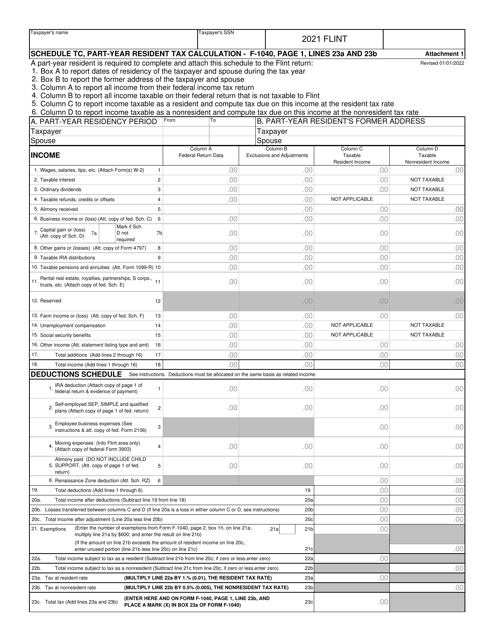

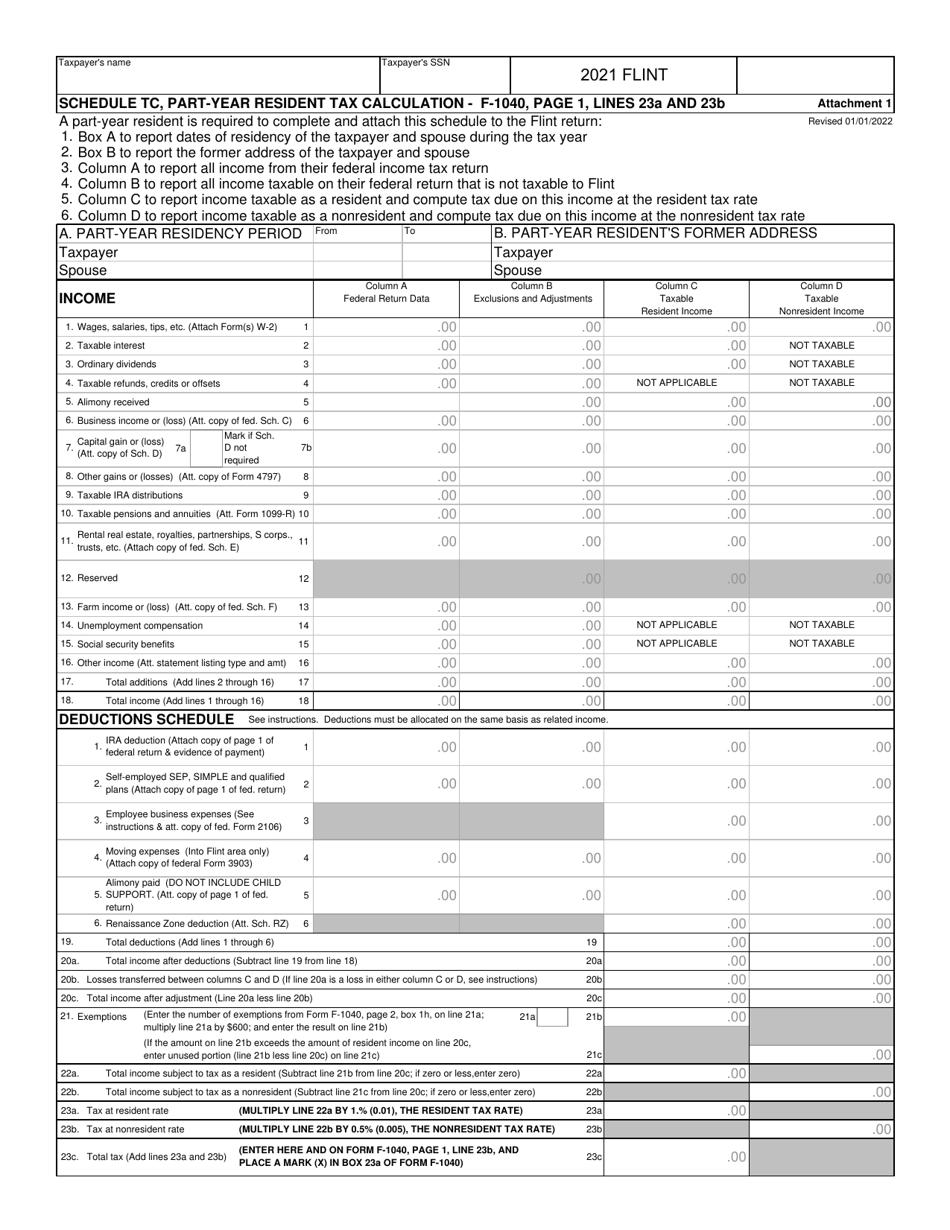

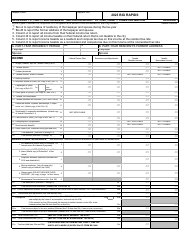

This version of the form is not currently in use and is provided for reference only. Download this version of

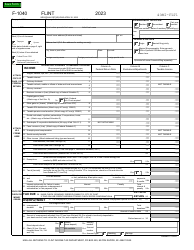

Form F-1040 Schedule TC

for the current year.

Form F-1040 Schedule TC Part-Year Resident Tax Calculation - City of Flint, Michigan

What Is Form F-1040 Schedule TC?

This is a legal form that was released by the Income Tax Department - City of Flint, Michigan - a government authority operating within Michigan. The form may be used strictly within City of Flint. The document is a supplement to Form F-1040, Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-1040 Schedule TC?

A: Form F-1040 Schedule TC is a tax form used to calculate the tax liability for part-year residents of Flint, Michigan.

Q: Who needs to file Form F-1040 Schedule TC?

A: Part-year residents of Flint, Michigan who have income that is subject to taxation need to file Form F-1040 Schedule TC.

Q: What is the purpose of Form F-1040 Schedule TC?

A: The purpose of Form F-1040 Schedule TC is to determine the tax liability for part-year residents of Flint, Michigan based on their income.

Q: How do I complete Form F-1040 Schedule TC?

A: You need to provide information about your income, deductions, and credits on the form as instructed.

Q: When is the deadline to file Form F-1040 Schedule TC?

A: The deadline to file Form F-1040 Schedule TC is the same as the deadline for filing your federal tax return, which is typically April 15th.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Income Tax Department - City of Flint, Michigan;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F-1040 Schedule TC by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Flint, Michigan.