This version of the form is not currently in use and is provided for reference only. Download this version of

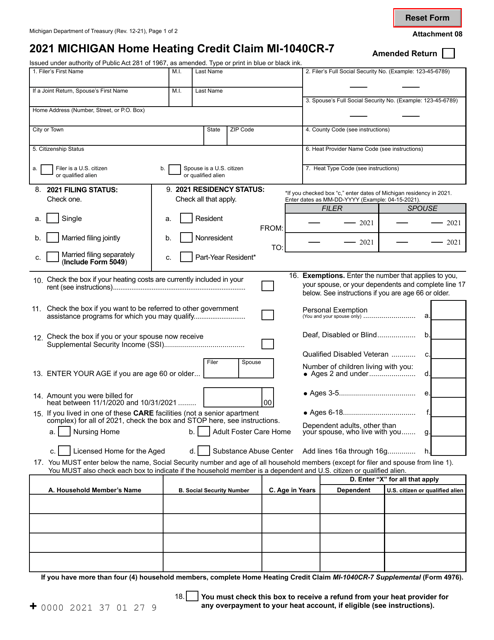

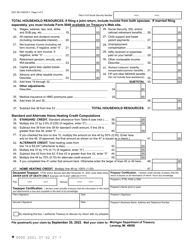

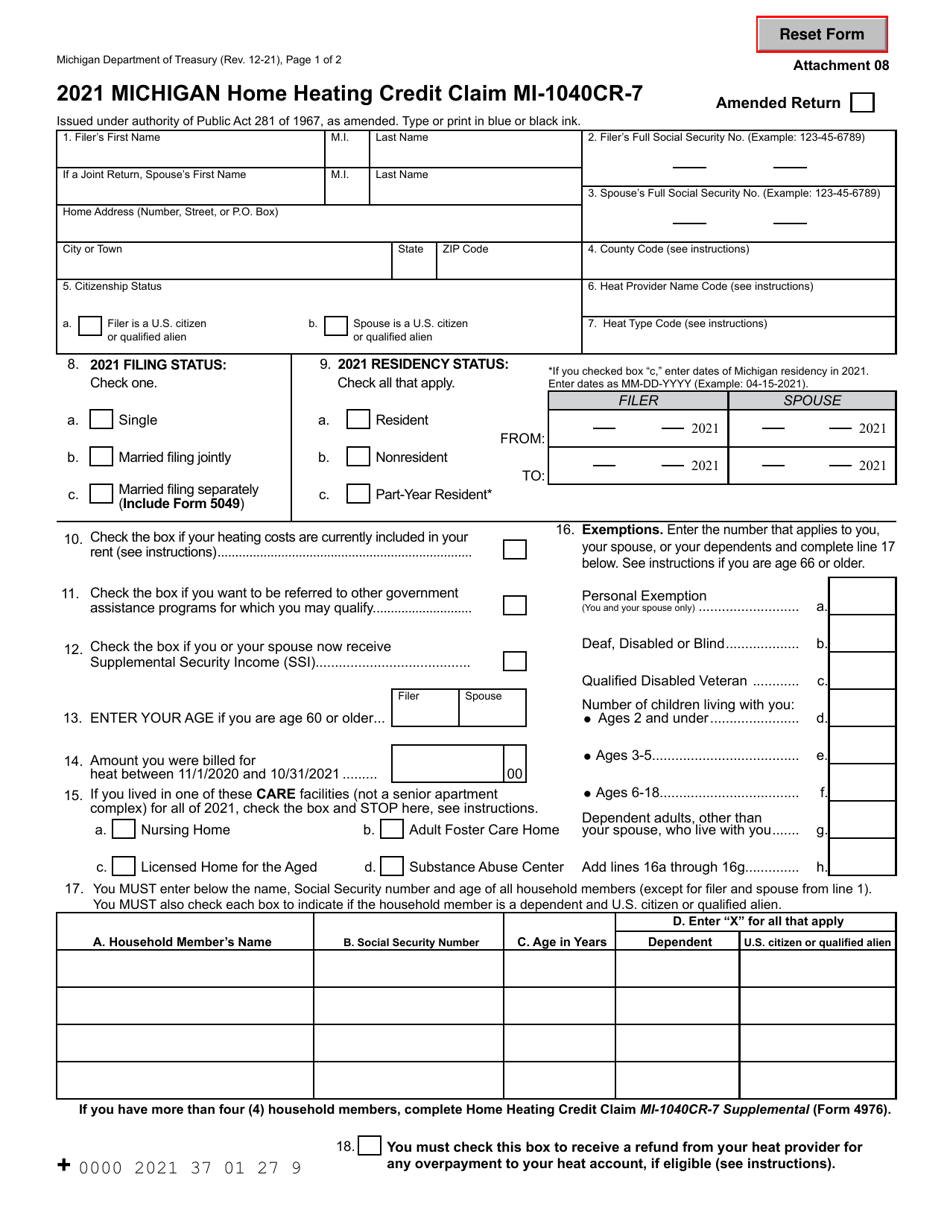

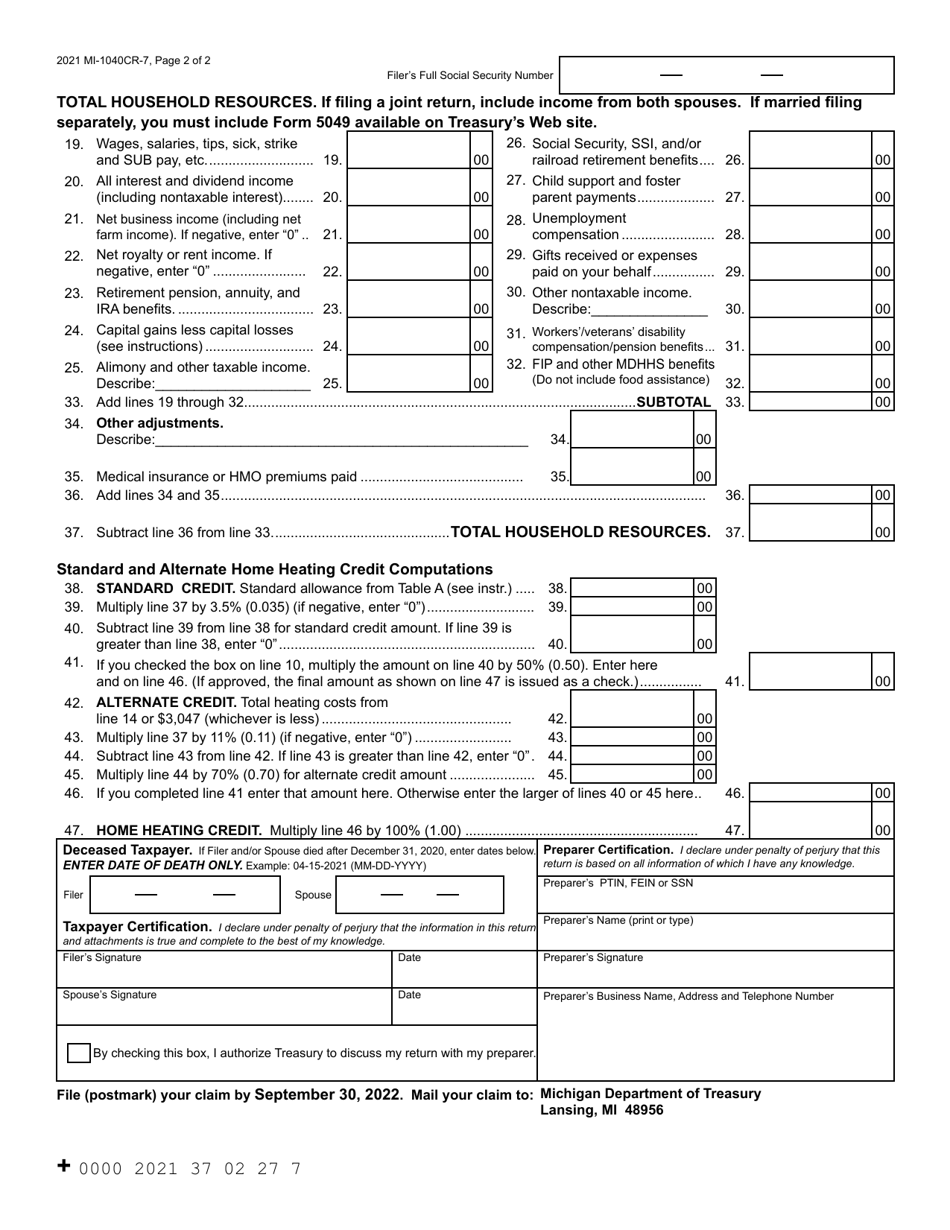

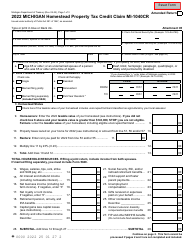

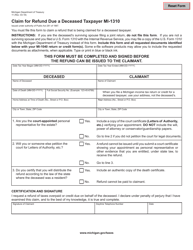

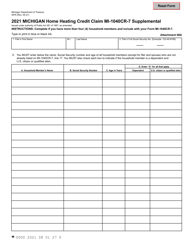

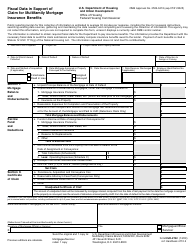

Form MI-1040CR-7

for the current year.

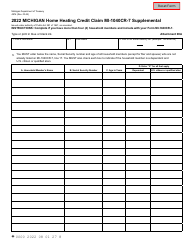

Form MI-1040CR-7 Michigan Home Heating Credit Claim - Michigan

What Is Form MI-1040CR-7?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MI-1040CR-7 form?

A: The MI-1040CR-7 form is the Michigan Home Heating Credit Claim form.

Q: What is the purpose of the MI-1040CR-7 form?

A: The purpose of the MI-1040CR-7 form is to claim a refundable credit for qualified heating expenses.

Q: Who is eligible to file the MI-1040CR-7 form?

A: Residents of Michigan who meet certain income and eligibility requirements are eligible to file the MI-1040CR-7 form.

Q: What expenses can be claimed on the MI-1040CR-7 form?

A: Qualified heating expenses, such as fuel, electricity, and certain other heating sources, can be claimed on the MI-1040CR-7 form.

Q: When is the deadline to file the MI-1040CR-7 form?

A: The deadline to file the MI-1040CR-7 form is typically September 30 of the year following the tax year for which the credit is claimed.

Q: How long does it take to receive the refund after filing the MI-1040CR-7 form?

A: It may take up to 10 weeks to receive the refund after filing the MI-1040CR-7 form, if eligible.

Q: Is the MI-1040CR-7 form available for residents of Canada?

A: No, the MI-1040CR-7 form is only available for residents of Michigan.

Q: What should I do if I need help with the MI-1040CR-7 form?

A: If you need assistance with the MI-1040CR-7 form, you can contact the Michigan Department of Treasury or seek help from a tax professional.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1040CR-7 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.