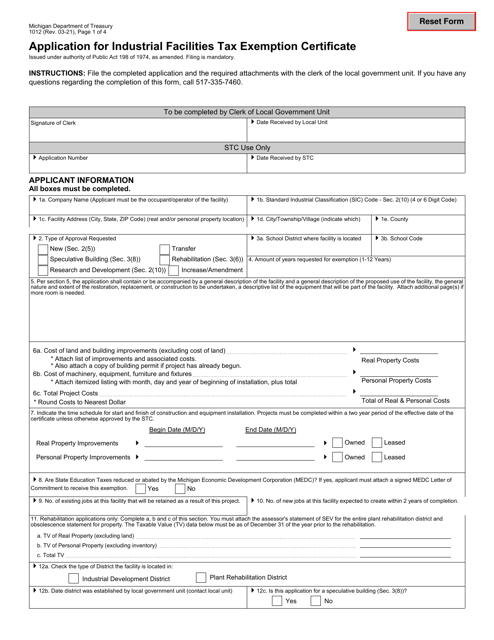

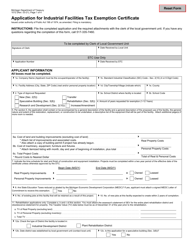

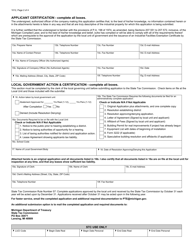

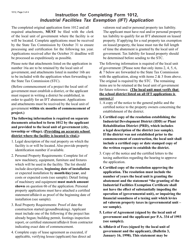

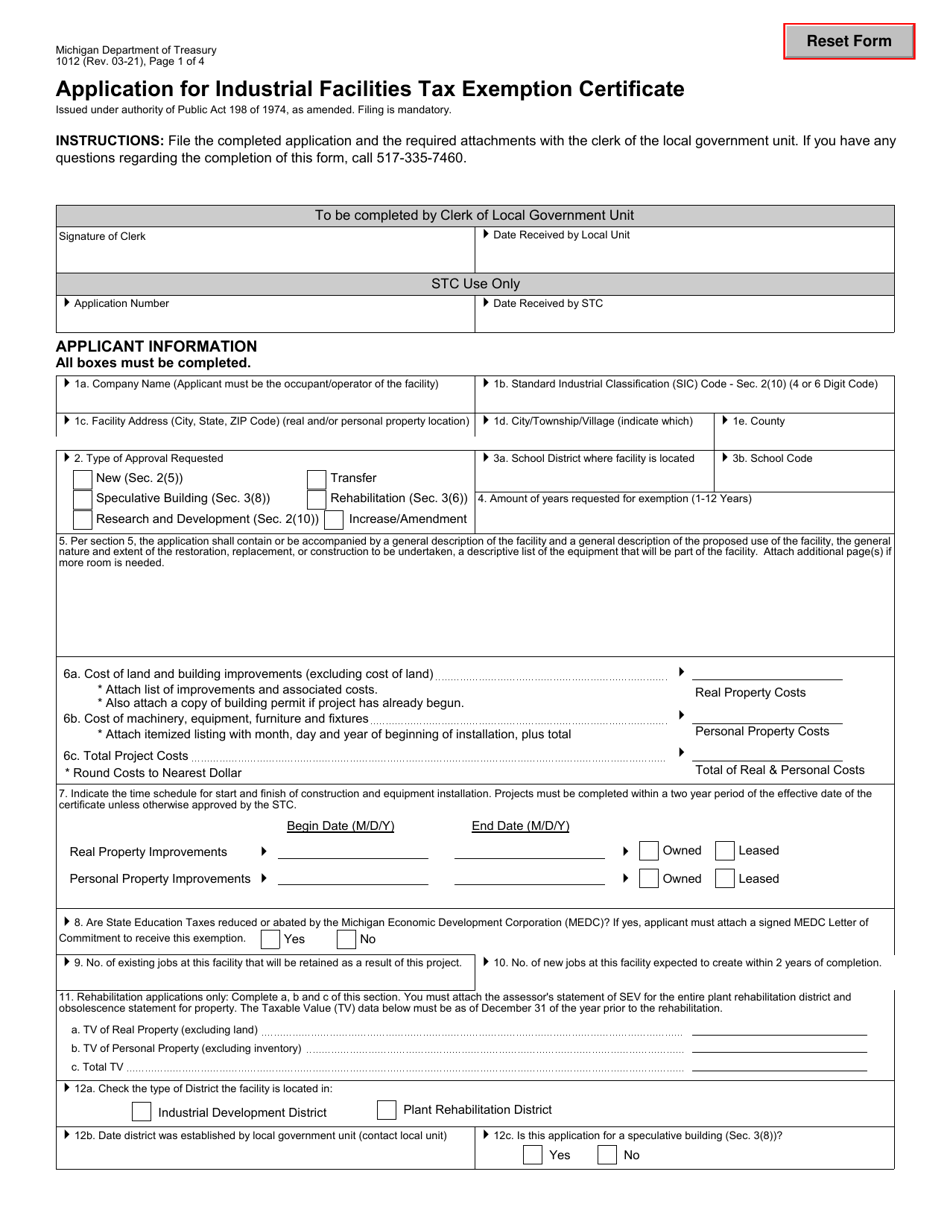

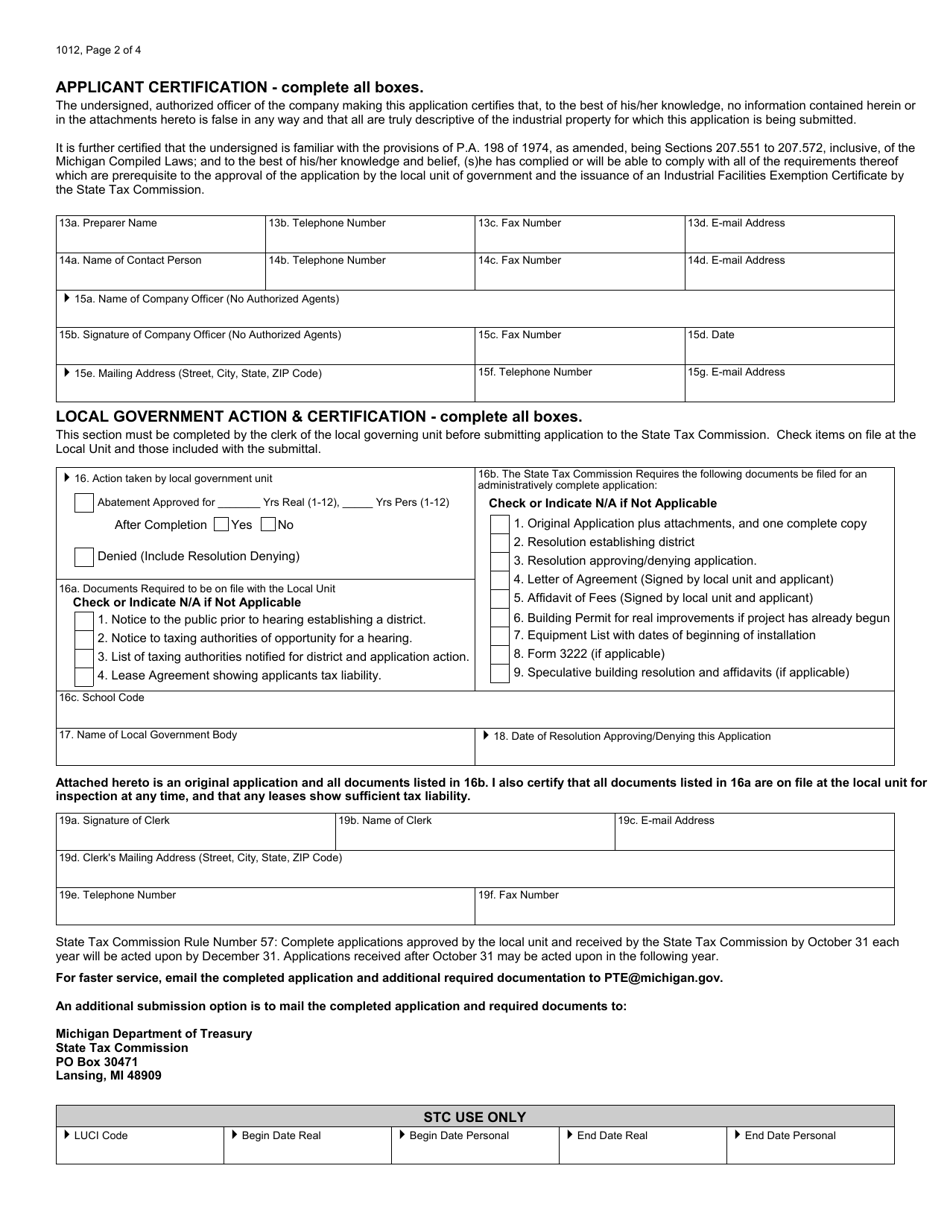

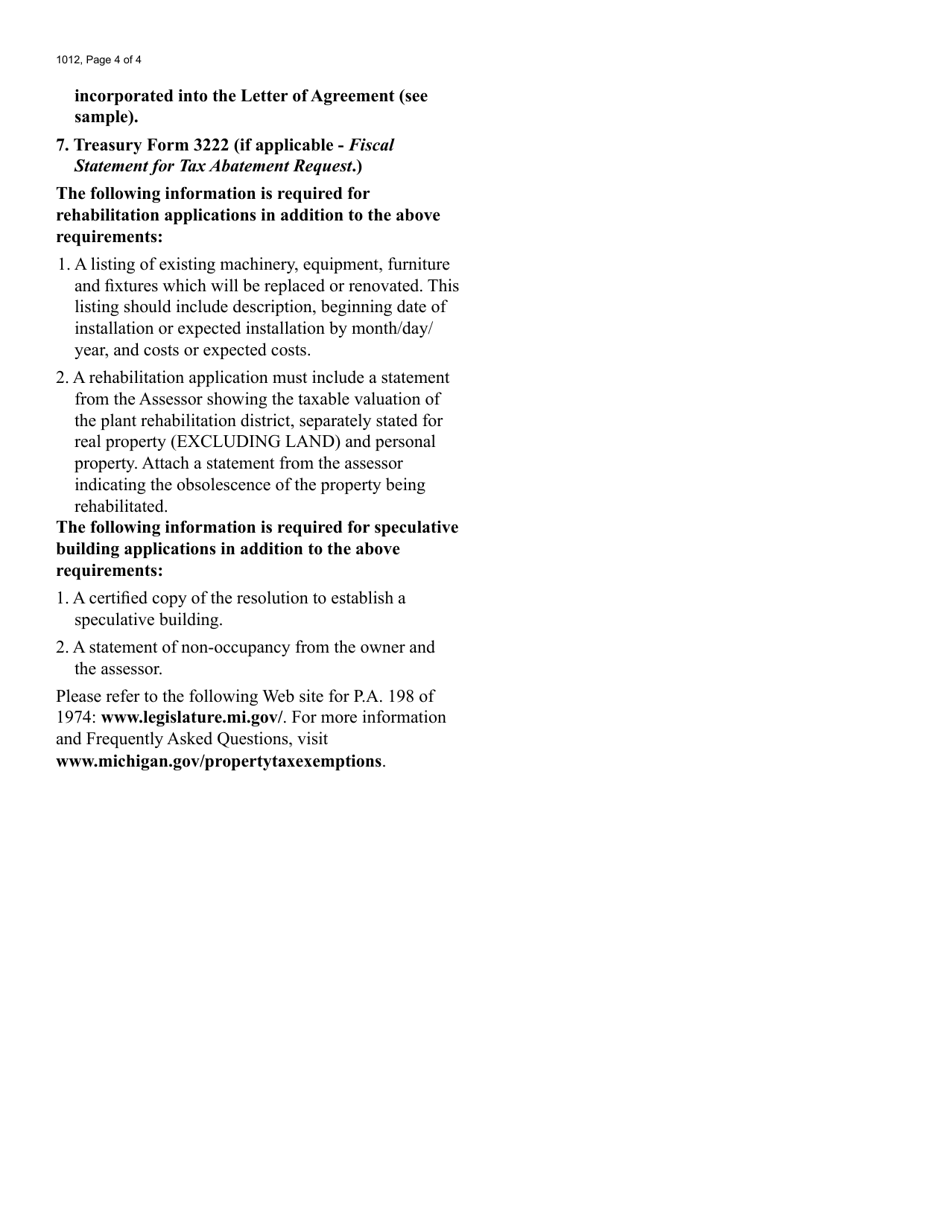

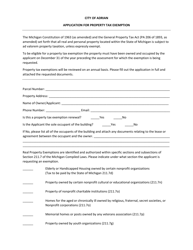

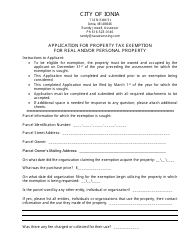

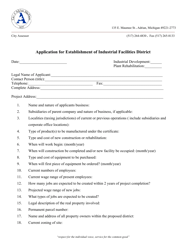

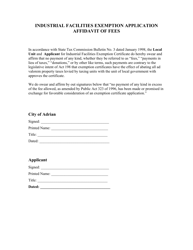

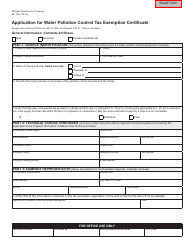

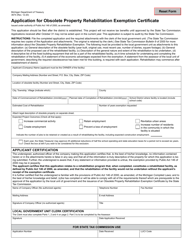

