This version of the form is not currently in use and is provided for reference only. Download this version of

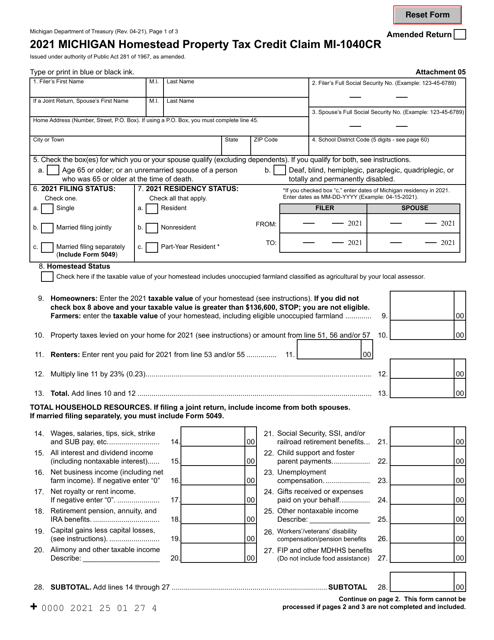

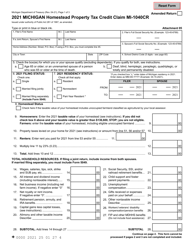

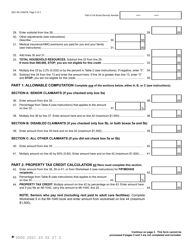

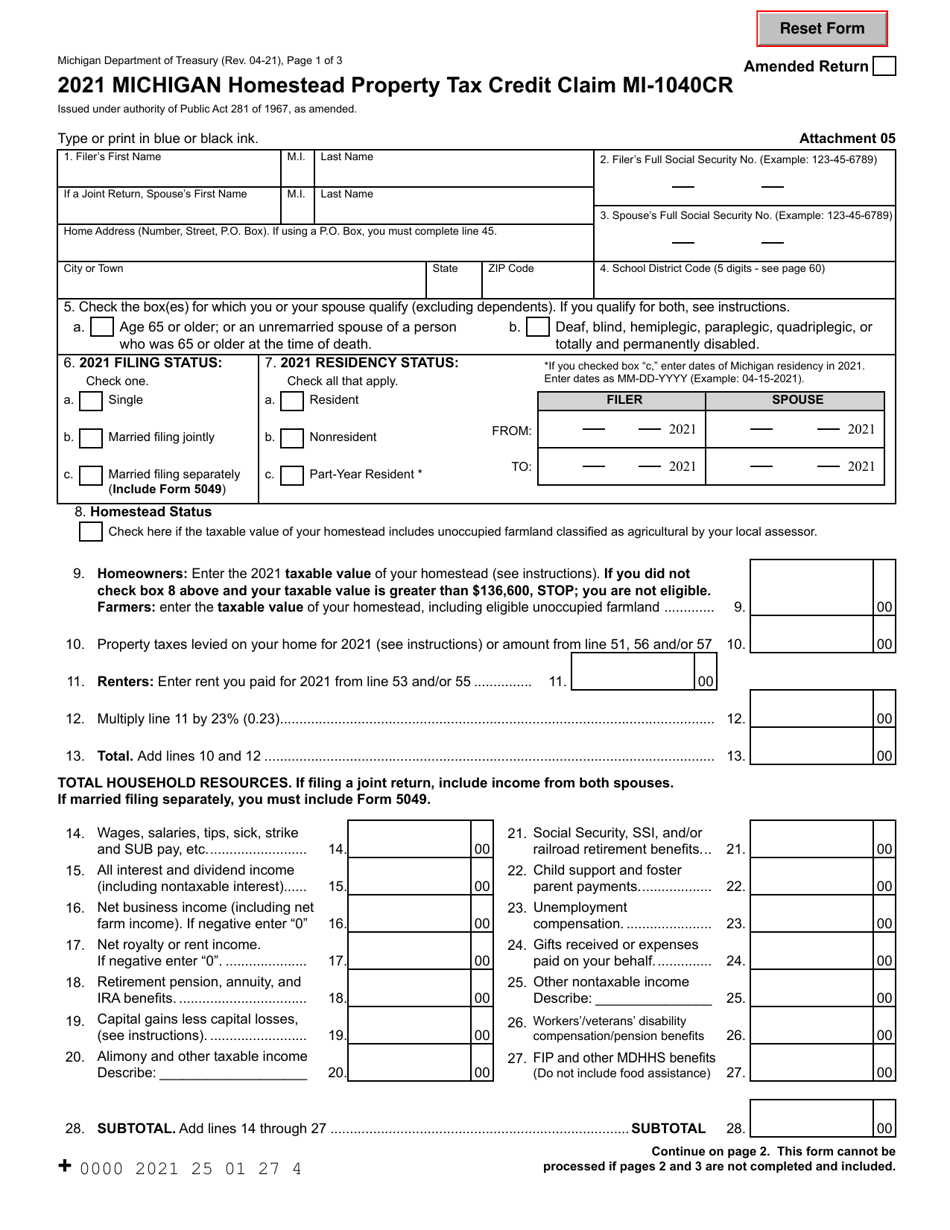

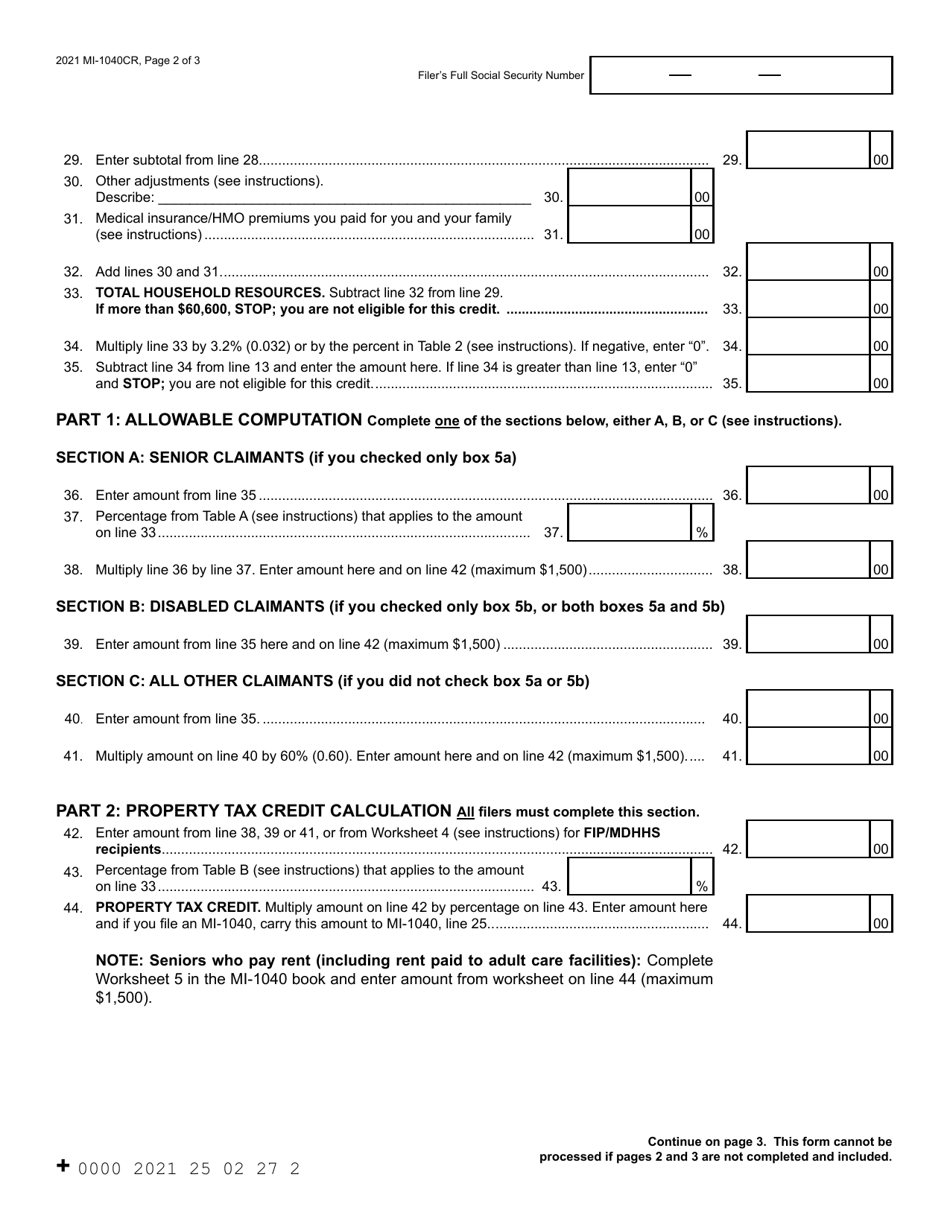

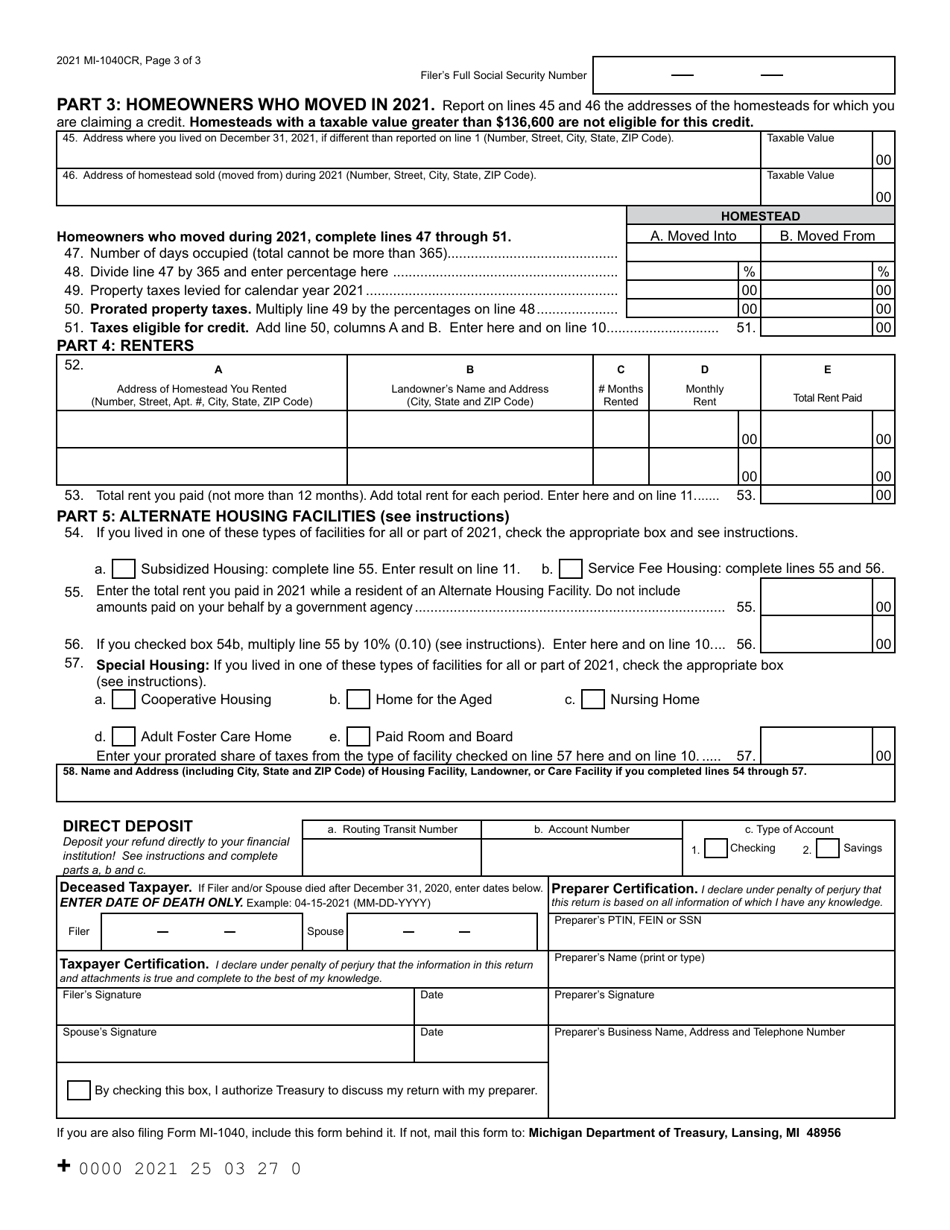

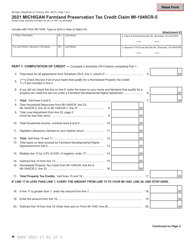

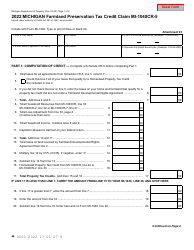

Form MI-1040CR

for the current year.

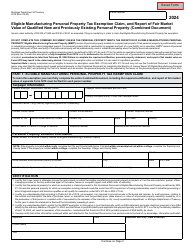

Form MI-1040CR Michigan Homestead Property Tax Credit Claim - Michigan

What Is Form MI-1040CR?

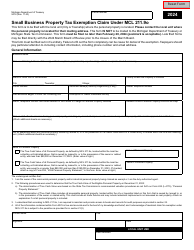

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MI-1040CR?

A: Form MI-1040CR is a form used to claim the Michigan Homestead PropertyTax Credit.

