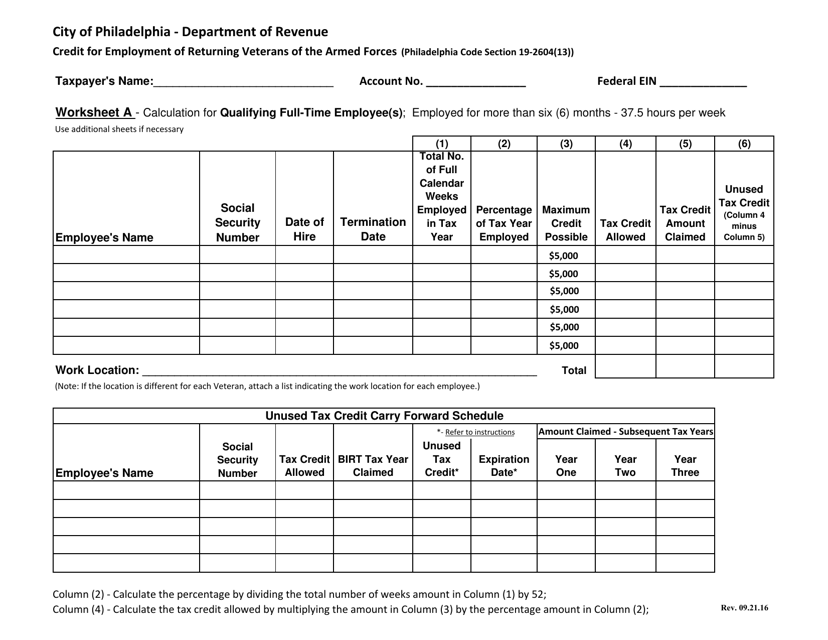

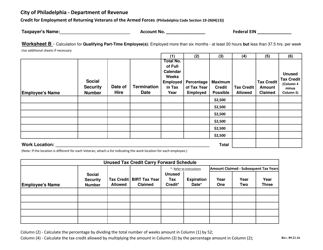

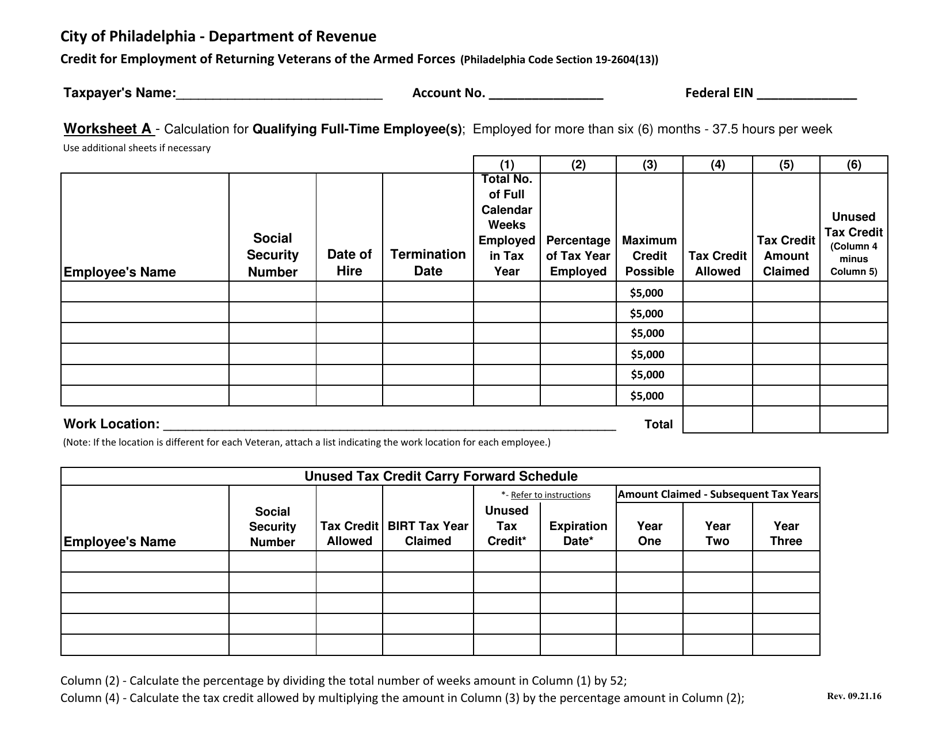

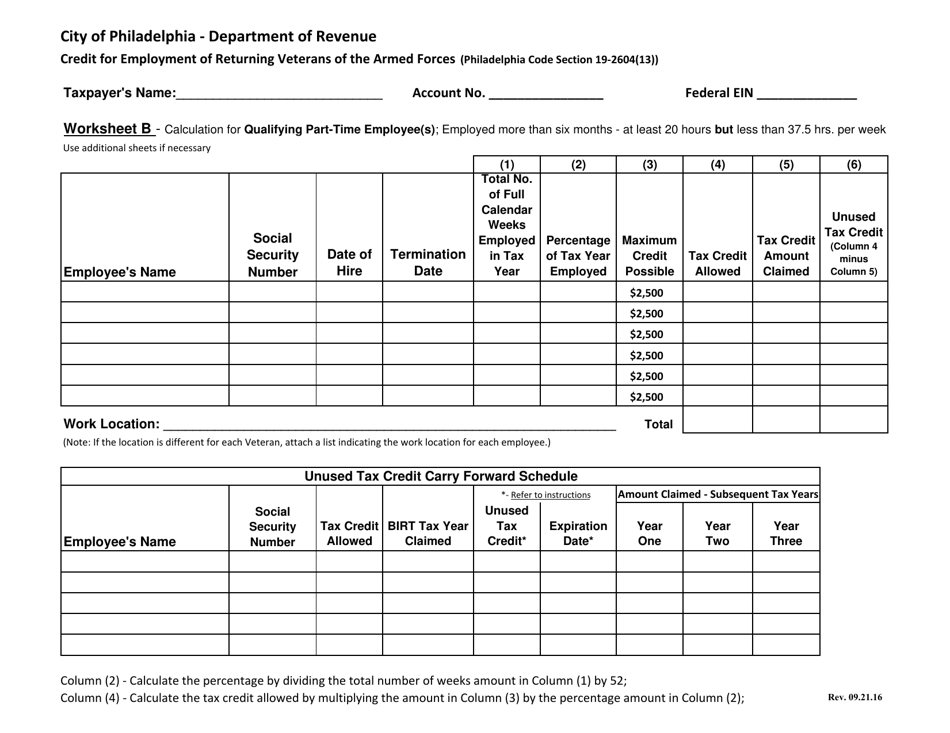

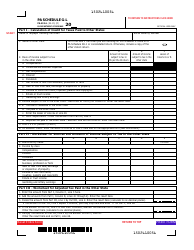

Veterans Tax Credit Worksheet - City of Philadelphia, Pennsylvania

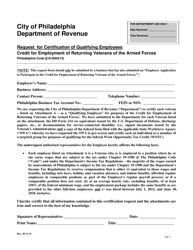

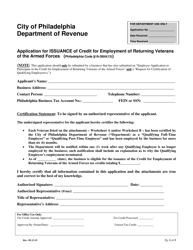

Veterans Tax Credit Worksheet is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the Veterans Tax Credit Worksheet?

A: The Veterans Tax Credit Worksheet is a document used by veterans in the City of Philadelphia, Pennsylvania to calculate their tax credit.

Q: Who is eligible for the Veterans Tax Credit?

A: Veterans who served on active duty during specific periods of conflict or certain other qualified service are generally eligible for the tax credit.

Q: How can veterans use the Veterans Tax Credit Worksheet?

A: Veterans can use the worksheet to determine their eligibility and calculate the amount of tax credit they may be entitled to.

Q: What information is needed to complete the Veterans Tax Credit Worksheet?

A: Veterans will need to gather information such as their military service dates, income information, and any other required documentation.

Q: Is the Veterans Tax Credit Worksheet specific to Philadelphia, Pennsylvania?

A: Yes, the Veterans Tax Credit Worksheet is specific to the City of Philadelphia in the state of Pennsylvania.

Q: What are the benefits of the Veterans Tax Credit?

A: The tax credit can help eligible veterans reduce their tax liability and potentially save money.

Q: Are there any deadlines for filing the Veterans Tax Credit Worksheet?

A: Yes, veterans must file the worksheet by the annual deadline specified by the City of Philadelphia.

Q: Is the Veterans Tax Credit retroactive?

A: No, the tax credit is not retroactive. It applies to the tax year in which it is claimed.

Q: Are there any income limitations for the Veterans Tax Credit?

A: Yes, there are income limitations that may affect the eligibility and amount of the tax credit for veterans.

Form Details:

- Released on September 21, 2016;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.