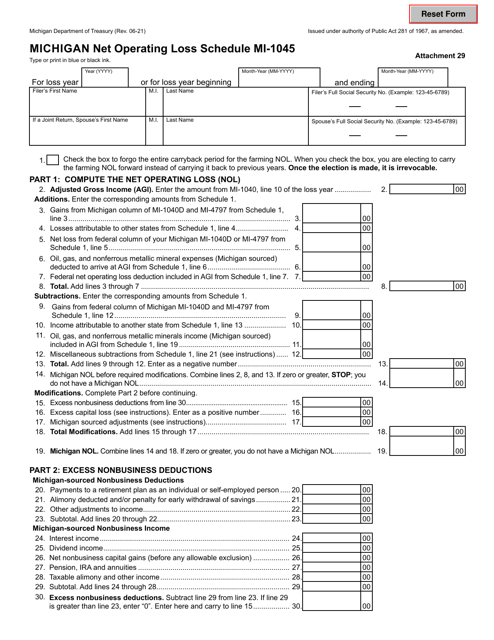

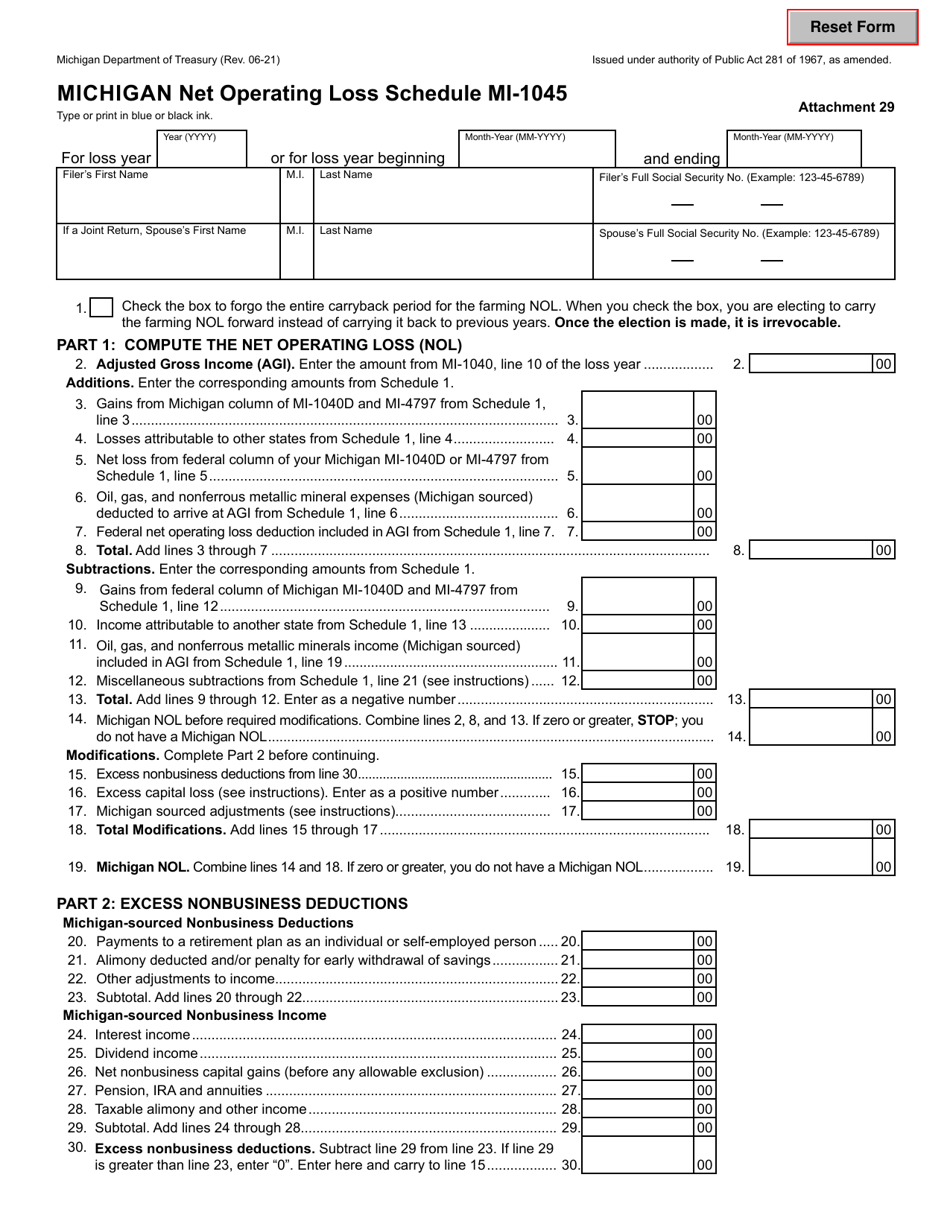

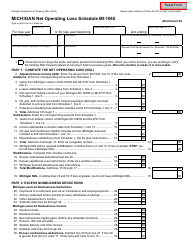

Schedule MI-1045 Michigan Net Operating Loss Schedule - Michigan

