This version of the form is not currently in use and is provided for reference only. Download this version of

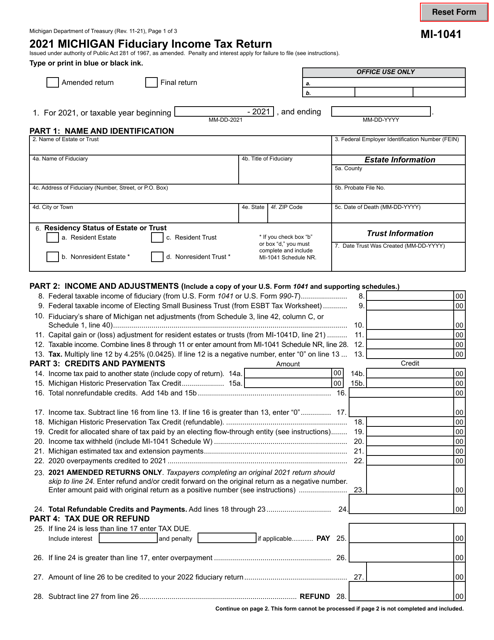

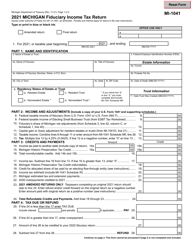

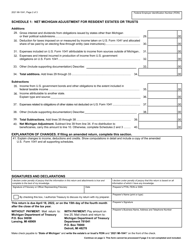

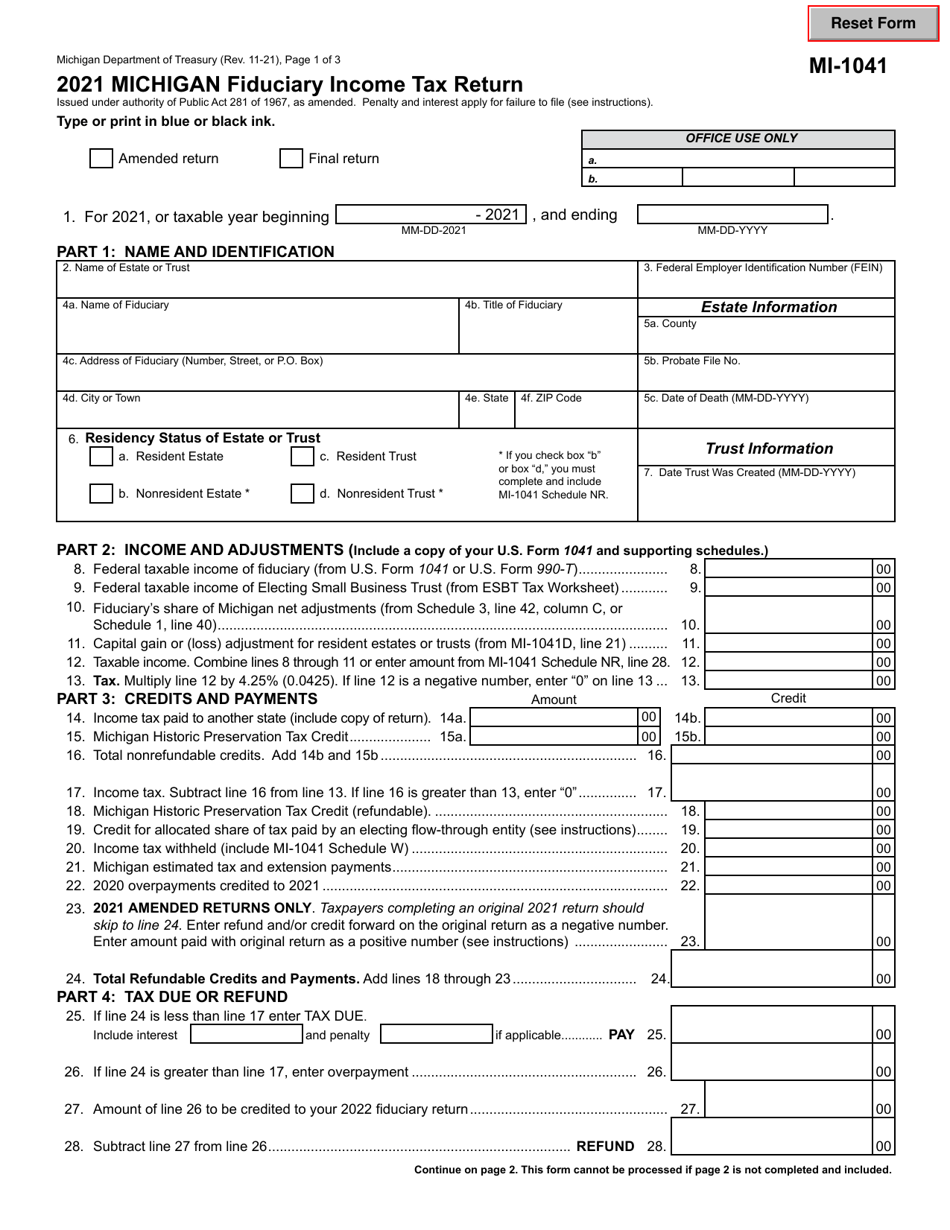

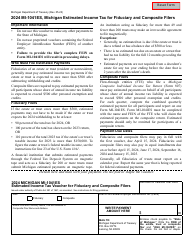

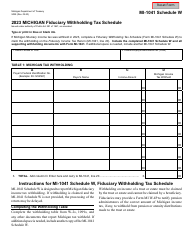

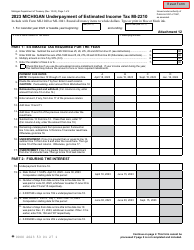

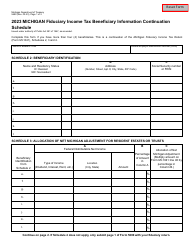

Form MI-1041

for the current year.

