This version of the form is not currently in use and is provided for reference only. Download this version of

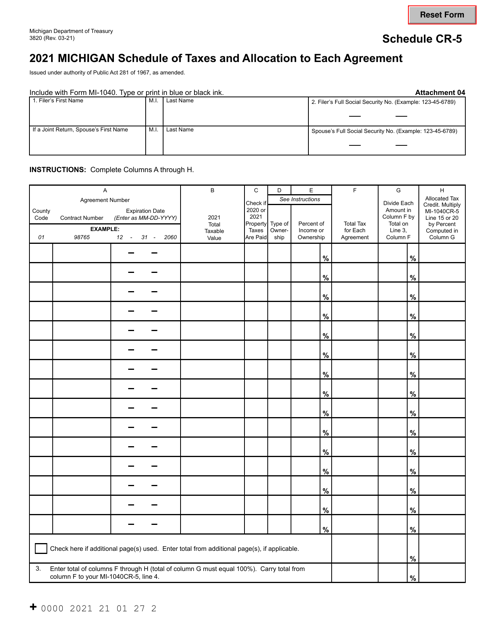

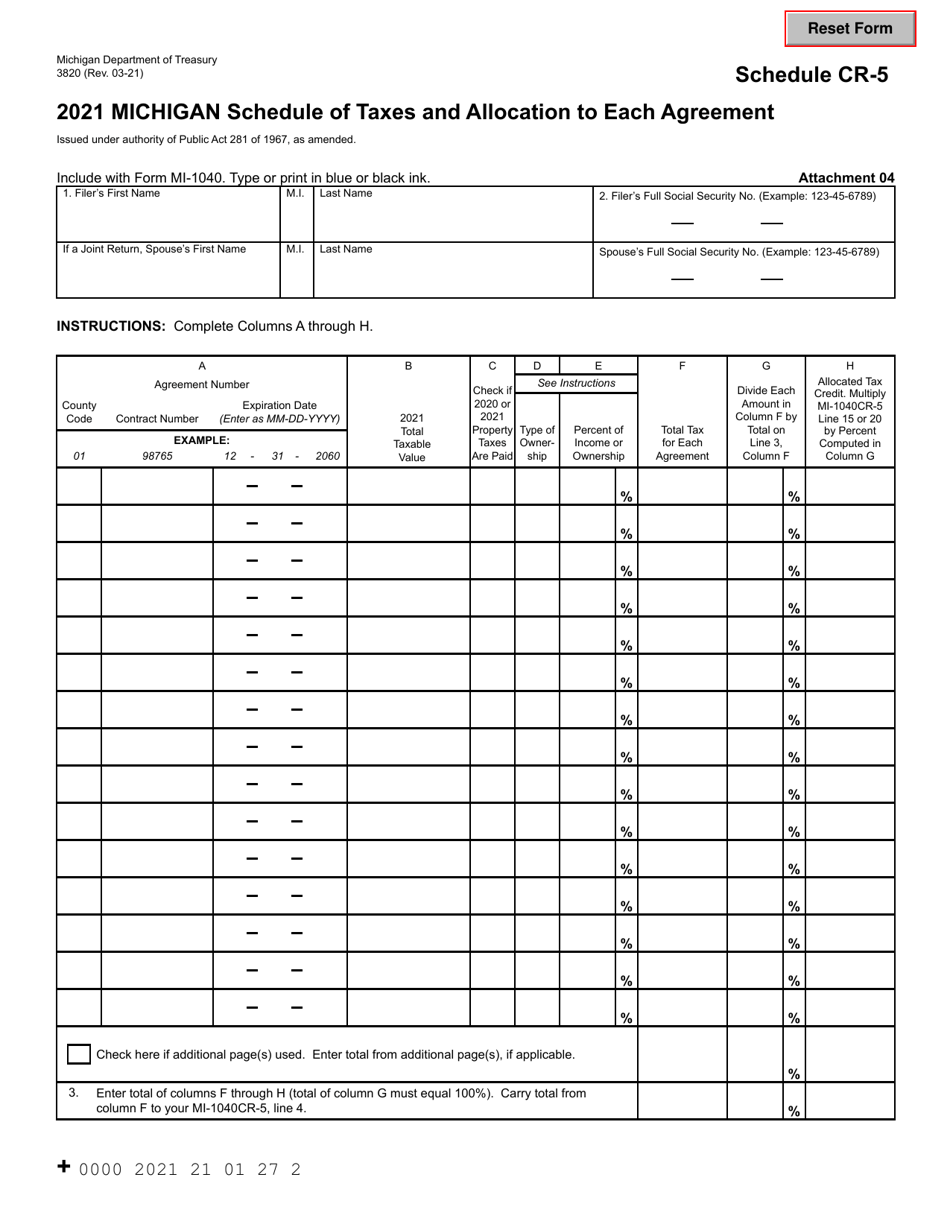

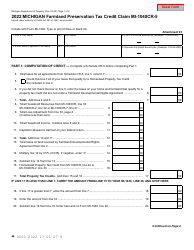

Form 3820 Schedule CR-5

for the current year.

Form 3820 Schedule CR-5 Michigan Schedule of Taxes and Allocation to Each Agreement - Michigan

What Is Form 3820 Schedule CR-5?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3820 Schedule CR-5?

A: Form 3820 Schedule CR-5 is the Michigan Schedule of Taxes and Allocation to Each Agreement.

Q: What is the purpose of Form 3820 Schedule CR-5?

A: The purpose of Form 3820 Schedule CR-5 is to report taxes and allocation to each agreement in Michigan.

Q: Who needs to file Form 3820 Schedule CR-5?

A: Individuals or entities who are required to report taxes and allocation to agreements in Michigan need to file Form 3820 Schedule CR-5.

Q: When is the deadline for filing Form 3820 Schedule CR-5?

A: The deadline for filing Form 3820 Schedule CR-5 is typically the same as the deadline for filing the Michigan state income tax return, which is April 15th.

Q: Are there any penalties for not filing Form 3820 Schedule CR-5?

A: Yes, there may be penalties for failure to file or late filing of Form 3820 Schedule CR-5. It is important to file on time to avoid these penalties.

Q: Do I need to include additional documentation with Form 3820 Schedule CR-5?

A: You may need to include supporting documentation, such as copies of agreements or contracts, to substantiate the information reported on Form 3820 Schedule CR-5.

Q: Can I file Form 3820 Schedule CR-5 electronically?

A: Yes, you can file Form 3820 Schedule CR-5 electronically through the Michigan Department of Treasury's e-file system.

Q: Is Form 3820 Schedule CR-5 only for Michigan residents?

A: No, Form 3820 Schedule CR-5 is not only for Michigan residents. It is for anyone who has tax obligations in Michigan related to agreements or contracts.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3820 Schedule CR-5 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.