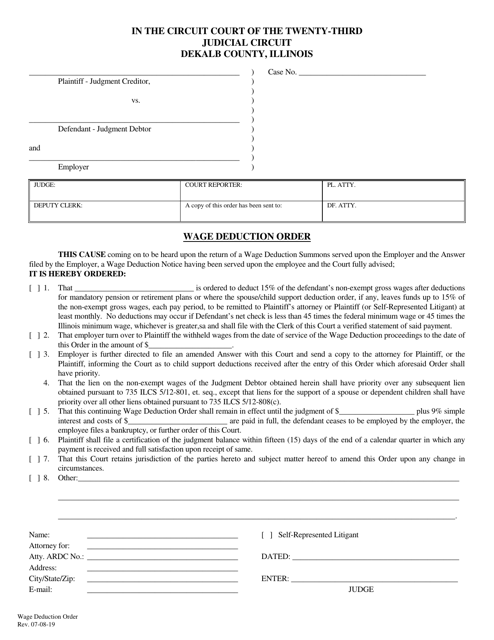

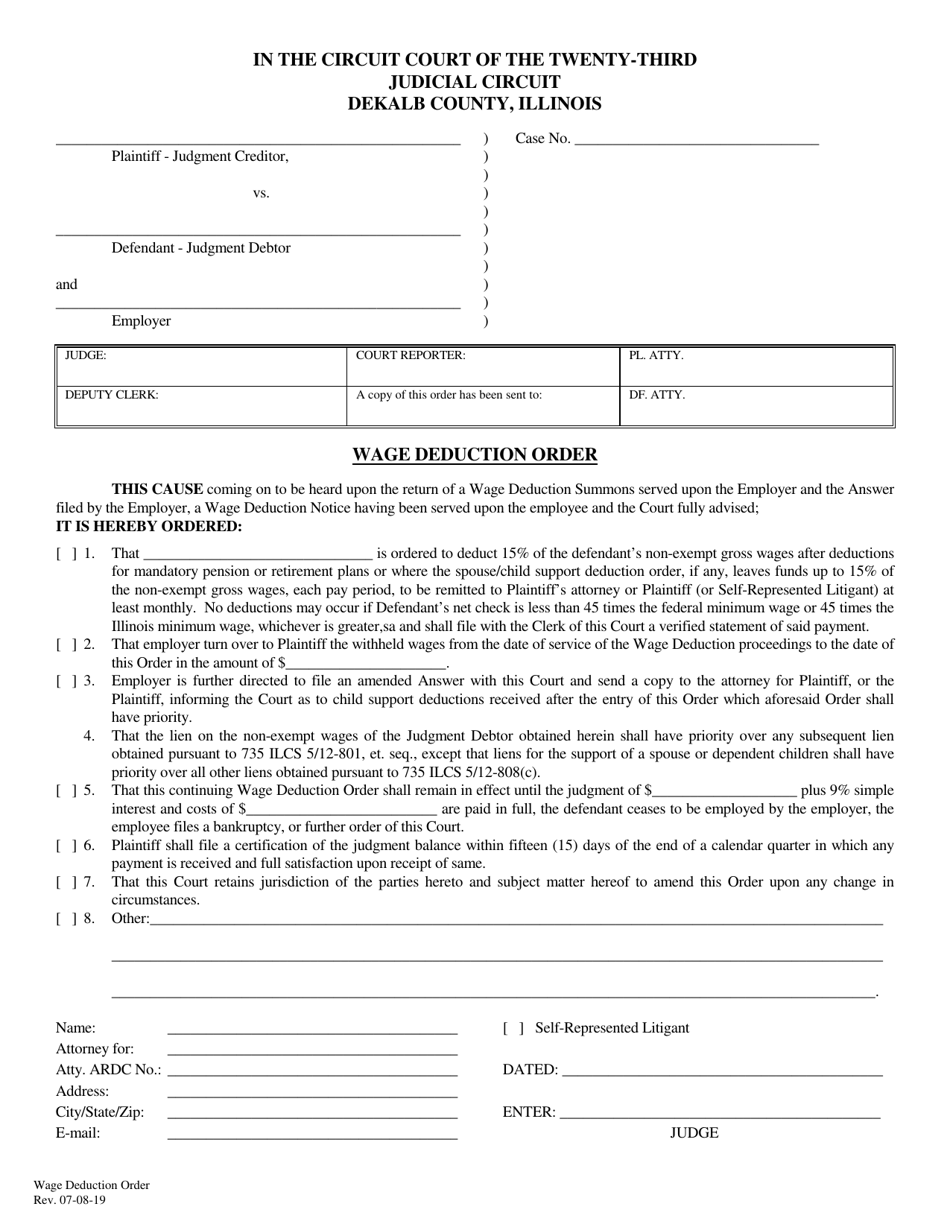

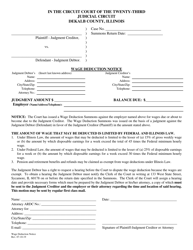

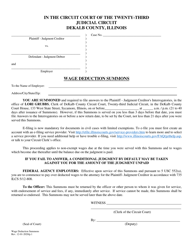

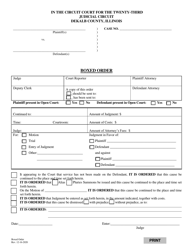

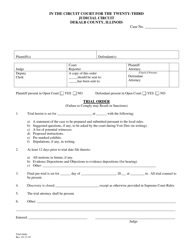

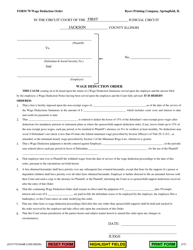

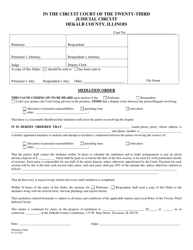

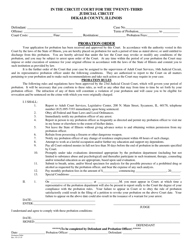

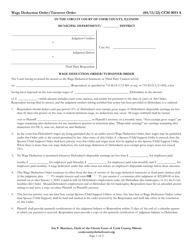

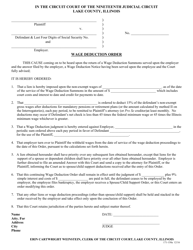

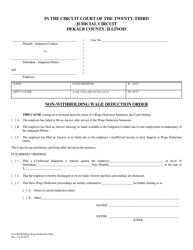

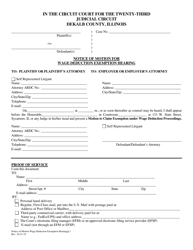

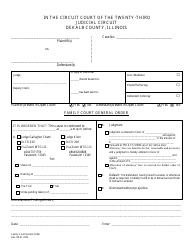

Wage Deduction Order - DeKalb County, Illinois

Wage Deduction Order is a legal document that was released by the Circuit Court - DeKalb County, Illinois - a government authority operating within Illinois. The form may be used strictly within DeKalb County.

FAQ

Q: What is a Wage Deduction Order?

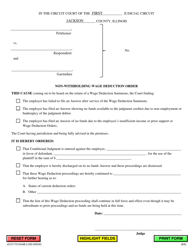

A: A Wage Deduction Order is a legal document that allows a creditor to collect a debt by deducting money directly from a debtor's wages.

Q: How does a Wage Deduction Order work?

A: Once a Wage Deduction Order is issued, the employer is legally required to deduct a specified amount from the employee's wages and send it to the creditor until the debt is fully paid.

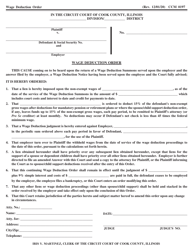

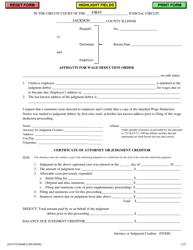

