This version of the form is not currently in use and is provided for reference only. Download this version of

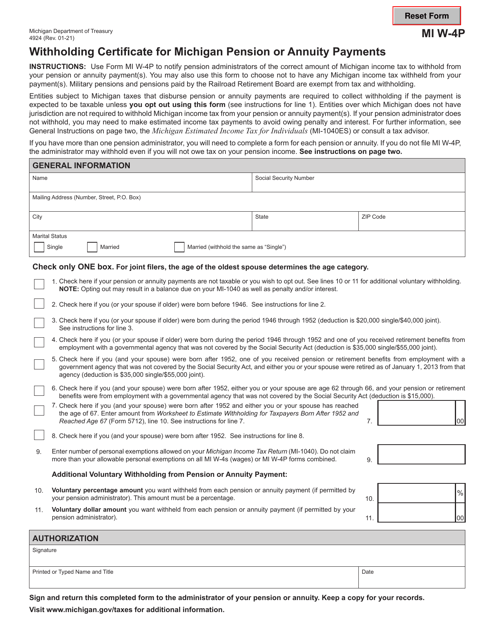

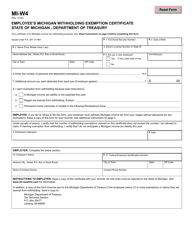

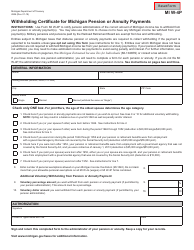

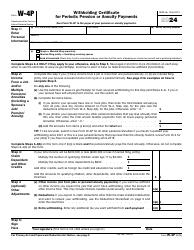

Form MI W-4P (4924)

for the current year.

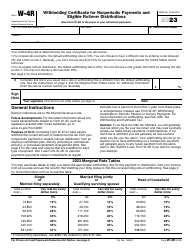

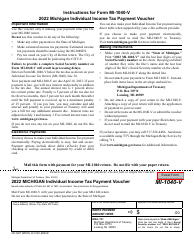

Form MI W-4P (4924) Withholding Certificate for Michigan Pension or Annuity Payments - Michigan

What Is Form MI W-4P (4924)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MI W-4P (4924)?

A: Form MI W-4P (4924) is a withholding certificate for Michigan pension or annuity payments.

Q: What is the purpose of Form MI W-4P (4924)?

A: The purpose of Form MI W-4P (4924) is to determine the amount of Michigan state income tax to withhold from pension or annuity payments.

Q: Who needs to fill out Form MI W-4P (4924)?

A: Anyone who receives pension or annuity payments in the state of Michigan may need to fill out Form MI W-4P (4924).