What Is Schedule MI-1045?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

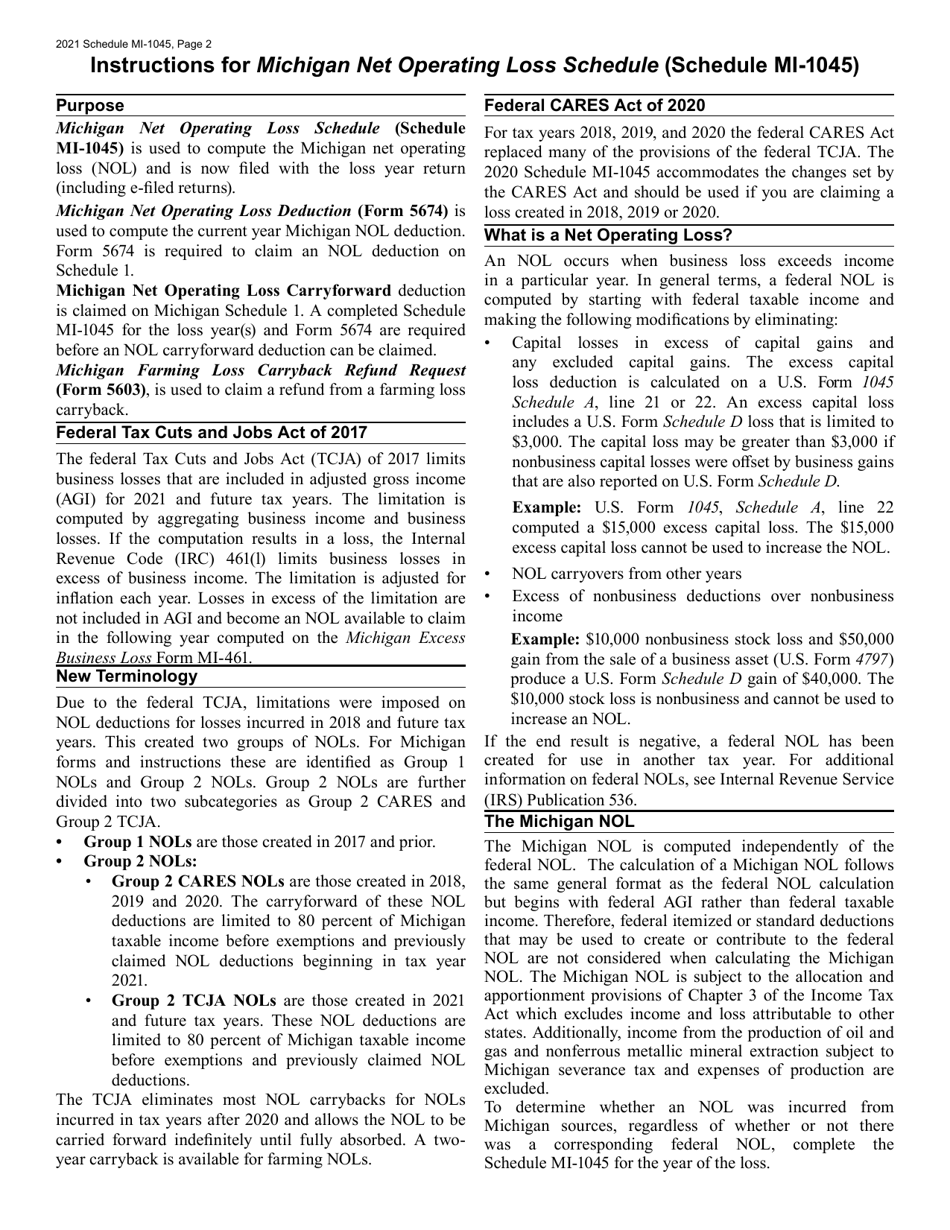

Q: What is the MI-1045 Michigan Net Operating Loss Schedule?

