This version of the form is not currently in use and is provided for reference only. Download this version of

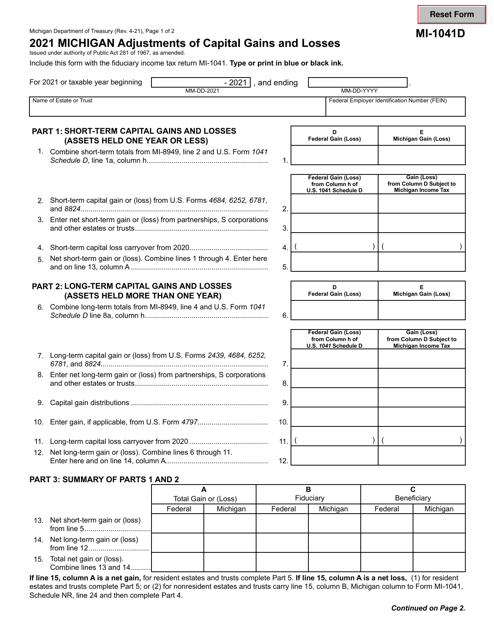

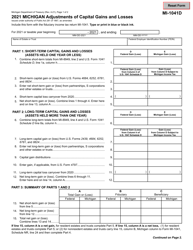

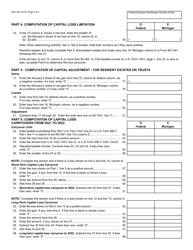

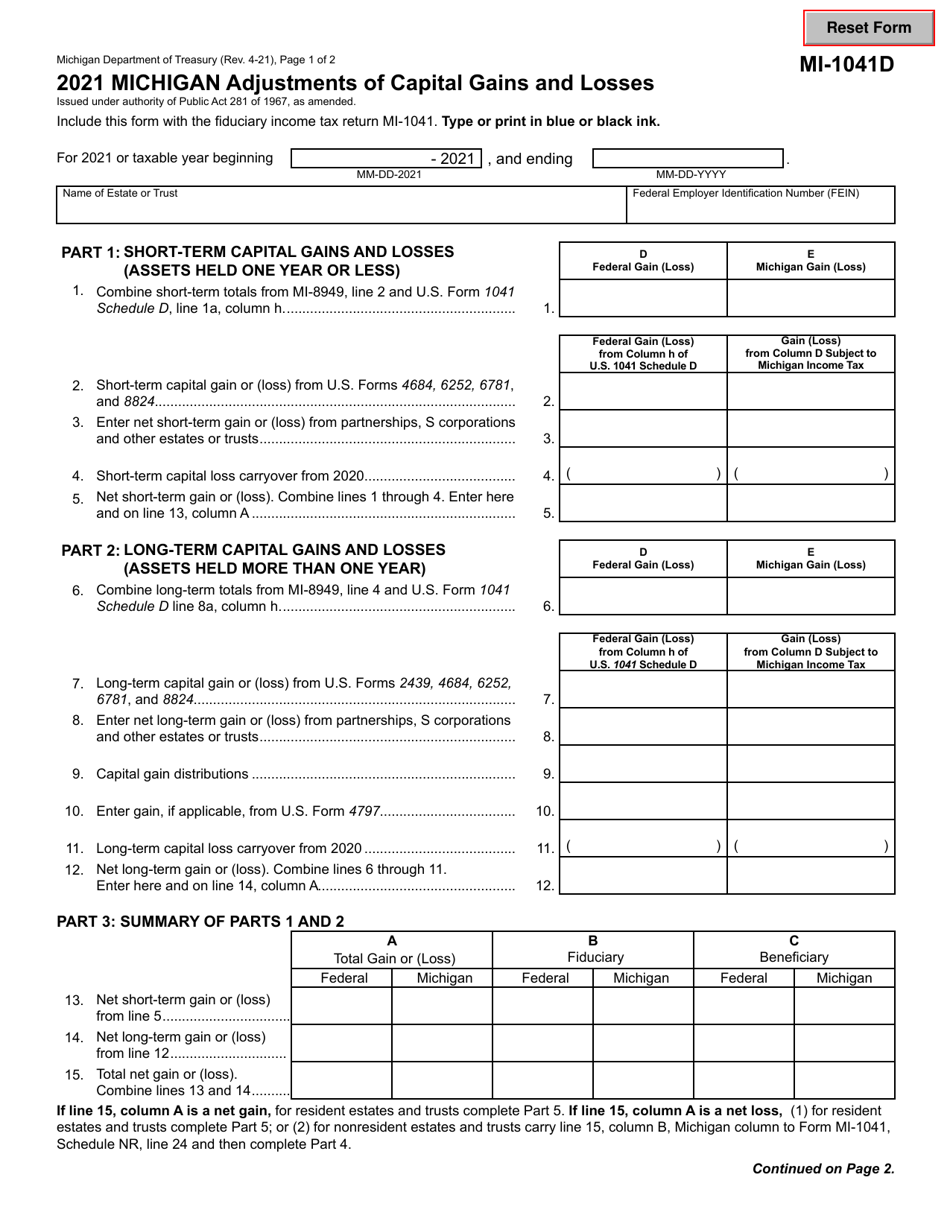

Form MI-1041D

for the current year.

