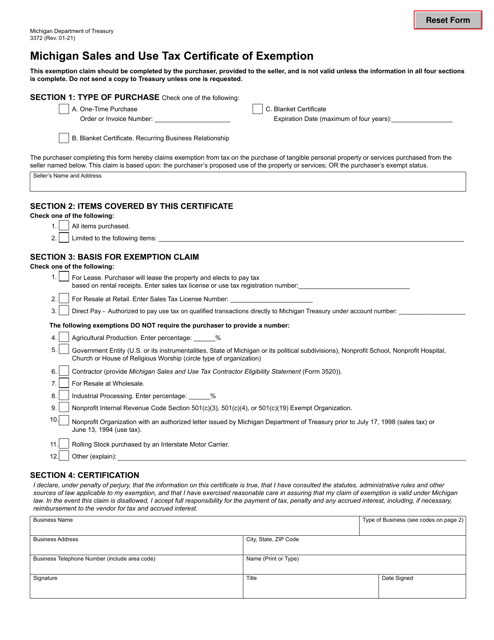

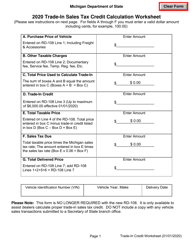

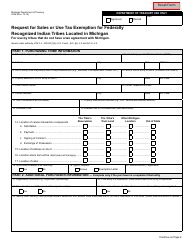

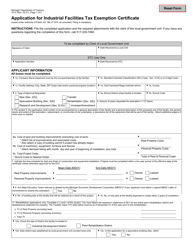

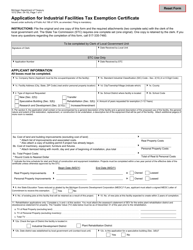

Form 3372 Michigan Sales and Use Tax Certificate of Exemption - Michigan

What Is Form 3372?

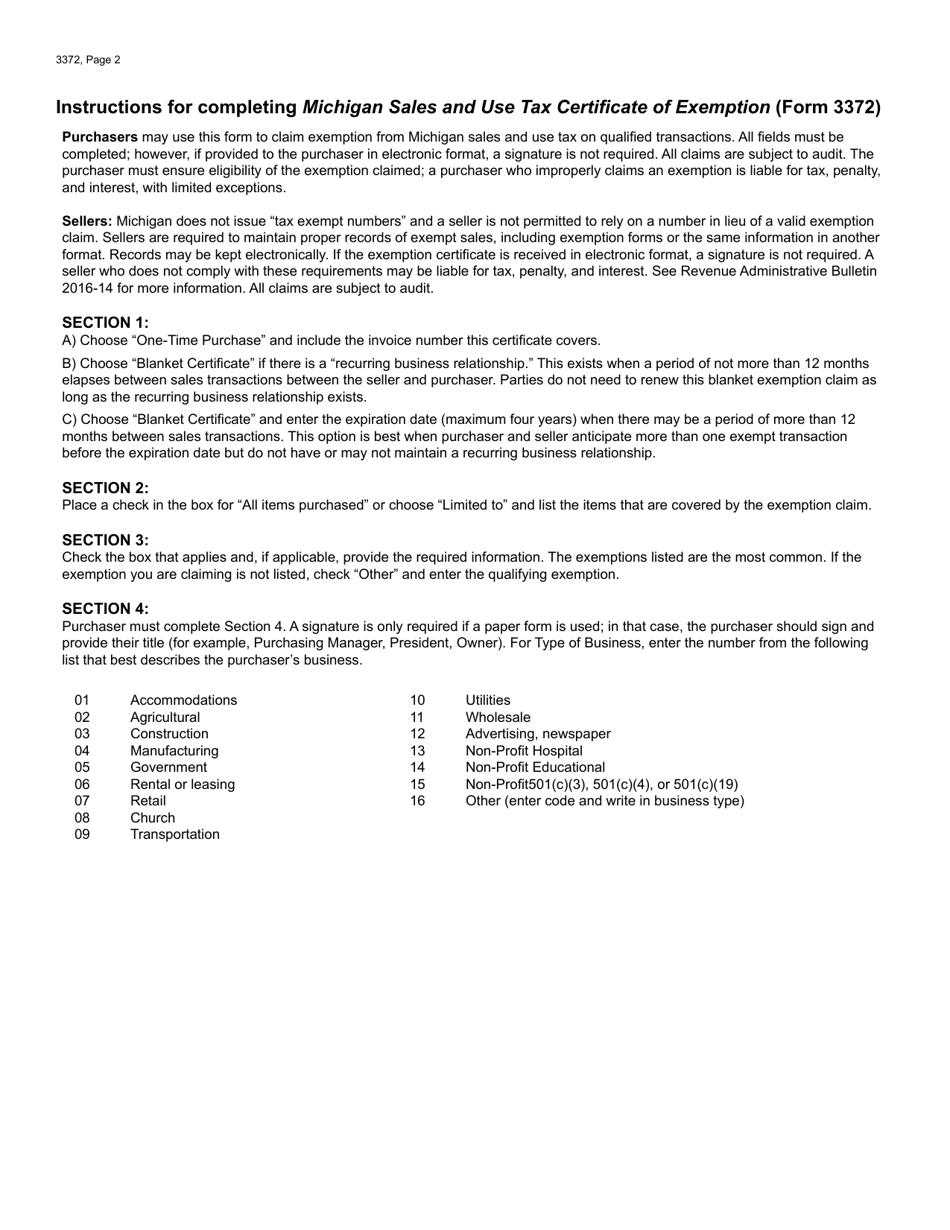

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3372?

A: Form 3372 is the Michigan Sales and Use Tax Certificate of Exemption.

Q: What is the purpose of Form 3372?

A: The purpose of Form 3372 is to claim an exemption from Michigan sales and use tax.

