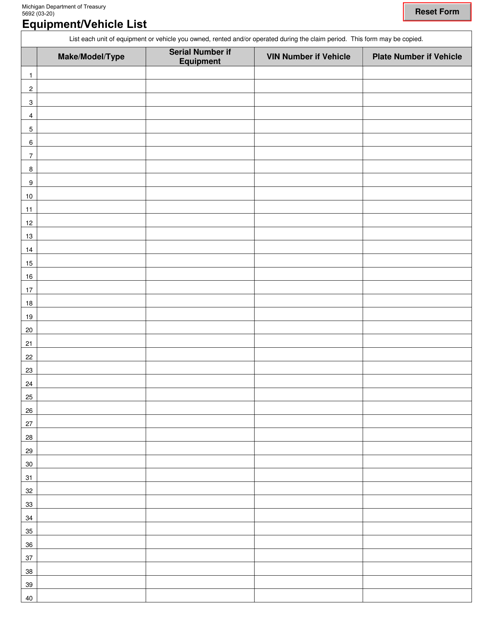

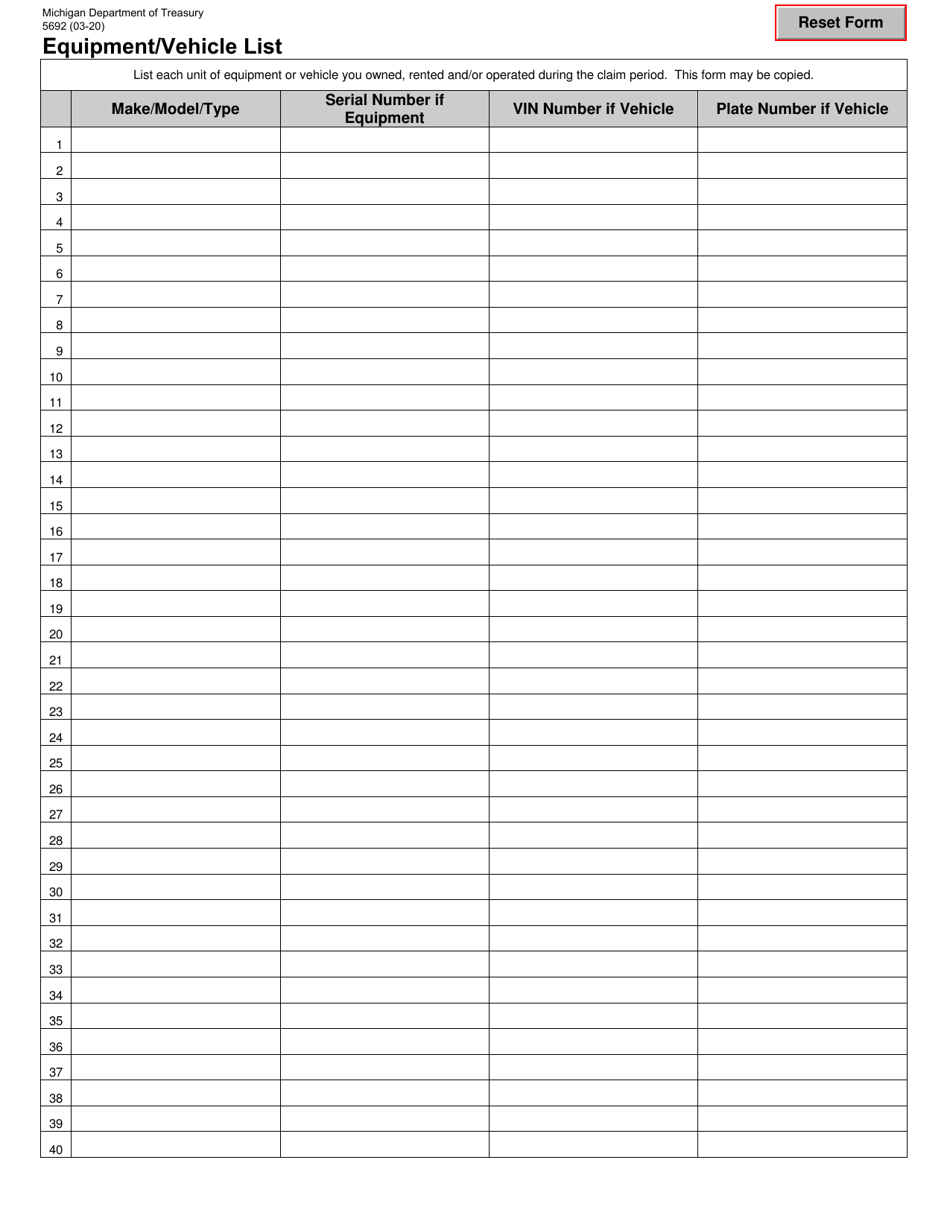

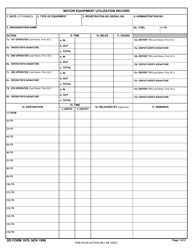

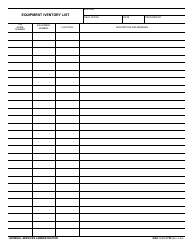

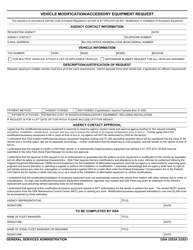

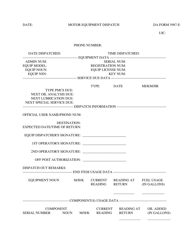

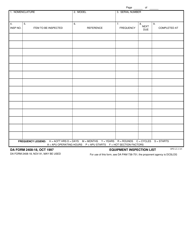

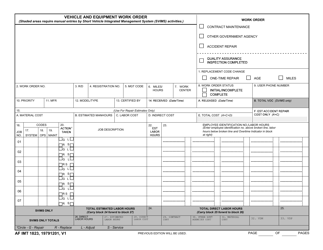

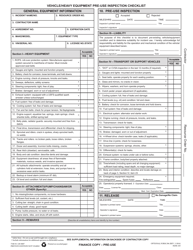

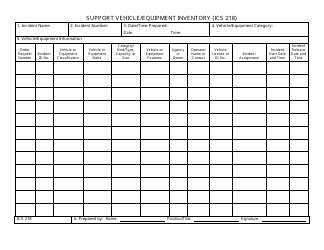

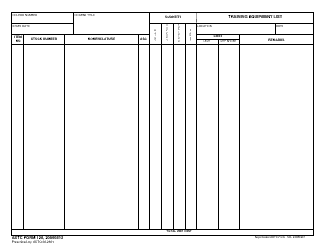

Form 5692 Equipment / Vehicle List - Michigan

What Is Form 5692?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5692?

A: Form 5692 is a document used in Michigan to list equipment or vehicles for tax purposes.

Q: Who needs to submit Form 5692?

A: Individuals or businesses that own or lease equipment or vehicles in Michigan may need to submit Form 5692.

Q: What is the purpose of Form 5692?

A: The purpose of Form 5692 is to provide information about equipment or vehicles owned or leased in Michigan for taxation purposes.

Q: What information do I need to complete Form 5692?

A: You will need to provide detailed information about each piece of equipment or vehicle, including its description, purchase date, and cost.

Q: When is the deadline to submit Form 5692?

A: The deadline to submit Form 5692 is typically April 15th of each year.

Q: Are there any fees associated with submitting Form 5692?

A: There are no fees associated with submitting Form 5692.

Q: What happens if I do not submit Form 5692?

A: Failure to submit Form 5692 may result in penalties or fines.

Q: Is Form 5692 only for residents of Michigan?

A: Form 5692 is specifically for individuals or businesses that own or lease equipment or vehicles in Michigan.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5692 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.