Q: Who can obtain a Wage Deduction Order in DeKalb County, Illinois?

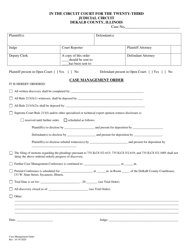

A: Any creditor who has filed a lawsuit and obtained a judgment against a debtor can apply for a Wage Deduction Order in DeKalb County, Illinois.

Q: Is there a limit to the amount that can be deducted from a debtor's wages?

A: Yes, under Illinois law, the maximum amount that can be deducted from a debtor's wages is 15% of the employee's gross weekly wages or the amount by which the debtor's disposable earnings exceed 45 times the federal minimum wage, whichever is less.

Q: Are there any exemptions from Wage Deduction Orders?

A: Yes, certain types of income, such as Social Security benefits and unemployment benefits, are exempt from Wage Deduction Orders.

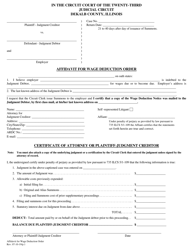

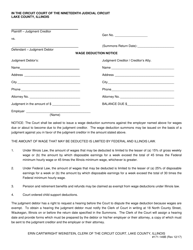

Q: What should an employee do if they believe a Wage Deduction Order is incorrect or unfair?

A: If an employee believes a Wage Deduction Order is incorrect or unfair, they should consult with an attorney to discuss their options and potentially request a hearing to challenge the order.

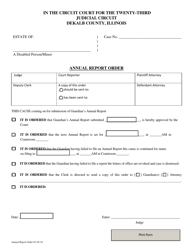

Form Details:

- Released on July 8, 2019;

- The latest edition currently provided by the Circuit Court - DeKalb County, Illinois;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Circuit Court - DeKalb County, Illinois.