This version of the form is not currently in use and is provided for reference only. Download this version of

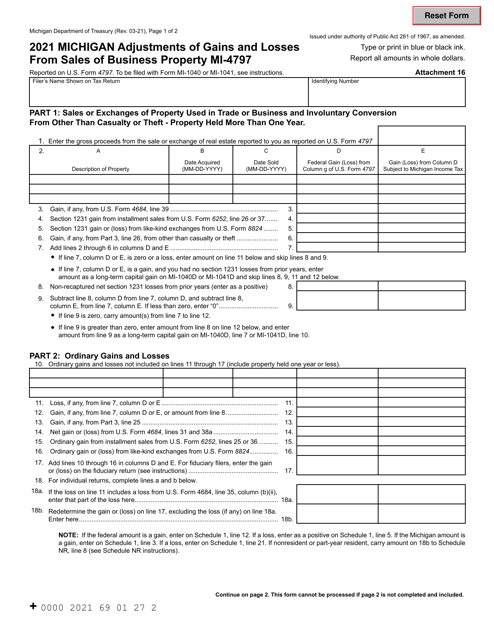

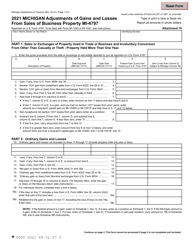

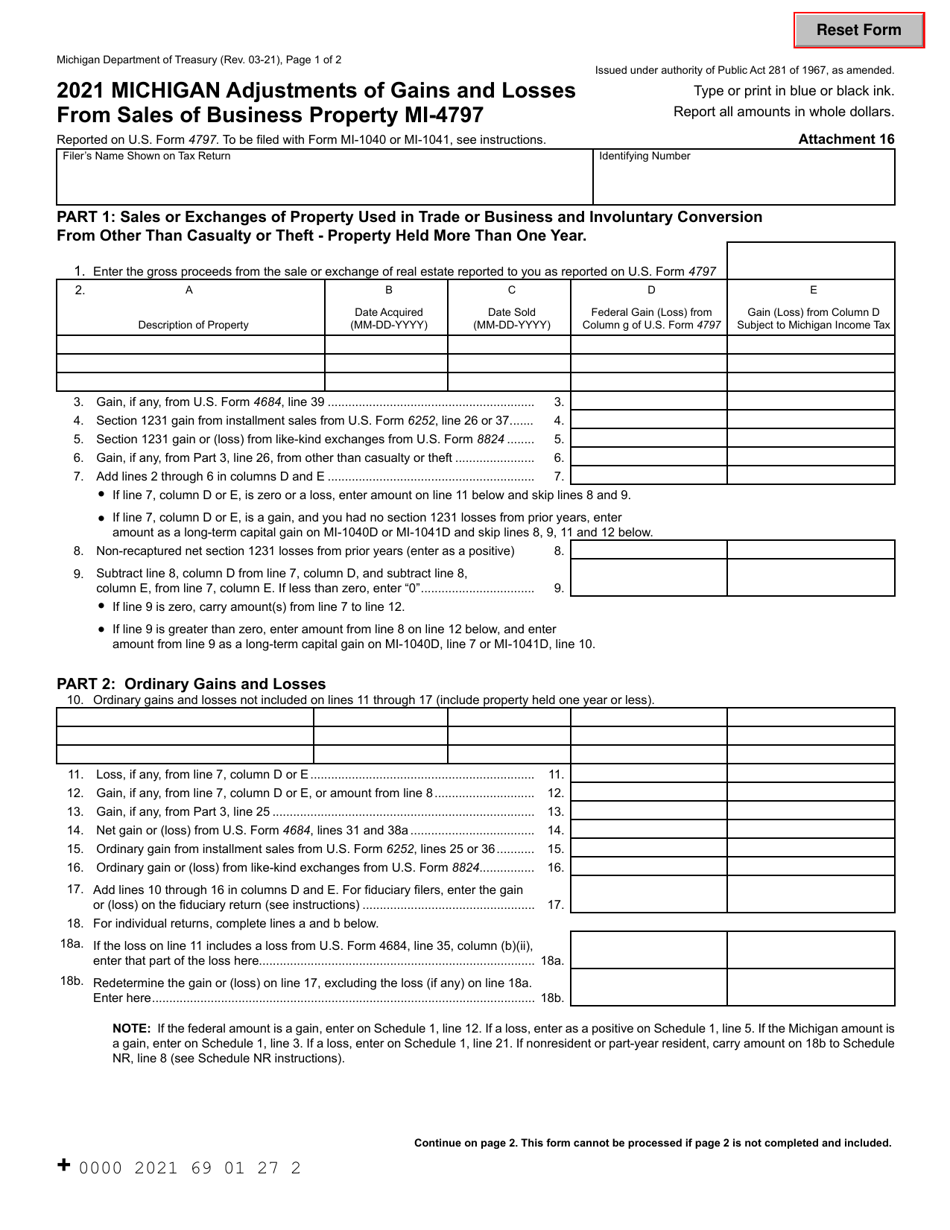

Form MI-4797

for the current year.

