This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

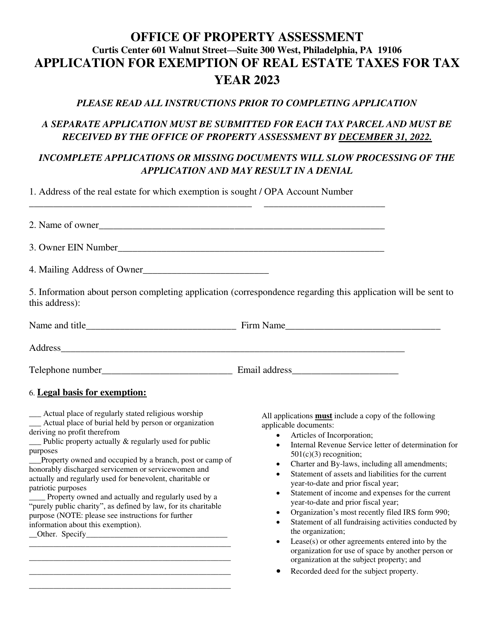

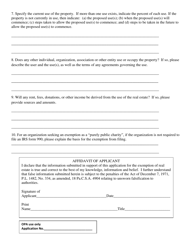

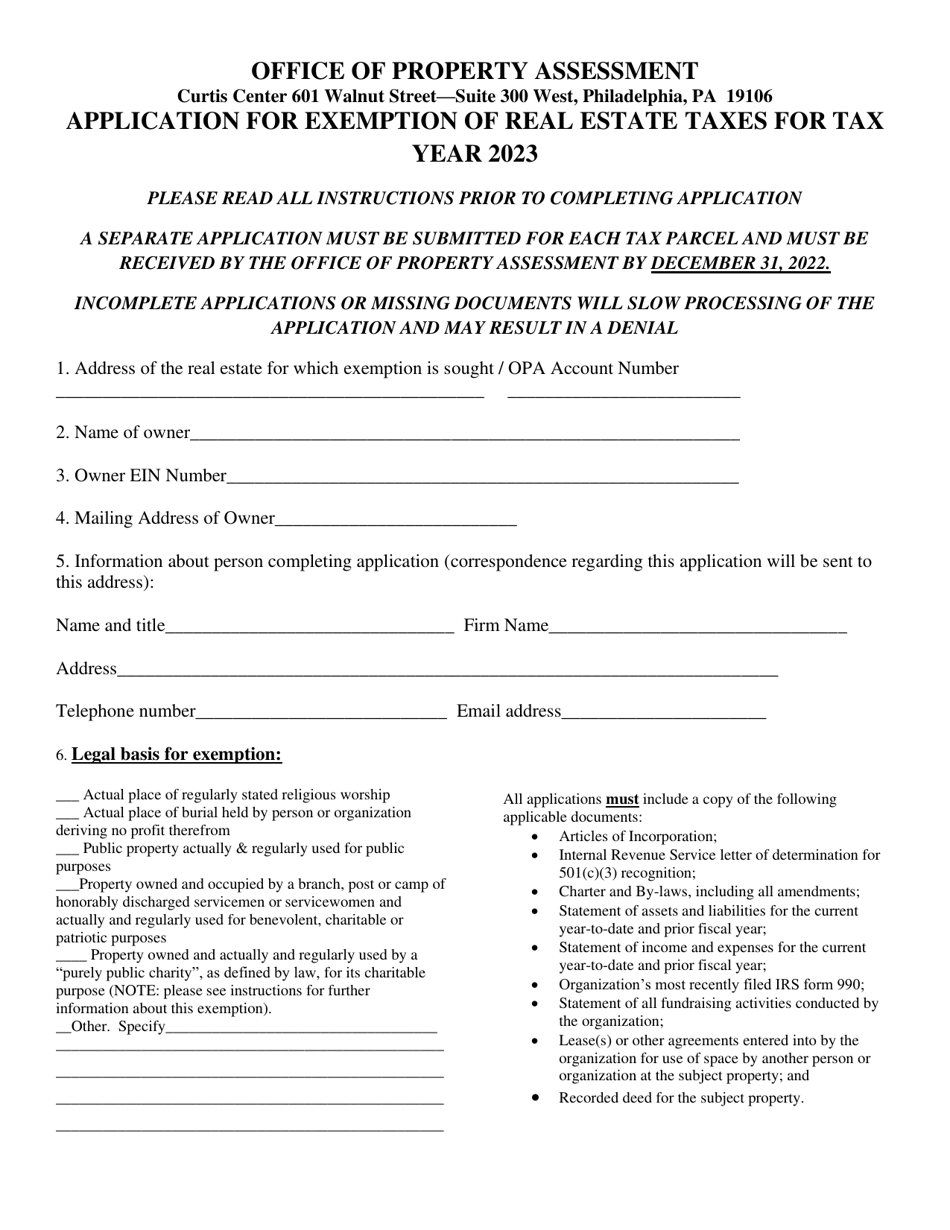

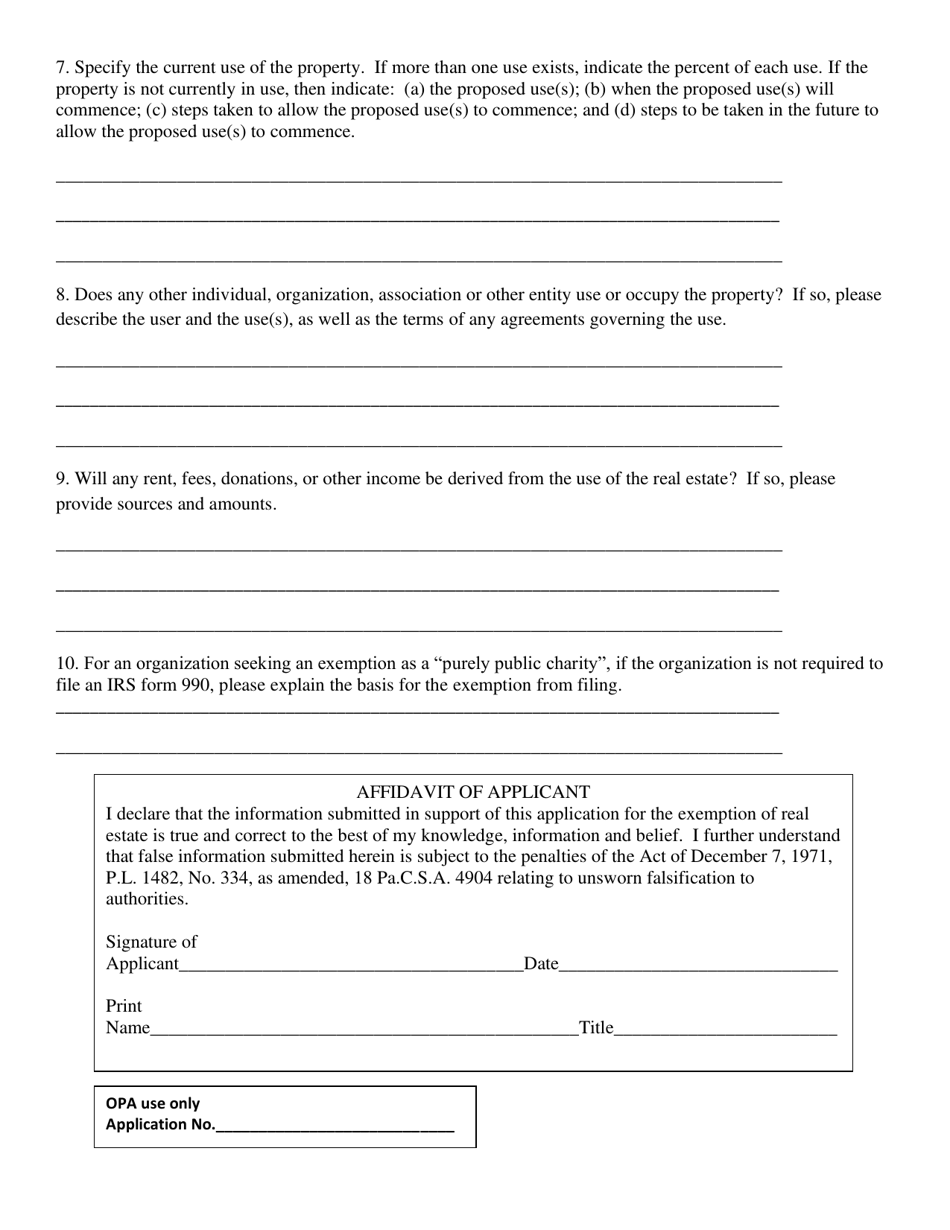

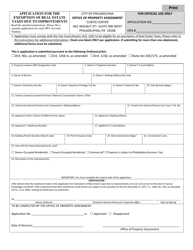

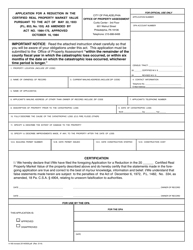

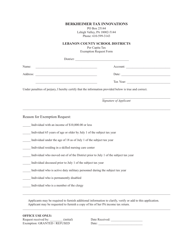

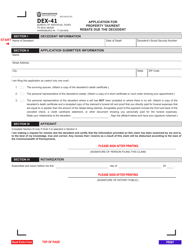

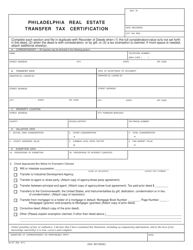

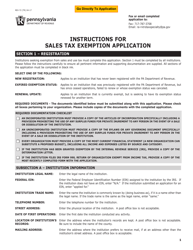

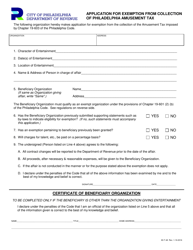

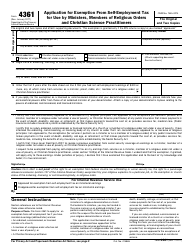

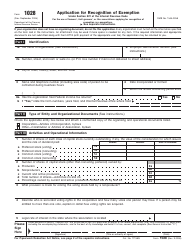

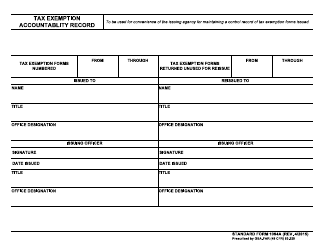

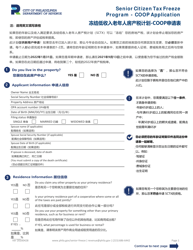

Application for Exemption of Real Estate Taxes - City of Philadelphia, Pennsylvania

Application for Exemption of Real Estate Taxes is a legal document that was released by the Office of Property Assessment - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the application for?

