This version of the form is not currently in use and is provided for reference only. Download this version of

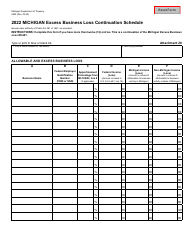

Form MI-461 (5595)

for the current year.

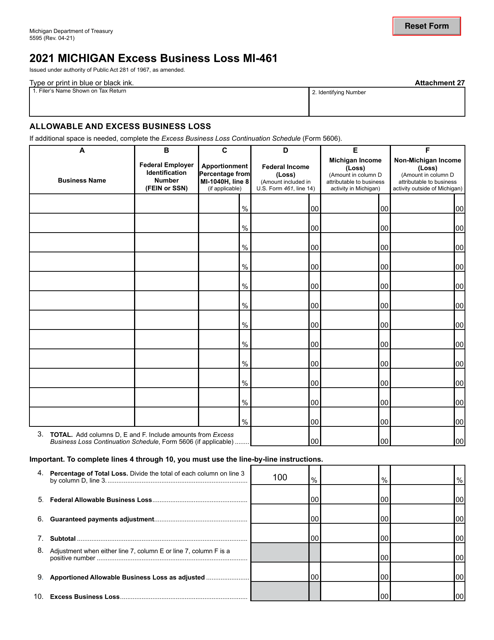

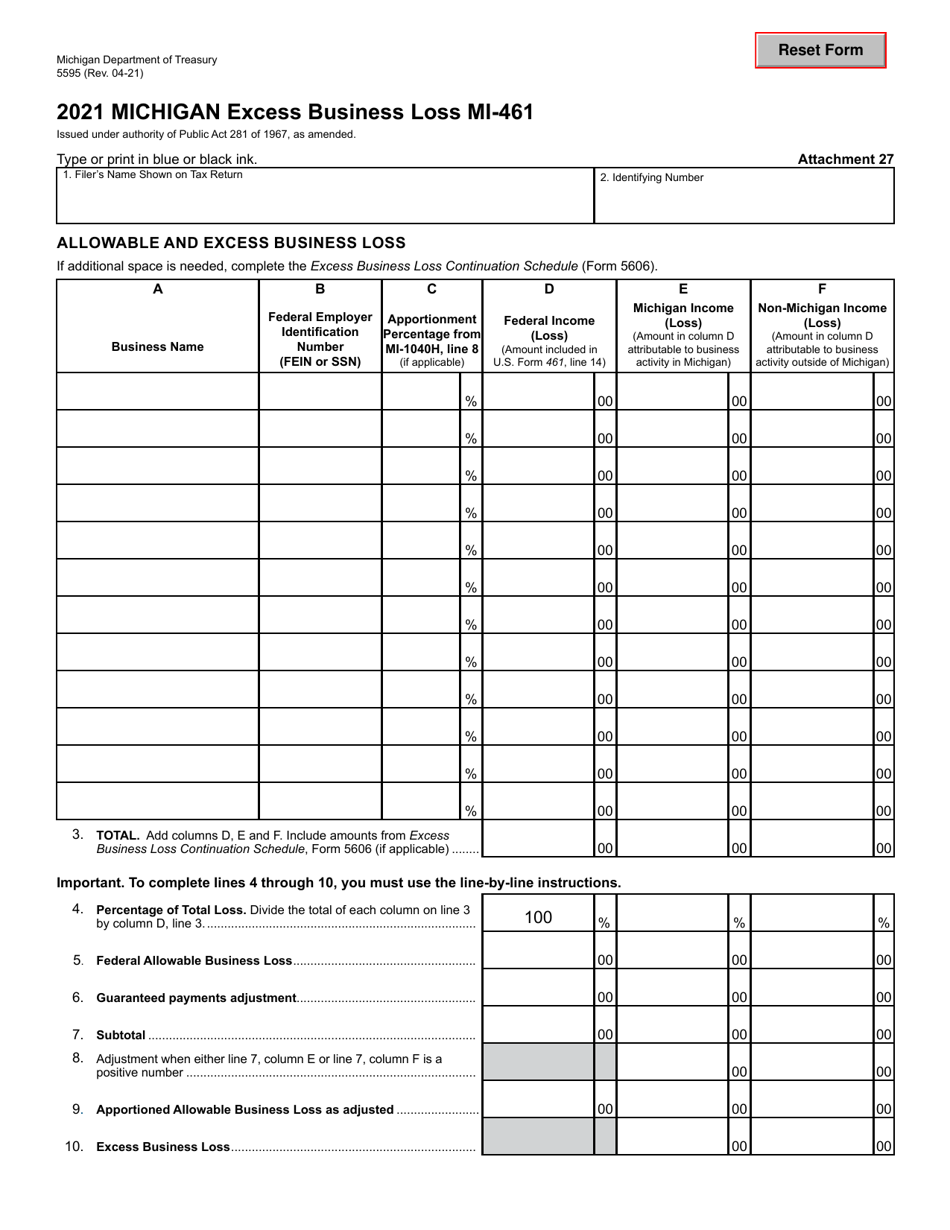

Form MI-461 (5595) Michigan Excess Business Loss - Michigan

What Is Form MI-461 (5595)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

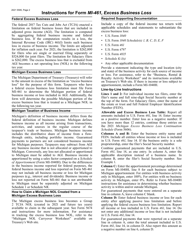

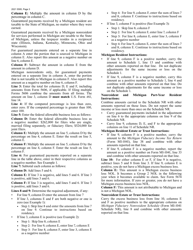

Q: What is Form MI-461?

A: Form MI-461 is the Michigan Excess Business Loss form.

Q: Who needs to file Form MI-461?

A: Taxpayers with a net operating loss (NOL) that exceeds the federal excess business loss limitation will need to file Form MI-461.

Q: What is a net operating loss?

A: A net operating loss (NOL) occurs when a taxpayer's allowable deductions exceed their taxable income in a given year.

Q: What is the federal excess business loss limitation?

A: The federal excess business loss limitation is a provision that limits the amount of business losses that can be deducted on a taxpayer's federal tax return.

Q: When is Form MI-461 due?

A: Form MI-461 is due on or before the due date of the taxpayer's Michigan income tax return, which is typically April 15th.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-461 (5595) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.