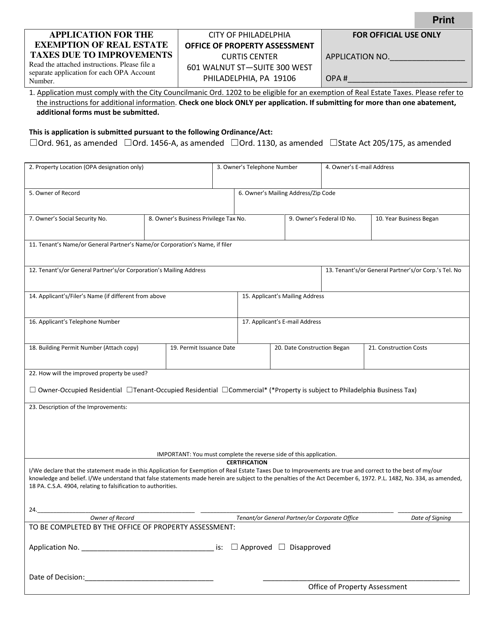

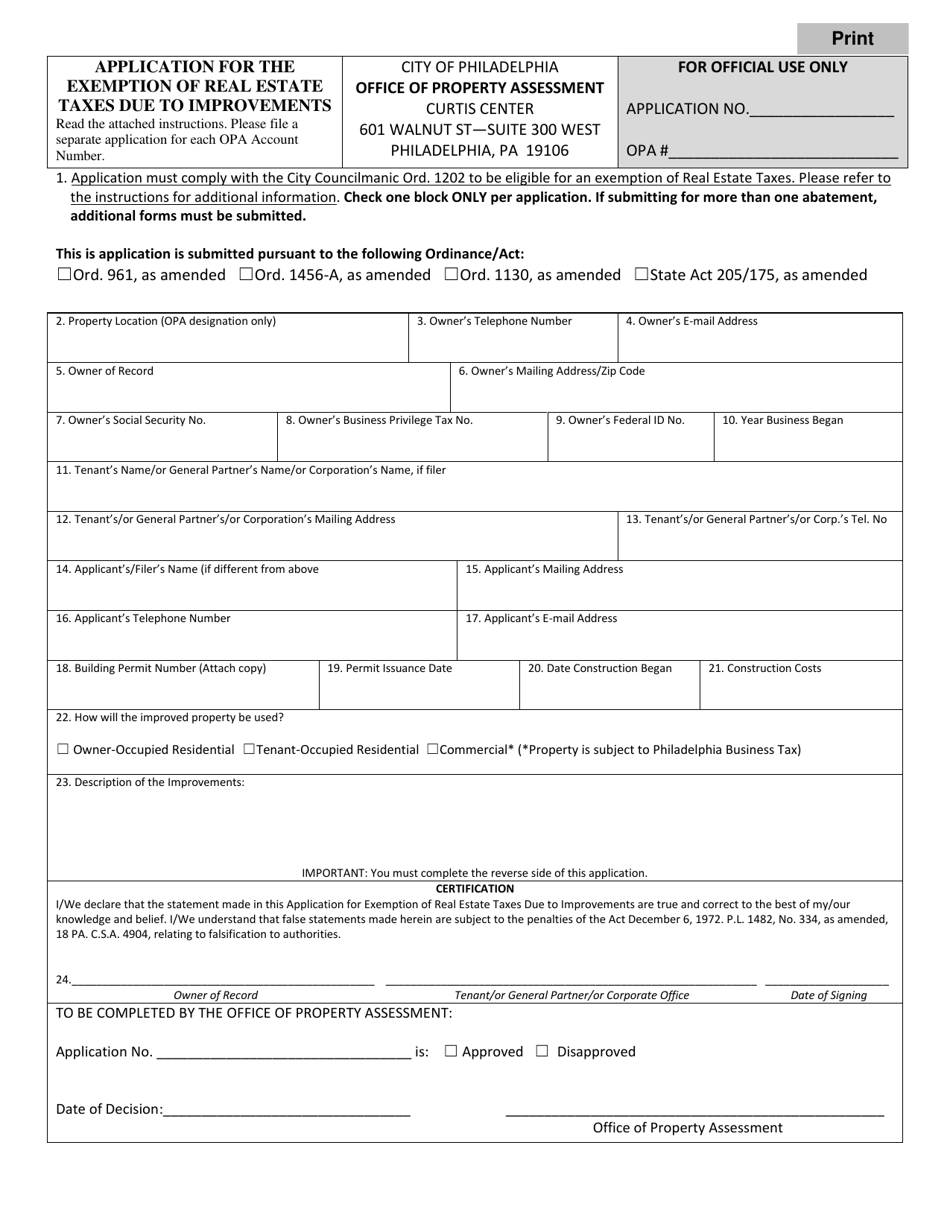

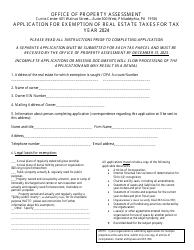

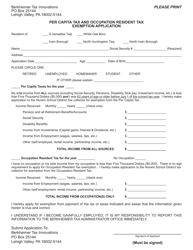

Application for the Exemption of Real Estate Taxes Due to Improvements - Rehab & New Construction for Commercial & Industrial Properties - City of Philadelphia, Pennsylvania

