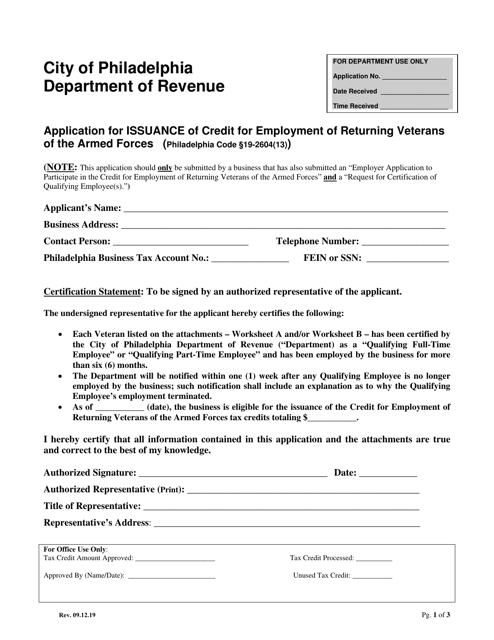

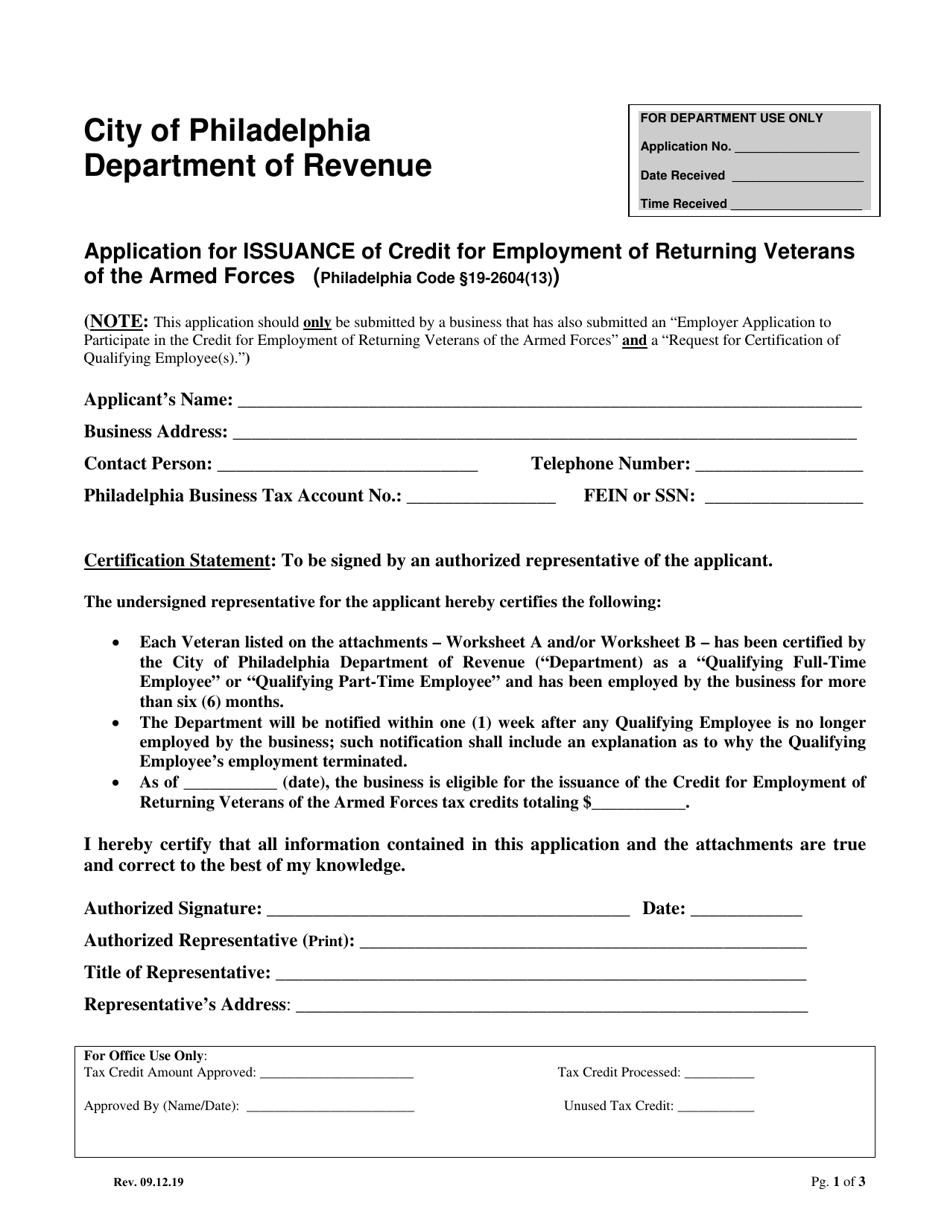

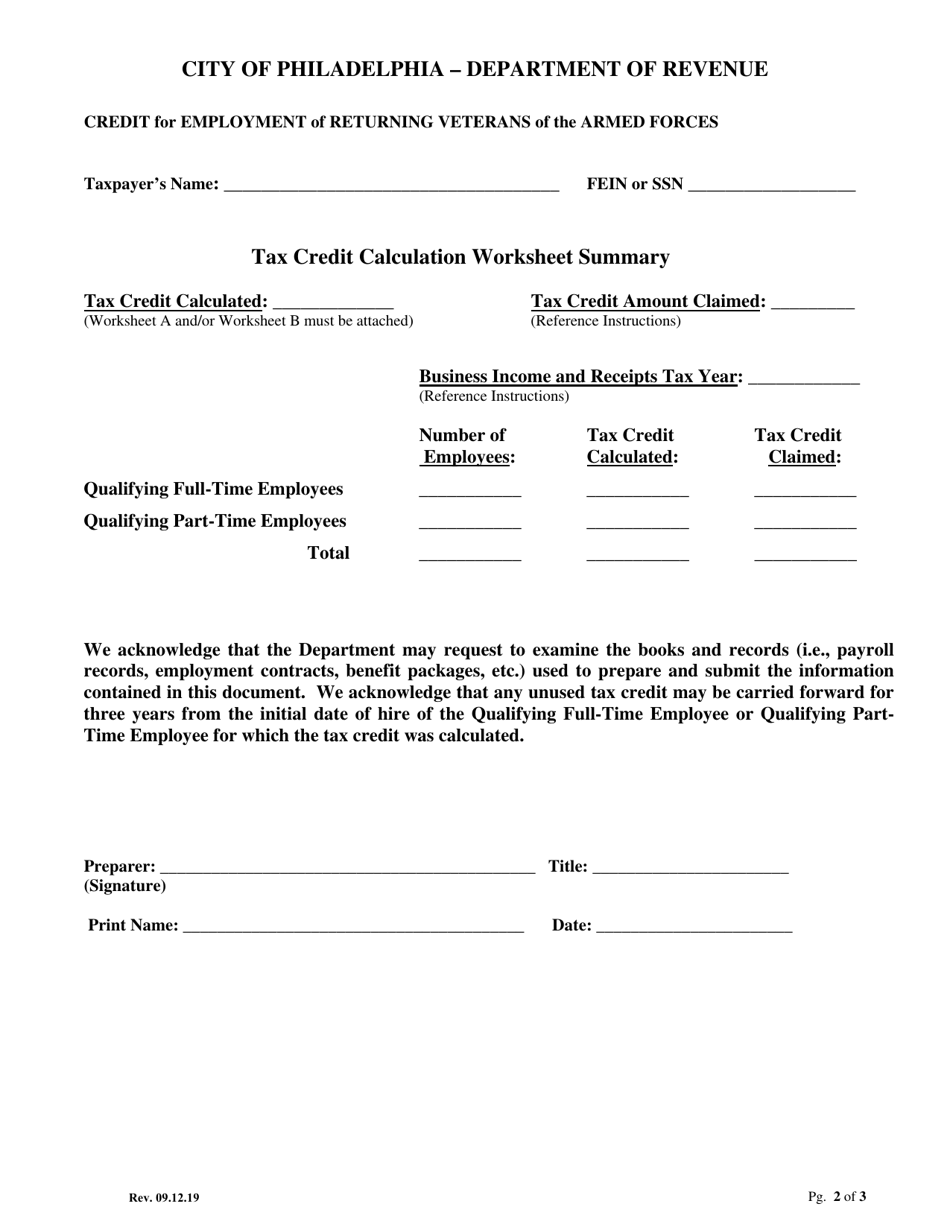

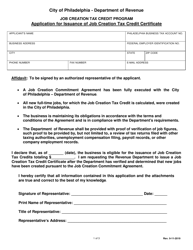

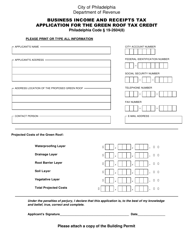

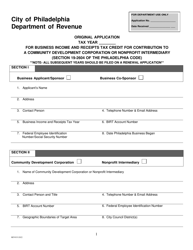

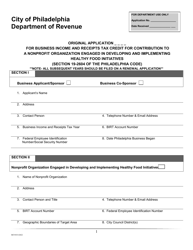

Application for Issuance of Veterans Tax Credit - City of Philadelphia, Pennsylvania

Application for Issuance of Veterans Tax Credit is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

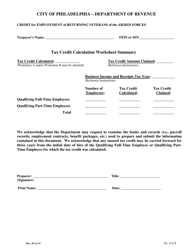

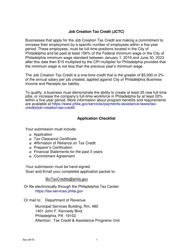

Q: What is the Veterans Tax Credit?

A: The Veterans Tax Credit is a tax benefit available for veterans in the City of Philadelphia, Pennsylvania.

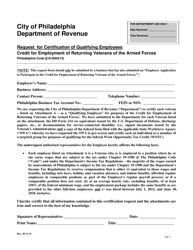

Q: Who is eligible for the Veterans Tax Credit?

A: Veterans who are residents of the City of Philadelphia, Pennsylvania are eligible for the tax credit.

