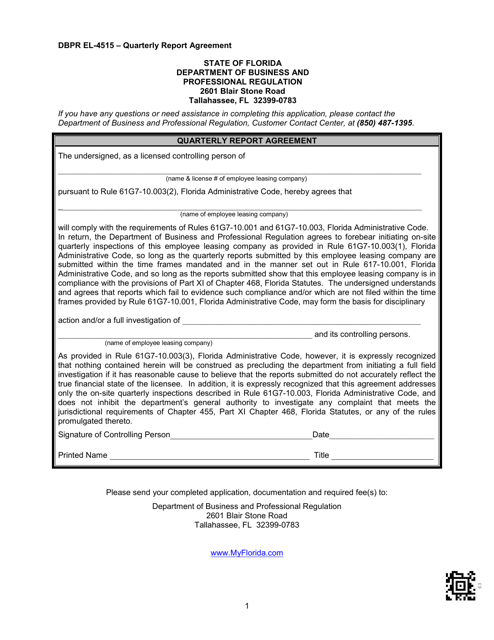

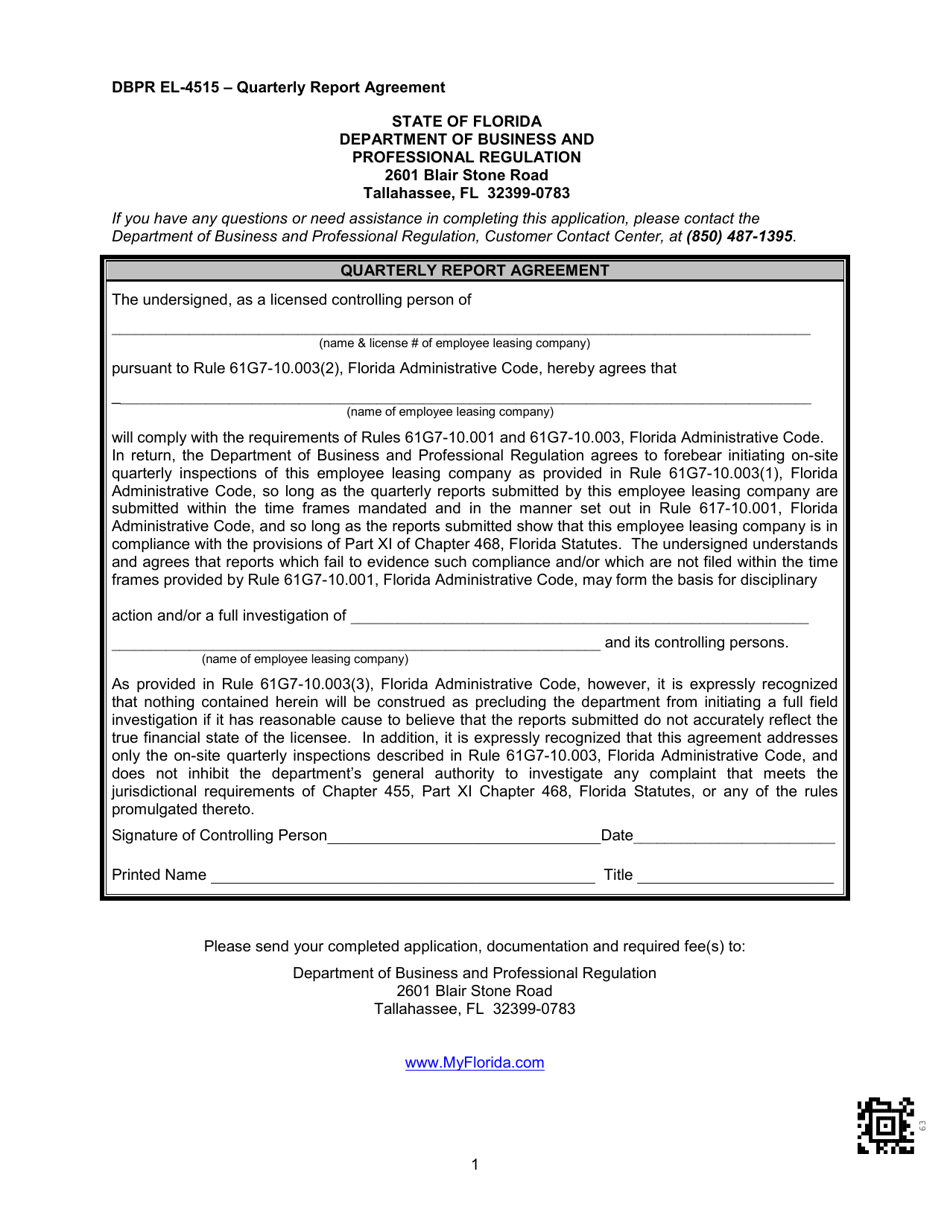

DBPR Form EL-4515 Quarterly Report Agreement - Florida

What Is DBPR Form EL-4515?

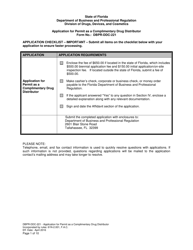

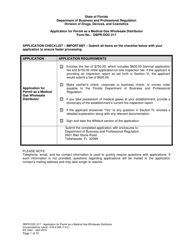

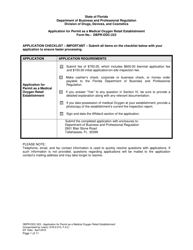

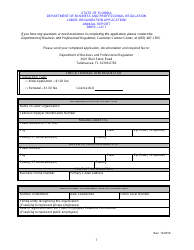

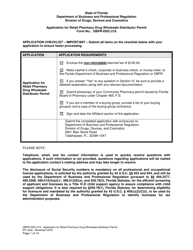

This is a legal form that was released by the Florida Department of Business & Professional Regulation - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DBPR Form EL-4515?

A: DBPR Form EL-4515 is a Quarterly Report Agreement used in the state of Florida.

Q: What is the purpose of DBPR Form EL-4515?

A: The purpose of DBPR Form EL-4515 is to report quarterly sales and transactions for certain businesses in Florida.

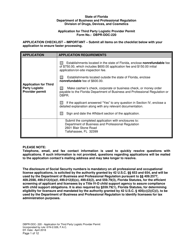

Q: Who is required to complete DBPR Form EL-4515?

A: Certain businesses in Florida, such as alcoholic beverage vendors, are required to complete DBPR Form EL-4515.

Q: What information needs to be provided on DBPR Form EL-4515?

A: DBPR Form EL-4515 requires information such as total sales, taxable sales, and tax collected for the reporting period.

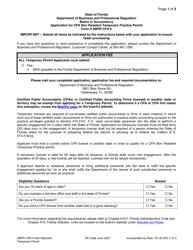

Q: When is DBPR Form EL-4515 due?

A: DBPR Form EL-4515 is typically due on the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not submitting DBPR Form EL-4515?

A: Yes, failure to submit DBPR Form EL-4515 or submitting it late can result in penalties, such as fines or license suspension.

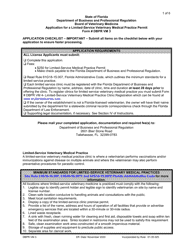

Form Details:

- The latest edition provided by the Florida Department of Business & Professional Regulation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of DBPR Form EL-4515 by clicking the link below or browse more documents and templates provided by the Florida Department of Business & Professional Regulation.