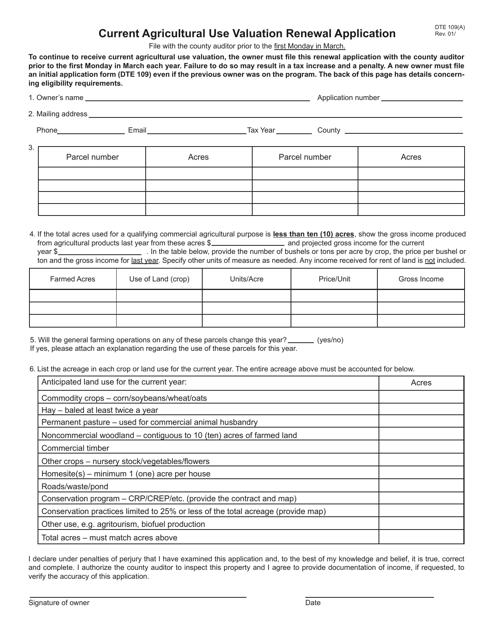

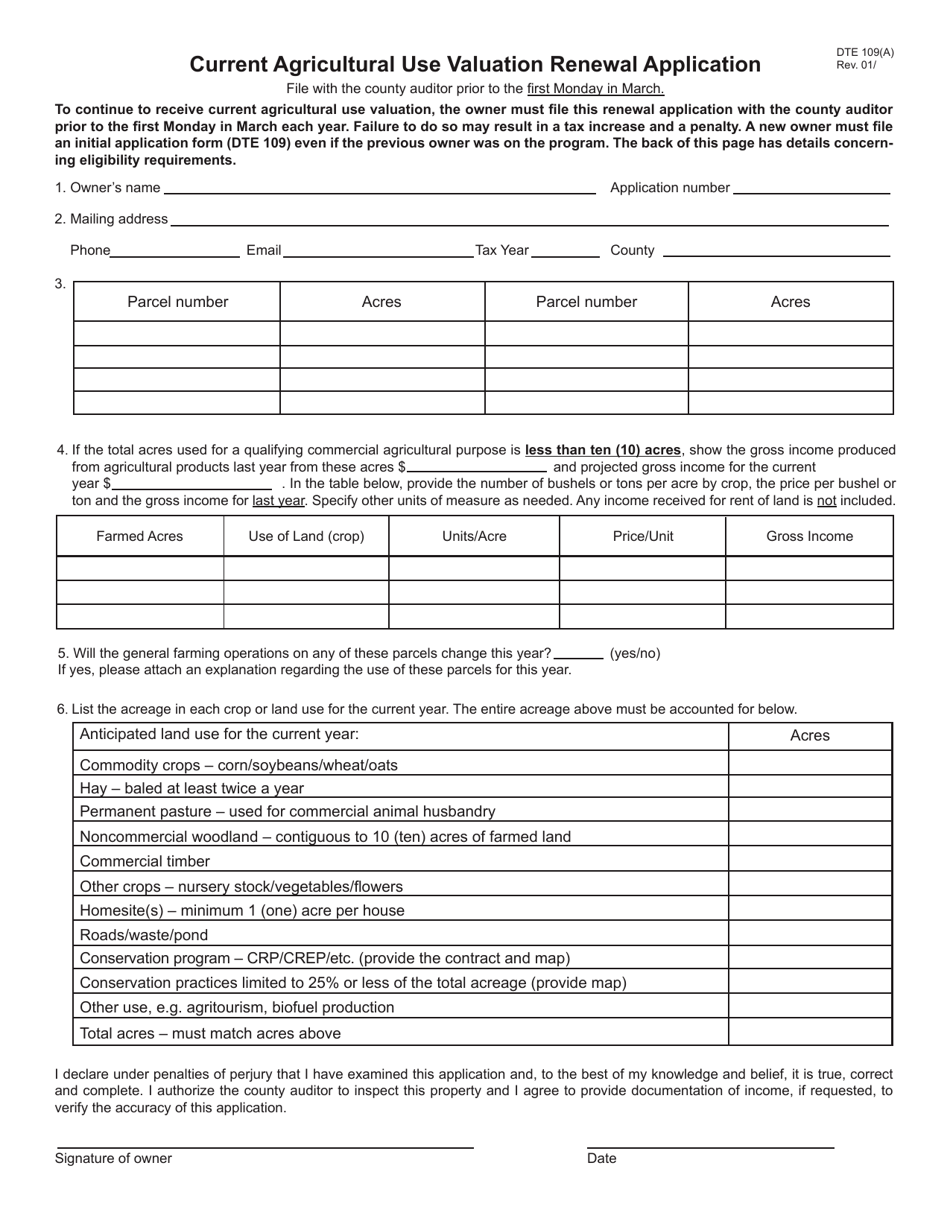

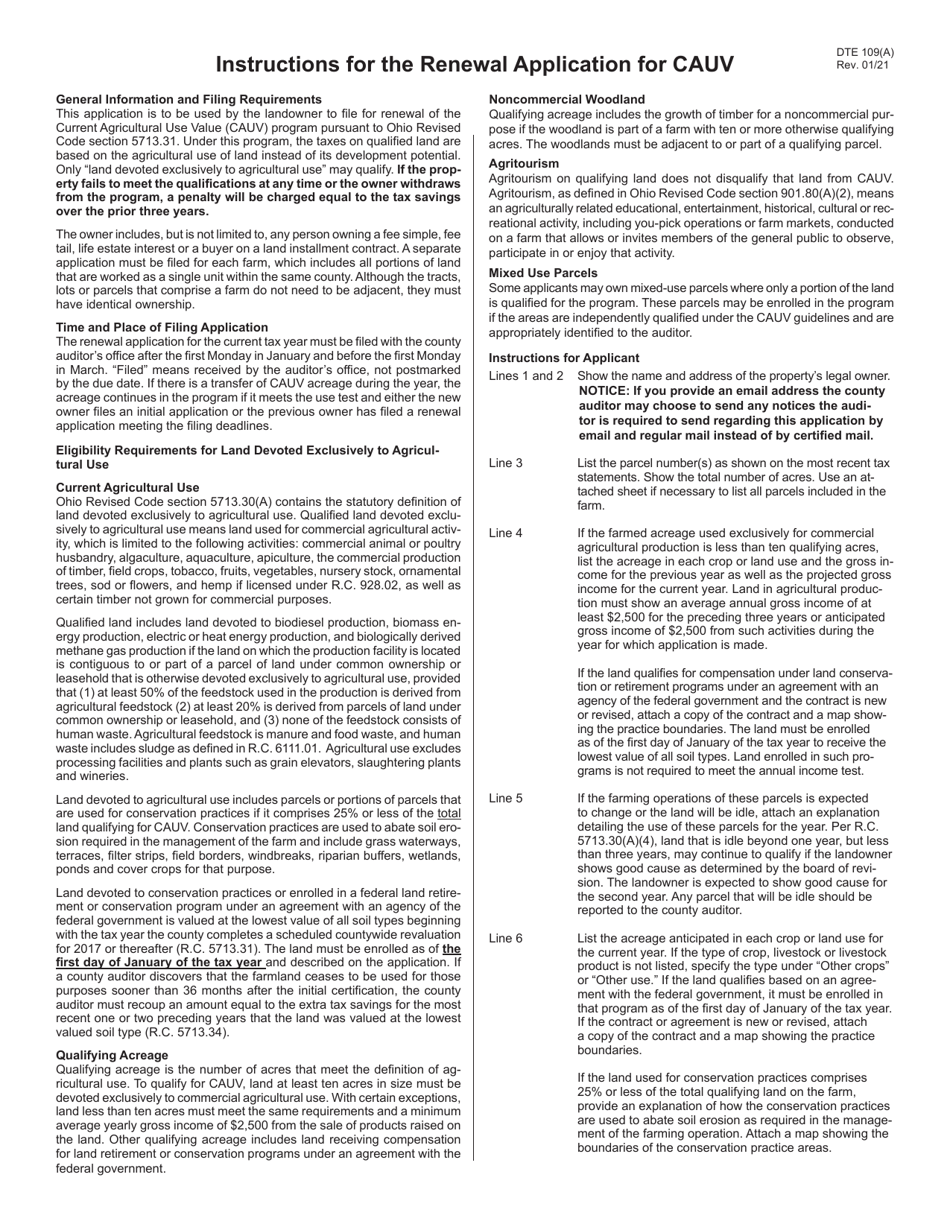

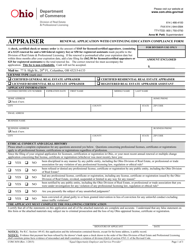

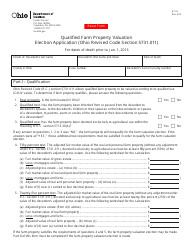

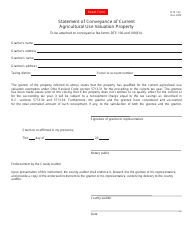

Form DTE109(A) Current Agricultural Use Valuation Renewal Application - Ohio

What Is Form DTE109(A)?

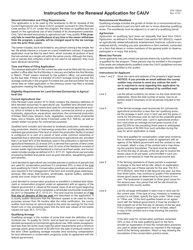

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the DTE109(A) form?

A: The DTE109(A) form is the Current Agricultural Use Valuation Renewal Application.

Q: What is the purpose of the DTE109(A) form?

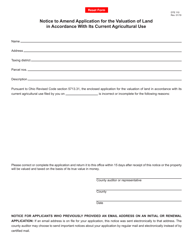

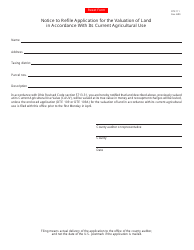

A: The purpose of the DTE109(A) form is to renew the Current Agricultural Use Valuation (CAUV) status for agricultural land in Ohio.