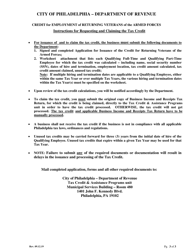

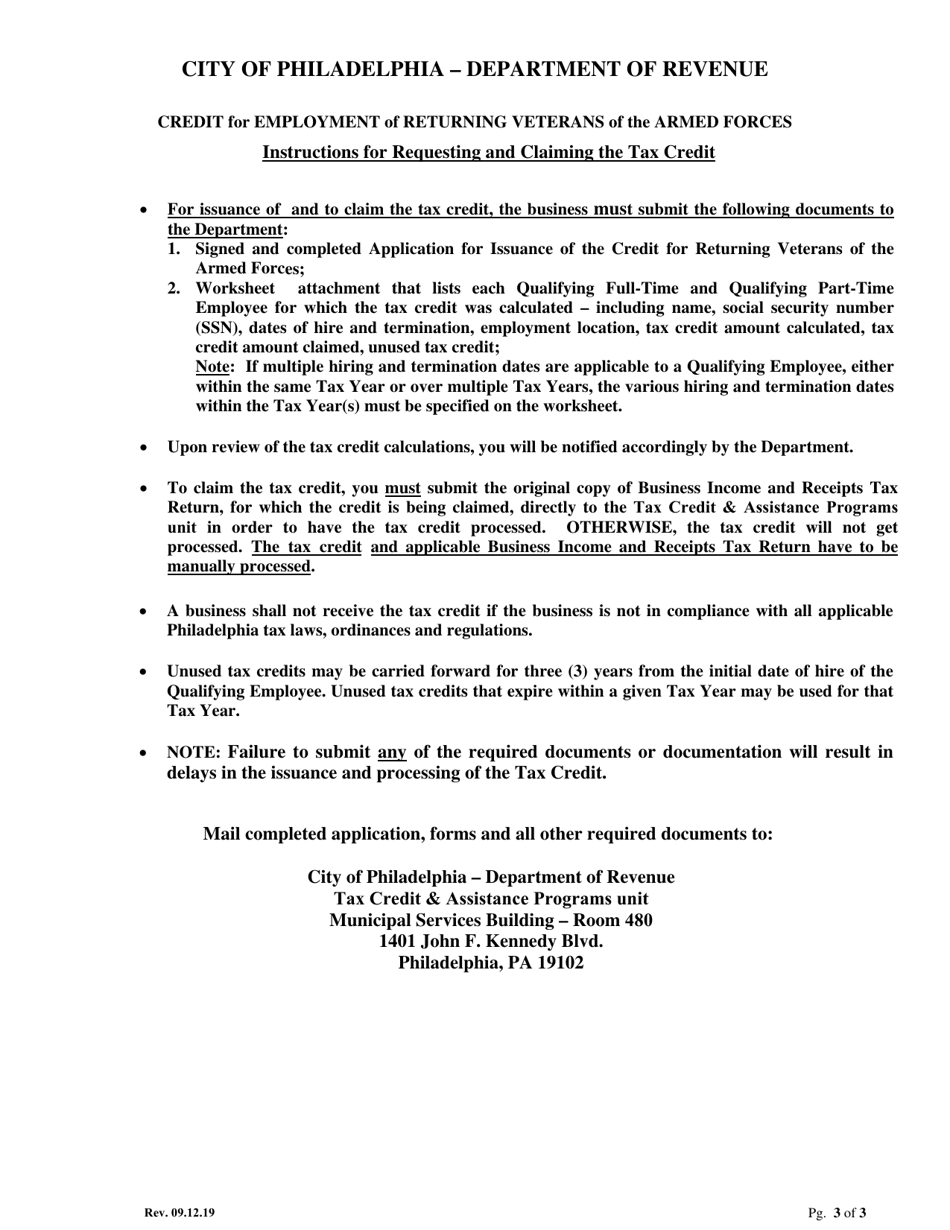

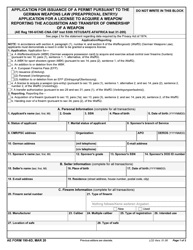

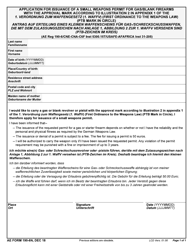

Q: How do I apply for the Veterans Tax Credit?

A: To apply for the Veterans Tax Credit, you need to fill out the application form provided by the City of Philadelphia, Pennsylvania.

Q: What documents do I need to include with my application for the Veterans Tax Credit?

A: You may need to provide proof of your military service and residency in the City of Philadelphia, Pennsylvania. Please check the application form for specific requirements.

Q: When is the deadline to submit the application for the Veterans Tax Credit?

A: The deadline to submit the application for the Veterans Tax Credit may vary. Please refer to the application form or contact the Department of Revenue for the specific deadline.

Q: Can I receive the Veterans Tax Credit if I am not a resident of the City of Philadelphia, Pennsylvania?

A: No, the Veterans Tax Credit is only available for veterans who are residents of the City of Philadelphia, Pennsylvania.

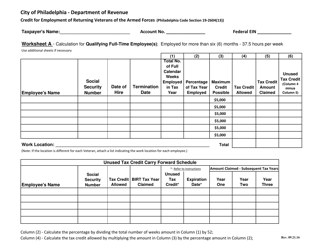

Q: Is the Veterans Tax Credit a one-time benefit or an annual benefit?

A: The Veterans Tax Credit is an annual benefit that can be claimed each year, provided you meet the eligibility criteria.

Form Details:

- Released on September 12, 2019;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.