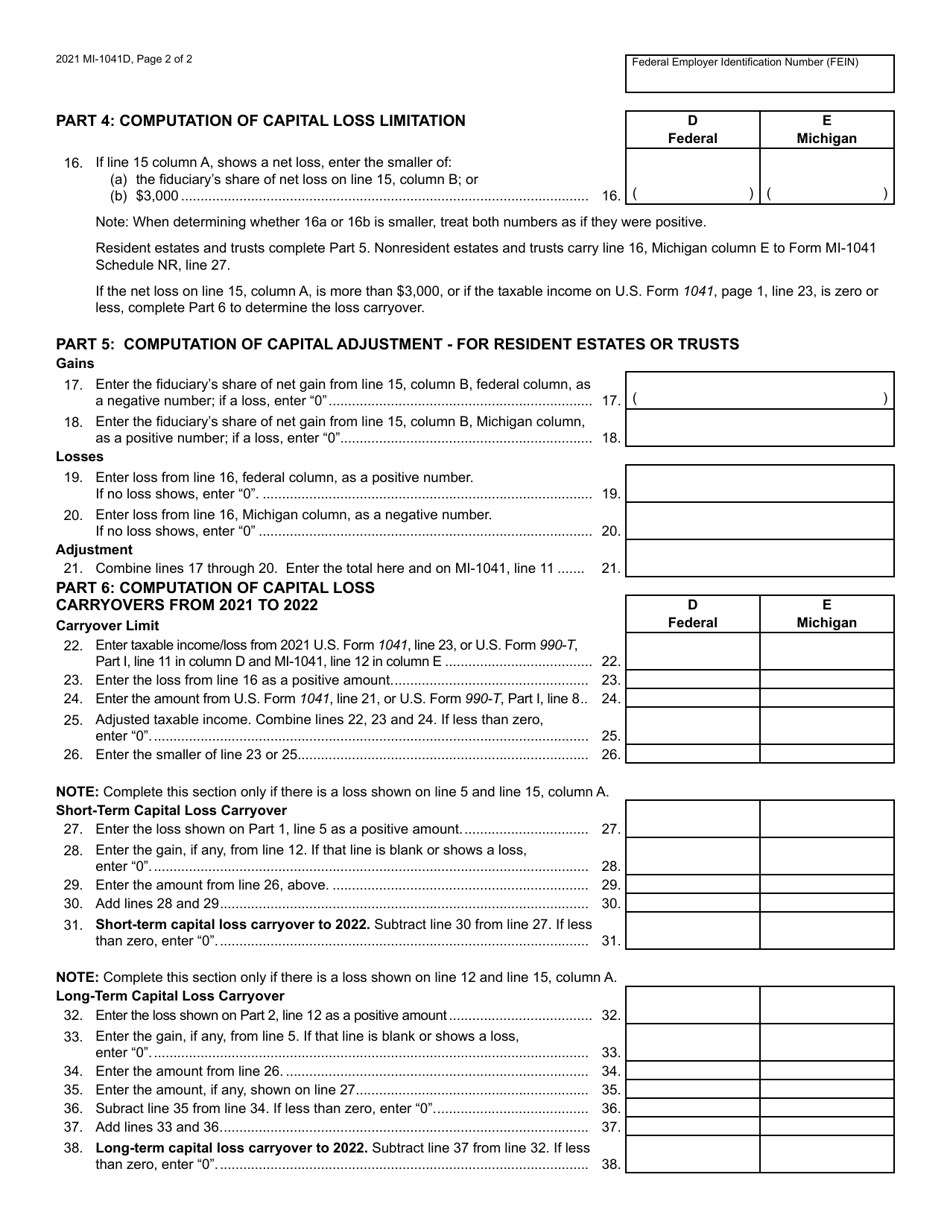

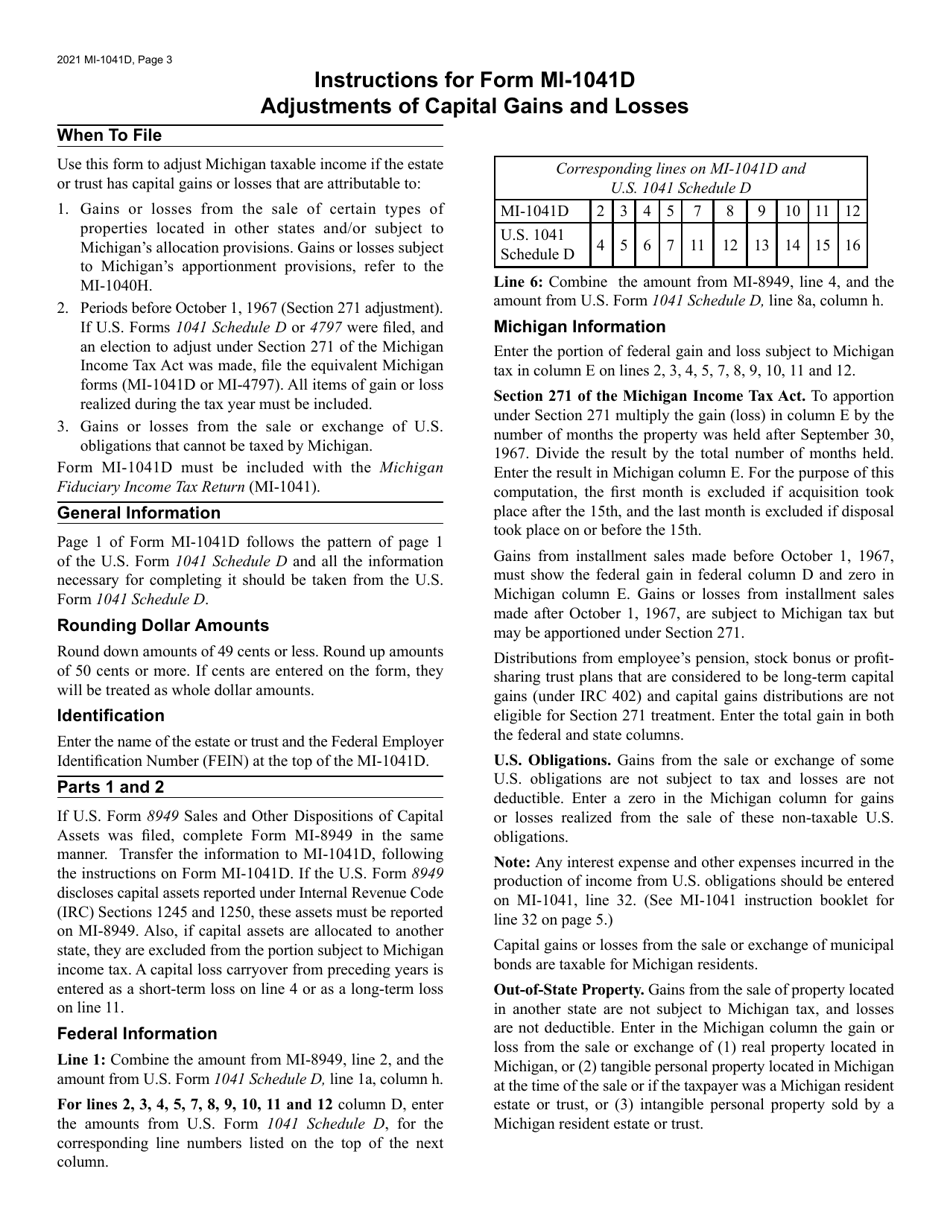

Form MI-1041D Michigan Adjustments of Capital Gains and Losses - Michigan

What Is Form MI-1041D?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MI-1041D form?

A: The MI-1041D form is a document used in Michigan to report adjustments of capital gains and losses for trusts and estates.