A: The MI-1045 Michigan Net Operating Loss Schedule is a form used in Michigan to report net operating losses incurred by businesses.

Q: Who needs to file the MI-1045 form?

A: Businesses that have incurred net operating losses in Michigan need to file the MI-1045 form.

Q: What is a net operating loss?

A: A net operating loss occurs when a business's allowable deductions exceed its taxable income.

Q: Why is it important to report net operating losses?

A: Reporting net operating losses can help businesses offset future taxable income and potentially reduce their tax liability.

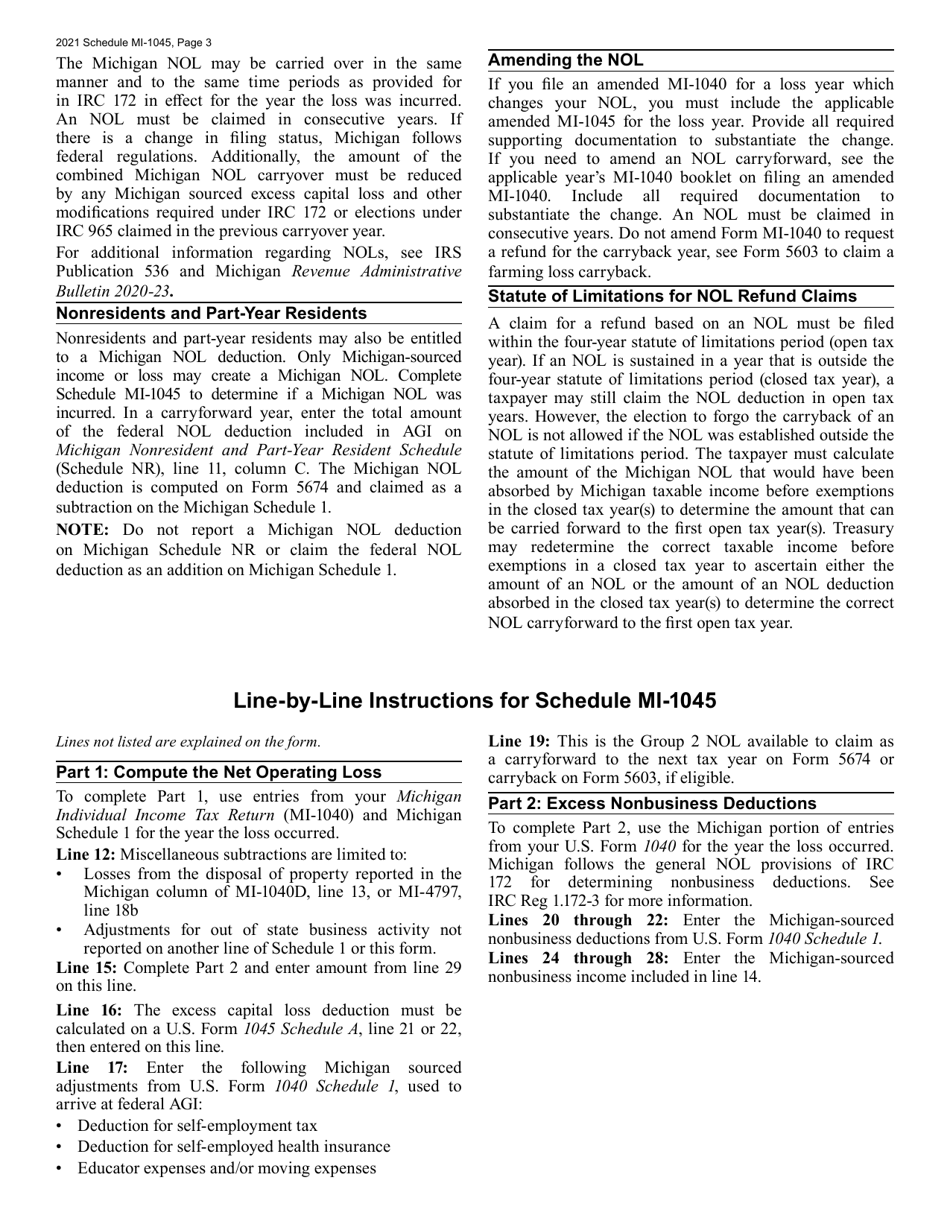

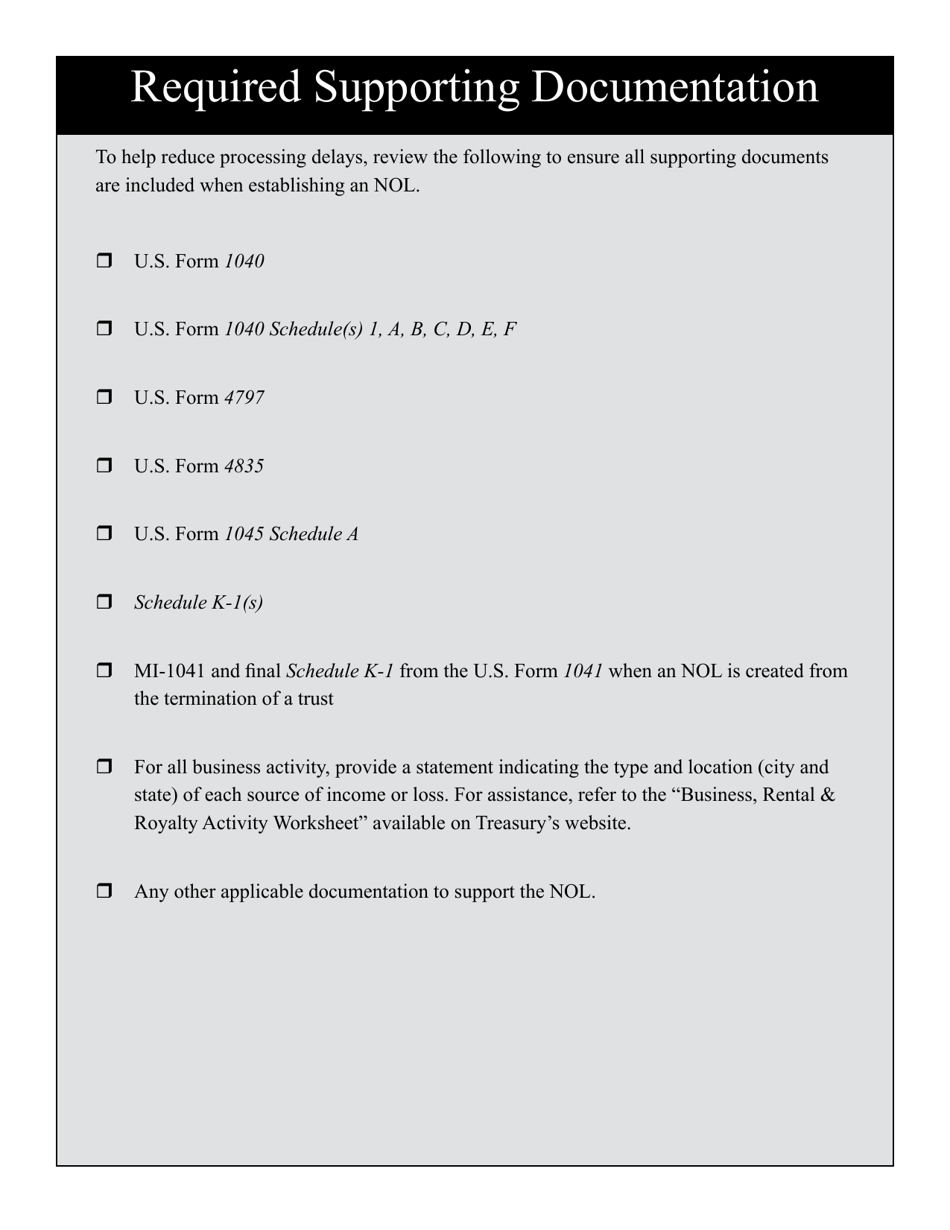

Q: What information is required on the MI-1045 form?

A: The MI-1045 form requires businesses to provide details about their net operating losses, including the tax year in which the loss was incurred and the amount of the loss.

Q: Are there any deadlines for filing the MI-1045 form?

A: Yes, the MI-1045 form must be filed by the due date of the business's Michigan tax return, which is generally April 30th.

Q: Can the MI-1045 form be filed electronically?

A: Yes, businesses have the option to file the MI-1045 form electronically through the Michigan Department of Treasury's e-file system.

Q: Are there any fees associated with filing the MI-1045 form?

A: No, there are no fees associated with filing the MI-1045 form.

Q: What should I do if I have questions or need assistance with the MI-1045 form?

A: If you have questions or need assistance with the MI-1045 form, you can contact the Michigan Department of Treasury or consult a tax professional.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule MI-1045 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.