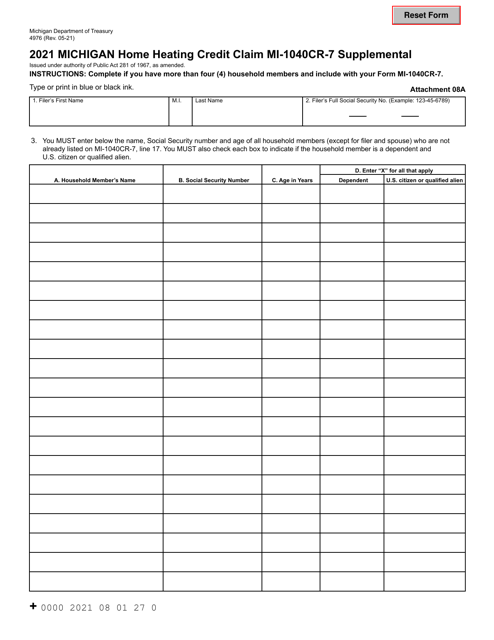

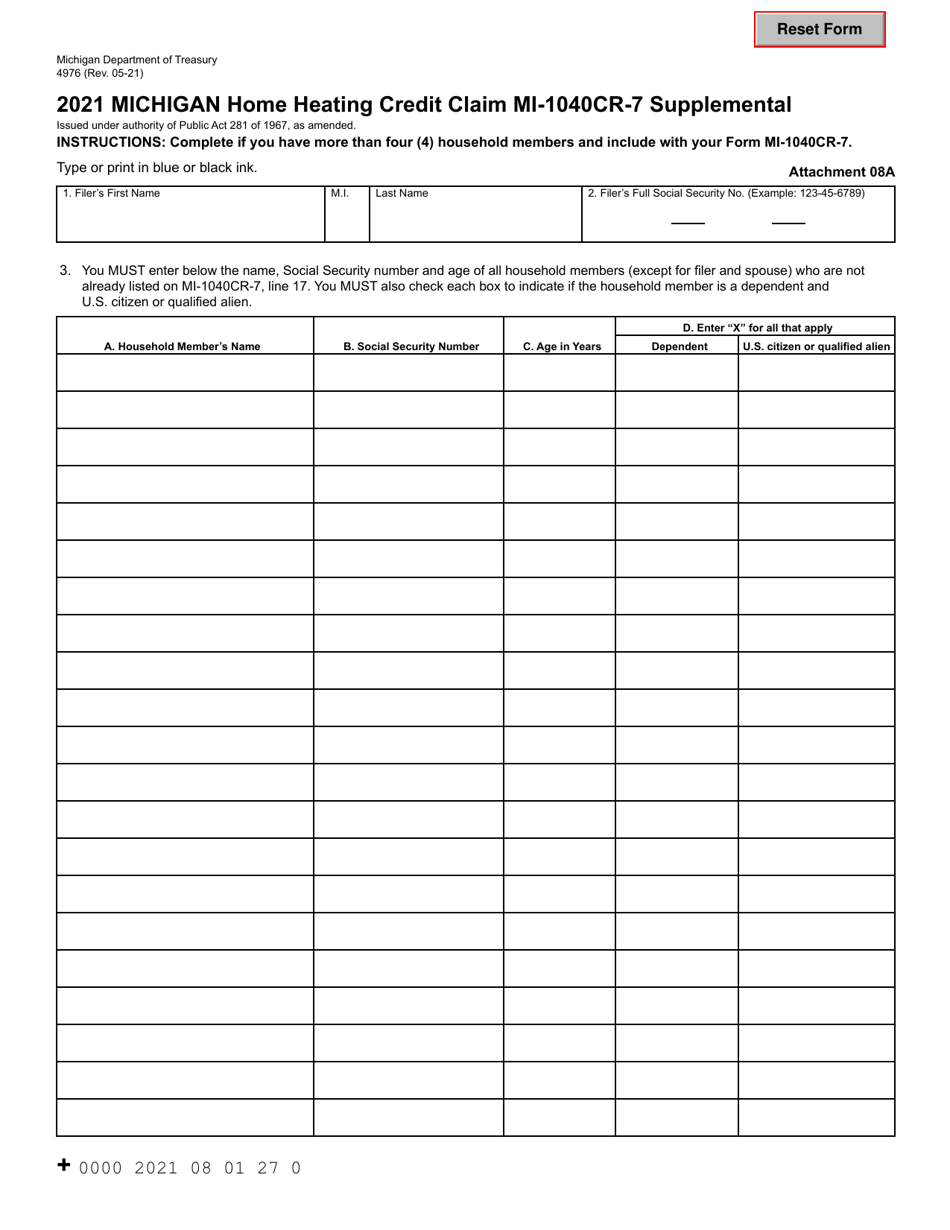

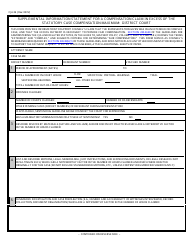

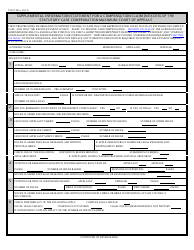

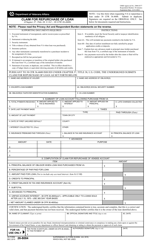

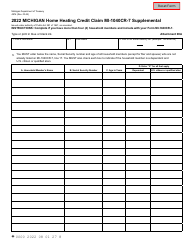

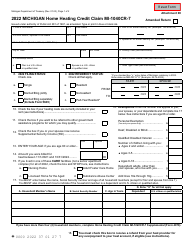

Form 4976 (MI-1040CR-7) Michigan Home Heating Credit Claim Supplemental - Michigan

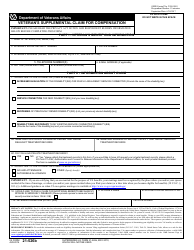

What Is Form 4976 (MI-1040CR-7)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4976?

A: Form 4976 is the Michigan Home Heating Credit Claim Supplemental form.

Q: What is the purpose of Form 4976?

A: The purpose of Form 4976 is to claim a supplemental credit for the Michigan Home Heating Credit.

Q: Who can use Form 4976?

A: Michigan residents who are eligible for the Home Heating Credit can use Form 4976 to claim the supplemental credit.

Q: What is the Home Heating Credit?

A: The Home Heating Credit is a tax credit program in Michigan that helps eligible residents pay for heating costs.

Q: What is the supplemental credit?

A: The supplemental credit is an additional credit that can be claimed by eligible individuals who qualify for the Michigan Home Heating Credit.

Q: Is there a deadline to file Form 4976?

A: Yes, the deadline to file Form 4976 is the same as the deadline for filing the Michigan Home Heating Credit, which is generally April 15th of the following year.

Q: Are there any income requirements to qualify for the Home Heating Credit?

A: Yes, there are income requirements to qualify for the Home Heating Credit. These requirements vary depending on the tax year.

Q: Can I claim the Home Heating Credit and the supplemental credit on the same form?

A: No, the Michigan Home Heating Credit and the supplemental credit must be claimed on separate forms. Form 4976 is specifically for the supplemental credit.

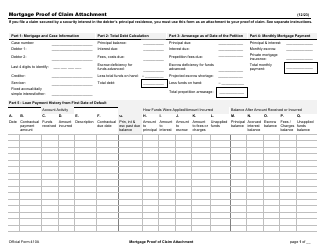

Q: What documents do I need to attach to Form 4976?

A: You may need to attach copies of your home heating bills or other supporting documents to Form 4976, depending on your individual circumstances.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4976 (MI-1040CR-7) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.