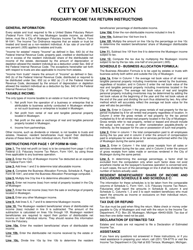

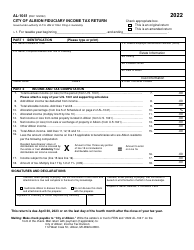

Form MI-1041 Michigan Fiduciary Income Tax Return - Michigan

What Is Form MI-1041?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MI-1041 form?

A: The MI-1041 form is the Michigan Fiduciary Income Tax Return.

Q: Who needs to file the MI-1041 form?

A: The MI-1041 form is for individuals or entities acting as fiduciaries for estates or trusts that need to report income and expenses.

Q: What is the purpose of the MI-1041 form?

A: The purpose of the MI-1041 form is to calculate and report the fiduciary income tax in the state of Michigan.

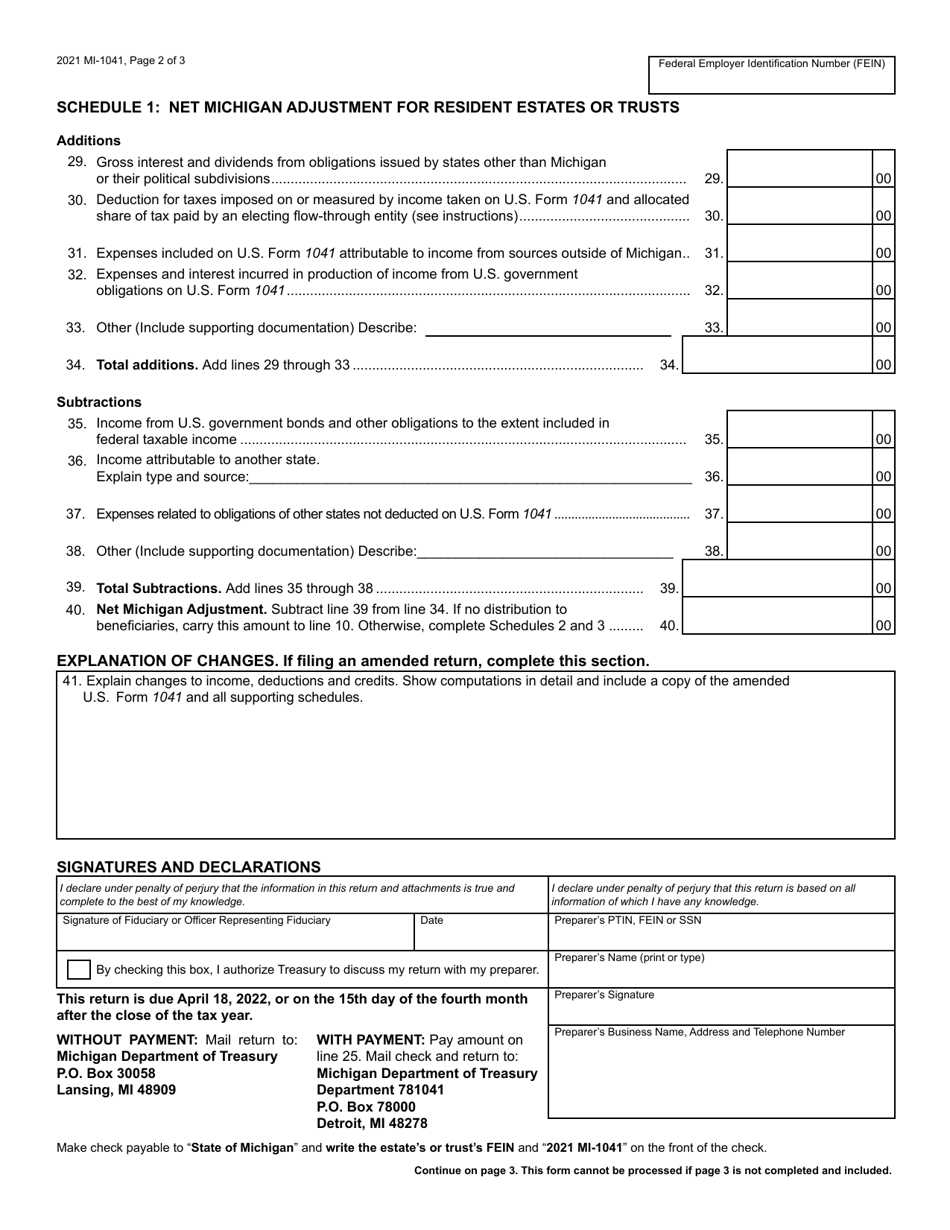

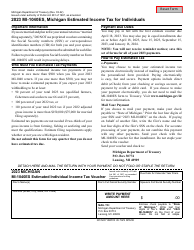

Q: When is the MI-1041 form due?

A: The MI-1041 form is due on or before the 15th day of the fourth month following the close of the tax year.

Q: Are there any filing requirements for the MI-1041 form?

A: Yes, if the estate or trust generated gross income of $600 or more during the tax year, you must file the MI-1041 form.

Q: Are there any penalties for late filing of the MI-1041 form?

A: Yes, there are penalties for late filing of the MI-1041 form. It's important to file the form on time to avoid penalties.

Q: What documents do I need to complete the MI-1041 form?

A: You will need various income and expense documents, such as W-2 forms, 1099 forms, and receipts to complete the MI-1041 form.

Q: Is there a separate state income tax for fiduciaries in Michigan?

A: Yes, the MI-1041 form is used to calculate and report the fiduciary income tax in the state of Michigan.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1041 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.