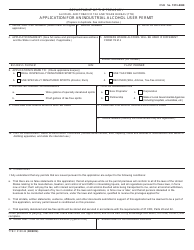

Form 1012 Application for Industrial Facilities Tax Exemption Certificate - Michigan

What Is Form 1012?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1012?

A: Form 1012 is the Application for Industrial Facilities Tax Exemption Certificate in Michigan.

Q: Who needs to fill out Form 1012?

A: Businesses seeking a tax exemption for industrial facilities in Michigan need to fill out Form 1012.

Q: What is the purpose of Form 1012?

A: The purpose of Form 1012 is to apply for a tax exemption on industrial facilities in Michigan.

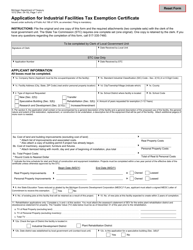

Q: What information is required on Form 1012?

A: Form 1012 requires information such as the applicant's name, address, contact information, property details, and the reason for the tax exemption request.

Q: Is there a deadline for submitting Form 1012?

A: Yes, Form 1012 should be submitted at least 45 days before the commencement of any construction or renovation work on the industrial facility.

Q: Is there a fee for submitting Form 1012?

A: Yes, there is a fee associated with submitting Form 1012. The fee is based on the estimated true cash value of the industrial facility.

Q: How long does it take to process Form 1012?

A: The processing time for Form 1012 can vary, but it is generally within 90 days of receipt.

Q: What is the duration of the tax exemption granted through Form 1012?

A: The duration of the tax exemption granted through Form 1012 is up to 12 years, subject to certain conditions and requirements.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1012 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.