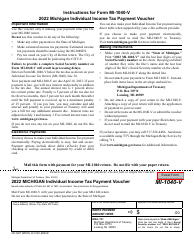

This version of the form is not currently in use and is provided for reference only. Download this version of

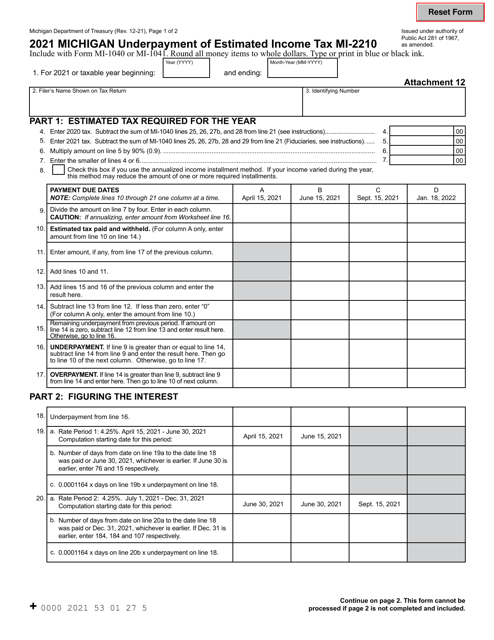

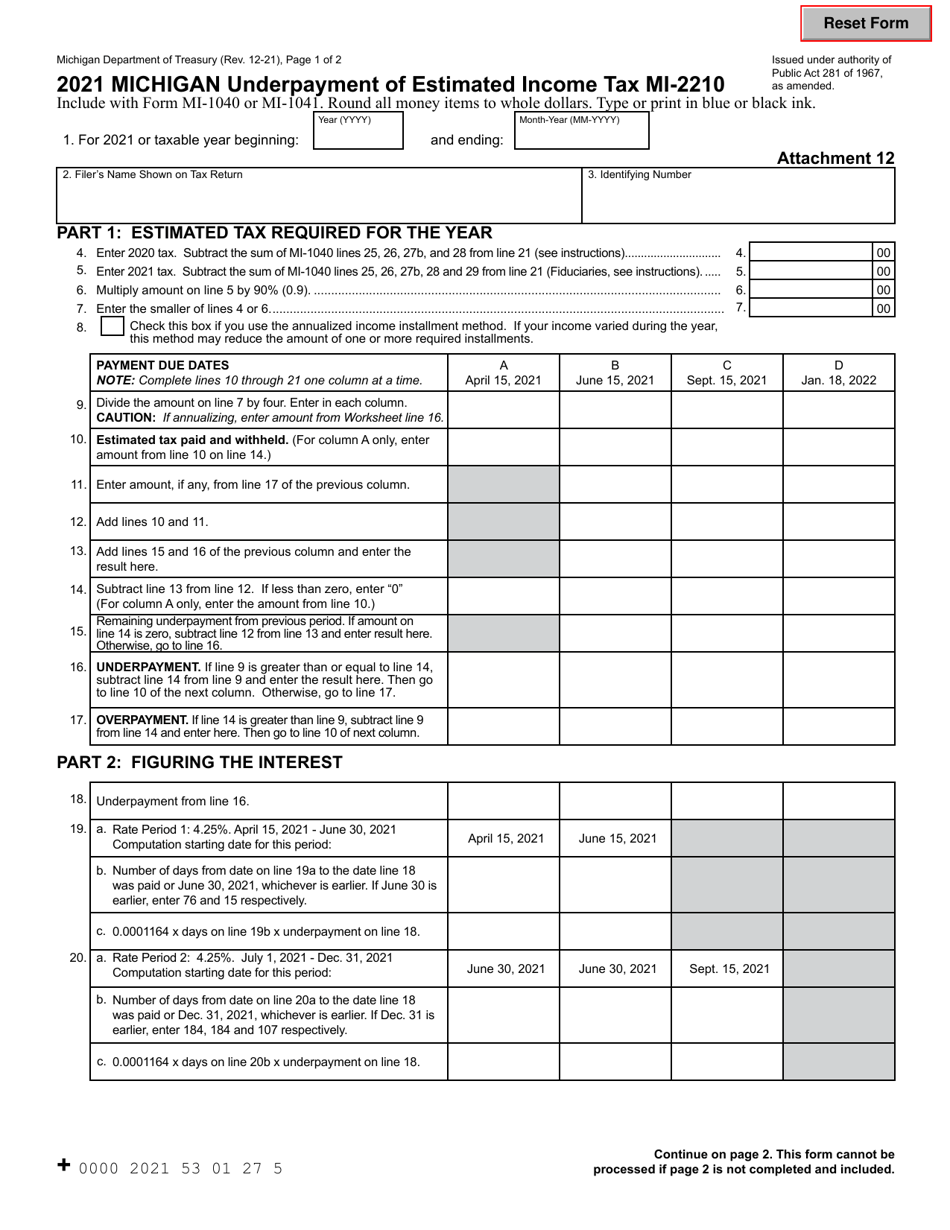

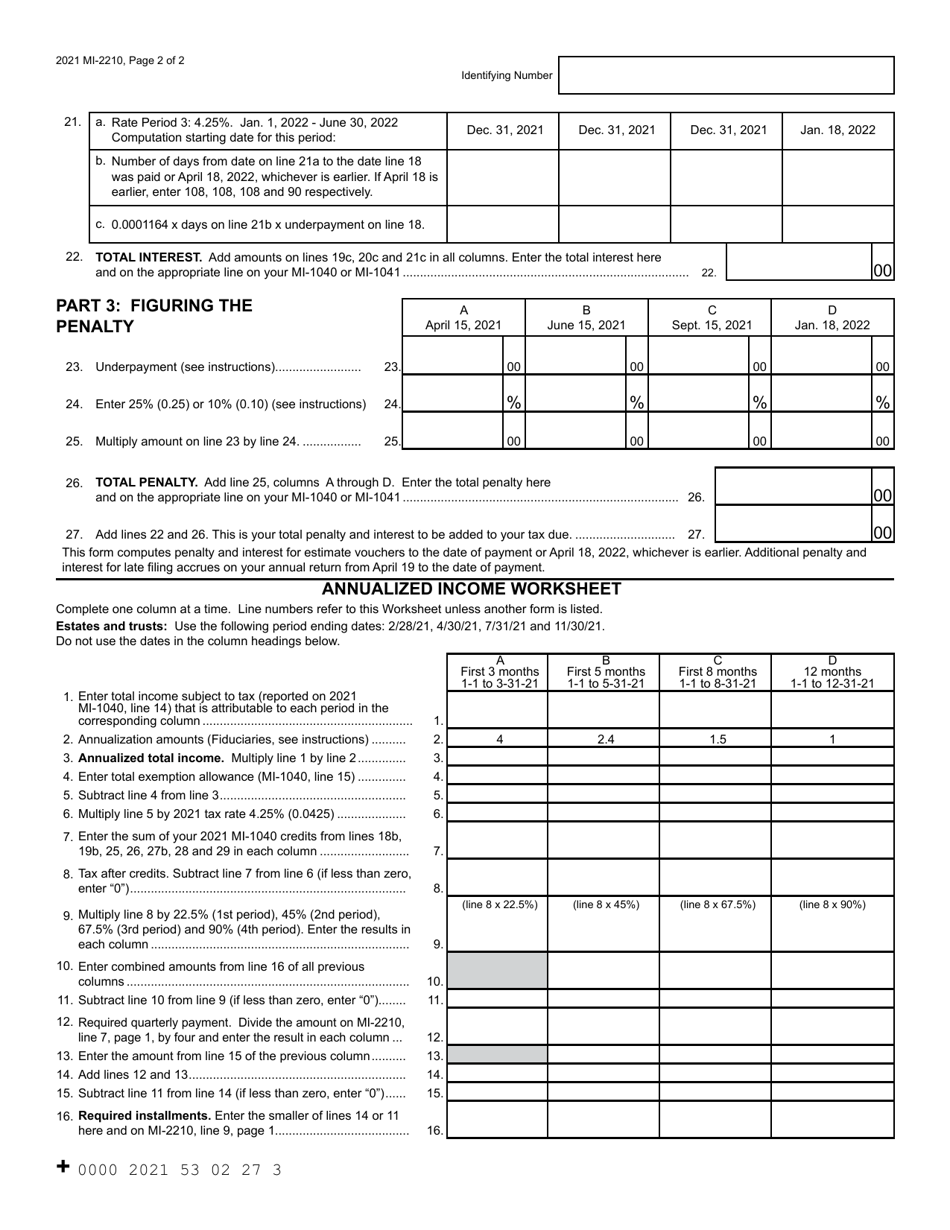

Form MI-2210

for the current year.

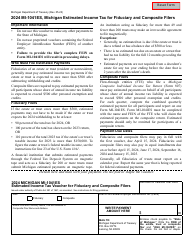

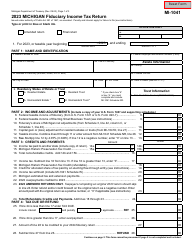

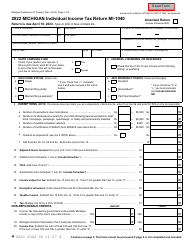

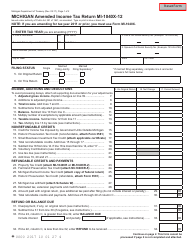

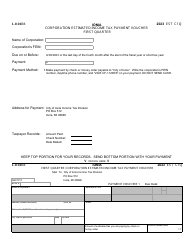

Form MI-2210 Michigan Underpayment of Estimated Income Tax - Michigan

What Is Form MI-2210?