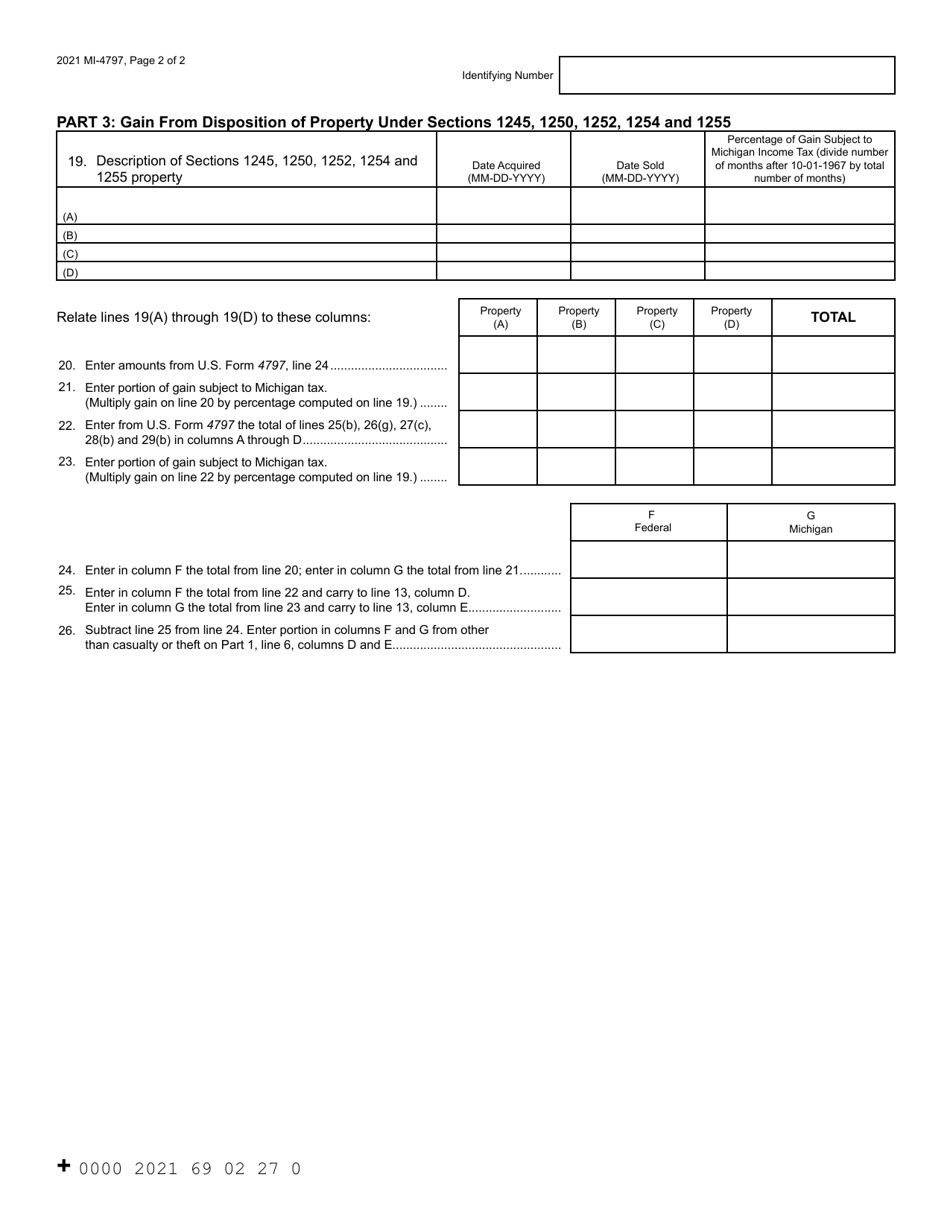

Form MI-4797 Michigan Adjustments of Gains and Losses From Sales of Business Property - Michigan

What Is Form MI-4797?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MI-4797?

A: Form MI-4797 is used in Michigan to report adjustments of gains and losses from the sale of business property.

Q: Who needs to file Form MI-4797?

A: Michigan taxpayers who have gains or losses from the sale of business property need to file Form MI-4797.

Q: What type of information is reported on Form MI-4797?

A: Form MI-4797 is used to report the details of the sale of business property, including the amount of the gain or loss.

Q: When is Form MI-4797 due?

A: Form MI-4797 is due on the same date as the taxpayer's Michigan income tax return.

Q: Can Form MI-4797 be filed electronically?

A: Yes, Form MI-4797 can be filed electronically using Michigan's e-file system.

Q: Are there any special instructions for completing Form MI-4797?

A: Yes, taxpayers should carefully read the instructions provided with Form MI-4797 to ensure it is completed correctly.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-4797 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.