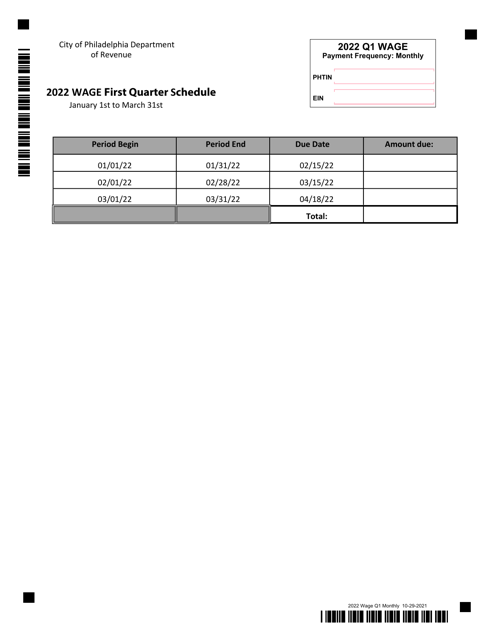

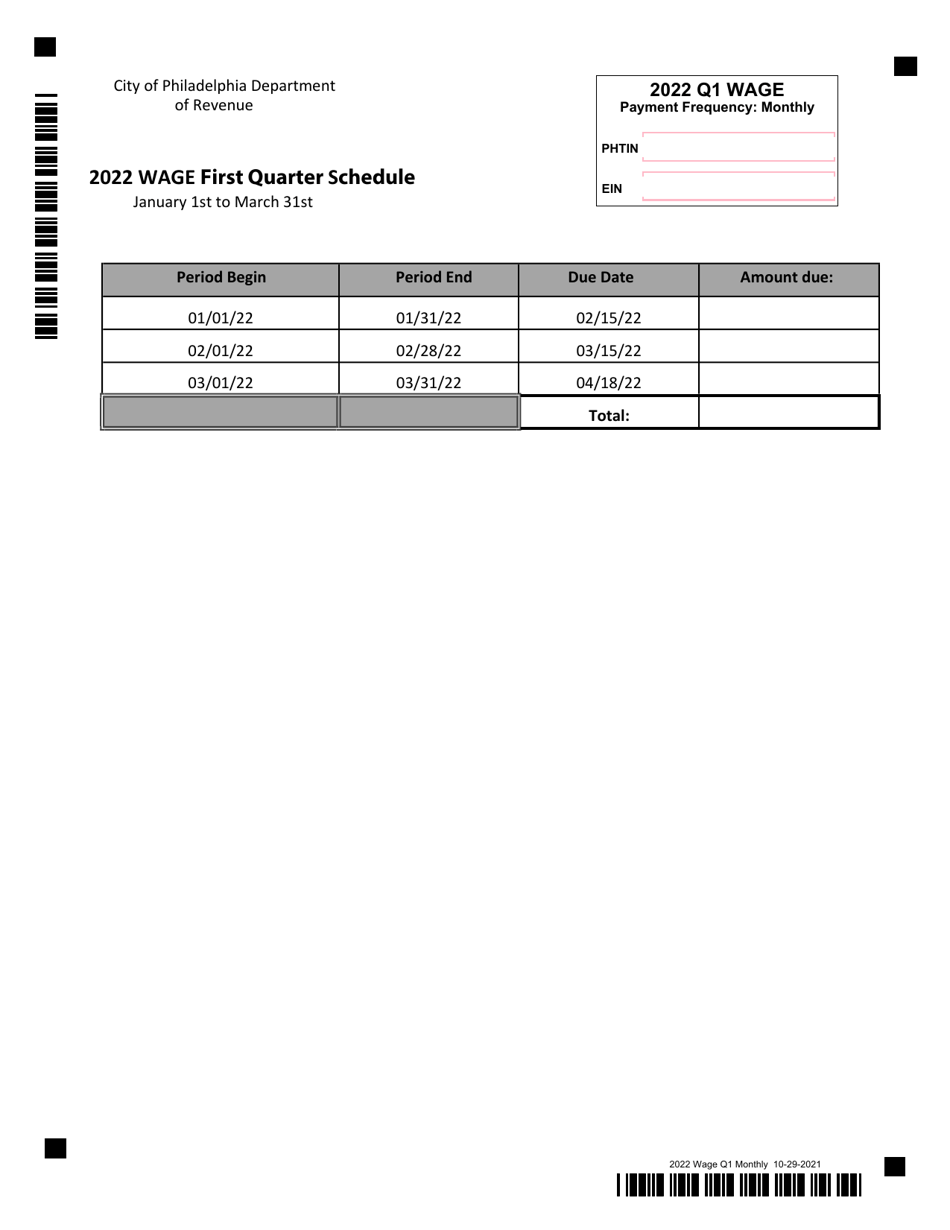

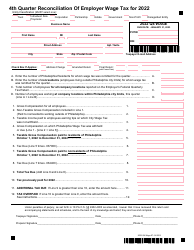

Wage First Quarter Schedule - City of Philadelphia, Pennsylvania

Wage First Quarter Schedule is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the Wage First Quarter Schedule?

A: The Wage First Quarter Schedule is a schedule that specifies the deadline for employers to file their wage tax returns and make payments for the first quarter in the City of Philadelphia, Pennsylvania.

Q: When is the deadline for filing wage tax returns for the first quarter in Philadelphia?

A: The deadline for filing wage tax returns for the first quarter in Philadelphia is typically April 30th.

Q: When is the deadline for making wage tax payments for the first quarter in Philadelphia?

A: The deadline for making wage tax payments for the first quarter in Philadelphia is typically April 30th.

Q: Is there any penalty for late filing or payment of wage tax returns in Philadelphia?

A: Yes, there may be penalties for late filing or payment of wage tax returns in Philadelphia. It is advisable to file and pay on time to avoid any penalties.

Q: How can employers make wage tax payments for the first quarter in Philadelphia?

A: Employers can make wage tax payments for the first quarter in Philadelphia through the City of Philadelphia's eFile/ePay system, by mail, or in person at the Revenue Department's Municipal Services Building location.

Form Details:

- Released on October 29, 2021;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.