Q: Who is eligible to use the DTE109(A) form?

A: Landowners in Ohio who have agricultural land that qualifies for CAUV status are eligible to use the DTE109(A) form.

Q: What is CAUV?

A: CAUV stands for Current Agricultural Use Valuation, which is a property tax program in Ohio that provides reduced property tax rates for eligible agricultural land.

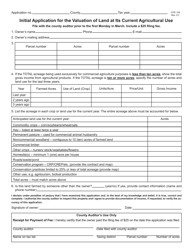

Q: What information is required on the DTE109(A) form?

A: The DTE109(A) form requires information such as the property owner's name, contact information, parcel number, acreage, and details about the agricultural activities on the land.

Q: When is the deadline to submit the DTE109(A) form?

A: The deadline to submit the DTE109(A) form is the first Monday in March each year.

Q: What happens if I fail to renew the CAUV status?

A: If you fail to renew the CAUV status by submitting the DTE109(A) form, your property may be subject to higher property tax rates.

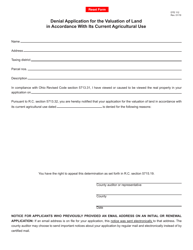

Q: Can I appeal the denial of CAUV renewal?

A: Yes, if your CAUV renewal is denied, you have the right to file an appeal with the Ohio Board of Tax Appeals within 60 days of receiving the denial notice.

Q: Is there a fee to submit the DTE109(A) form?

A: There is no fee to submit the DTE109(A) form, but you may need to pay a fee for the appraisal of your agricultural land as part of the CAUV renewal process.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE109(A) by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.