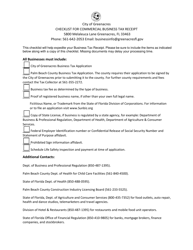

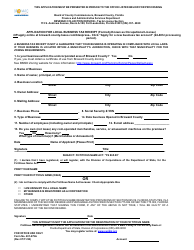

Q: What information is required in the affidavit for a Local Business Tax Receipt?

A: The affidavit for a Local Business Tax Receipt typically requires information such as the business name, address, contact details, and proof of professional certification or license.

Q: What is the purpose of the Home Inspector Local Business Tax Receipt Affidavit?

A: The purpose of the Home Inspector Local Business Tax Receipt Affidavit is to provide accurate information about the home inspector's business for tax and licensing purposes in Lee County, Florida.

Form Details:

- Released on December 7, 2009;

- The latest edition currently provided by the Tax Collector's Office - Lee County, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Tax Collector's Office - Lee County, Florida.