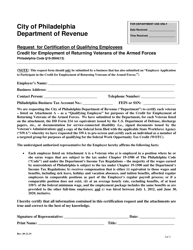

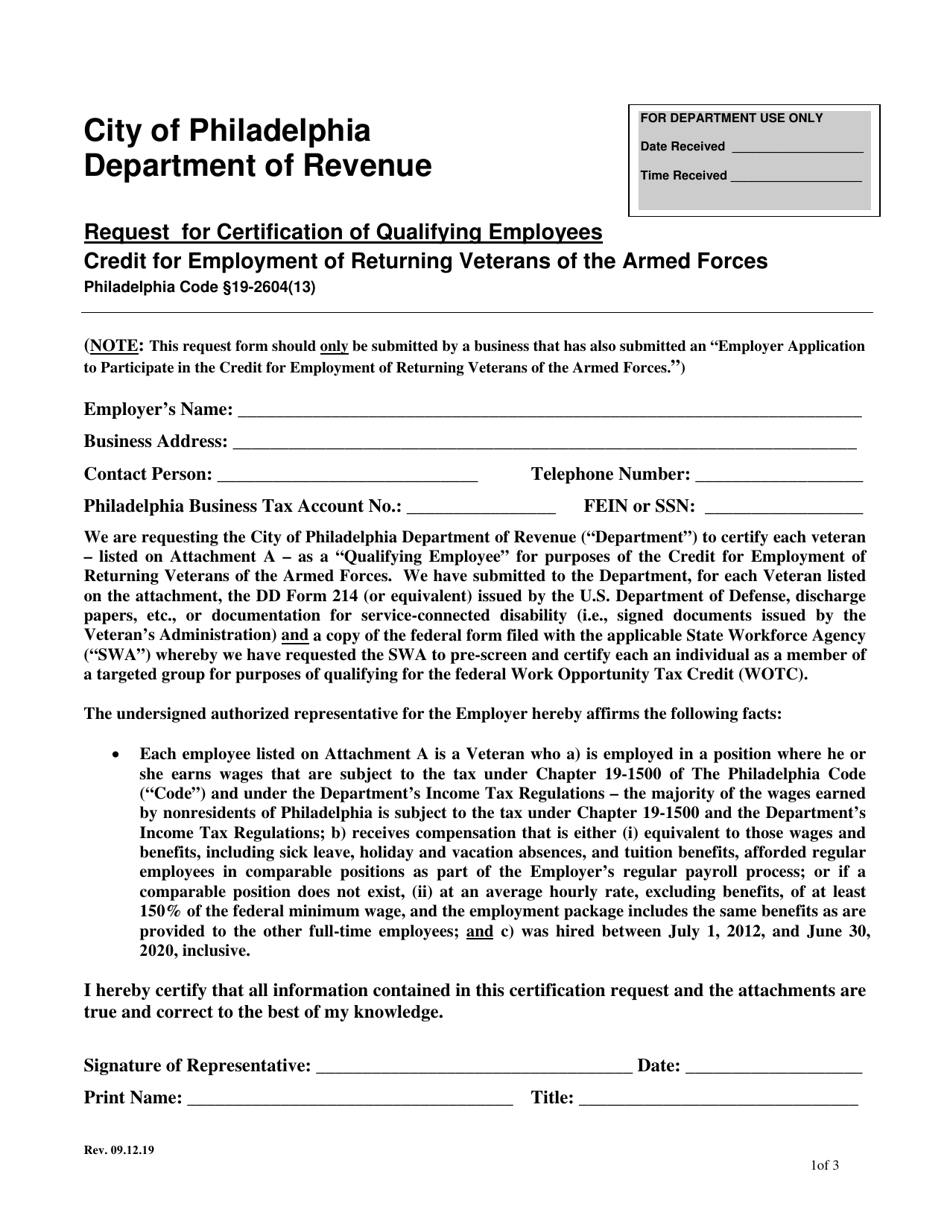

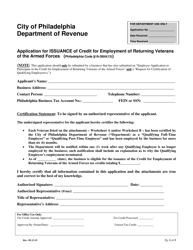

Veterans Tax Credit Certification of Qualified Employees - City of Philadelphia, Pennsylvania

Veterans Tax Credit Certification of Qualified Employees is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the Veterans Tax Credit Certification of Qualified Employees?

A: The Veterans Tax Credit Certification of Qualified Employees is a program in the City of Philadelphia, Pennsylvania that provides tax credits to businesses that hire qualified veterans as employees.

