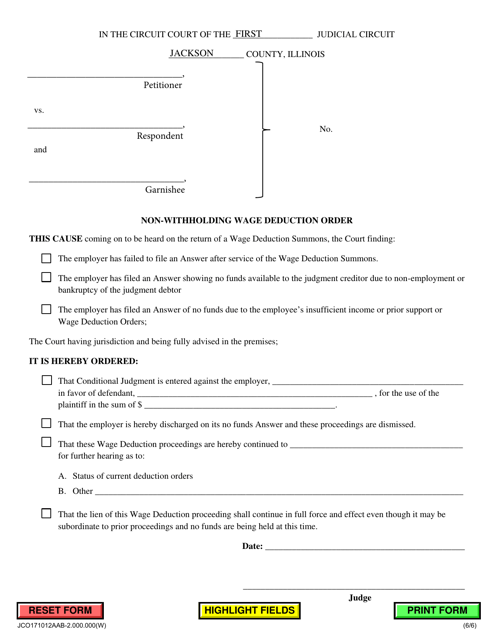

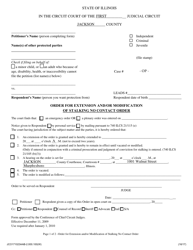

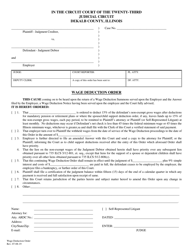

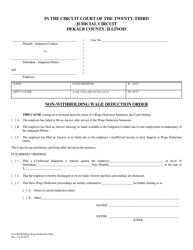

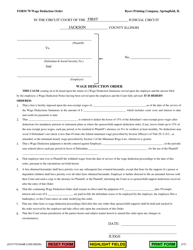

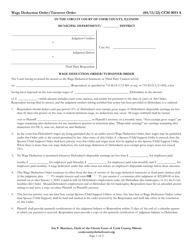

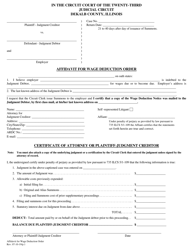

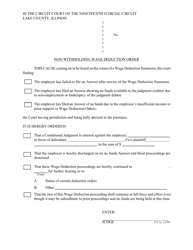

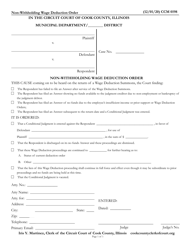

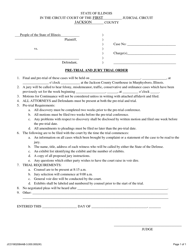

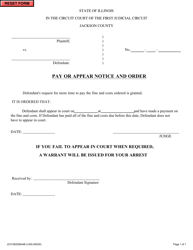

Non-withholding Wage Deduction Order - Jackson County, Illinois

Non-withholding Wage Deduction Order is a legal document that was released by the Circuit Clerk’s Office - Jackson County, Illinois - a government authority operating within Illinois. The form may be used strictly within Jackson County.

FAQ

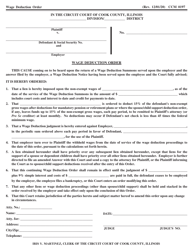

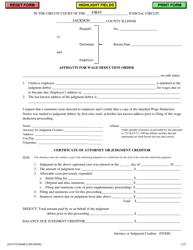

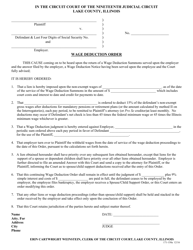

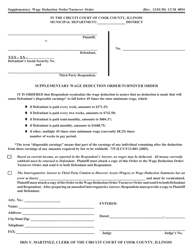

Q: What is a non-withholding wage deduction order?

A: A non-withholding wage deduction order is a court-issued order that requires an employer to deduct a specified amount from an employee's wages for the purpose of paying a debt.

Q: Who issues the non-withholding wage deduction order in Jackson County, Illinois?

A: The non-withholding wage deduction order in Jackson County, Illinois is issued by a court.

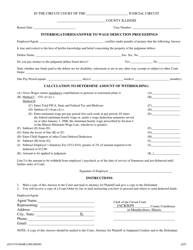

Q: How is the amount of the deduction determined?

A: The amount of the deduction is usually determined based on the amount owed by the employee.

Q: What is the purpose of a non-withholding wage deduction order?

A: The purpose of a non-withholding wage deduction order is to ensure that a debt is repaid by automatically deducting a certain amount from the employee's wages.

Q: What happens if an employer fails to comply with a non-withholding wage deduction order?

A: If an employer fails to comply with a non-withholding wage deduction order, they may be subject to penalties or legal consequences.

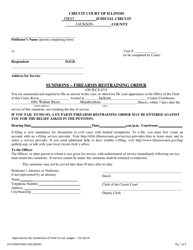

Q: Can an employee challenge a non-withholding wage deduction order?

A: Yes, an employee has the right to challenge a non-withholding wage deduction order in court if they believe it is not valid or the amount being deducted is incorrect.

Form Details:

- The latest edition currently provided by the Circuit Clerk’s Office - Jackson County, Illinois;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Circuit Clerk’s Office - Jackson County, Illinois.