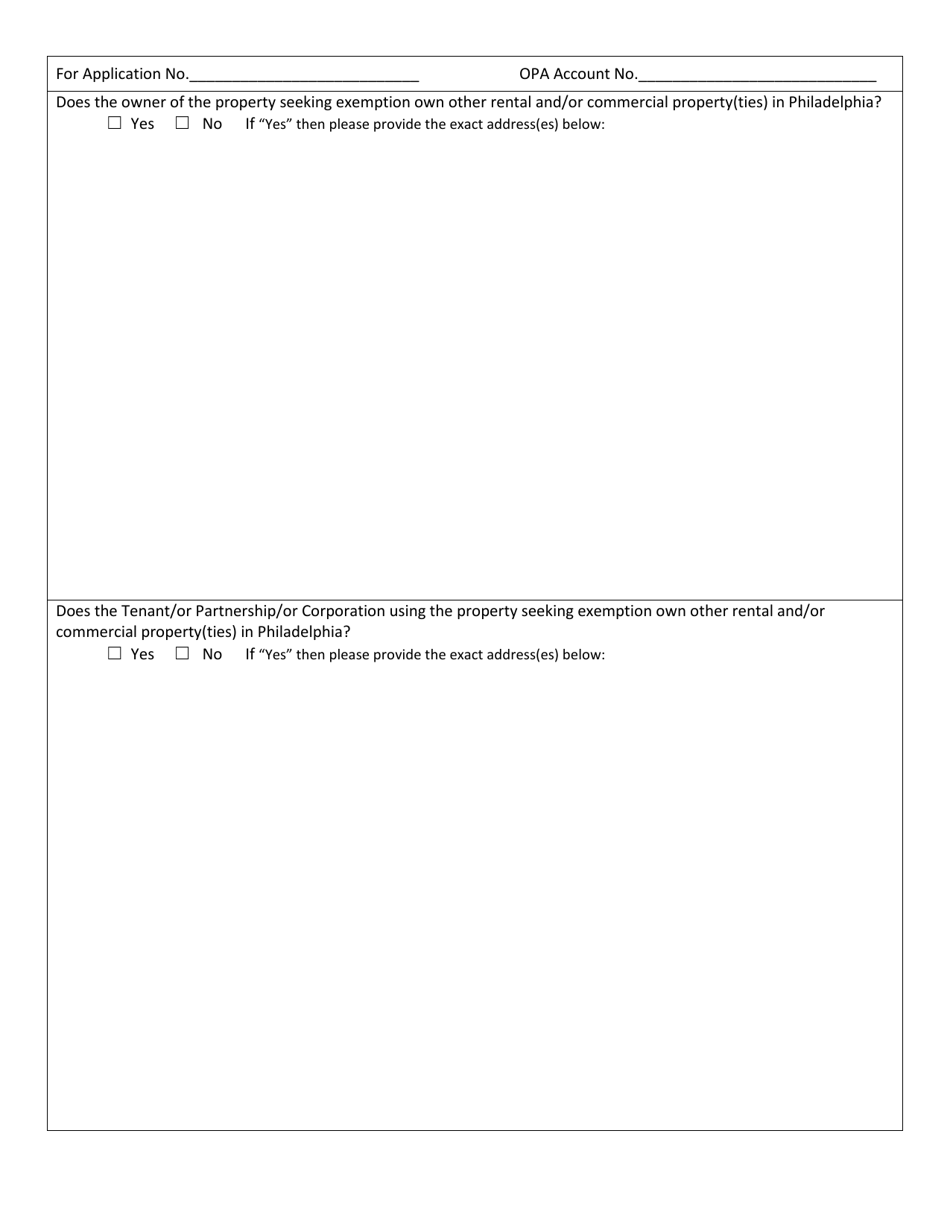

Application for the Exemption of Real Estate Taxes Due to Improvements - Rehab & New Construction for Commercial & Industrial Properties is a legal document that was released by the Office of Property Assessment - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