Q: Who is eligible for the Veterans Tax Credit?

A: Qualified veterans who are hired by businesses in the City of Philadelphia are eligible for the Veterans Tax Credit.

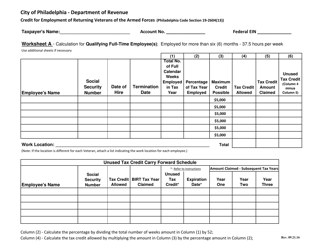

Q: How much is the tax credit?

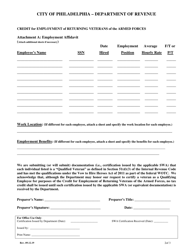

A: The tax credit amount varies depending on the length of time the qualified veterans are employed and the number of hours they work per week. The credit can range from $2,400 to $5,600 per qualified employee per year.

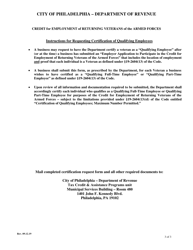

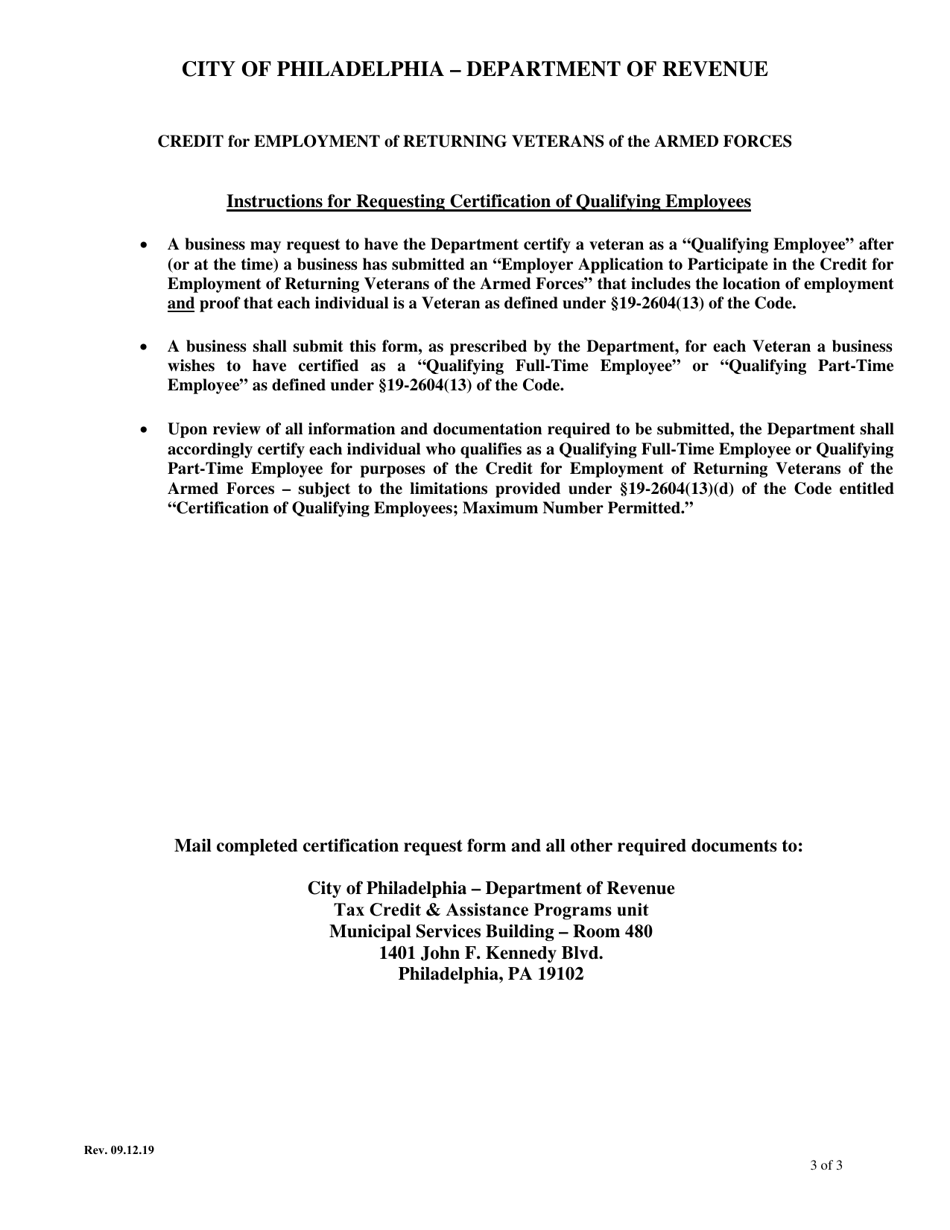

Q: How can businesses apply for the Veterans Tax Credit?

