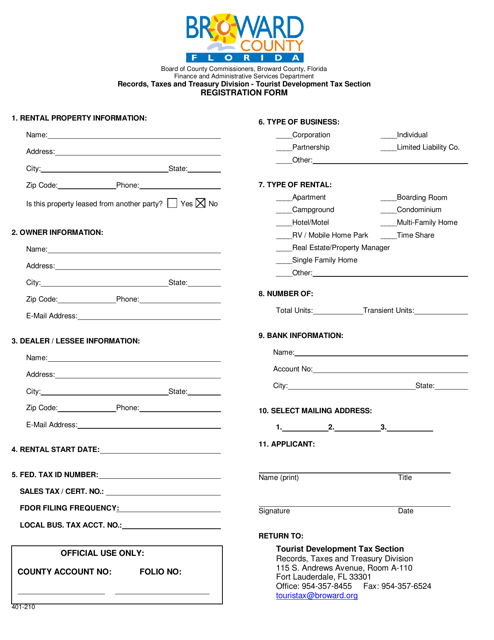

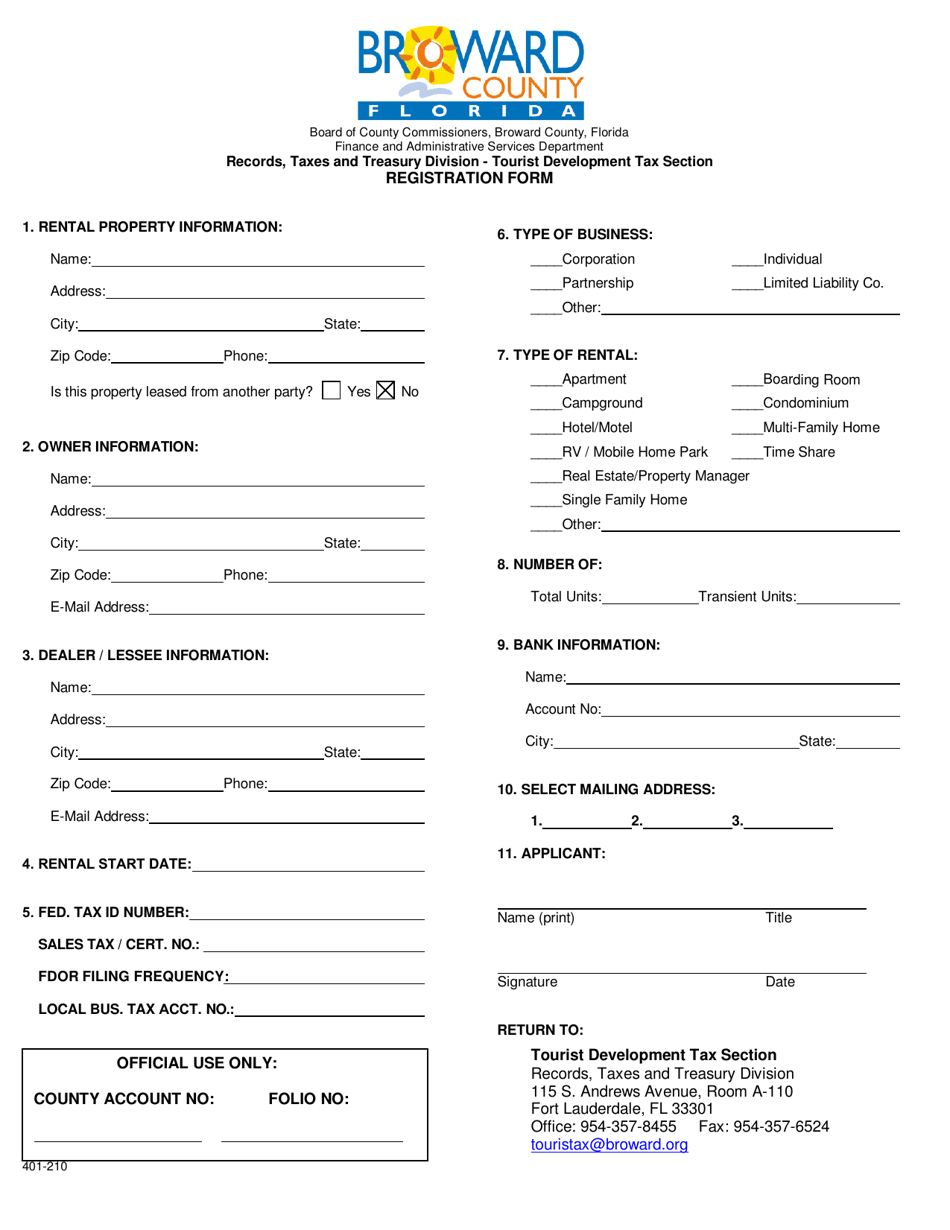

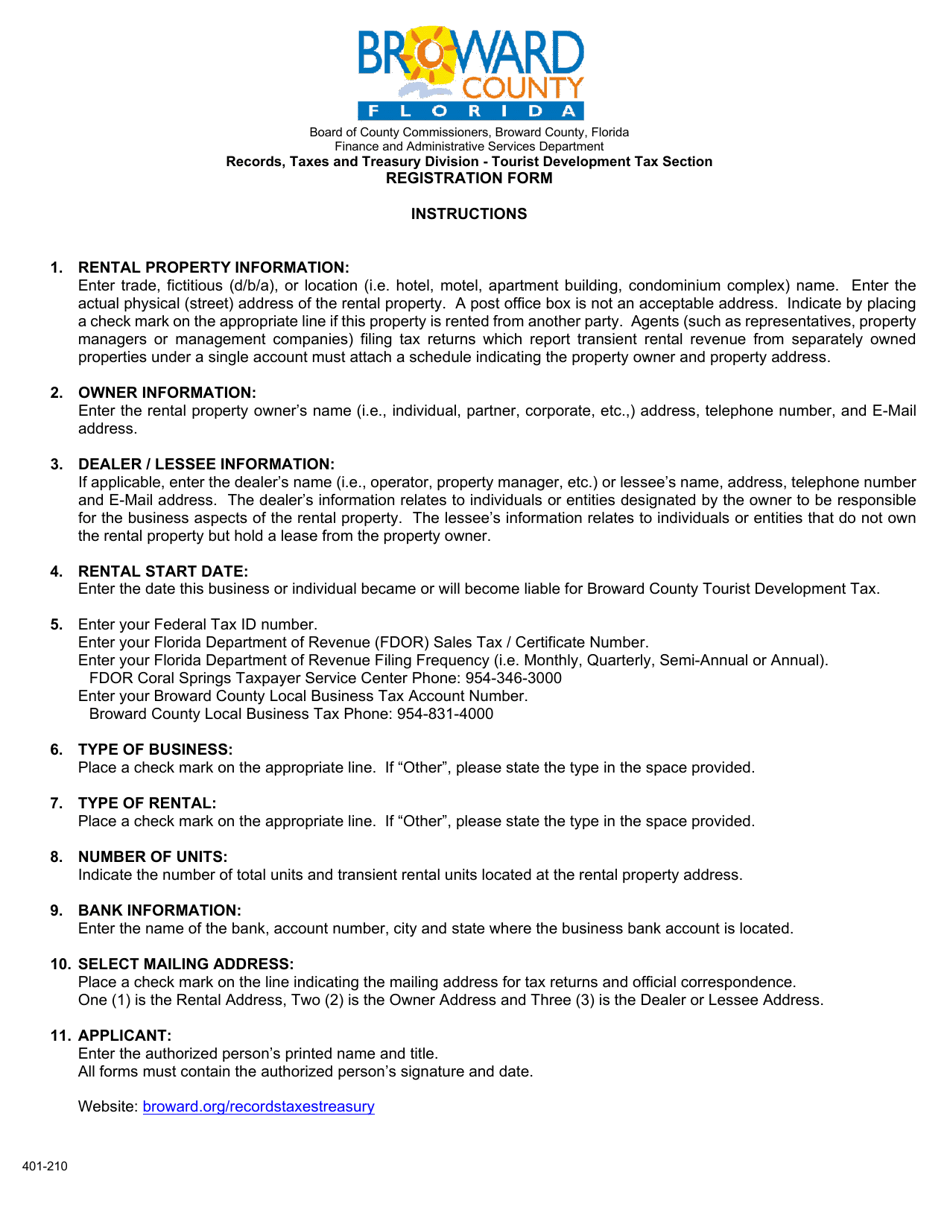

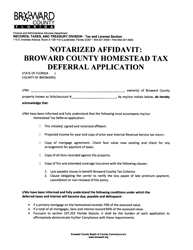

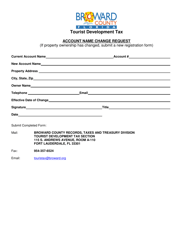

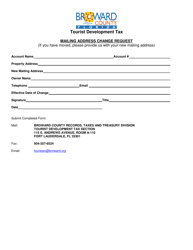

Form 401-210 Tourist Development Tax Registration Form - Broward County, Florida

What Is Form 401-210?

This is a legal form that was released by the Records, Taxes & Treasury Division - Broward County, Florida - a government authority operating within Florida. The form may be used strictly within Broward County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 401-210?

A: Form 401-210 is the Tourist Development Tax Registration Form for Broward County, Florida.

Q: What is the purpose of Form 401-210?

A: The purpose of Form 401-210 is to register for the Tourist Development Tax in Broward County, Florida.

Q: Who needs to fill out Form 401-210?

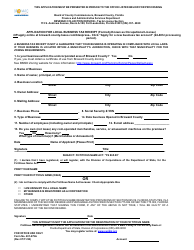

A: Any individual or business that owns or operates a hotel, motel, short-term rental property, or other accommodations in Broward County, Florida must fill out Form 401-210.

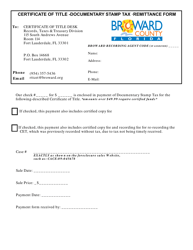

Q: What is the Tourist Development Tax?

A: The Tourist Development Tax is a tax imposed on the rental of accommodations in Broward County, Florida. It is used to support tourism-related activities and marketing efforts.

Q: What information is required on Form 401-210?

A: Form 401-210 requires information such as the property owner's name, contact information, property address, number of units, and rental period.

Form Details:

- The latest edition provided by the Records, Taxes & Treasury Division - Broward County, Florida;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 401-210 by clicking the link below or browse more documents and templates provided by the Records, Taxes & Treasury Division - Broward County, Florida.