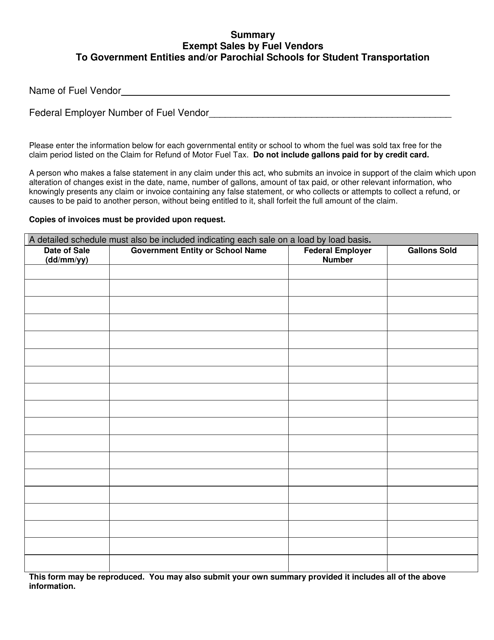

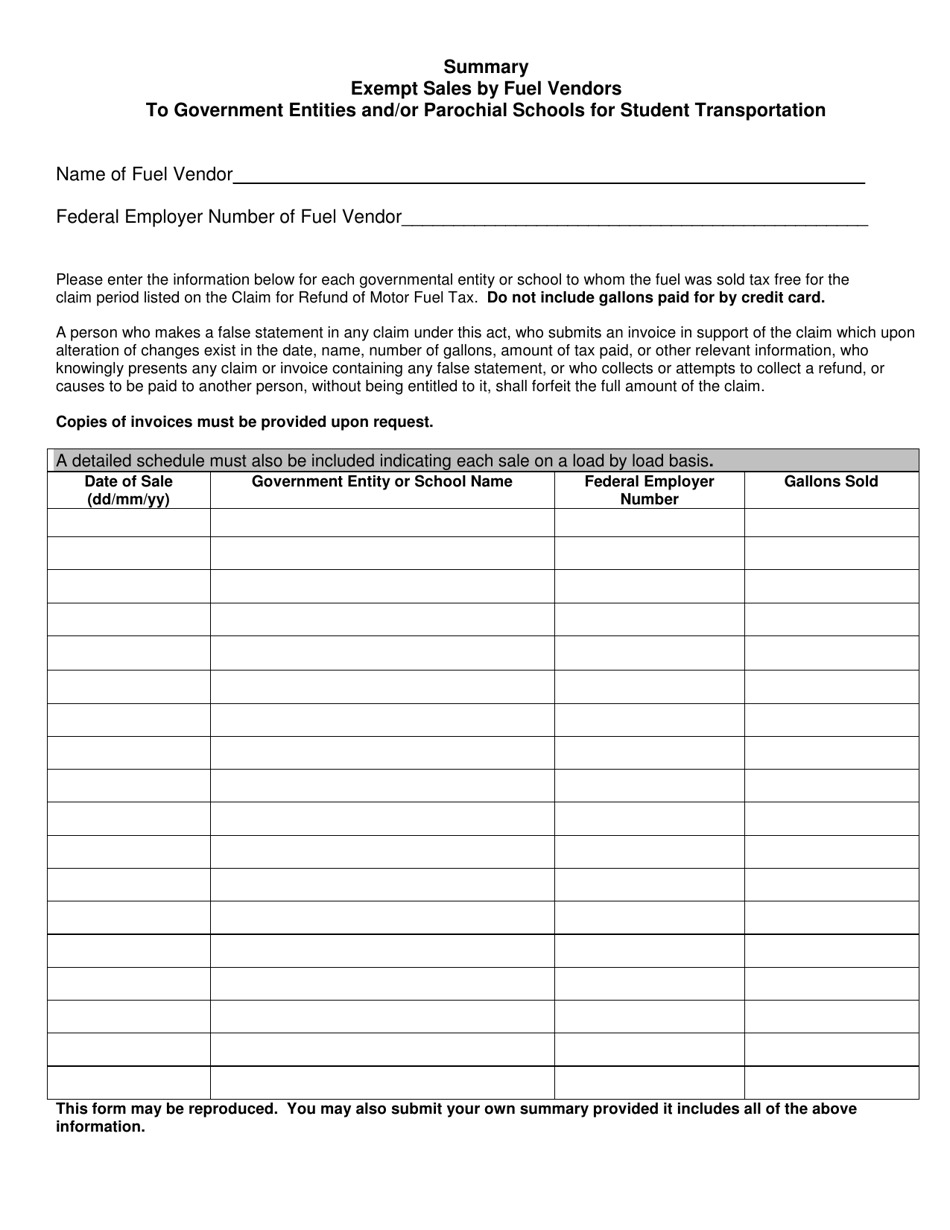

Summary of Exempt Sales by Fuel Vendors to Government Entities and / or Parochial Schools for Student Transportation - Michigan

Summary of Government Entities and/or Parochial Schools for Student Transportation is a legal document that was released by the Michigan Department of Treasury - a government authority operating within Michigan.

FAQ

Q: What are exempt sales by fuel vendors to government entities and/or parochial schools for student transportation in Michigan?

A: These are sales of fuel that are not subject to certain taxes or fees because they are being made to government entities or parochial schools for student transportation.

Q: Which sales are exempt?

A: Sales of fuel made to government entities or parochial schools for student transportation are exempt.

Q: Why are these sales exempt?

A: These sales are exempt to support government entities and parochial schools in providing transportation for students.

Q: Do the fuel vendors need to meet any specific requirements to qualify for the exemption?

A: Yes, the fuel vendors must meet certain requirements to qualify for the exemption. They need to keep records and provide them upon request by the Michigan Department of Treasury.

Q: Do the government entities and parochial schools need to meet any specific requirements to qualify for the exemption?

A: No, the government entities and parochial schools do not need to meet any specific requirements to qualify for the exemption.

Q: Are there any limitations or restrictions on the exemption?

A: Yes, there are limitations and restrictions. The exemption does not apply to sales of fuel for any other purpose, and it does not apply to sales of fuel for use in motor vehicles that are not used primarily for student transportation.

Q: Is there any documentation required for these exempt sales?

A: Yes, the fuel vendors are required to keep records of these exempt sales and provide them upon request by the Michigan Department of Treasury.

Q: Who should I contact for more information or assistance?

A: For more information or assistance, you can contact the Michigan Department of Treasury.

Form Details:

- The latest edition currently provided by the Michigan Department of Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.