This version of the form is not currently in use and is provided for reference only. Download this version of

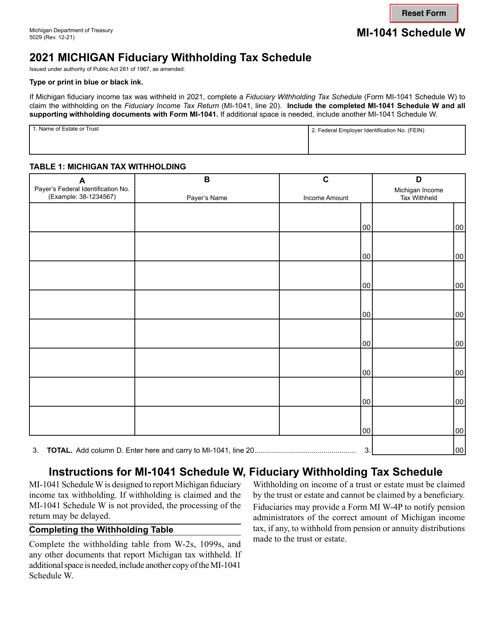

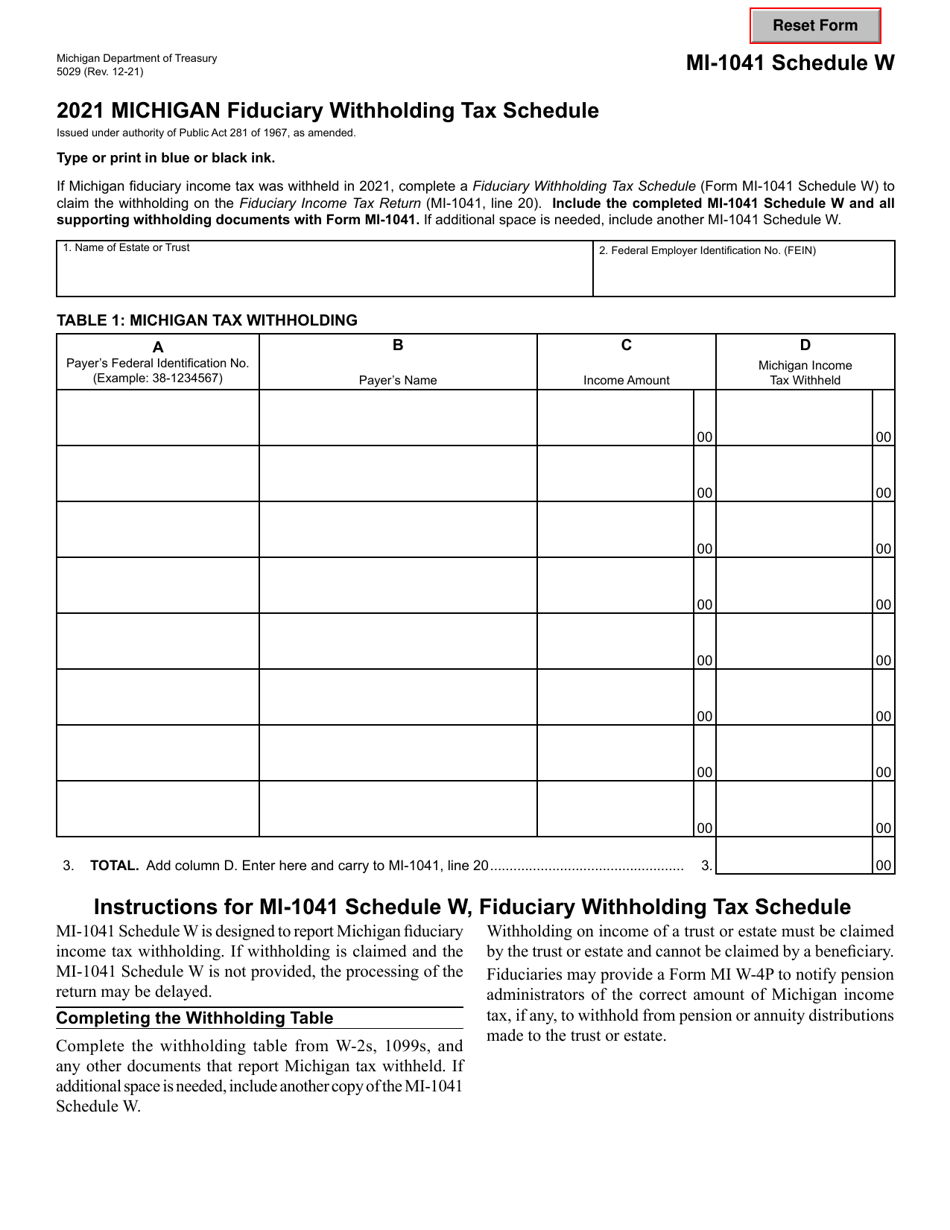

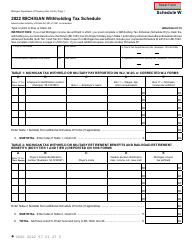

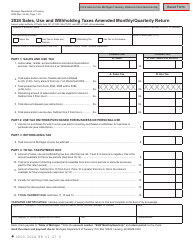

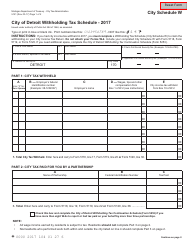

Form MI-1041 (5029) Schedule W

for the current year.

Form MI-1041 (5029) Schedule W Michigan Fiduciary Withholding Tax Schedule - Michigan

What Is Form MI-1041 (5029) Schedule W?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MI-1041 (5029) Schedule W?

A: Form MI-1041 (5029) Schedule W is the Michigan Fiduciary Withholding Tax Schedule.

Q: What is the purpose of Form MI-1041 (5029) Schedule W?

A: The purpose of Form MI-1041 (5029) Schedule W is to report and calculate the recipient's Michigan income tax withholdings from a fiduciary entity, such as a trust or estate.

Q: Who needs to file Form MI-1041 (5029) Schedule W?

A: Any fiduciary entity that has withheld Michigan income tax on behalf of a beneficiary or a nonresident individual needs to file Form MI-1041 (5029) Schedule W.

Q: Is Form MI-1041 (5029) Schedule W specific to Michigan?

A: Yes, Form MI-1041 (5029) Schedule W is specific to the state of Michigan and is used to report Michigan fiduciary withholding tax.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1041 (5029) Schedule W by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.