Affidavit to File for Tax Deed Surplus Funds (Prior to 10 / 1 / 2018) - Broward County, Florida

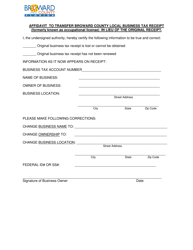

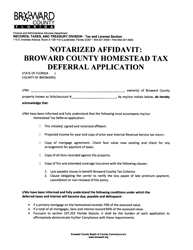

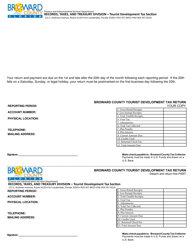

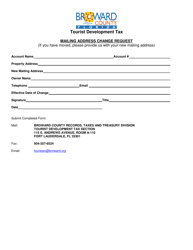

Affidavit to File for Surplus Funds (Prior to 10/1/2018) is a legal document that was released by the Records, Taxes & Treasury Division - Broward County, Florida - a government authority operating within Florida. The form may be used strictly within Broward County.

FAQ

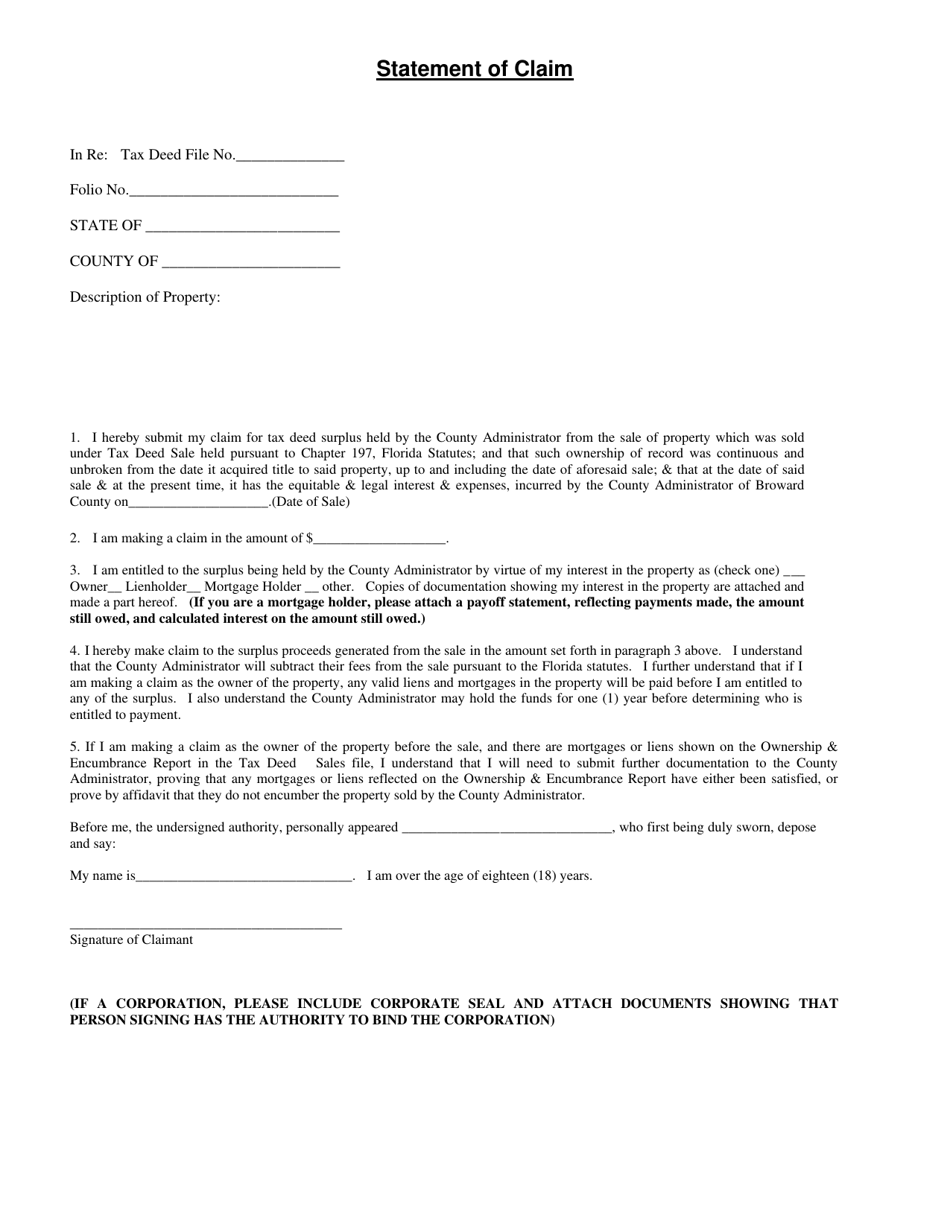

Q: What is an affidavit to file for tax deed surplus funds?

A: An affidavit to file for tax deed surplus funds is a legal document used to claim surplus funds from a tax deed sale in Broward County, Florida.

Q: What are tax deed surplus funds?

A: Tax deed surplus funds are excess proceeds from the sale of a property at a tax auction, which are available to individuals or entities with a valid claim.

Q: Who can file an affidavit to claim surplus funds?

A: Any person or entity that believes they have a valid claim to tax deed surplus funds can file an affidavit to claim those funds.

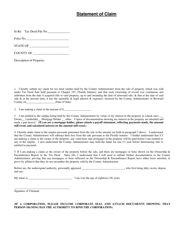

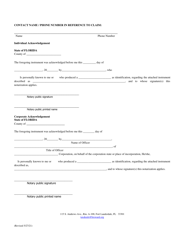

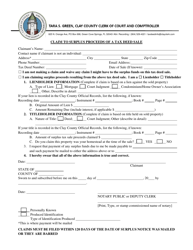

Q: What information is required in the affidavit?

A: The affidavit typically requires information such as the claimant's name, contact information, details about the tax deed sale, and supporting documentation.

Q: What is the deadline to file an affidavit?

A: The deadline to file an affidavit to claim tax deed surplus funds in Broward County, Florida is typically 60 days from the date of the tax deed sale.

Q: What happens after filing the affidavit?

A: After filing the affidavit, the Clerk of Courts will review the claim, conduct a hearing if necessary, and determine the distribution of the surplus funds.

Q: Can I hire an attorney to help with the process?

A: Yes, you can hire an attorney to assist you with the process of filing an affidavit to claim tax deed surplus funds.

Form Details:

- Released on May 27, 2021;

- The latest edition currently provided by the Records, Taxes & Treasury Division - Broward County, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Records, Taxes & Treasury Division - Broward County, Florida.