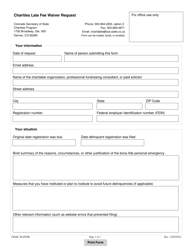

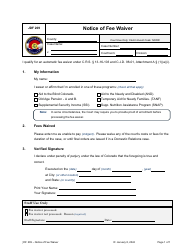

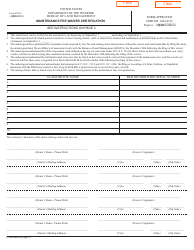

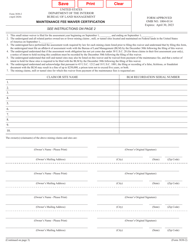

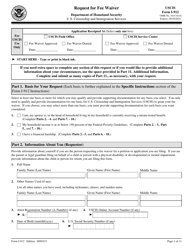

Fee Waiver and Tax-Exempt Status Form - Colorado

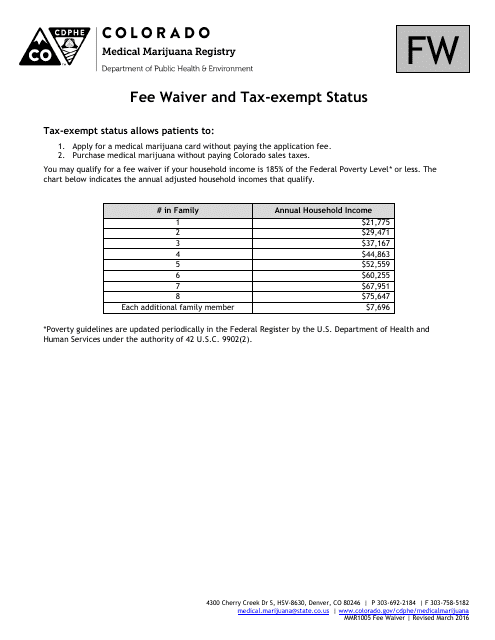

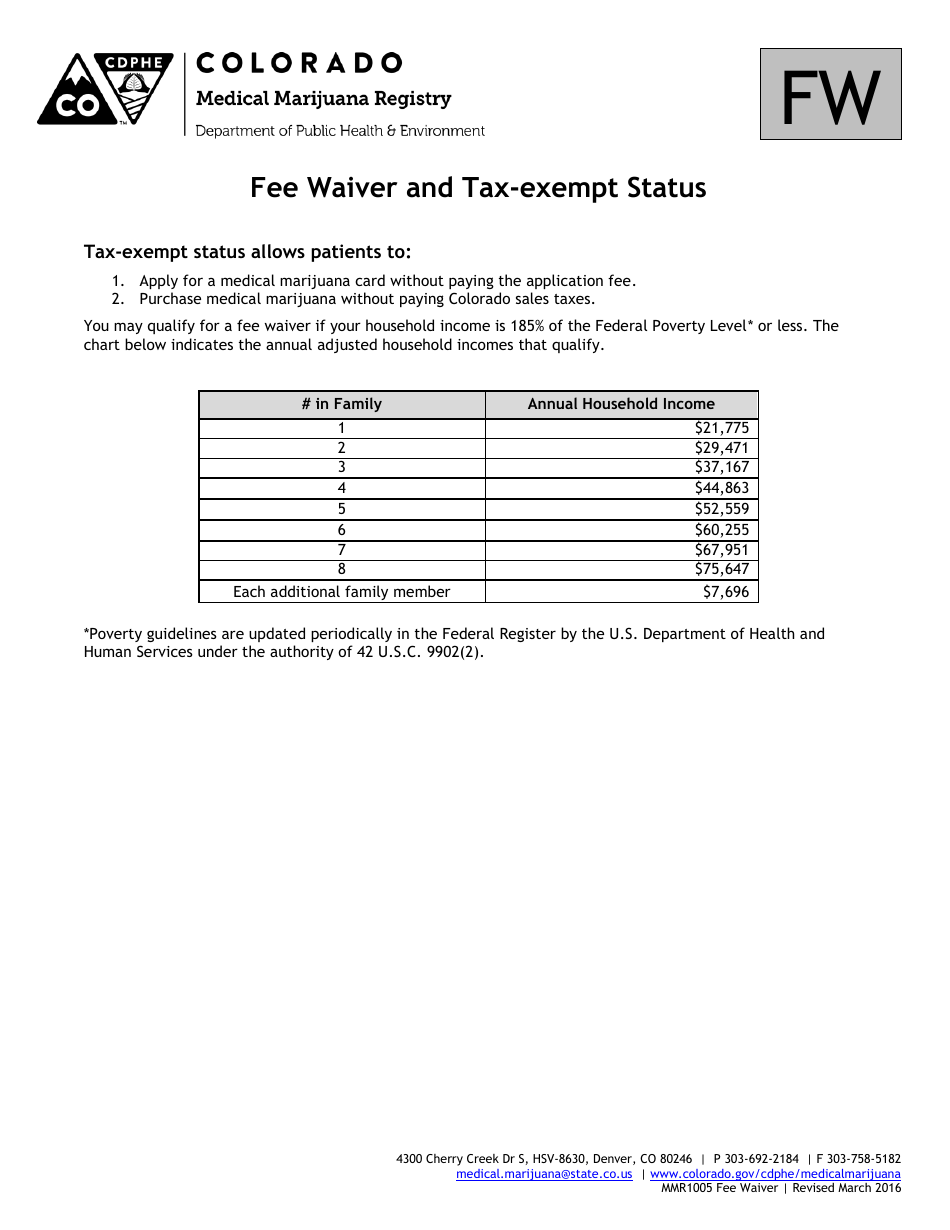

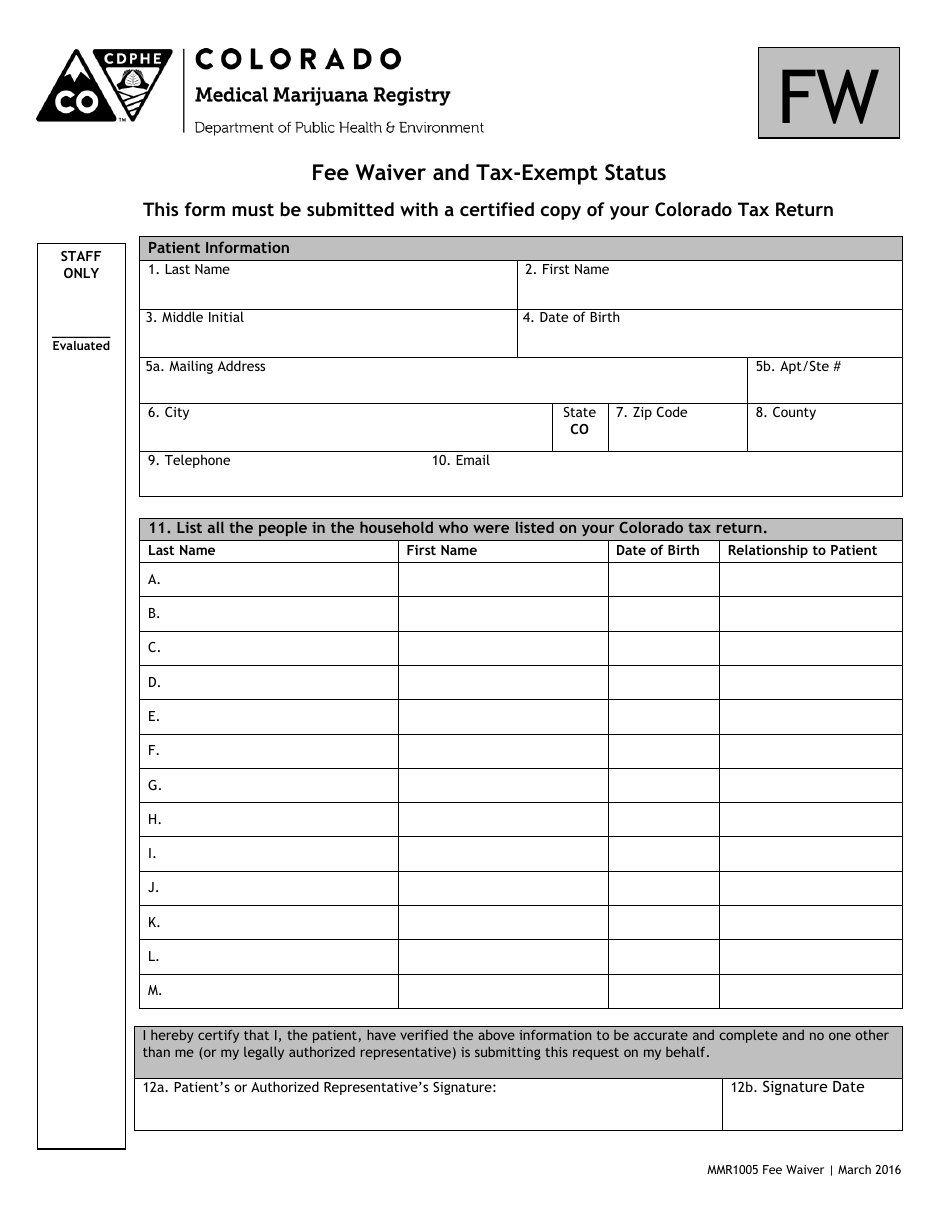

Fee Waiver and Tax-Exempt Status Form is a legal document that was released by the Colorado Department of Public Health and Environment - a government authority operating within Colorado.

FAQ

Q: What is a fee waiver?

A: A fee waiver is a request to have certain fees waived or reduced.

Q: Who can apply for a fee waiver?

A: Anyone who meets the eligibility requirements determined by the organization or agency can apply for a fee waiver.

Q: What is tax-exempt status?

A: Tax-exempt status means that an organization is exempt from paying certain taxes.

Q: Who can apply for tax-exempt status?

A: Nonprofit organizations and certain government entities are eligible to apply for tax-exempt status.

Q: Why would an organization want tax-exempt status?

A: Tax-exempt status allows organizations to avoid certain taxes and receive certain benefits, such as being eligible to receive tax-deductible donations.

Form Details:

- Released on March 1, 2016;

- The latest edition currently provided by the Colorado Department of Public Health and Environment;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Colorado Department of Public Health and Environment.