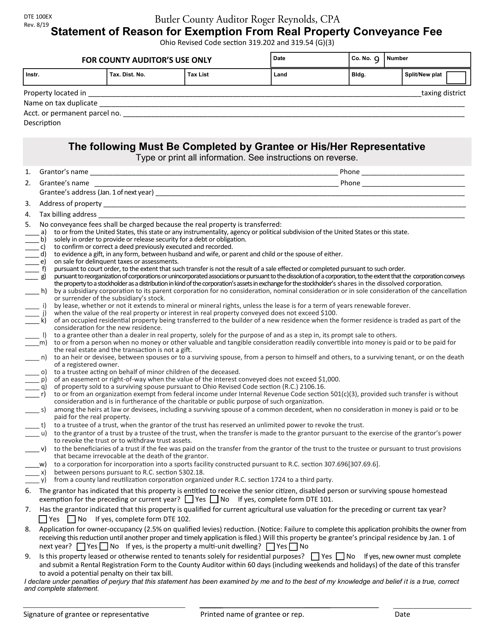

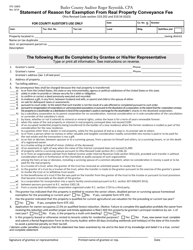

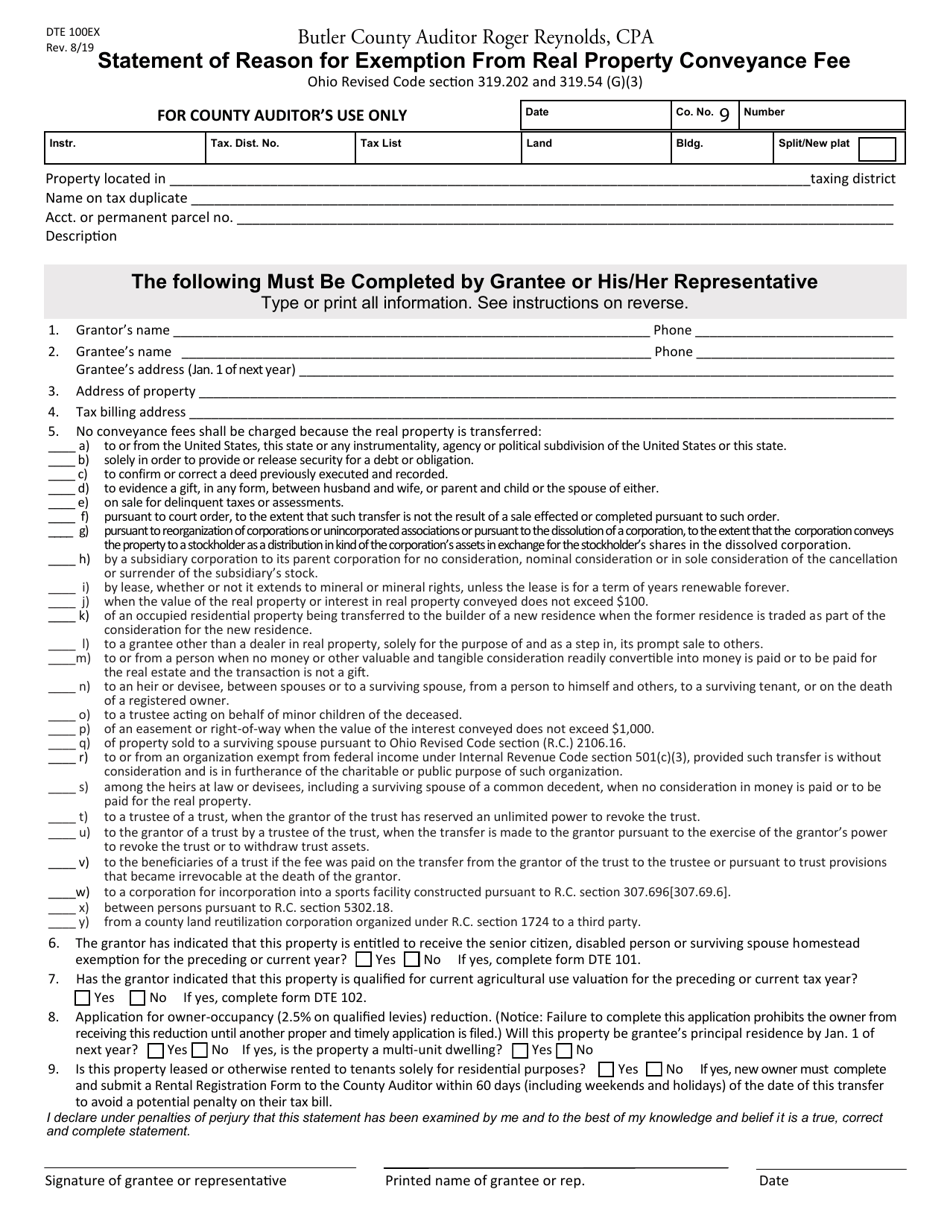

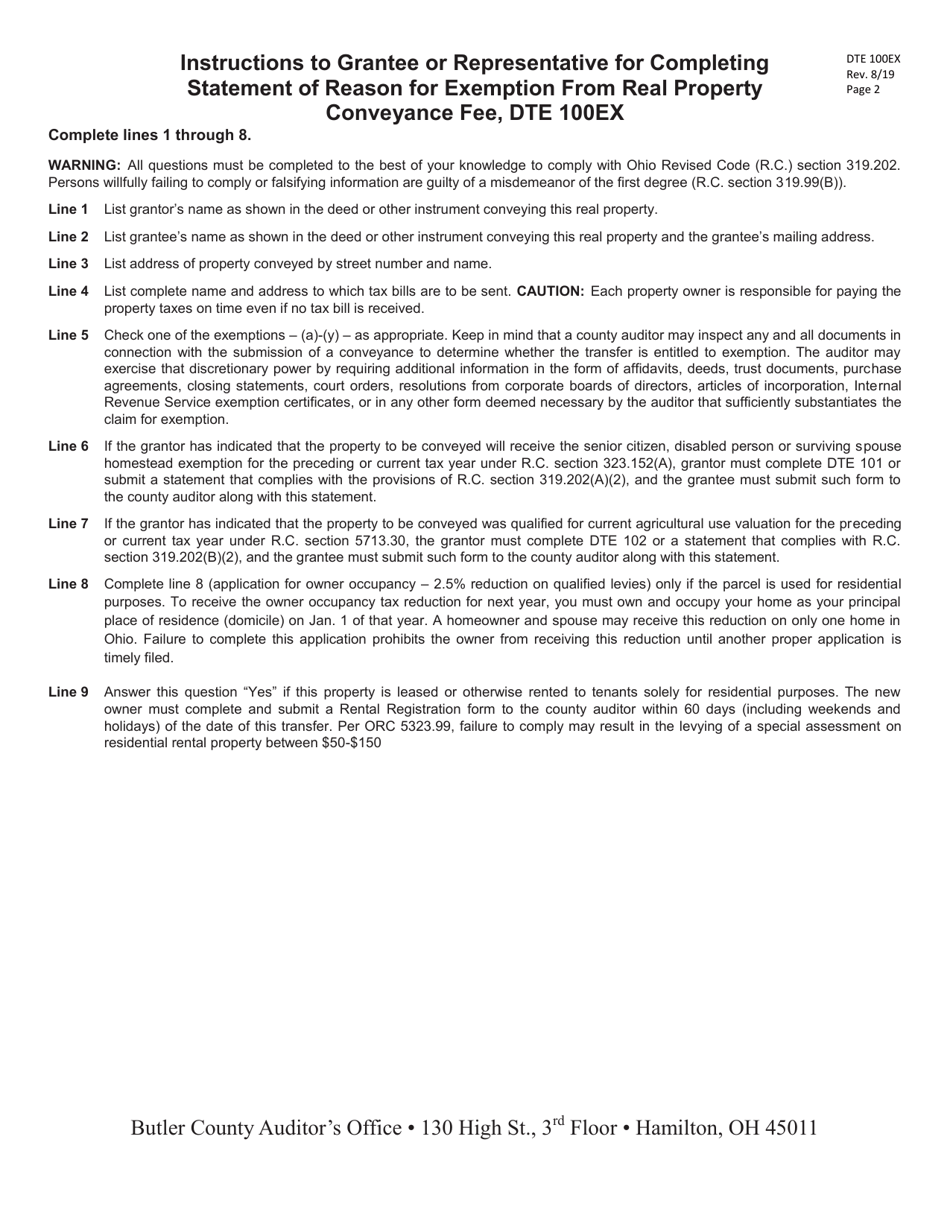

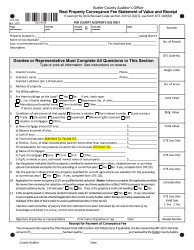

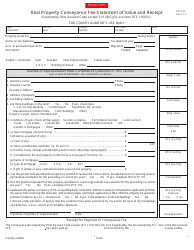

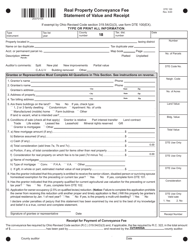

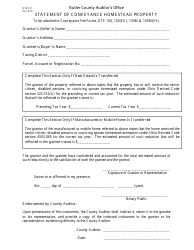

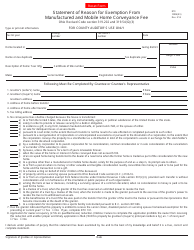

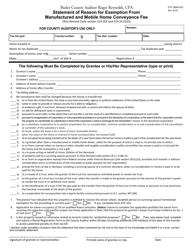

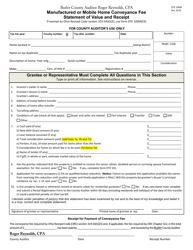

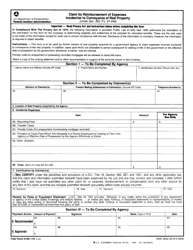

Form DTE100EX Statement of Reason for Exemption From Real Property Conveyance Fee - Butler County, Ohio

What Is Form DTE100EX?

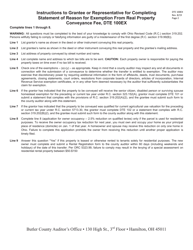

This is a legal form that was released by the County Auditor's Office - Butler County, Ohio - a government authority operating within Ohio. The form may be used strictly within Butler County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a DTE100EX form?