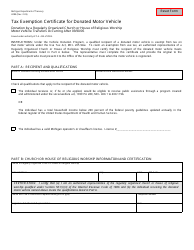

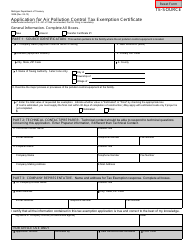

Q: Who should use Form 3372?

A: Form 3372 should be used by entities or individuals who qualify for a sales and use tax exemption in Michigan.

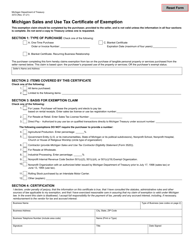

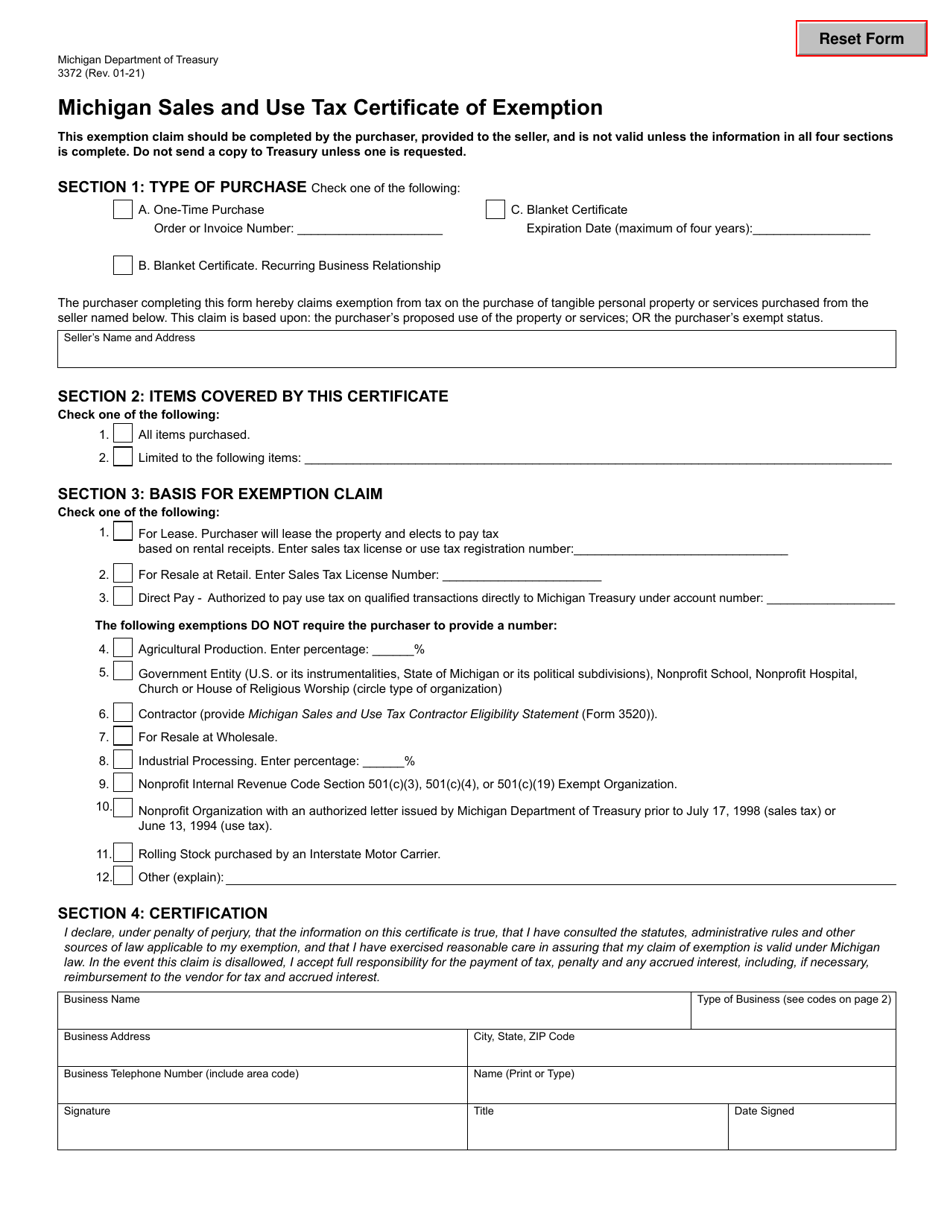

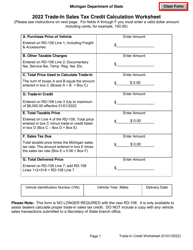

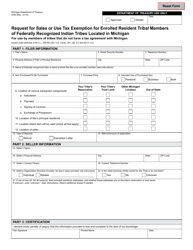

Q: What information is required on Form 3372?

A: Form 3372 requires information such as the purchaser's name, address, and reason for claiming the exemption.

Q: Do I need to renew Form 3372?

A: No, Form 3372 does not need to be renewed. Once it is obtained, it can be used until the exemption status changes.

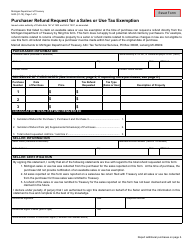

Q: Can I use Form 3372 for multiple purchases?

A: Yes, Form 3372 can be used for multiple purchases as long as the exemption status remains the same.

Q: Can individuals use Form 3372?

A: Yes, individuals who qualify for a sales and use tax exemption in Michigan can use Form 3372.

Q: Are there any other requirements to claim the exemption?

A: Depending on the type of exemption, there may be additional requirements or supporting documentation needed.

Q: What should I do with Form 3372 after completion?

A: Completed Form 3372 should be kept on file by the purchaser and provided to sellers when claiming the exemption.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3372 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.