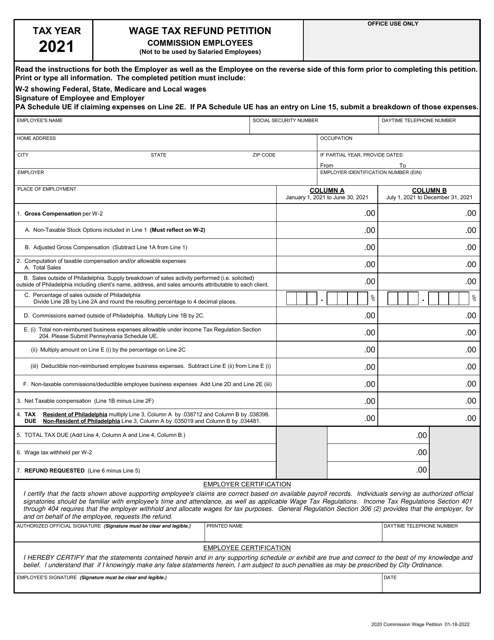

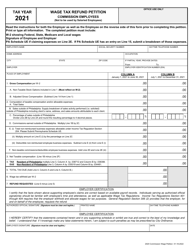

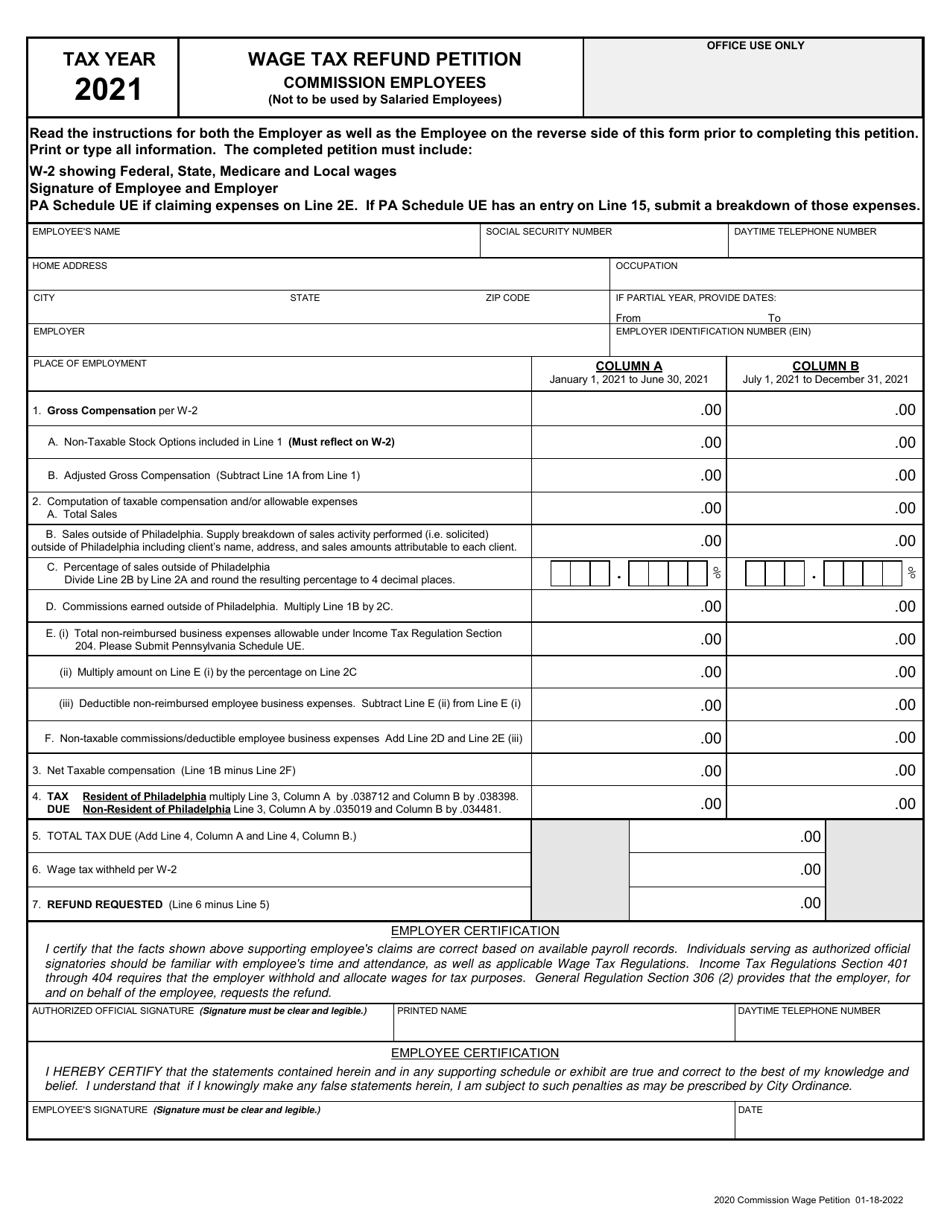

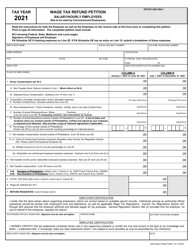

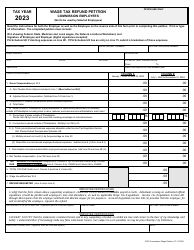

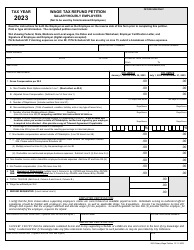

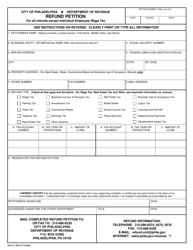

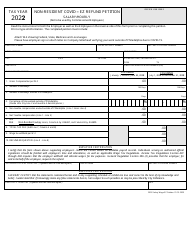

Wage Tax Refund Petition (Commissioned Employees) - City of Philadelphia, Pennsylvania

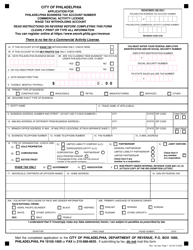

Wage Tax Refund Petition (Commissioned Employees) is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

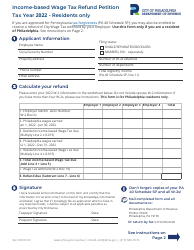

Q: What is the Wage Tax Refund Petition for commissioned employees in Philadelphia?

A: The Wage Tax Refund Petition is a form that commissioned employees in Philadelphia, Pennsylvania can use to request a refund of the wage tax they paid.

Q: Who is eligible to file a Wage Tax Refund Petition for commissioned employees in Philadelphia?

A: Commissioned employees who live or work in Philadelphia may be eligible to file a Wage Tax Refund Petition.

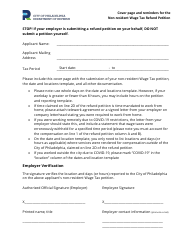

Q: What documents do I need to include with the Wage Tax Refund Petition?

A: You will need to include documentation of your commission income, such as pay stubs or W-2 forms, as well as proof of your residence or work location in Philadelphia.

Q: Is there a deadline to file the Wage Tax Refund Petition?

A: Yes, the Wage Tax Refund Petition must be filed within three years of the end of the calendar year in which the tax was withheld.

Q: How long does it take to process the Wage Tax Refund Petition?

A: Processing times may vary, but it typically takes several weeks to several months for the City of Philadelphia to review and process the Wage Tax Refund Petition.

Q: What happens if my Wage Tax Refund Petition is approved?

A: If your Wage Tax Refund Petition is approved, the City of Philadelphia will issue you a refund for the amount of wage tax you overpaid.

Q: What happens if my Wage Tax Refund Petition is denied?

A: If your Wage Tax Refund Petition is denied, you may have the option to appeal the decision or seek further assistance from the City of Philadelphia's Department of Revenue.

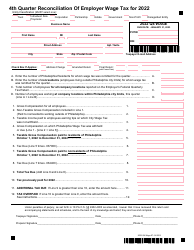

Form Details:

- Released on January 18, 2022;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.