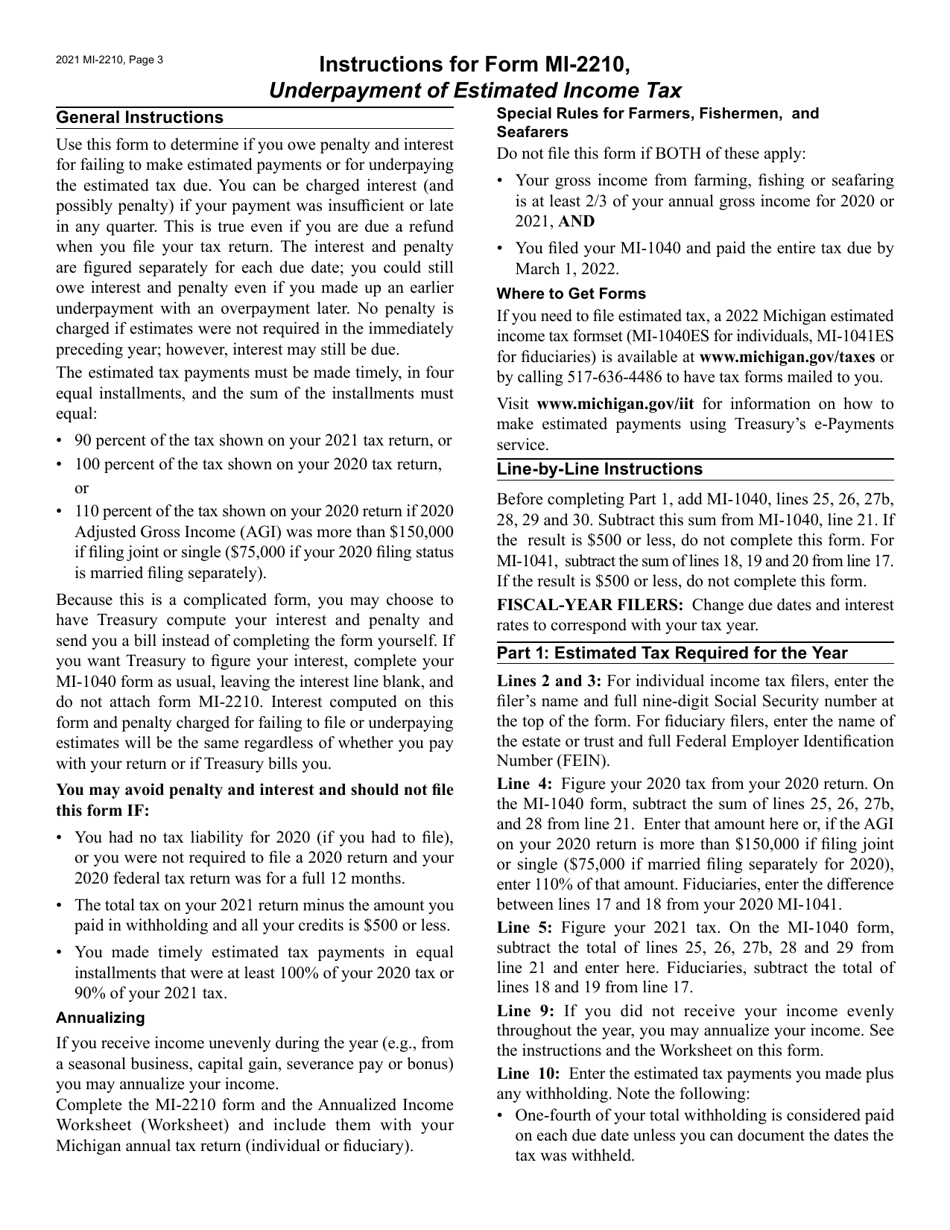

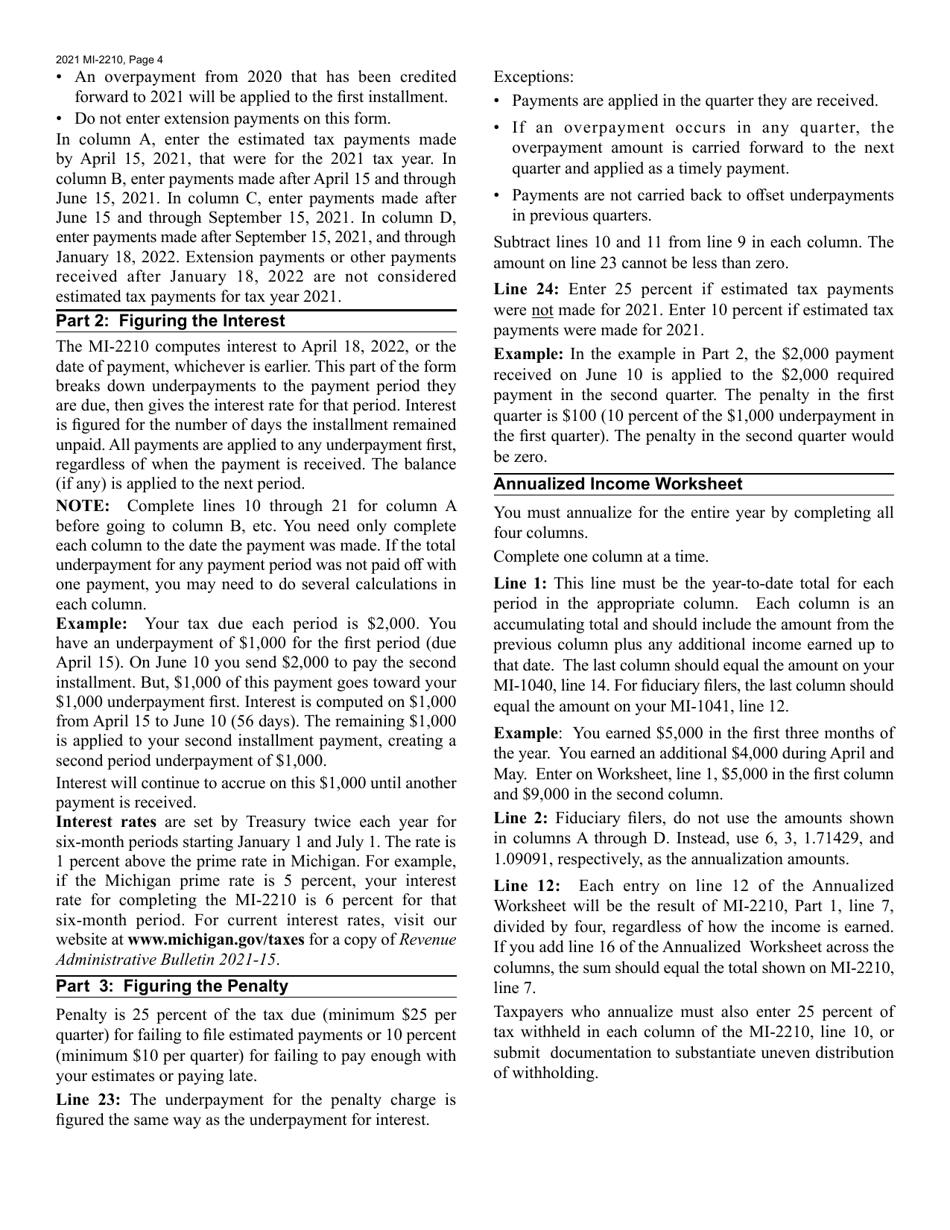

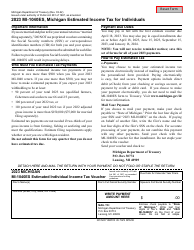

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MI-2210?

A: Form MI-2210 is the Michigan Underpayment of Estimated Income Tax form.

Q: Who needs to file Form MI-2210?

A: Individuals in Michigan who have underpaid their estimated income tax may need to file Form MI-2210.

Q: What is the purpose of Form MI-2210?

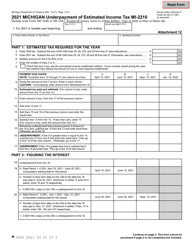

A: The purpose of Form MI-2210 is to calculate any penalties and interest owed due to underpayment of estimated income tax in Michigan.

Q: When is Form MI-2210 due?

A: Form MI-2210 is typically due on the same date as your Michigan income tax return, which is April 15th.

Q: How do I fill out Form MI-2210?

A: You will need to provide your personal information, calculate your underpayment penalty, and include the form with your Michigan income tax return.

Q: Are there any penalties for not filing Form MI-2210?

A: If you have underpaid your estimated income tax in Michigan and do not file Form MI-2210, you may be subject to penalties and interest.

Q: Can I e-file Form MI-2210?

A: Yes, you can e-file Form MI-2210 if you are submitting your Michigan income tax return electronically.

Q: Do I need to attach any additional documents to Form MI-2210?

A: In most cases, you do not need to attach any additional documents to Form MI-2210.

Q: Can I request an extension to file Form MI-2210?

A: No, there is no specific extension available for filing Form MI-2210. It must be filed by the due date of your Michigan income tax return.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-2210 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.