Q: What is the Michigan Homestead Property Tax Credit?

A: The Michigan Homestead Property Tax Credit is a credit that provides property tax relief to eligible homeowners.

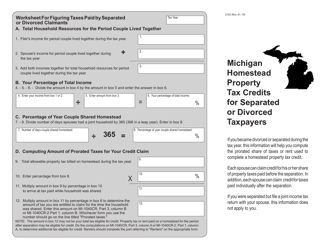

Q: Who is eligible for the Michigan Homestead Property Tax Credit?

A: To be eligible for the Michigan Homestead Property Tax Credit, you must be a Michigan resident, own or rent a home in Michigan, and meet certain income requirements.

Q: How do I claim the Michigan Homestead Property Tax Credit?

A: You can claim the Michigan Homestead Property Tax Credit by completing and filing Form MI-1040CR.

Q: What documents do I need to include with Form MI-1040CR?

A: You will need to include copies of your property tax statements or rent receipts, as well as any other supporting documentation requested on the form.

Q: When is the deadline to file Form MI-1040CR?

A: The deadline to file Form MI-1040CR is April 15th of each year.

Q: Can I file Form MI-1040CR electronically?

A: Yes, you can file Form MI-1040CR electronically using e-file services provided by the Michigan Department of Treasury.

Q: Is there a fee to file Form MI-1040CR?

A: No, there is no fee to file Form MI-1040CR.

Q: What if I have questions or need help with Form MI-1040CR?

A: If you have questions or need help with Form MI-1040CR, you can contact the Michigan Department of Treasury or seek assistance from a tax professional.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1040CR by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.