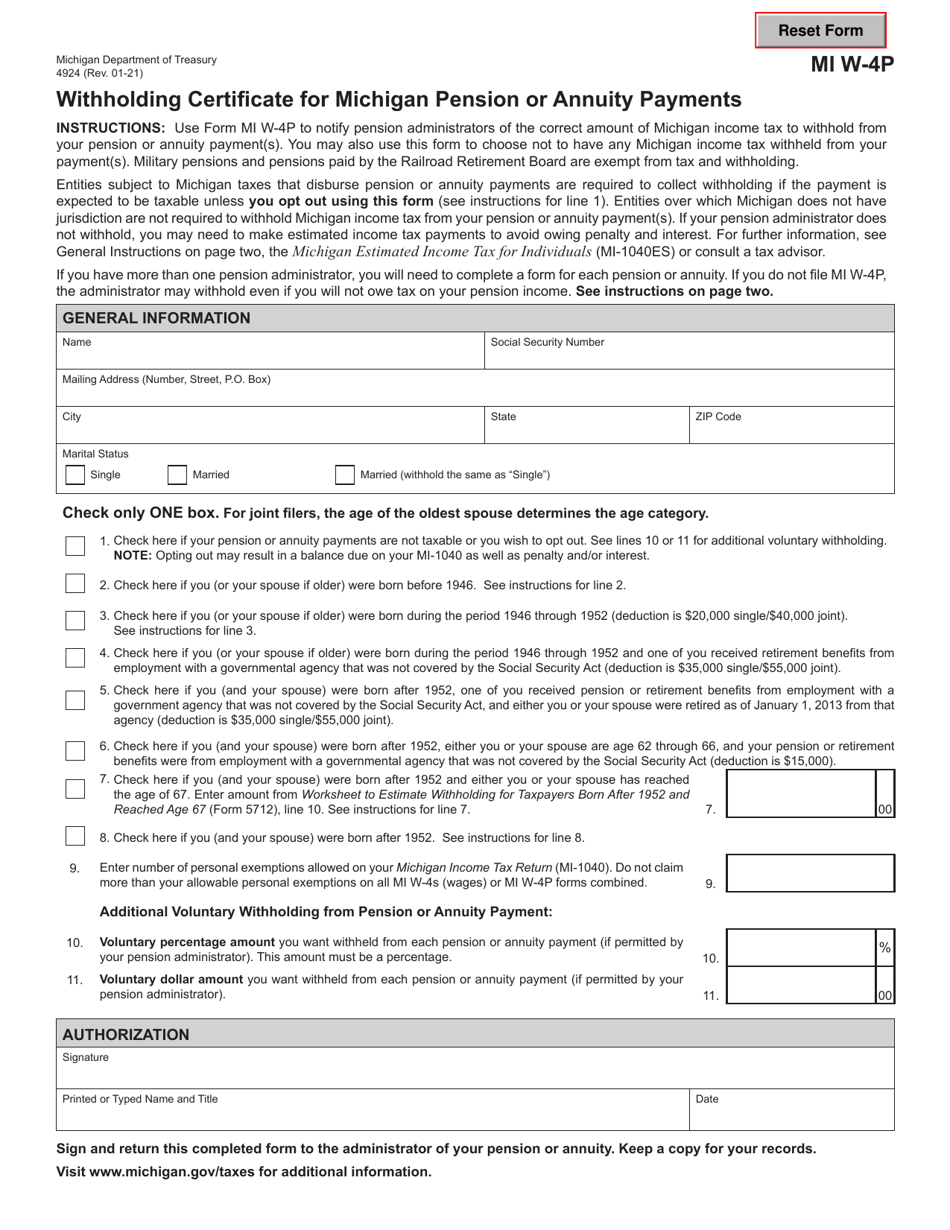

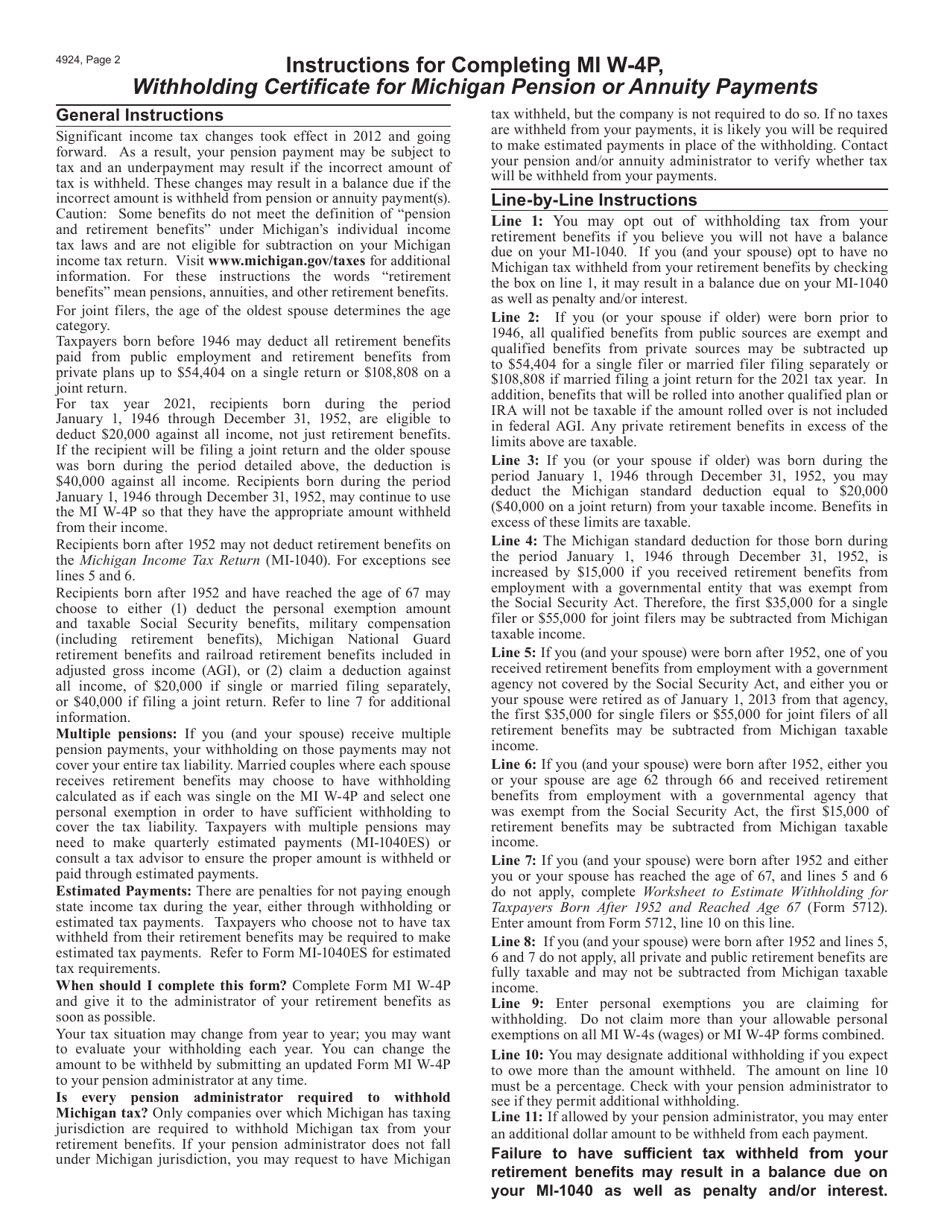

Q: How do I fill out Form MI W-4P (4924)?

A: You will need to provide your personal information, such as your name and Social Security number, and indicate your marital status and number of exemptions. You will also need to calculate the amount of Michigan state income tax to withhold based on the instructions provided.

Q: When do I need to submit Form MI W-4P (4924)?

A: You should submit Form MI W-4P (4924) as soon as possible after you start receiving pension or annuity payments.

Q: Do I need to submit Form MI W-4P (4924) every year?

A: Not necessarily. If your withholding information has not changed, you may not need to submit a new form each year. However, it is recommended to review your withholding status periodically to ensure accuracy.

Q: What happens if I do not submit Form MI W-4P (4924)?

A: If you do not submit Form MI W-4P (4924), the payer of your pension or annuity may withhold Michigan state income tax at the highest tax rate.

Q: Can I make changes to my Form MI W-4P (4924) after submitting it?

A: Yes, you can make changes to your Form MI W-4P (4924) at any time by filing a new form with the payer of your pension or annuity.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI W-4P (4924) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.