This version of the form is not currently in use and is provided for reference only. Download this version of

Form FIS0321

for the current year.

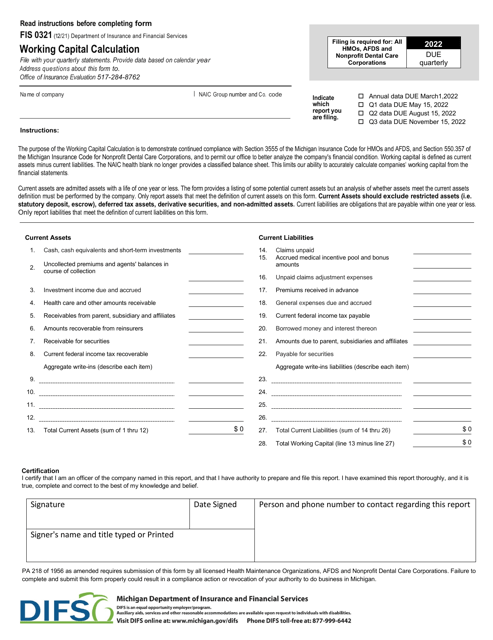

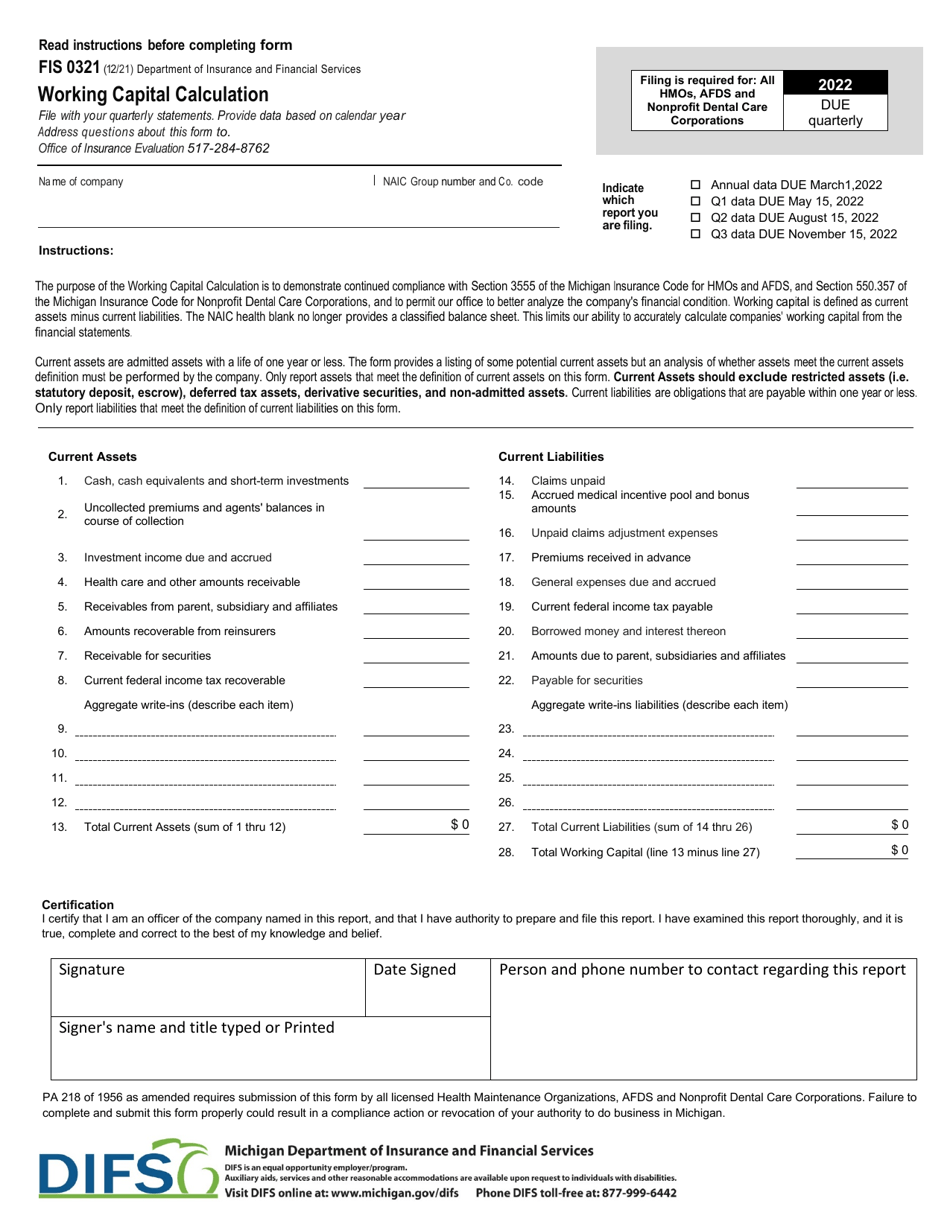

Form FIS0321 Working Capital Calculation - Michigan

What Is Form FIS0321?

This is a legal form that was released by the Michigan Department of Insurance and Financial Services - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FIS0321?

A: Form FIS0321 is a document used in Michigan to calculate working capital.

Q: Why is working capital important?

A: Working capital is important because it indicates a company's ability to pay its short-term debts and fund its day-to-day operations.

Q: How is working capital calculated?

A: Working capital is calculated by subtracting a company's current liabilities from its current assets.

Q: What are current liabilities?

A: Current liabilities are debts or obligations that are due within one year.

Q: What are current assets?

A: Current assets are assets that are expected to be converted into cash or used up within one year.

Q: What are some examples of current assets?

A: Examples of current assets include cash, accounts receivable, inventory, and prepaid expenses.

Q: What are some examples of current liabilities?

A: Examples of current liabilities include accounts payable, short-term loans, and accrued expenses.

Q: What does a positive working capital indicate?

A: A positive working capital indicates that a company has enough assets to cover its short-term obligations.

Q: What does a negative working capital indicate?

A: A negative working capital indicates that a company may struggle to meet its short-term obligations.

Q: How can a company improve its working capital?

A: A company can improve its working capital by increasing its current assets, reducing its current liabilities, or a combination of both.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Michigan Department of Insurance and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIS0321 by clicking the link below or browse more documents and templates provided by the Michigan Department of Insurance and Financial Services.