A: The application is for exemption of real estate taxes in the City of Philadelphia, Pennsylvania.

Q: Who can apply for exemption?

A: Property owners in the City of Philadelphia, Pennsylvania can apply for exemption of real estate taxes.

Q: What is the purpose of the exemption?

A: The purpose of the exemption is to provide relief from paying real estate taxes for eligible properties.

Q: How can I apply?

A: You can apply by filling out the application form provided by the City of Philadelphia, Pennsylvania.

Q: What documents do I need to submit with the application?

A: You may need to submit supporting documents such as proof of ownership, income information, and other relevant documents.

Q: Is there a deadline for submitting the application?

A: Yes, there is a deadline for submitting the application. Please check with the City of Philadelphia, Pennsylvania for the specific deadline.

Q: Are all properties eligible for exemption?

A: No, not all properties are eligible for exemption. There are certain criteria that must be met.

Q: How will I know if my application is approved?

A: You will be notified by the City of Philadelphia, Pennsylvania regarding the status of your application.

Q: What happens if my application is approved?

A: If your application is approved, you may be exempt from paying real estate taxes for the eligible period.

Q: Can I appeal if my application is denied?

A: Yes, you can appeal if your application is denied. There is a process in place for appealing the decision.

Form Details:

- The latest edition currently provided by the Office of Property Assessment - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Office of Property Assessment - City of Philadelphia, Pennsylvania.