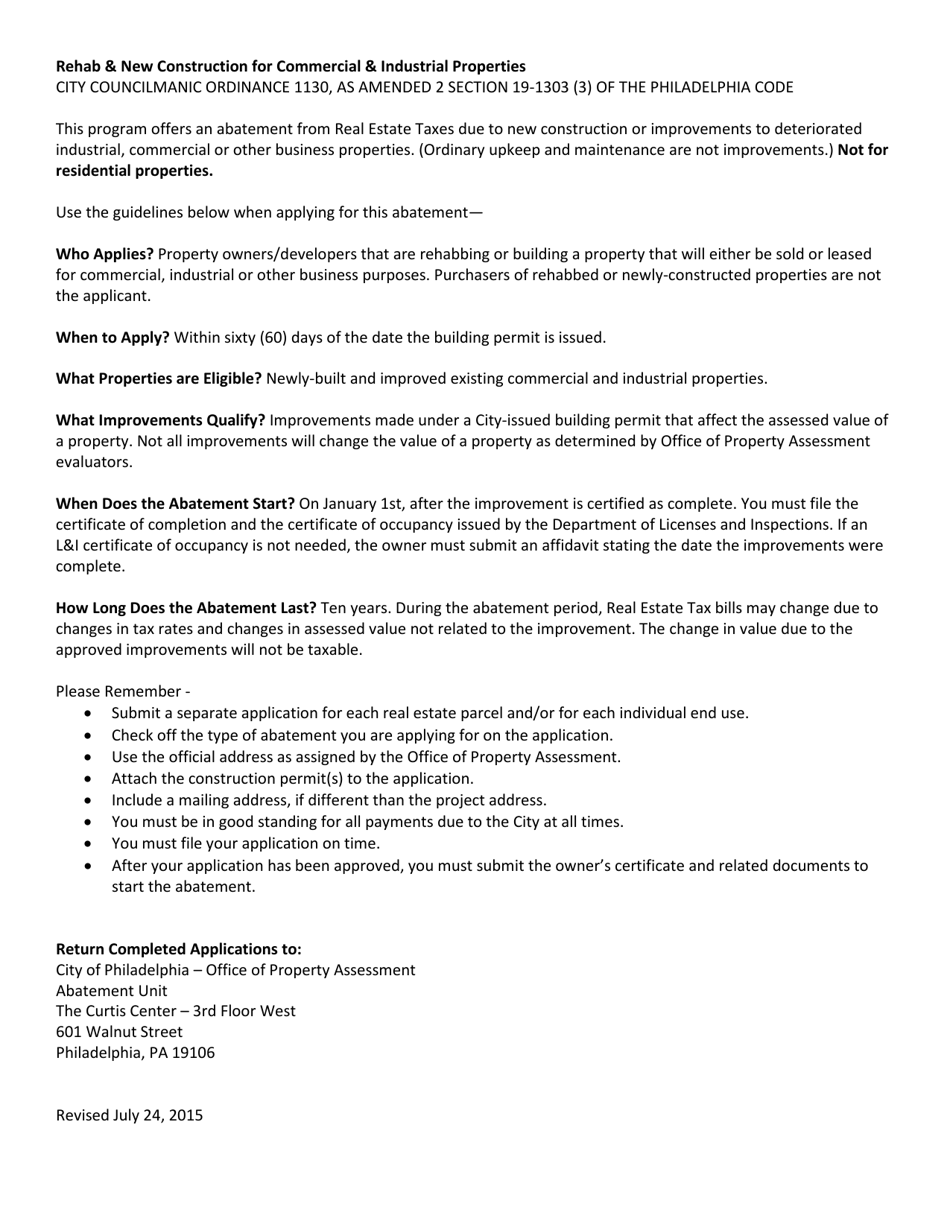

Q: What is the application for?

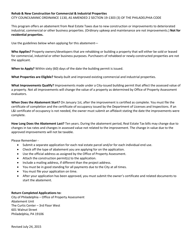

A: The application is for the exemption of real estate taxes due to improvements - rehab and new construction for commercial and industrial properties.

Q: What properties are eligible for the exemption?

A: Commercial and industrial properties that undergo rehab or new construction are eligible for the exemption.

Q: What is the purpose of the exemption?

A: The exemption is intended to provide tax relief for property owners who invest in improving or constructing commercial and industrial properties.

Q: Who can submit the application?

A: Property owners can submit the application for the exemption.

Q: Are all improvements eligible for the exemption?

A: No, only improvements related to rehab and new construction of commercial and industrial properties are eligible for the exemption.

Q: Are there any deadlines for submitting the application?

A: Yes, there are specific deadlines for submitting the application. It is advisable to check the official guidelines for the current deadlines.

Q: Is the exemption automatically granted?

A: No, the exemption is not automatically granted. The application will be reviewed and evaluated to determine eligibility.

Q: Is there a fee for submitting the application?

A: There may be a fee associated with submitting the application. It is recommended to check the official guidelines for the current fee information.

Form Details:

- Released on July 24, 2015;

- The latest edition currently provided by the Office of Property Assessment - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of Property Assessment - City of Philadelphia, Pennsylvania.