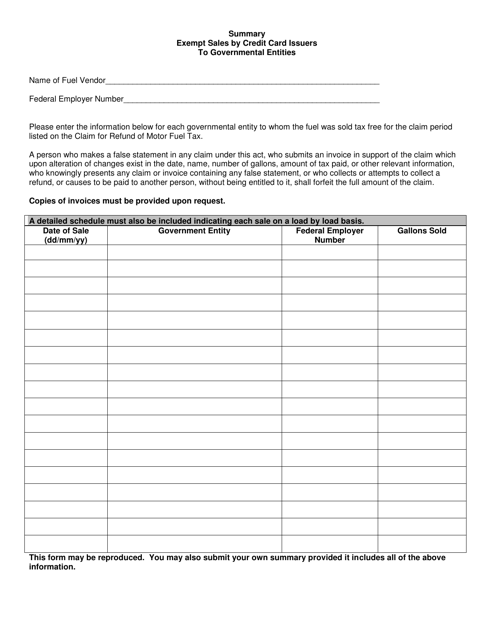

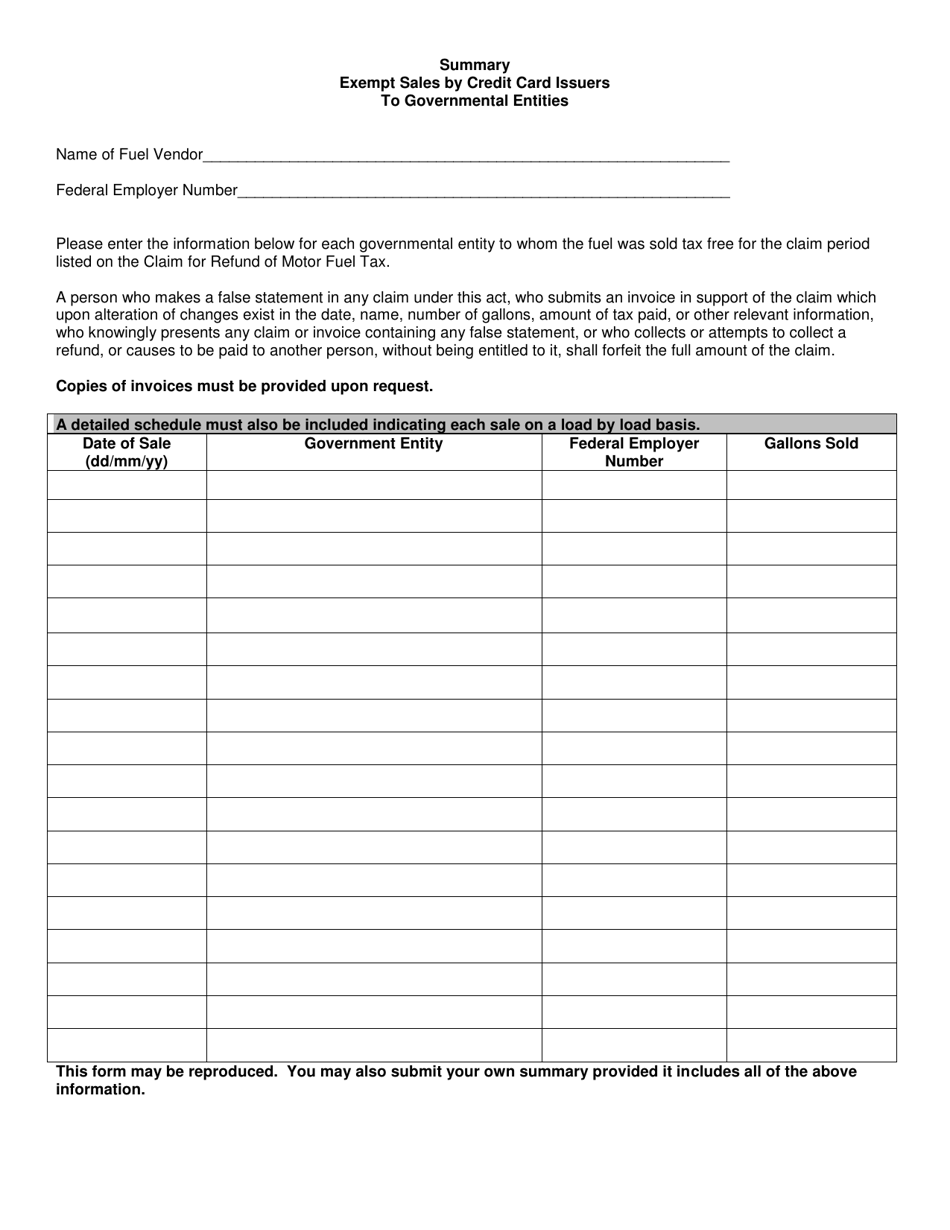

Summary of Exempt Sales by Credit Card Issuers to Governmental Entities - Michigan

Summary of Credit Card Issuers to Governmental Entities is a legal document that was released by the Michigan Department of Treasury - a government authority operating within Michigan.

FAQ

Q: What are exempt sales by credit card issuers to governmental entities?

A: Exempt sales refer to transactions where credit card issuers do not charge sales tax to governmental entities.

Q: What is a governmental entity?

A: A governmental entity refers to any federal, state, or local government organization, including agencies, departments, and municipalities.

Q: Why are credit card issuers exempt from charging sales tax to governmental entities?

A: Credit card issuers are exempt from charging sales tax to governmental entities because these entities are tax-exempt and therefore not subject to sales tax.

Q: What is the purpose of this exemption?

A: The purpose of this exemption is to facilitate financial transactions and simplify the purchasing process for governmental entities.

Q: Do credit card issuers need to provide any documentation for these exempt sales?

A: Yes, credit card issuers must maintain adequate records and documentation to support the exempt status of these sales.

Q: Who can benefit from this exemption?

A: Governmental entities in Michigan who make purchases using credit cards can benefit from this exemption.

Q: Are there any specific requirements for credit card issuers to qualify for this exemption?

A: Yes, credit card issuers must meet certain conditions, such as proper registration with the Michigan Department of Treasury.

Q: Are there any limitations to this exemption?

A: Yes, there are limitations to this exemption, and it does not apply to sales made by credit card issuers to non-governmental entities in Michigan.

Form Details:

- The latest edition currently provided by the Michigan Department of Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.