Q: Who needs to file the MI-1041D form?

A: The MI-1041D form is typically filed by trusts and estates in Michigan that have capital gains or losses to report and need to make adjustments.

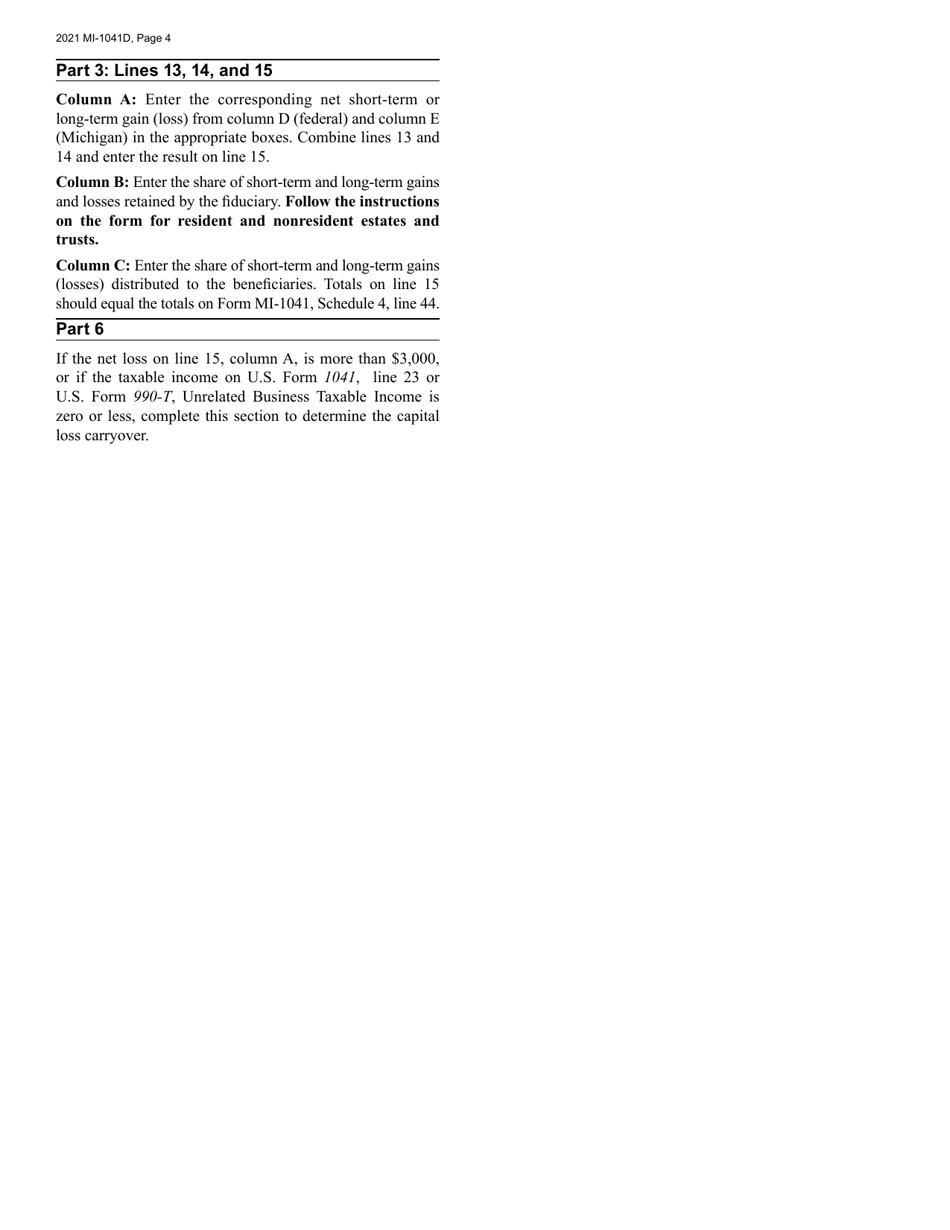

Q: What kind of adjustments can be reported on the MI-1041D form?

A: The MI-1041D form is used to report adjustments to federal capital gains or losses for Michigan tax purposes.

Q: When is the deadline to file the MI-1041D form?

A: The deadline to file the MI-1041D form is the same as the deadline to file the federal Form 1041, which is generally April 15th of each year.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1041D by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.