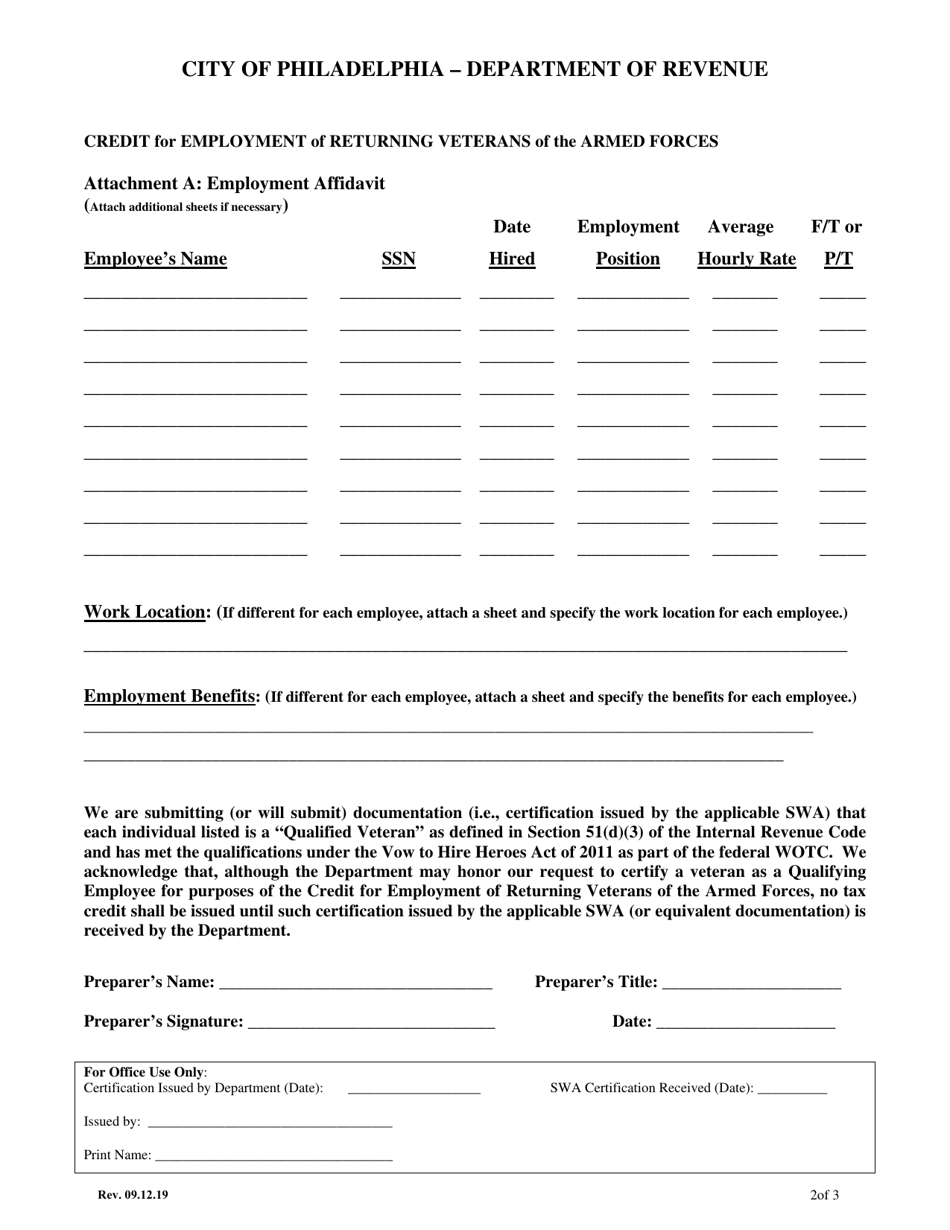

A: Businesses can apply for the Veterans Tax Credit by completing the appropriate certification forms and submitting them to the Department of Revenue in the City of Philadelphia.

Q: Are there any additional requirements for businesses to qualify for the tax credit?

A: Yes, businesses must comply with certain requirements such as providing proof of the veteran's eligibility and maintaining records of the veteran's employment.

Form Details:

- Released on September 12, 2019;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.