A: A DTE100EX form is a Statement of Reason for Exemption from Real PropertyConveyance Fee.

Q: What is the purpose of the DTE100EX form?

A: The purpose of the DTE100EX form is to request an exemption from paying the real property conveyance fee in Butler County, Ohio.

Q: Who needs to fill out the DTE100EX form?

A: Anyone who wants to claim an exemption from the real property conveyance fee in Butler County, Ohio needs to fill out the DTE100EX form.

Q: What is the real property conveyance fee?

A: The real property conveyance fee is a fee imposed on the transfer of real estate in Butler County, Ohio.

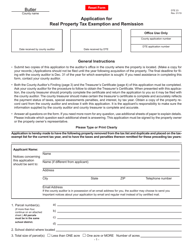

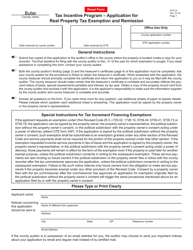

Q: What are some common reasons for requesting an exemption?

A: Common reasons for requesting an exemption include transfers to exempt organizations, transfers between family members, and transfers of certain types of property.

Q: What supporting documents are required when submitting the DTE100EX form?

A: The required supporting documents vary depending on the reason for the exemption, but generally include documentation such as a deed, tax exemption certificate, or proof of relationship.

Q: Is there a deadline for submitting the DTE100EX form?

A: Yes, the DTE100EX form must be submitted within 30 days of the transfer of the property.

Q: Is there a fee for filing the DTE100EX form?

A: No, there is no fee for filing the DTE100EX form.

Q: Who should I contact for more information about the DTE100EX form?

A: For more information about the DTE100EX form, you can contact the Butler County Auditor's Office.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the County Auditor's Office - Butler County, Ohio;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE100EX by clicking the link below or browse more documents and templates provided by the County Auditor's Office - Butler County, Ohio.